Fashion conglomerate G-III (NASDAQ:GIII) fell short of analysts' expectations in Q4 FY2023 with revenue down 10.5% year on year to $764.8 million. On the other hand, next quarter's outlook exceeded expectations with revenue guided to $615 million at the midpoint, or 1% above analysts' estimates. It made a GAAP profit of $0.61 per share, improving from its loss of $5.54 per share in the same quarter last year.

G-III (GIII) Q4 FY2023 Highlights:

- Revenue: $764.8 million vs analyst estimates of $817 million (6.4% miss)

- EPS: $0.61 vs analyst expectations of $0.67 (9.3% miss)

- Revenue Guidance for Q1 2024 is $615 million at the midpoint, above analyst estimates of $608.6 million

- Management's revenue guidance for the upcoming financial year 2024 is $3.2 billion at the midpoint, missing analyst estimates by 0.6% and implying 3.3% growth (vs -3.6% in FY2023)

- Gross Margin (GAAP): 36.9%, up from 33% in the same quarter last year

- Market Capitalization: $1.39 billion

Founded as a small leather goods business, G-III (NASDAQ:GIII) is a fashion and apparel conglomerate with a diverse portfolio of brands.

G-III's portfolio of licensed and owned brands caters to both the luxury and mass market segments. The company holds licenses for household names such as Calvin Klein, Tommy Hilfiger, Levi's, and Champion, allowing it to produce and sell products under these esteemed labels. G-III also owns brands such as DKNY, Donna Karan, Vilebrequin, G.H. Bass, and Andrew Marc.

G-III leverages an extensive distribution network to reach its customers, including department stores, specialty retailers, online retailers, and its own branded brick-and-mortar stores. This multi-channel distribution strategy enables G-III to sell its products globally.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

G-III’s primary competitors include Ralph Lauren (NYSE:RL), VF Corp (NYSE:VFC), owner of The North Face and Timberland, and Capri Holdings (NYSE:CPRI), owner of Michael Kors and Versace.Sales Growth

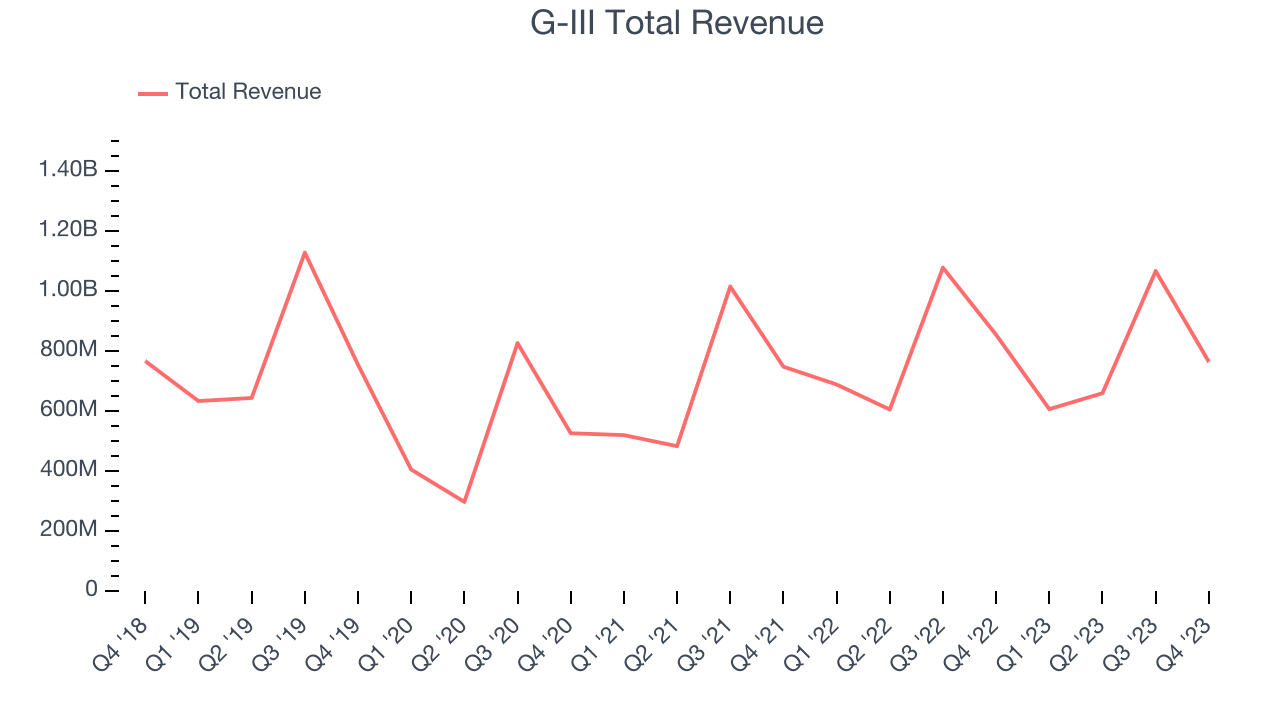

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. G-III's revenue was flat over the last five years.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. G-III's annualized revenue growth of 5.8% over the last two years is above its five-year trend, suggesting some bright spots.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. G-III's annualized revenue growth of 5.8% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, G-III missed Wall Street's estimates and reported a rather uninspiring 10.5% year-on-year revenue decline, generating $764.8 million of revenue. The company is guiding for revenue to rise 1.4% year on year to $615 million next quarter, improving from the 11.9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 2.6% over the next 12 months, an acceleration from this quarter.

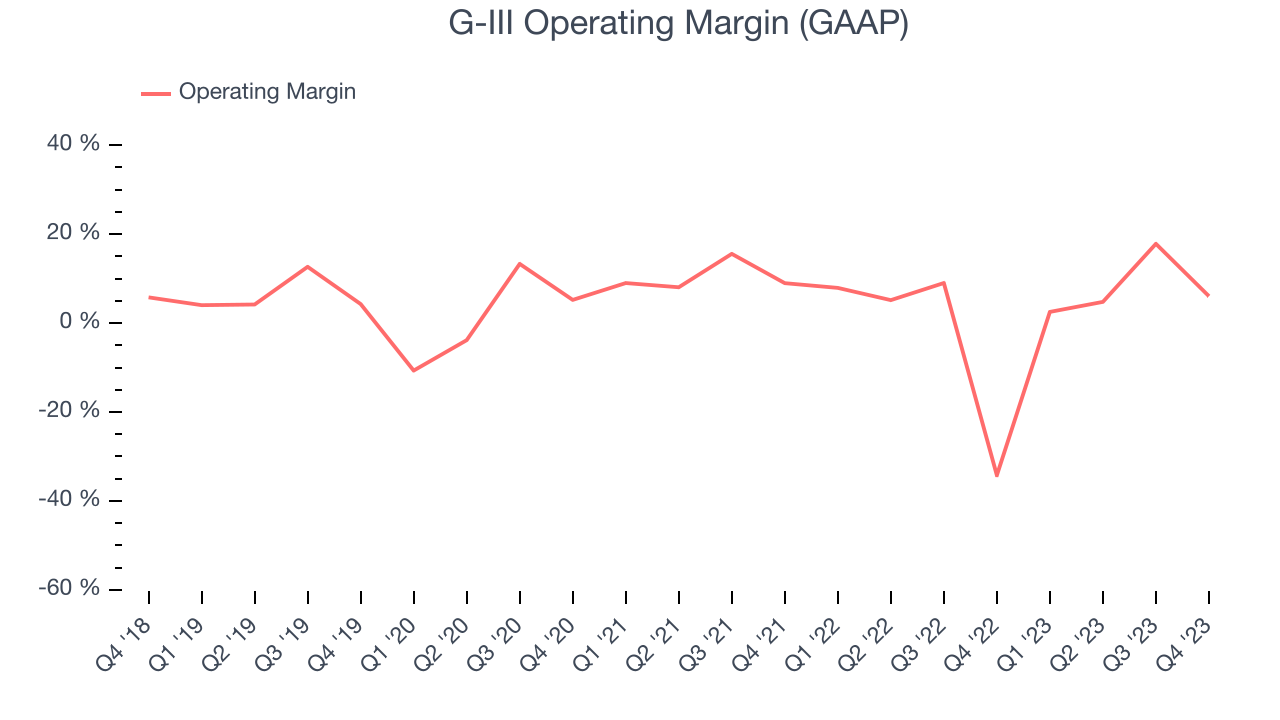

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

G-III was profitable over the last two years but held back by its large expense base. Its average operating margin of 2.7% has been paltry for a consumer discretionary business.

This quarter, G-III generated an operating profit margin of 6.1%, up 40.3 percentage points year on year.

Over the next 12 months, Wall Street expects G-III to maintain its LTM operating margin of 9.1%.EPS

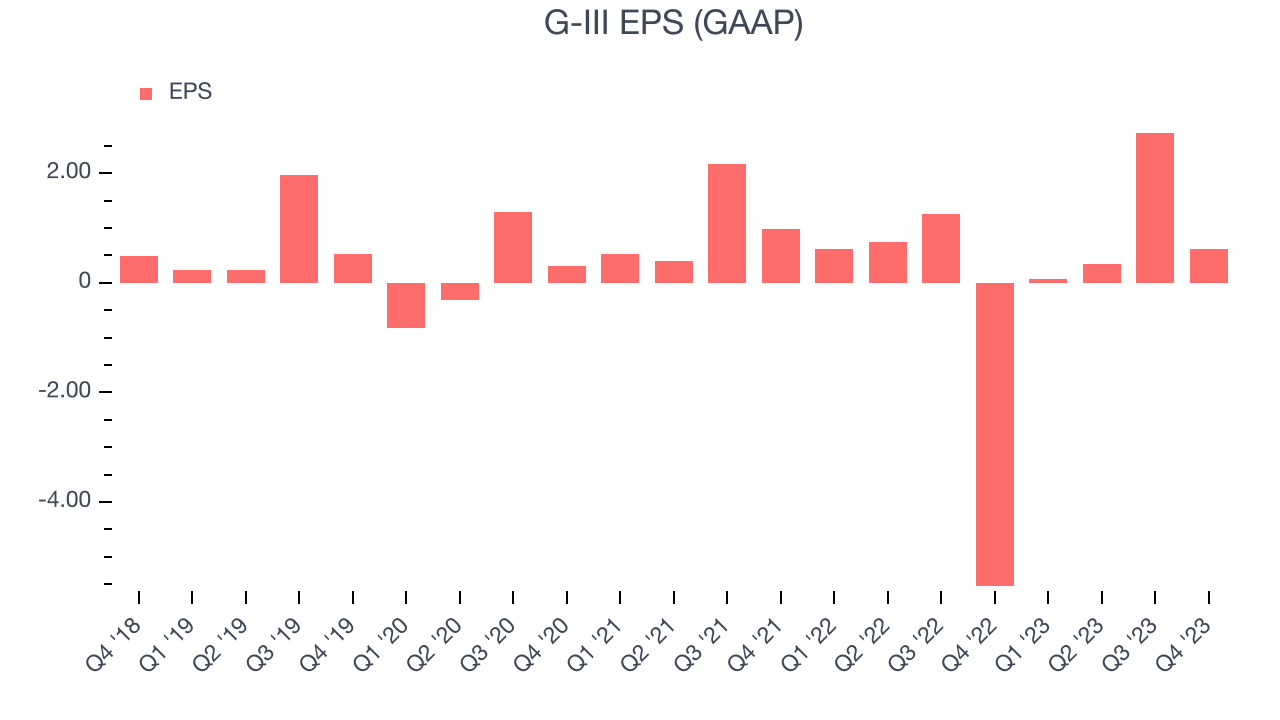

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, G-III's EPS grew 42.6%, translating into an unimpressive 7.4% compounded annual growth rate. This performance, however, is materially higher than its flat revenue over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals. A five-year view shows that G-III has repurchased its stock, shrinking its share count by 6.1%. This has led to higher per share earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.

In Q4, G-III reported EPS at $0.61, up from negative $5.54 in the same quarter a year ago. This print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street expects G-III to grow its earnings. Analysts are projecting its LTM EPS of $3.77 to climb by 1.3% to $3.82.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

G-III's five-year average return on invested capital was 8%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, G-III's ROIC over the last two years averaged 3.9 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from G-III's Q4 Results

We struggled to find many strong positives in this quarter's results. Its revenue guidance for next quarter beat analysts' expectations, but looking at the company's full-year 2024 outlook, its forecasted revenue was in line while its forecasted EPS fell short. Furthermore, this quarter's revenue and EPS missed Wall Street's estimates. Overall, the results could have been better. The company is down 2.2% on the results and currently trades at $29.69 per share.

Is Now The Time?

G-III may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of G-III, we'll be cheering from the sidelines. Its revenue growth has been weak over the last five years, but at least growth is expected to increase in the short term. On top of that, its low free cash flow margins give it little breathing room, and its operating margins reveal poor profitability compared to other consumer discretionary companies.

G-III's price-to-earnings ratio based on the next 12 months is 7.9x. While the price is reasonable and there are some things to like about G-III, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $28.83 per share right before these results (compared to the current share price of $29.69).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.