Looking back on software development stocks' Q1 earnings, we examine this quarter's best and worst performers, including GitLab (NASDAQ:GTLB) and its peers.

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 11 software development stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 1.7%. while next quarter's revenue guidance was in line with consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and while some of the software development stocks have fared somewhat better than others, they collectively declined, with share prices falling 2.7% on average since the previous earnings results.

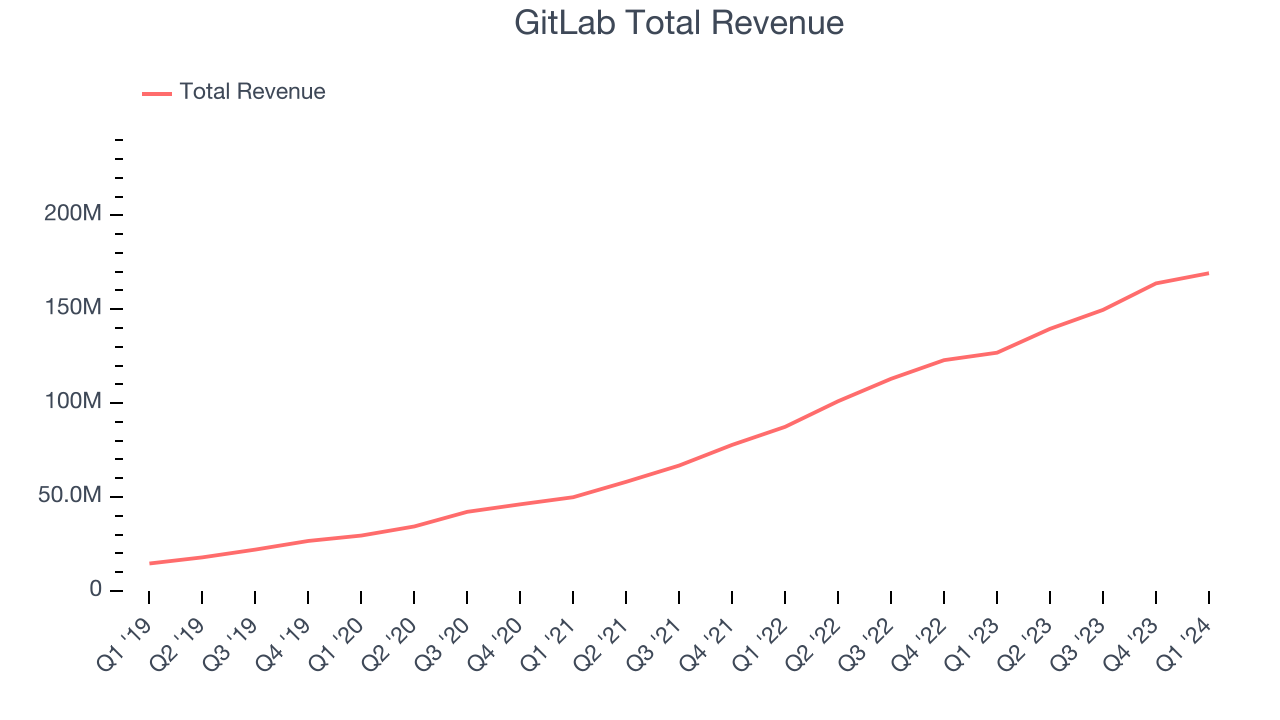

GitLab (NASDAQ:GTLB)

Founded as an open-source project in 2011, GitLab (NASDAQ:GTLB) is a leading software development tools platform.

GitLab reported revenues of $169.2 million, up 33.3% year on year, topping analysts' expectations by 1.9%. It was a weak quarter for the company, with a miss of analysts' billings estimates.

“GitLab continues to differentiate our platform with AI-driven software innovations that are streamlining how customers build, test, secure, and deploy software,” said Sid Sijbrandij, GitLab CEO and co-founder.

GitLab scored the fastest revenue growth of the whole group. The stock is up 12.9% since the results and currently trades at $53.17.

Is now the time to buy GitLab? Access our full analysis of the earnings results here, it's free.

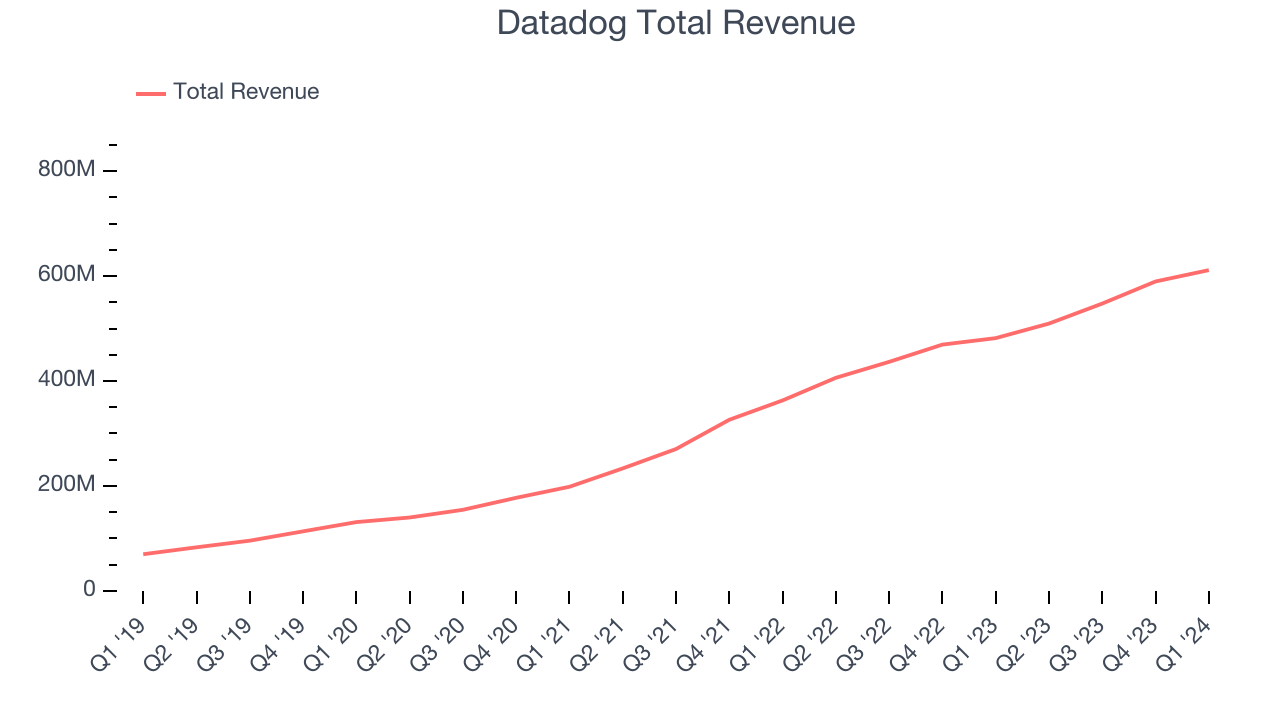

Best Q1: Datadog (NASDAQ:DDOG)

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) is a software-as-a-service platform that makes it easier to monitor cloud infrastructure and applications.

Datadog reported revenues of $611.3 million, up 26.9% year on year, outperforming analysts' expectations by 3.3%. It was a strong quarter for the company, with an impressive beat of analysts' ARR (annual recurring revenue) estimates and accelerating growth in large customers.

The stock is up 3.4% since the results and currently trades at $131.31.

Is now the time to buy Datadog? Access our full analysis of the earnings results here, it's free.

Weakest Q1: F5 (NASDAQ:FFIV)

Initially started as a hardware appliances company in the late 1990s, F5 (NASDAQ:FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting them from cyberattacks.

F5 reported revenues of $681.4 million, down 3.1% year on year, falling short of analysts' expectations by 0.4%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' billings estimates.

F5 had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is down 6.4% since the results and currently trades at $170.49.

Read our full analysis of F5's results here.

HashiCorp (NASDAQ:HCP)

Initially created as a research project at the University of Washington, HashiCorp (NASDAQ:HCP) provides software that helps companies operate their own applications in a multi-cloud environment.

HashiCorp reported revenues of $160.6 million, up 16.4% year on year, surpassing analysts' expectations by 4.8%. It was a slower quarter for the company, with a miss of analysts' billings estimates and a decline in its gross margin.

HashiCorp pulled off the biggest analyst estimates beat among its peers. The company added 21 enterprise customers paying more than $100,000 annually to reach a total of 918. The stock is up 0.2% since the results and currently trades at $33.63.

Read our full, actionable report on HashiCorp here, it's free.

JFrog (NASDAQ:FROG)

Named after the founders' affinity for frogs, JFrog (NASDAQ:FROG) provides a software-as-a-service platform that makes developing and releasing software easier and faster, especially for large teams.

JFrog reported revenues of $100.3 million, up 25.7% year on year, surpassing analysts' expectations by 1.7%. It was a weaker quarter for the company, with a miss of analysts' billings estimates and decelerating growth in large customers.

The company added 25 enterprise customers paying more than $100,000 annually to reach a total of 911. The stock is down 12.8% since the results and currently trades at $35.45.

Read our full, actionable report on JFrog here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.