Software development tools maker GitLab (NASDAQ:GTLB) reported results ahead of analysts' expectations in Q4 FY2024, with revenue up 33.3% year on year to $163.8 million. The company also expects next quarter's revenue to be around $165.5 million, coming in 2.1% above analysts' estimates. It made a non-GAAP profit of $0.15 per share, improving from its loss of $0.05 per share in the same quarter last year.

GitLab (GTLB) Q4 FY2024 Highlights:

- Revenue: $163.8 million vs analyst estimates of $158.3 million (3.5% beat)

- EPS (non-GAAP): $0.15 vs analyst estimates of $0.08 ($0.07 beat)

- Revenue Guidance for Q1 2025 is $165.5 million at the midpoint, above analyst estimates of $162 million

- Management's revenue guidance for the upcoming financial year 2025 is $728 million at the midpoint, missing analyst estimates by 1.3% and implying 25.5% growth (vs 37.3% in FY2024)

- Free Cash Flow of $24.52 million is up from -$6.70 million in the previous quarter

- Net Revenue Retention Rate: 130%, in line with the previous quarter

- Gross Margin (GAAP): 90.2%, up from 88.4% in the same quarter last year

- Market Capitalization: $11.41 billion

Founded as an open-source project in 2011, GitLab (NASDAQ:GTLB) is a leading software development tools platform.

As businesses across all sizes and industries are increasingly seeking the cost savings and improvements in customer engagement that Digital Transformation provides, this means that all companies are becoming software companies. Today, many software developers prefer to use reusable components that provide functionality so they don’t have to recreate the wheel for each new app. Traditionally, developing software meant costly internal or third party best-of-breed tools, all internally integrated, which only increased complexity, particularly when the frequency of updating / upgrading services has increased.

As a result, software development or DevOps has evolved to become more centralized, whereby all developers in a given organization use the same tools from the next gen software stacks: containers and microservices, which are modularized components of applications that allow a quicker pace of development. The second trend in modern software development is the adoption of best in class platforms rather than using a disparate collection of tools that need to be integrated with each other.

This is where GitLab comes in, its platform is a one stop shop for a huge range of DevOps tools with a single code base that is meant to address every stage in the lifecycle of software development. Two key differentiations versus other DevOps platforms are its breadth of tools and its ability to be deployed across AWS, Azure, Google Cloud Platform, which customers appreciate as a means of avoiding vendor lock-in.

Developer Operations

As Marc Andreessen says, "software is eating the world" which means the volume of software produced is exploding. But building software is complex and difficult work which drives demand for software tools that help increase the speed, quality, and security of software deployment.

GitLab’s competitors are Microsoft’s Github(NASDAQ: MSFT), JFrog (NASDAQ: FROG), Atlassian (NASDAQ: TEAM), along with private competitors like Sonatype.

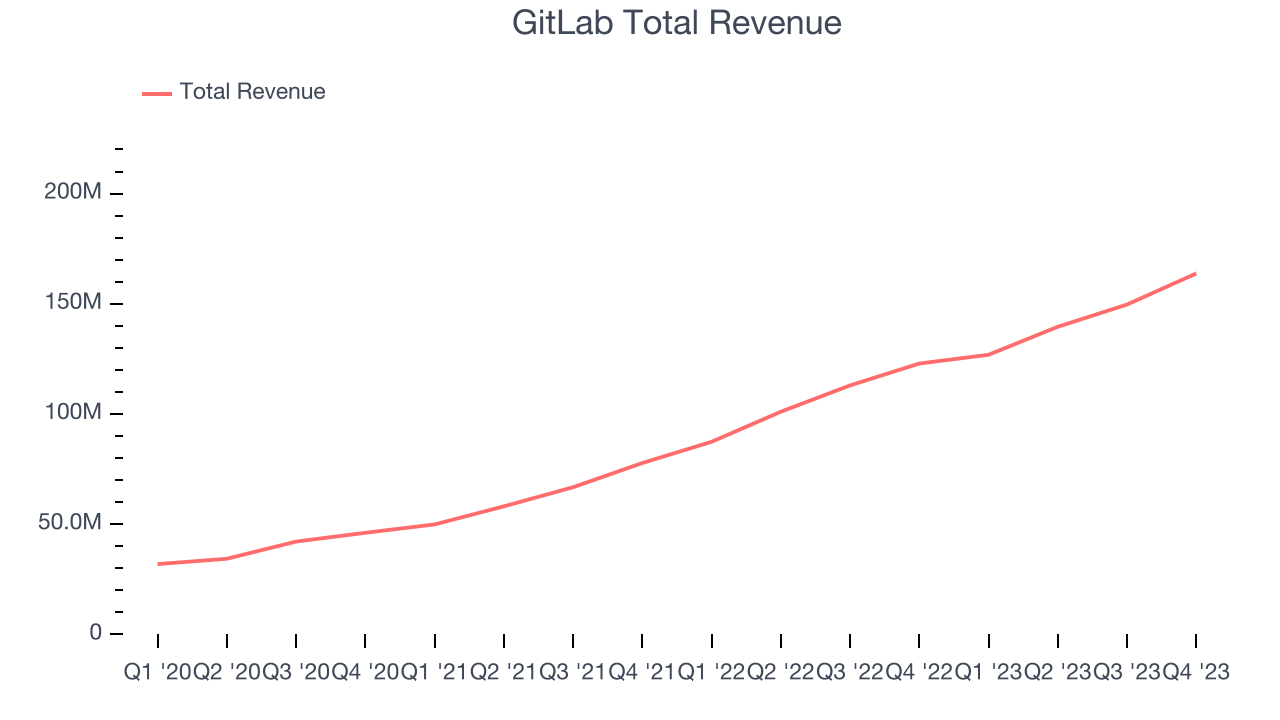

Sales Growth

As you can see below, GitLab's revenue growth has been exceptional over the last two years, growing from $77.8 million in Q4 FY2022 to $163.8 million this quarter.

Unsurprisingly, this was another great quarter for GitLab with revenue up 33.3% year on year. On top of that, its revenue increased $14.11 million quarter on quarter, a very strong improvement from the $10.09 million increase in Q3 2024. This is a sign of acceleration of growth and great to see.

Next quarter's guidance suggests that GitLab is expecting revenue to grow 30.4% year on year to $165.5 million, slowing down from the 45.2% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $728 million at the midpoint, growing 25.5% year on year compared to the 36.7% increase in FY2024.

Product Success

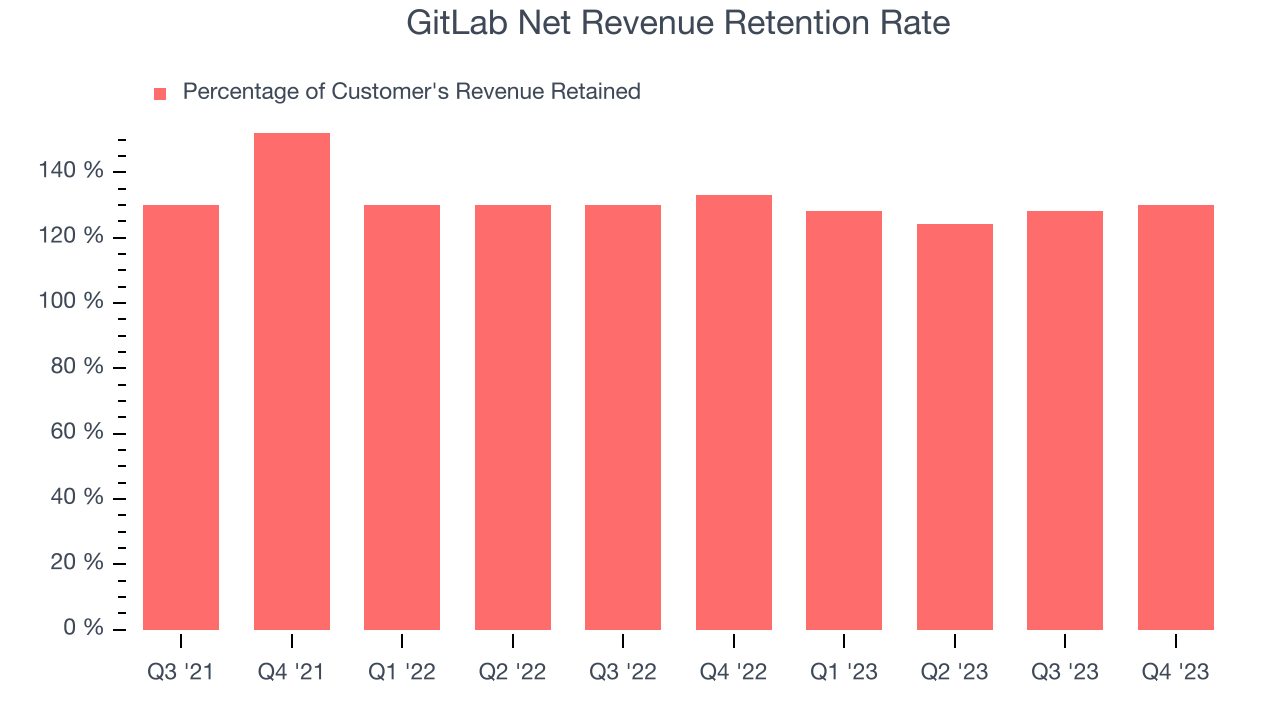

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

GitLab's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 130% in Q4. This means that even if GitLab didn't win any new customers over the last 12 months, it would've grown its revenue by 30%.

Significantly up from the last quarter, GitLab has an excellent net retention rate. This data point proves that the company sells useful products, and we can see that its customers are satisfied and increasing usage over time.

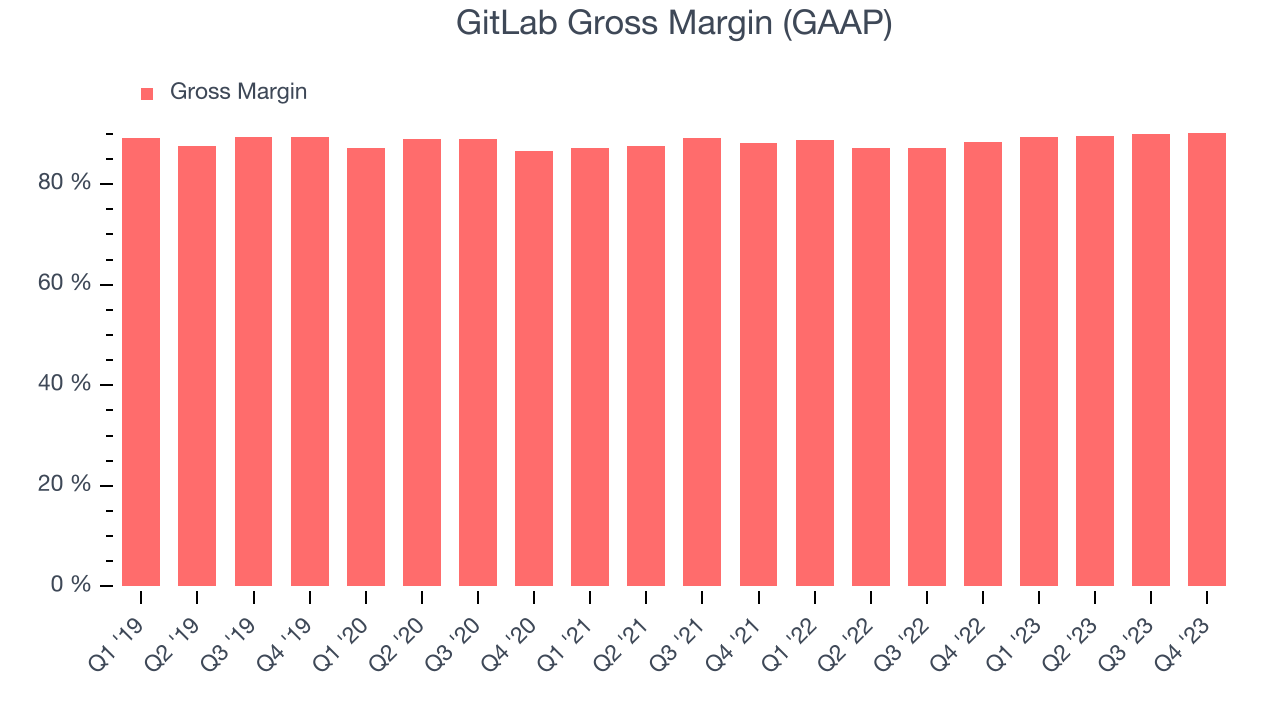

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. GitLab's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 90.2% in Q4.

That means that for every $1 in revenue the company had $0.90 left to spend on developing new products, sales and marketing, and general administrative overhead. GitLab's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that GitLab is controlling its costs and not under pressure from its competitors to lower prices.

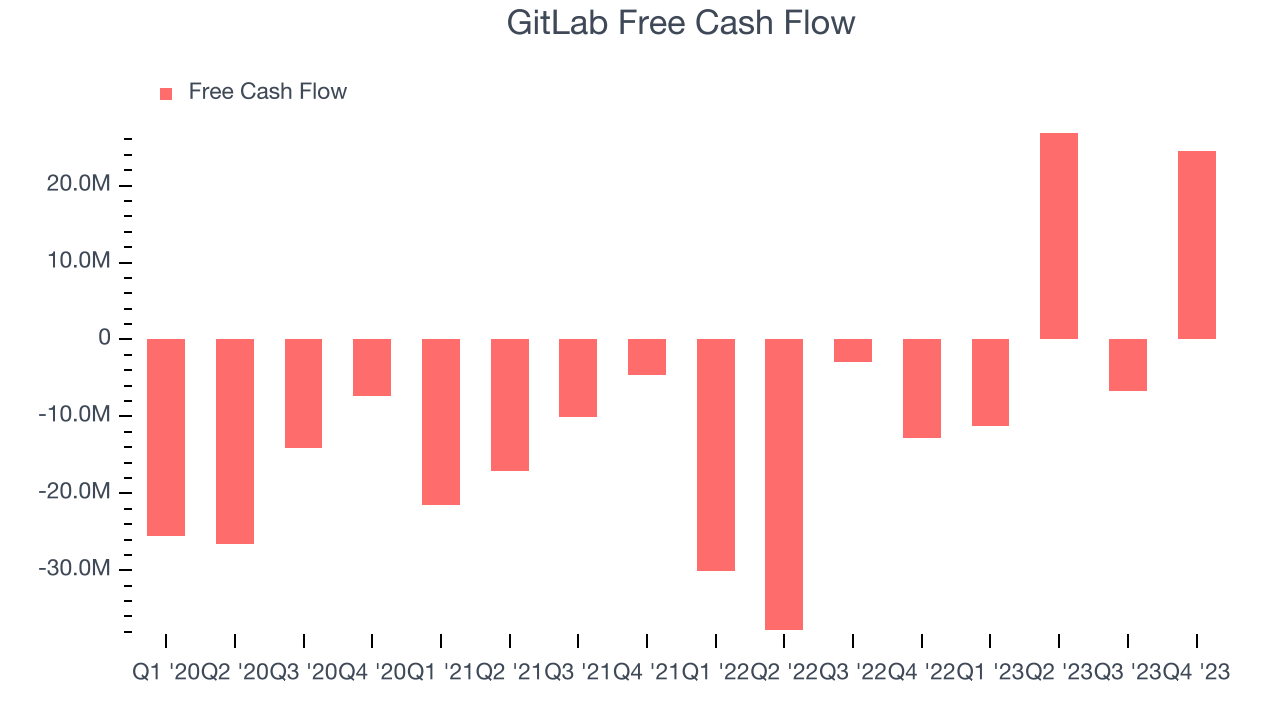

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. GitLab's free cash flow came in at $24.52 million in Q4, turning positive over the last year.

GitLab has generated $33.44 million in free cash flow over the last 12 months, or 5.8% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from GitLab's Q4 Results

It was good to see GitLab beat Wall Street's revenue estimates, driven by a better-than-expected net revenue retention rate (130% vs estimates of 127%). Furthermore, its number of customers with more than $100k in ARR significantly outperformed (955 vs estimates of 859). On the other hand, its full-year revenue guidance was below expectations and its full-year EPS guidance significantly missed, coming in 43% below analysts' forecasts.

During the quarter, GitLab appointed Sabrina Farmer as its Chief Technology Officer. Farmer joined the company from Google, where she was VP of Engineering.

Overall, the results could have been better. Software names have been showing weaker 2024 guidance across the board this quarter, and GitLab was not spared. The company is down 14.1% on the results and currently trades at $64 per share.

Is Now The Time?

When considering an investment in GitLab, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are numerous reasons why we think GitLab is one of the best software-as-a-service companies out there. While we'd expect growth rates to moderate from here, its historical revenue growth rates have been splendid. Additionally, its impressive gross margins indicate excellent business economics, and its customers are increasing their spending quite quickly, suggesting they love the product.

There's no doubt that the market is optimistic about GitLab's growth prospects, as its price-to-sales ratio based on the next 12 months of 15.9x would suggest. And looking at the tech landscape today, GitLab's qualities really stand out. We are big fans of the stock at this price.

Wall Street analysts covering the company had a one-year price target of $75.06 per share right before these results (compared to the current share price of $64), implying they saw upside in buying GitLab in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.