Discount grocery store chain Grocery Outlet (NASDAQ:GO) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 7.4% year on year to $1.04 billion. The company expects the full year's revenue to be around $4.33 billion, in line with analysts' estimates. It made a non-GAAP profit of $0.09 per share, down from its profit of $0.27 per share in the same quarter last year.

Grocery Outlet (GO) Q1 CY2024 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $1.02 billion (1.4% beat)

- Adjusted EBITDA: $39.4 million vs analyst estimates of $52.3 million (big miss)

- EPS (non-GAAP): $0.09 vs analyst estimates of $0.18 (-$0.09 miss)

- The company reconfirmed its revenue guidance for the full year of $4.33 billion at the midpoint

- The company lowered its gross margin and adjusted EBITDA guidance for the full year

- Gross Margin (GAAP): 29.3%, down from 31.1% in the same quarter last year

- Free Cash Flow was -$38.43 million, down from $54.74 million in the same quarter last year

- Same-Store Sales were up 3.9% year on year (beat)

- Store Locations: 474 at quarter end, increasing by 30 over the last 12 months

- Market Capitalization: $2.58 billion

Due to its differentiated procurement and buying approach, Grocery Outlet (NASDAQ:GO) is a discount grocery store chain that offers substantial discounts on name-brand products.

Specifically, the company purchases closeout merchandise, excess inventory, and discontinued items from manufacturers and other retailers. The result is prices up to 60% less than regular supermarkets. The positive of this approach is low prices whereas the negative is less reliable selection. The core Grocery Outlet customer is a shopper who therefore values the savings and doesn’t mind some inventory inconsistency.

The size of the average Grocery Outlet store is around 18,000 square feet, which is much smaller than the traditional supermarket. The stores are typically located in strip malls or standalone buildings in suburban areas. Overall, the layout of a Grocery Outlet store is similar to a traditional supermarket, just smaller. Fresh produce is towards the front, meat and dairy is towards the back, and the center aisles of packaged goods fill the middle.

A unique feature of Grocery Outlet's layout is the "treasure hunt" section, located towards the front of the store. This section features unique and unusual products at even deeper discounts than the rest of the store. The selection in this section changes regularly, so customers may find potato chips one week and canned soup the next.

Grocery Store

Grocery stores are non-discretionary because they sell food, an essential staple for life (maybe not that ice cream?). Selling food, however, is a notoriously tough business as grocers must deal with the costs of procuring and transporting oftentimes perishable products. Plus, the costs of operating stores to sell everything from raw meat to ice cream and fresh fruit are high. Competition is also fierce because grocers and other peers such as wholesale clubs tend to sell very similar brands and products. On the bright side, grocery is one of the least penetrated categories in e-commerce because customers prefer to buy their food in person. Still, the online threat exists and will likely increase over time rather than dwindle.

Grocery competitors with offering brand-name products at competitive prices include Walmart (NYSE:WMT), Dollar General (NYSE:DG), and Kroger (NYSE:KR)Sales Growth

Grocery Outlet is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

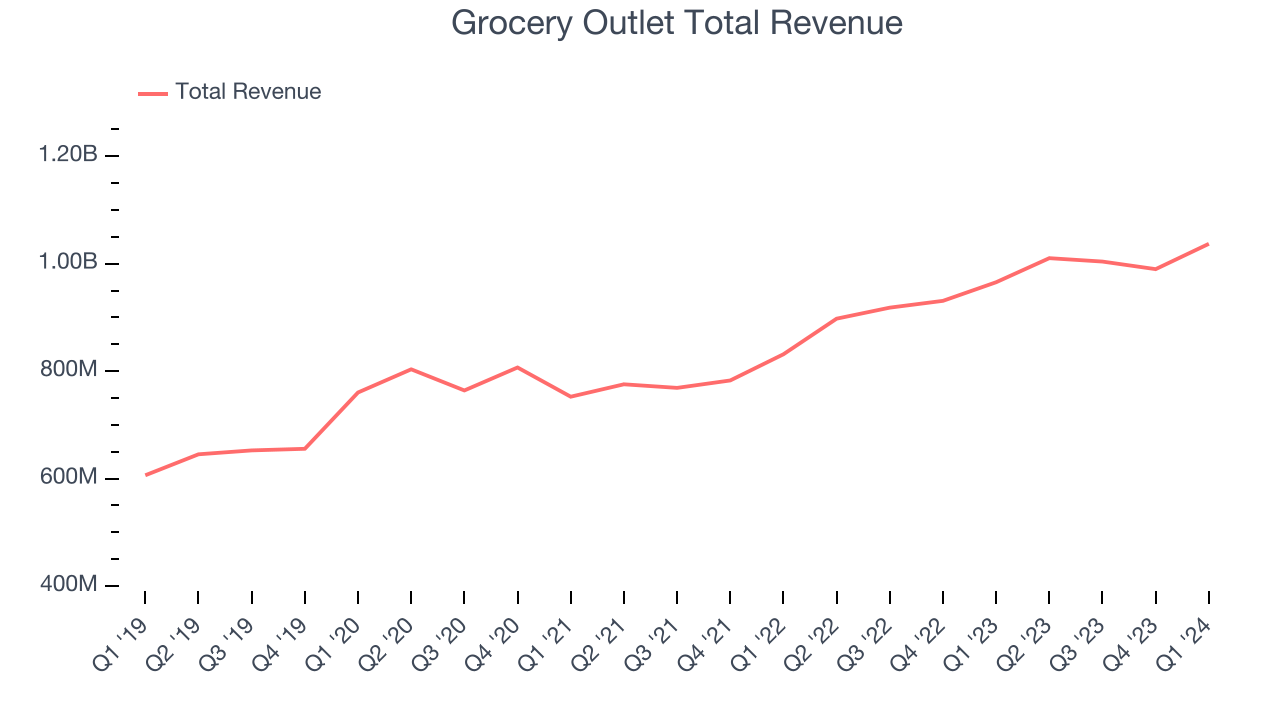

As you can see below, the company's annualized revenue growth rate of 11.5% over the last five years was decent as it opened new stores and grew sales at existing, established stores.

This quarter, Grocery Outlet reported solid year-on-year revenue growth of 7.4%, and its $1.04 billion in revenue outperformed Wall Street's estimates by 1.4%. Looking ahead, Wall Street expects sales to grow 10.2% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

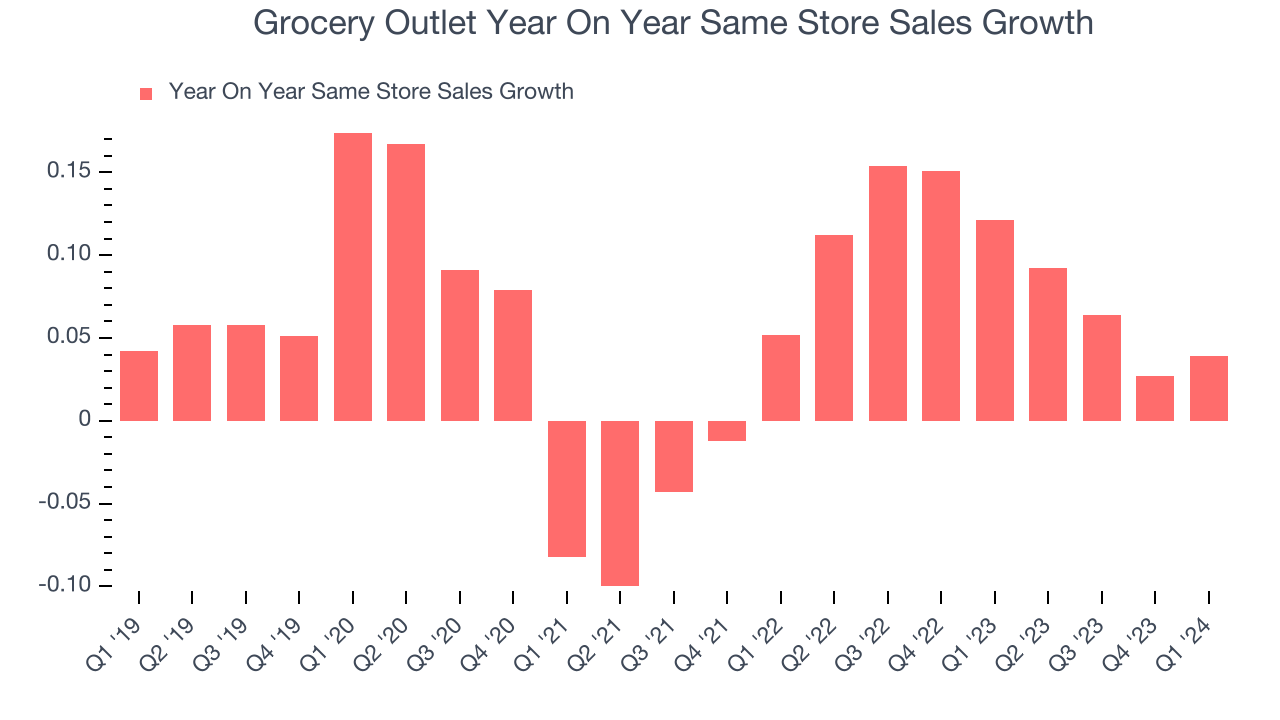

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

Grocery Outlet's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 9.5% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Grocery Outlet is reaching more customers and growing sales.

In the latest quarter, Grocery Outlet's same-store sales rose 3.9% year on year. By the company's standards, this growth was a meaningful deceleration from the 12.1% year-on-year increase it posted 12 months ago. We'll be watching Grocery Outlet closely to see if it can reaccelerate growth.

Number of Stores

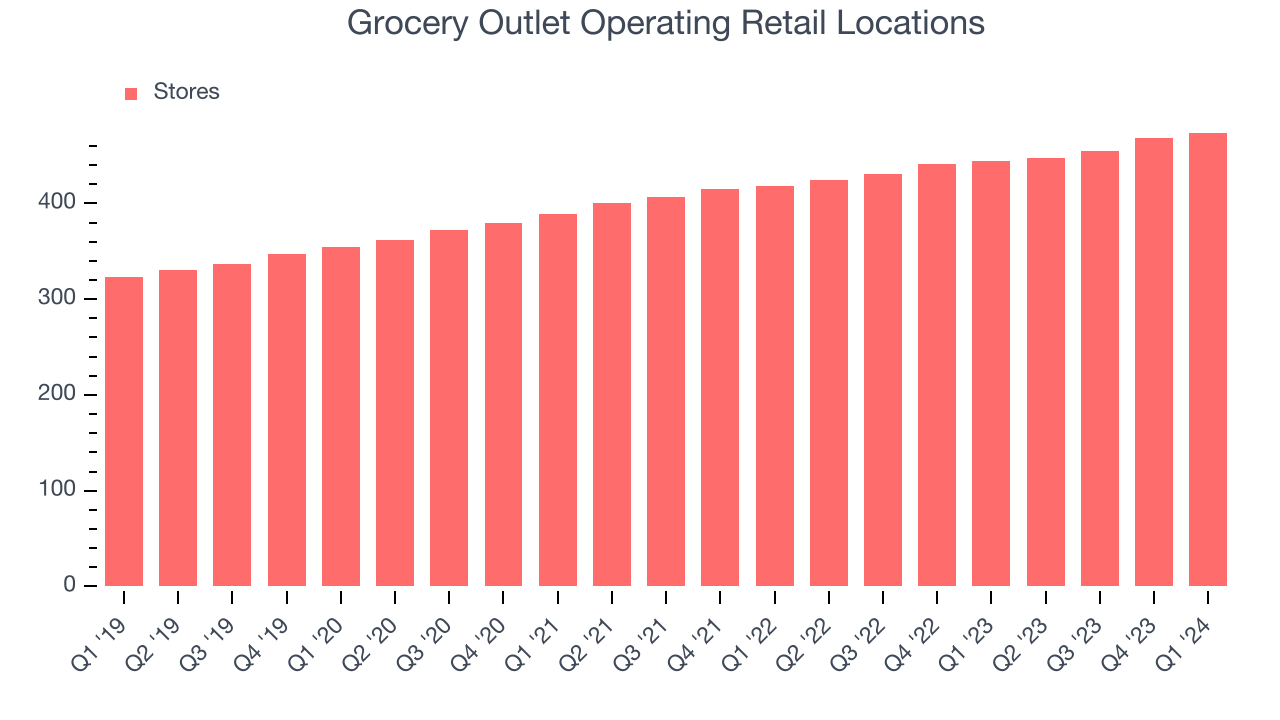

A retailer's store count is a crucial factor influencing how much it can sell, and store growth is a critical driver of how quickly its sales can grow.

When a retailer like Grocery Outlet is opening new stores, it usually means it's investing for growth because demand is greater than supply. Since last year, Grocery Outlet's store count increased by 30 locations, or 6.8%, to 474 total retail locations in the most recently reported quarter.

Over the last two years, the company has opened new stores quickly and averaged 6% annual growth in new locations, meaningfully higher than other consumer retail businesses. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Gross Margin & Pricing Power

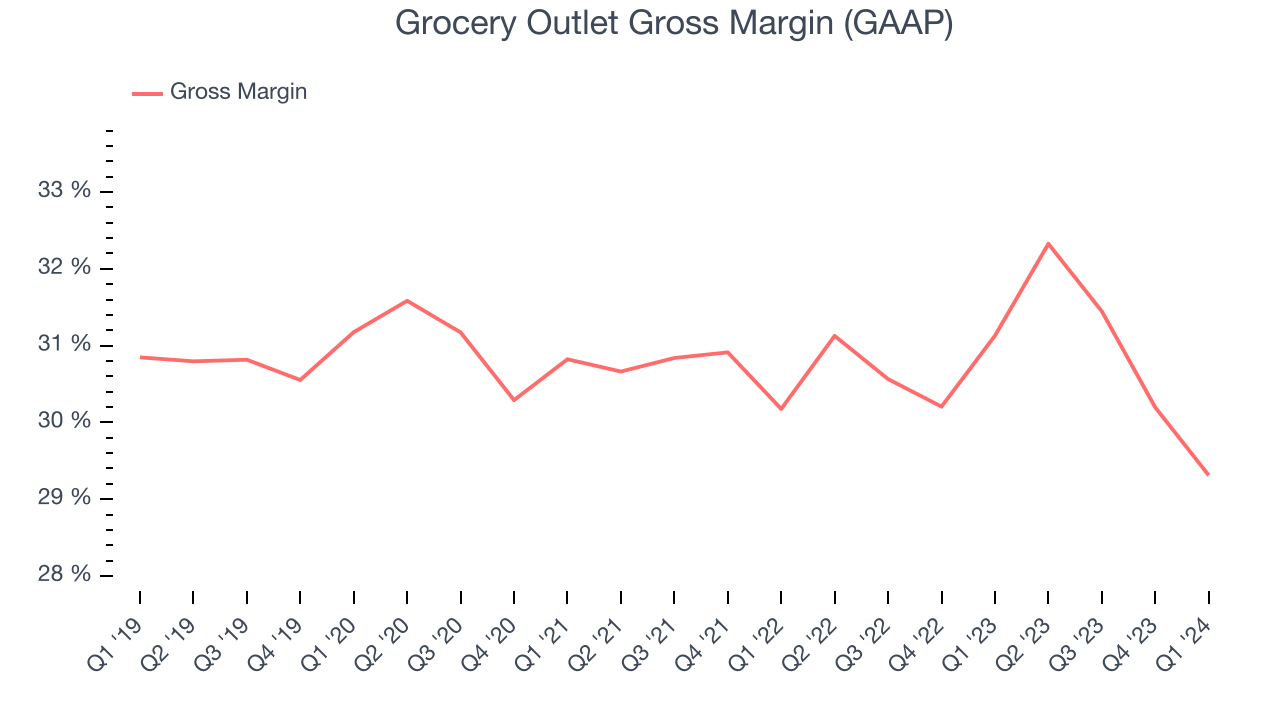

Grocery Outlet has weak unit economics for a retailer, making it difficult to reinvest in the business. As you can see below, it's averaged a 30.8% gross margin over the last eight quarters. However, when comparing its margin specifically to other non-discretionary retailers, it's actually pretty solid. That's because non-discretionary retailers have structurally lower gross margins as they compete to provide the lowest possible price, sell products easily found elsewhere, and have high transportation costs to move their goods. We believe the best metrics to assess these types of companies are free cash flow margin, operating leverage, and profit volatility, which take their scale advantages and non-cyclical demand characteristics into account.

Grocery Outlet's gross profit margin came in at 29.3% this quarter, marking a 1.8 percentage point decrease from 31.1% in the same quarter last year. This drop raises an eyebrow for a retailer like Grocery Outlet, which is structurally less profitable than the typical retail business for the reasons mentioned above, as it signals a more competitive environment with higher input costs (such as distribution expenses to move goods) and more pressure to discount products.

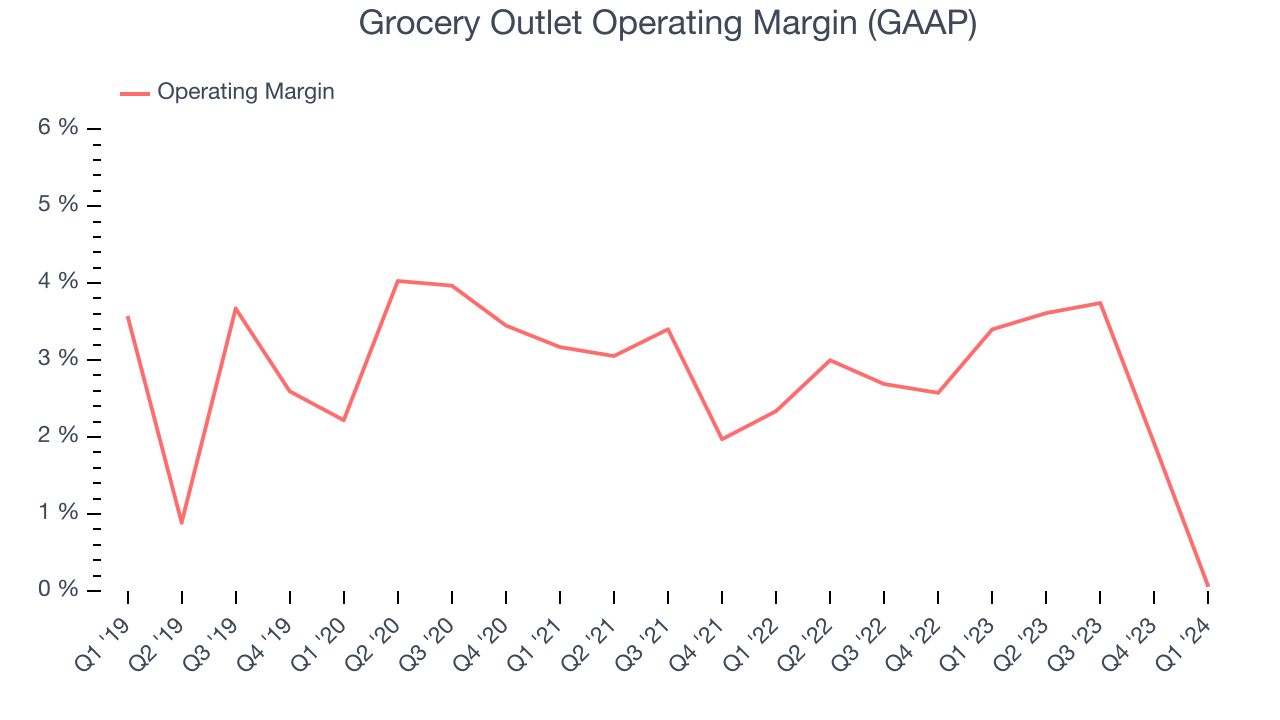

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Grocery Outlet generated an operating profit margin of 0.1%, down 3.3 percentage points year on year. We can infer Grocery Outlet was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Zooming out, Grocery Outlet was profitable over the last two years but held back by its large expense base. Its average operating margin of 2.6% has been paltry for a consumer retail business. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.

Zooming out, Grocery Outlet was profitable over the last two years but held back by its large expense base. Its average operating margin of 2.6% has been paltry for a consumer retail business. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.EPS

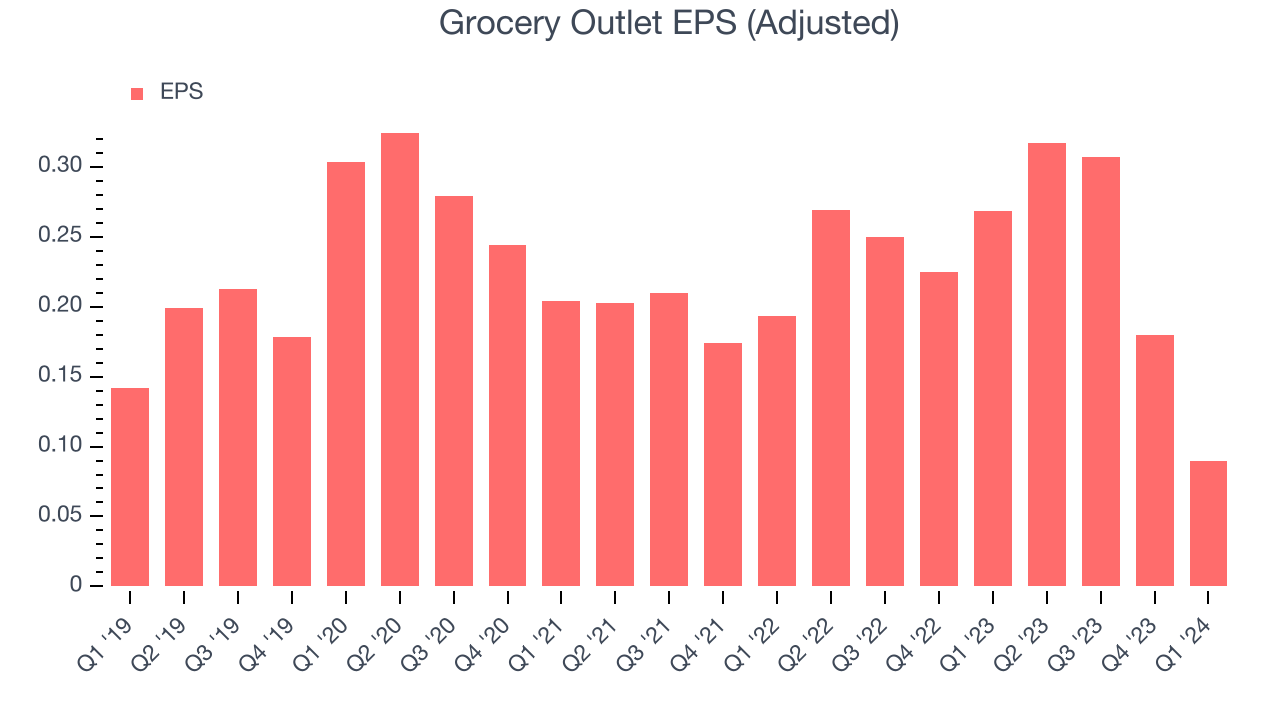

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Grocery Outlet reported EPS at $0.09, down from $0.27 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

On the bright side, Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 39% year-on-year increase in EPS.

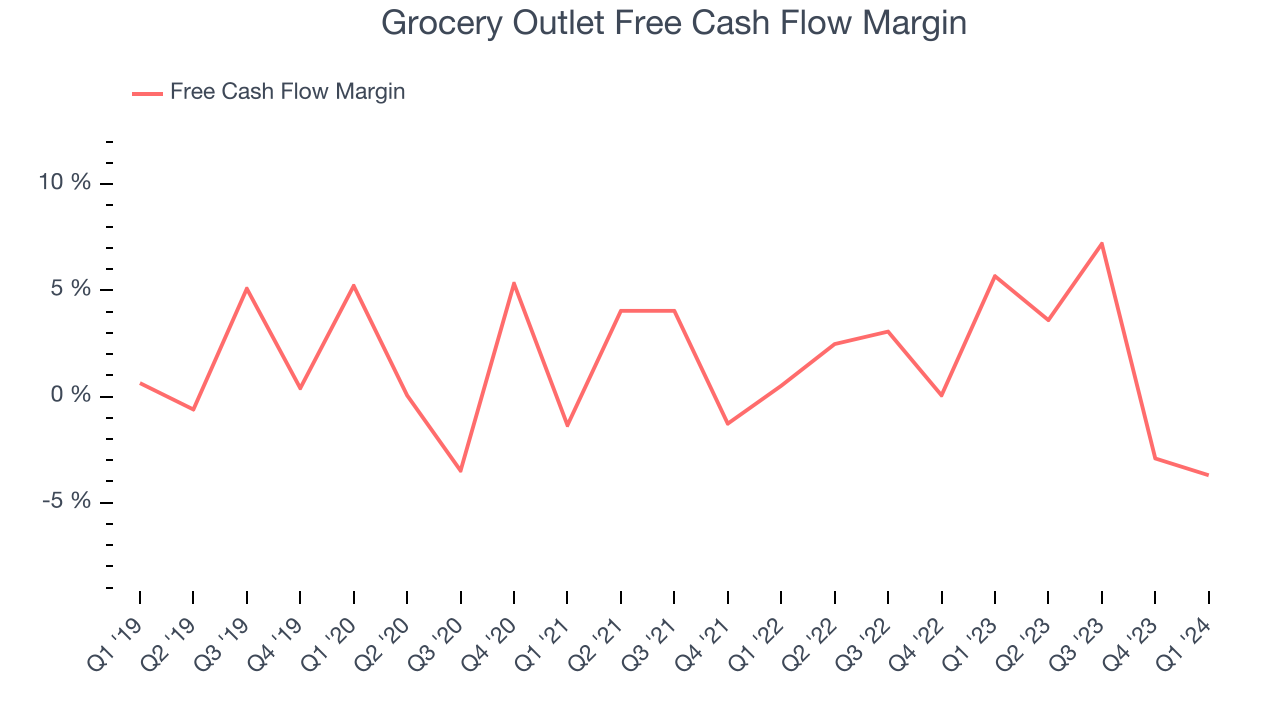

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

Grocery Outlet burned through $38.43 million of cash in Q1, representing a negative 3.7% free cash flow margin. The company shifted to cash flow negative from cash flow positive in the same quarter last year, which happened for several reasons including (but not limited to) the stockpiling of inventory in anticipation of higher demand or unforeseen, one-time events.

Over the last eight quarters, Grocery Outlet has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 1.9%, subpar for a consumer retail business. Furthermore, its margin has averaged year-on-year declines of 1.8 percentage points.

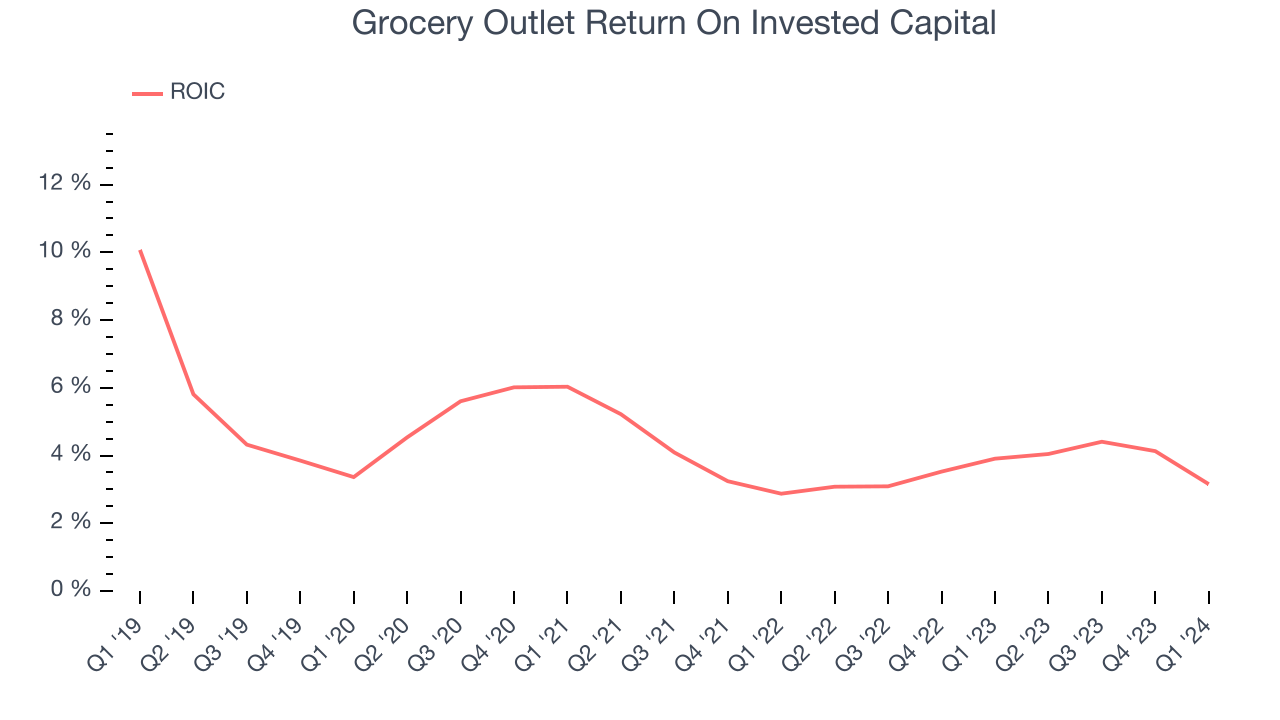

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Grocery Outlet's five-year average ROIC was 3.9%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Grocery Outlet's ROIC averaged 1.2 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Grocery Outlet's $1.40 billion of debt exceeds the $66.89 million of cash on its balance sheet. Furthermore, its 6x net-debt-to-EBITDA ratio (based on its EBITDA of $228.9 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Grocery Outlet could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Grocery Outlet can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Grocery Outlet's Q1 Results

It was good to see Grocery Outlet beat analysts' revenue expectations this quarter. On the other hand, adjusted EBITDA missed by a meaningful amount, and the company's full-year earnings forecast missed analysts' expectations. Overall, this was a mediocre quarter for Grocery Outlet. The company is down 19.2% on the results and currently trades at $20.96 per share.

Is Now The Time?

Grocery Outlet may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Grocery Outlet isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been solid over the last five years, its relatively low ROIC suggests it has struggled to grow profits historically. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its operating margins reveal poor profitability compared to other retailers.

Grocery Outlet's price-to-earnings ratio based on the next 12 months is 20.9x. In the end, beauty is in the eye of the beholder. While Grocery Outlet wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $31.27 per share right before these results (compared to the current share price of $20.96).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.