Fashion conglomerate G-III (NASDAQ:GIII) missed analysts’ expectations in Q2 CY2024, with revenue down 2.3% year on year to $644.8 million. Next quarter’s revenue guidance of $1.1 billion also underwhelmed, coming in 2.6% below analysts’ estimates. It made a GAAP profit of $0.53 per share, improving from its profit of $0.35 per share in the same quarter last year.

Is now the time to buy G-III? Find out by accessing our full research report, it’s free.

G-III (GIII) Q2 CY2024 Highlights:

- Revenue: $644.8 million vs analyst estimates of $649.5 million (small miss)

- EBITDA: $43.3 million vs analyst estimates of $30.8 million (40.6% beat)

- EPS: $0.53 vs analyst estimates of $0.30 (75.8% beat)

- The company reconfirmed its revenue guidance for the full year of $3.2 billion at the midpoint

- EBITDA guidance for the full year is $307.5 million at the midpoint, above analyst estimates of $295.7 million

- Gross Margin (GAAP): 42.8%, in line with the same quarter last year

- EBITDA Margin: 6.7%, in line with the same quarter last year

- Market Capitalization: $1.13 billion

Morris Goldfarb, G-III’s Chairman and Chief Executive Officer, said, “We delivered a strong first half of the year. Our second quarter non-GAAP net income per diluted share of $0.52 exceeded our expectations, led by our owned brands. DKNY and Karl Lagerfeld collectively grew double-digits and the Donna Karan relaunch has been incredibly successful, in addition to continued solid performance with healthy sell-throughs across the rest of our business.”

Founded as a small leather goods business, G-III (NASDAQ:GIII) is a fashion and apparel conglomerate with a diverse portfolio of brands.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

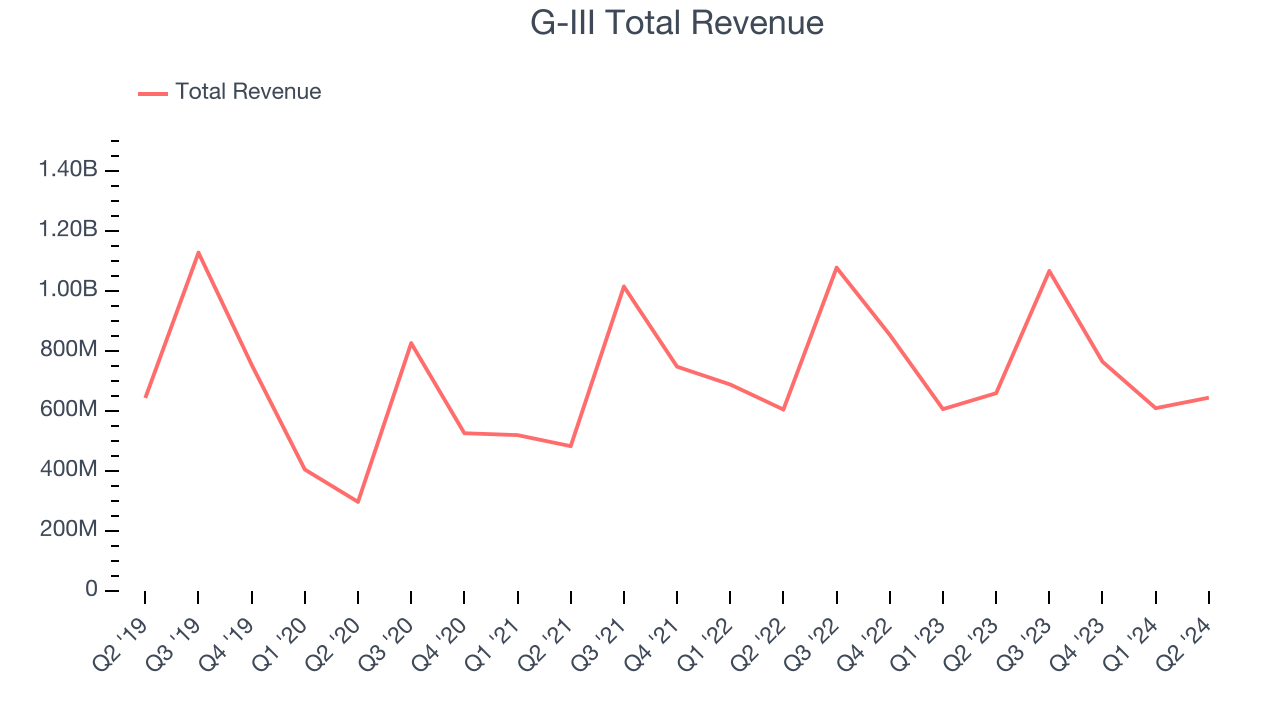

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one tends to grow for years. G-III struggled to generate demand over the last five years as its sales were flat. This is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Just like its five-year trend, G-III’s revenue over the last two years was flat, suggesting it is in a slump.

This quarter, G-III missed Wall Street’s estimates and reported a rather uninspiring 2.3% year-on-year revenue decline, generating $644.8 million of revenue. The company is guiding for revenue to rise 3.1% year on year to $1.1 billion next quarter, improving from the 1% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 4.3% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

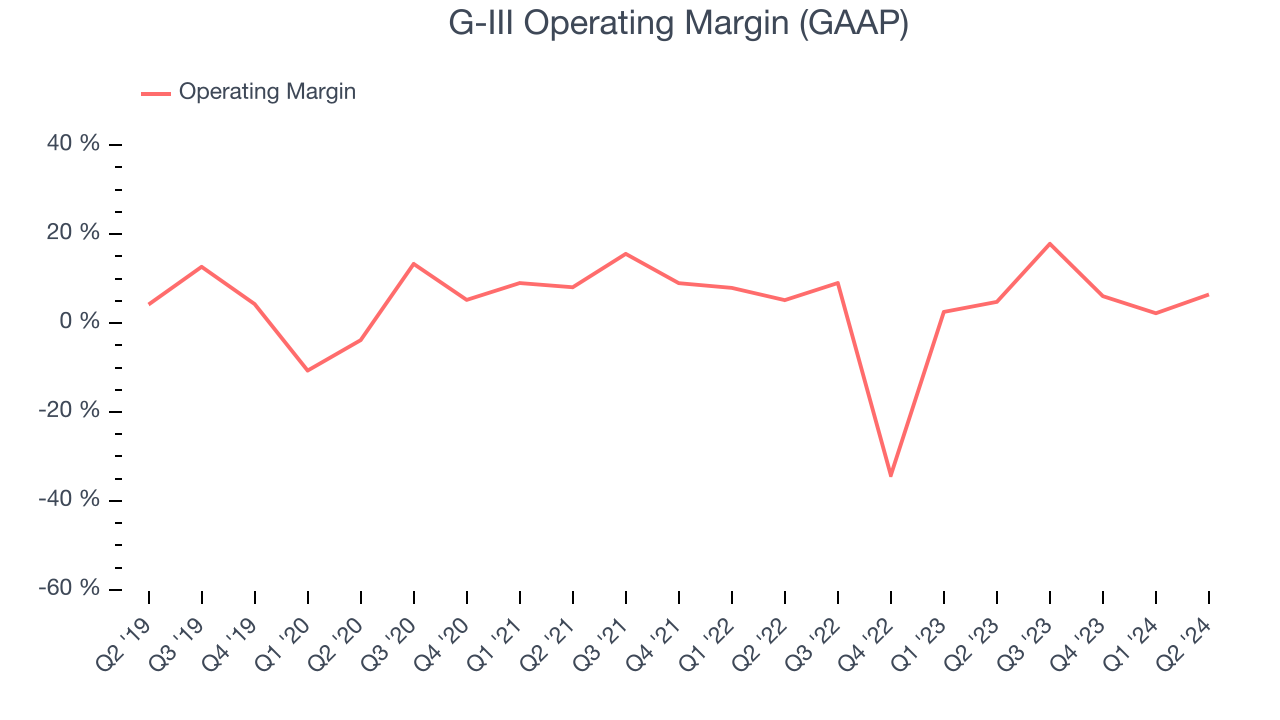

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

G-III’s operating margin has been trending up over the last year and averaged 2.3%. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

This quarter, G-III generated an operating profit margin of 6.4%, up 1.7 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was recently more efficient because it scaled down its expenses.

Key Takeaways from G-III’s Q2 Results

We were impressed by how significantly G-III blew past analysts’ EBITDA and EPS expectations this quarter. On the other hand, its revenue guidance for next quarter was underwhelming and its revenue fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter featuring some areas of strength but also some blemishes. The stock traded up 1.7% to $25.47 immediately following the results.

So should you invest in G-III right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.