Discount grocery store chain Grocery Outlet (NASDAQ:GO) announced better-than-expected results in Q2 CY2024, with revenue up 11.7% year on year to $1.13 billion. On the other hand, the company's full-year revenue guidance of $4.33 billion at the midpoint came in slightly below analysts' estimates. It made a non-GAAP profit of $0.25 per share, down from its profit of $0.32 per share in the same quarter last year.

Is now the time to buy Grocery Outlet? Find out by accessing our full research report, it's free.

Grocery Outlet (GO) Q2 CY2024 Highlights:

- Revenue: $1.13 billion vs analyst estimates of $1.10 billion (2.4% beat)

- EPS (non-GAAP): $0.25 vs analyst estimates of $0.20 (25.2% beat)

- The company reconfirmed its revenue guidance for the full year of $4.33 billion at the midpoint

- EPS (non-GAAP) guidance for the full year is $0.92 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 30.9%, down from 32.3% in the same quarter last year

- Adjusted EBITDA Margin: 6%, in line with the same quarter last year

- Free Cash Flow of $2.73 million, down 92.5% from the same quarter last year

- Locations: 524 at quarter end, up from 447 in the same quarter last year

- Same-Store Sales rose 3.4% year on year (9.2% in the same quarter last year)

- Market Capitalization: $1.83 billion

"We are pleased with our second quarter performance with gross margins and earnings coming in better than our expectations," said RJ Sheedy, President and CEO of Grocery Outlet.

Due to its differentiated procurement and buying approach, Grocery Outlet (NASDAQ:GO) is a discount grocery store chain that offers substantial discounts on name-brand products.

Grocery Store

Grocery stores are non-discretionary because they sell food, an essential staple for life (maybe not that ice cream?). Selling food, however, is a notoriously tough business as grocers must deal with the costs of procuring and transporting oftentimes perishable products. Plus, the costs of operating stores to sell everything from raw meat to ice cream and fresh fruit are high. Competition is also fierce because grocers and other peers such as wholesale clubs tend to sell very similar brands and products. On the bright side, grocery is one of the least penetrated categories in e-commerce because customers prefer to buy their food in person. Still, the online threat exists and will likely increase over time rather than dwindle.

Sales Growth

Grocery Outlet is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

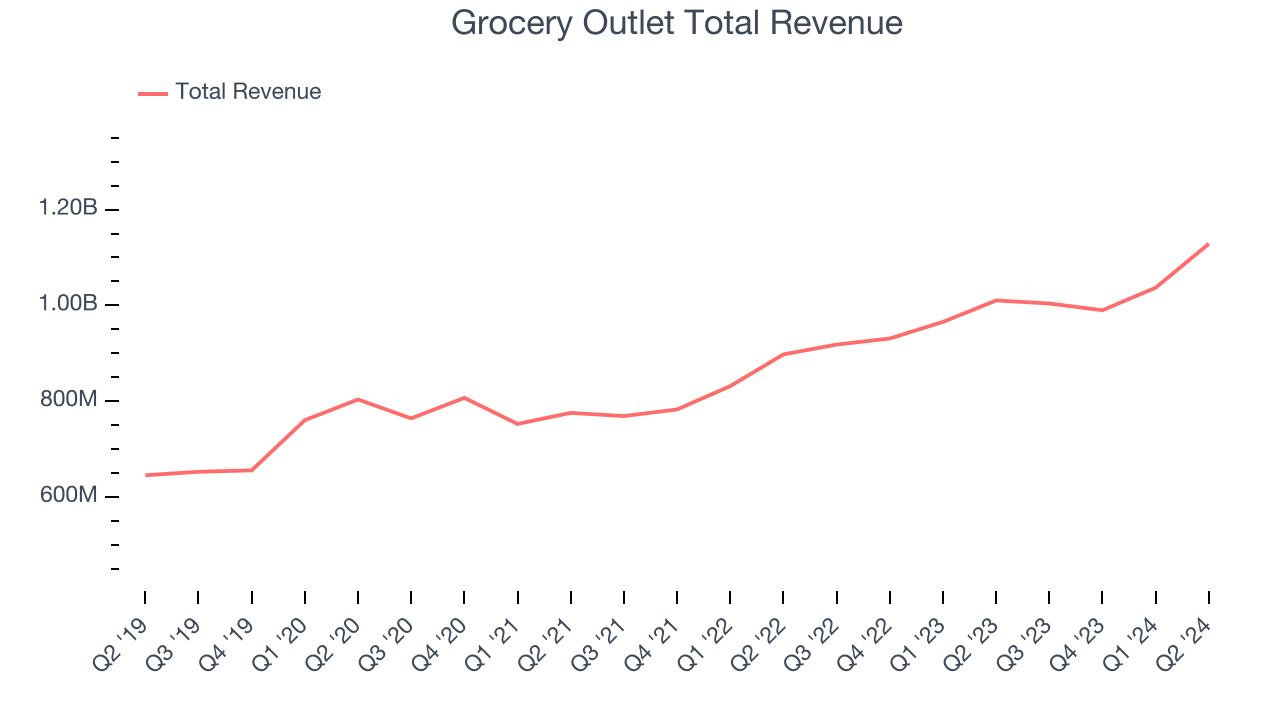

As you can see below, the company's annualized revenue growth rate of 11.5% over the last five years was decent as it opened new stores and grew sales at existing, established stores.

This quarter, Grocery Outlet reported robust year-on-year revenue growth of 11.7%, and its $1.13 billion in revenue exceeded Wall Street's estimates by 2.4%. Looking ahead, Wall Street expects sales to grow 9.6% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

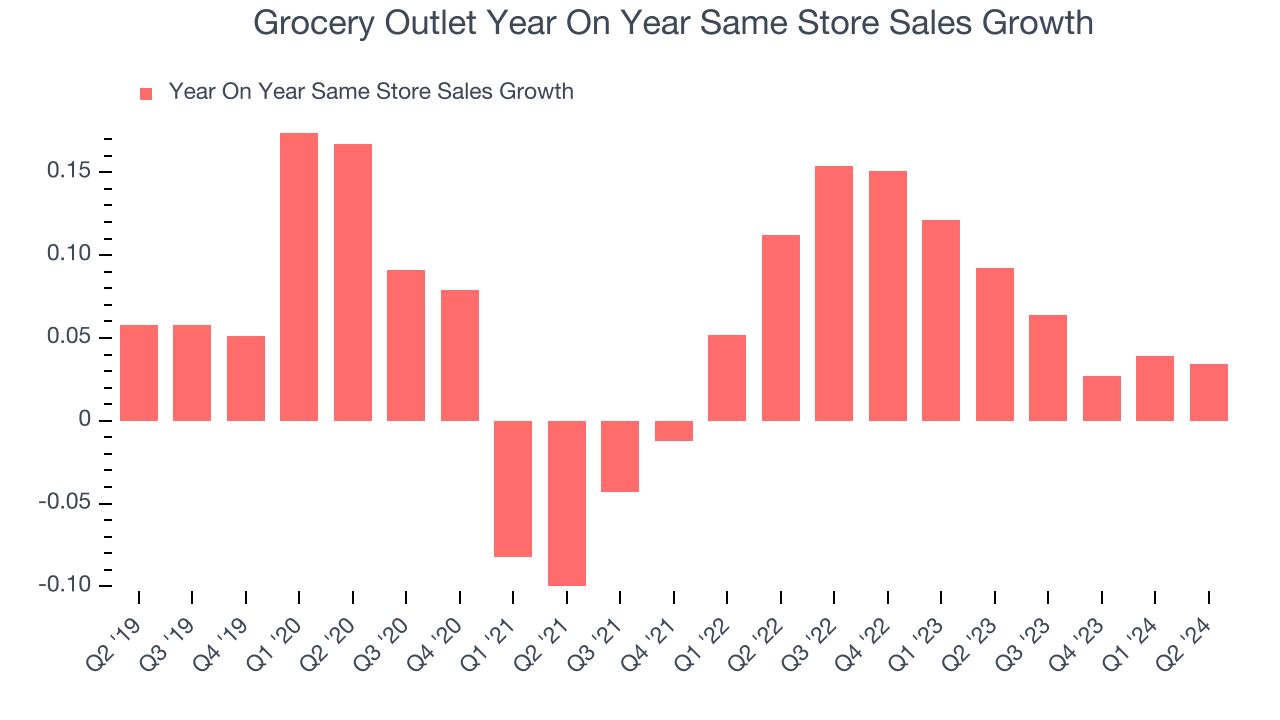

Grocery Outlet's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 8.5% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Grocery Outlet is reaching more customers and growing sales.

In the latest quarter, Grocery Outlet's same-store sales rose 3.4% year on year. By the company's standards, this growth was a meaningful deceleration from the 9.2% year-on-year increase it posted 12 months ago. We'll be watching Grocery Outlet closely to see if it can reaccelerate growth.

Key Takeaways from Grocery Outlet's Q2 Results

We were impressed by how significantly Grocery Outlet blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. The company largely reaffirmed full year guidance, showing that the company remains on track. Overall, we think this was a solid quarter. The stock traded up 10.9% to $20.55 immediately after reporting.

Grocery Outlet may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.