Toy and entertainment company Hasbro (NASDAQ:HAS) reported Q2 CY2024 results topping analysts' expectations, with revenue down 17.7% year on year to $995.3 million. It made a non-GAAP profit of $1.22 per share, improving from its profit of $0.49 per share in the same quarter last year.

Is now the time to buy Hasbro? Find out by accessing our full research report, it's free.

Hasbro (HAS) Q2 CY2024 Highlights:

- Revenue: $995.3 million vs analyst estimates of $943.4 million (5.5% beat)

- EPS (non-GAAP): $1.22 vs analyst estimates of $0.76 (60.3% beat)

- Gross Margin (GAAP): 69.7%, up from 49.9% in the same quarter last year

- Free Cash Flow of $135.4 million, similar to the previous quarter

- Market Capitalization: $8.27 billion

"We delivered a solid performance in games and digital licensing and substantial margin improvement this quarter,” said Chris Cocks, Hasbro Chief Executive Officer.

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ:HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

Sales Growth

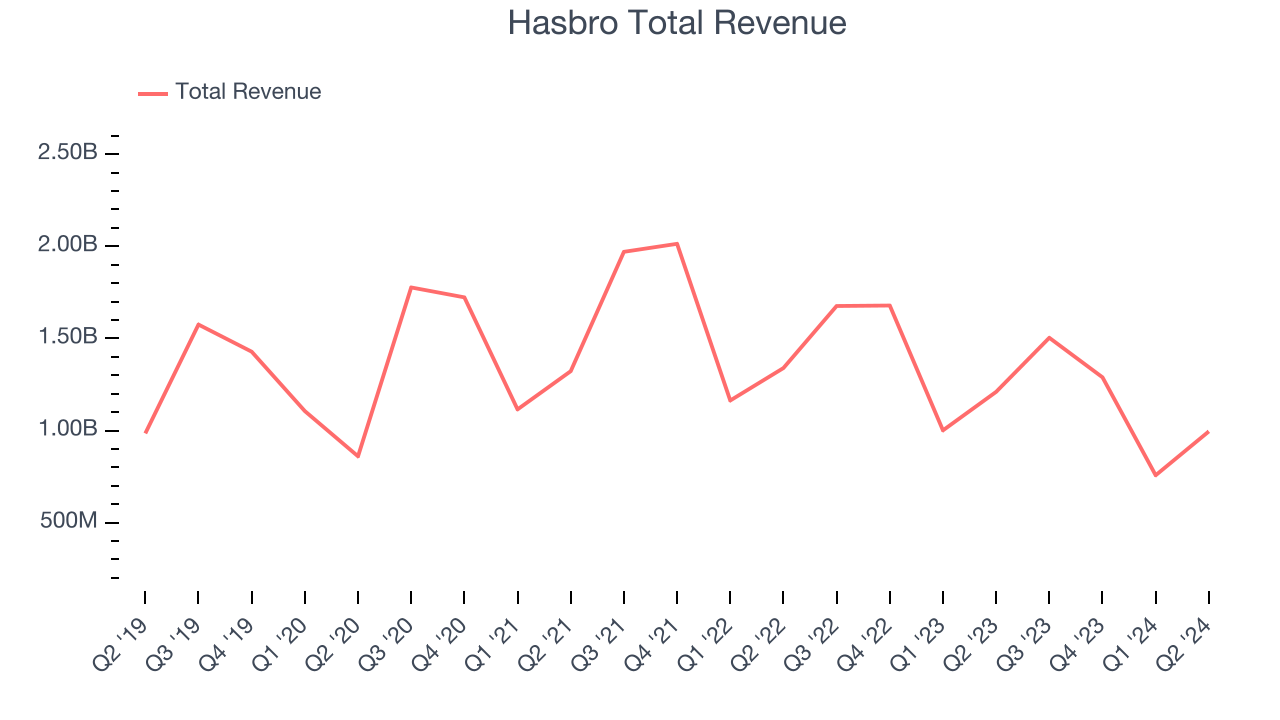

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Hasbro struggled to generate demand over the last five years as its sales were flat. This is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Hasbro's recent history shows its demand has stayed suppressed as its revenue has declined by 16.3% annually over the last two years.

This quarter, Hasbro's revenue fell 17.7% year on year to $995.3 million but beat Wall Street's estimates by 5.5%. Looking ahead, Wall Street expects revenue to decline 7.8% over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

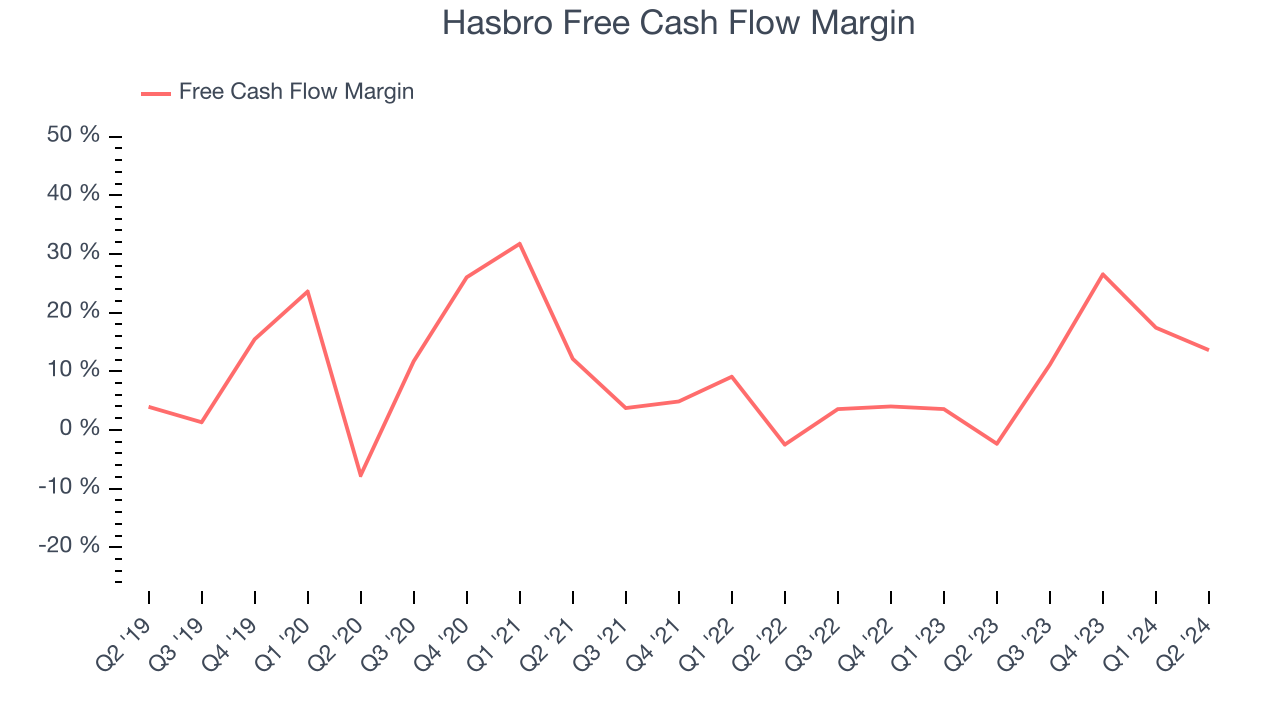

Hasbro has shown mediocre cash profitability over the last two years, putting it in a pinch as it gave the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin averaged 9%, subpar for a consumer discretionary business.

Hasbro's free cash flow clocked in at $135.4 million in Q2, equivalent to a 13.6% margin. This quarter's result was nice as its cash flow turned positive after being negative in the same quarter last year, but we wouldn't read too much into it because working capital and capital expenditure needs can be seasonal, causing quarter-to-quarter swings. Long-term trends carry greater meaning.

Key Takeaways from Hasbro's Q2 Results

We were impressed by how significantly Hasbro blew past analysts' revenue and EPS expectations this quarter. We were also excited it upgraded its full-year revenue guidance. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock traded up 6.3% to $63.21 immediately after reporting.

Hasbro may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.