Healthcare business data analyst company Health Catalyst (Nasdaq: HCAT) reported strong growth in the Q1 FY2021 earnings announcement, with revenue up 23.7% year on year to $55.8 million. Health Catalyst made a GAAP loss of $28.3 million, down on it's loss of $17.4 million, in the same quarter last year.

Get access to the fastest analysis of earnings results on the market. Get investing superpowers with StockStory. Signup here for early access.

Health Catalyst (NASDAQ:HCAT) Q1 FY2021 Highlights:

- Revenue: $55.8 million vs analyst estimates of $54.3 million (2.84% beat)

- EPS (non-GAAP): -$0.06 vs analyst estimates of -$0.14

- Revenue guidance for Q2 2021 is $56.6 million at the midpoint, above analyst estimates of $54.8 million

- The company lifted revenue guidance for the full year, from $226.6 million to $229.6 million at the midpoint, a 1.32% increase

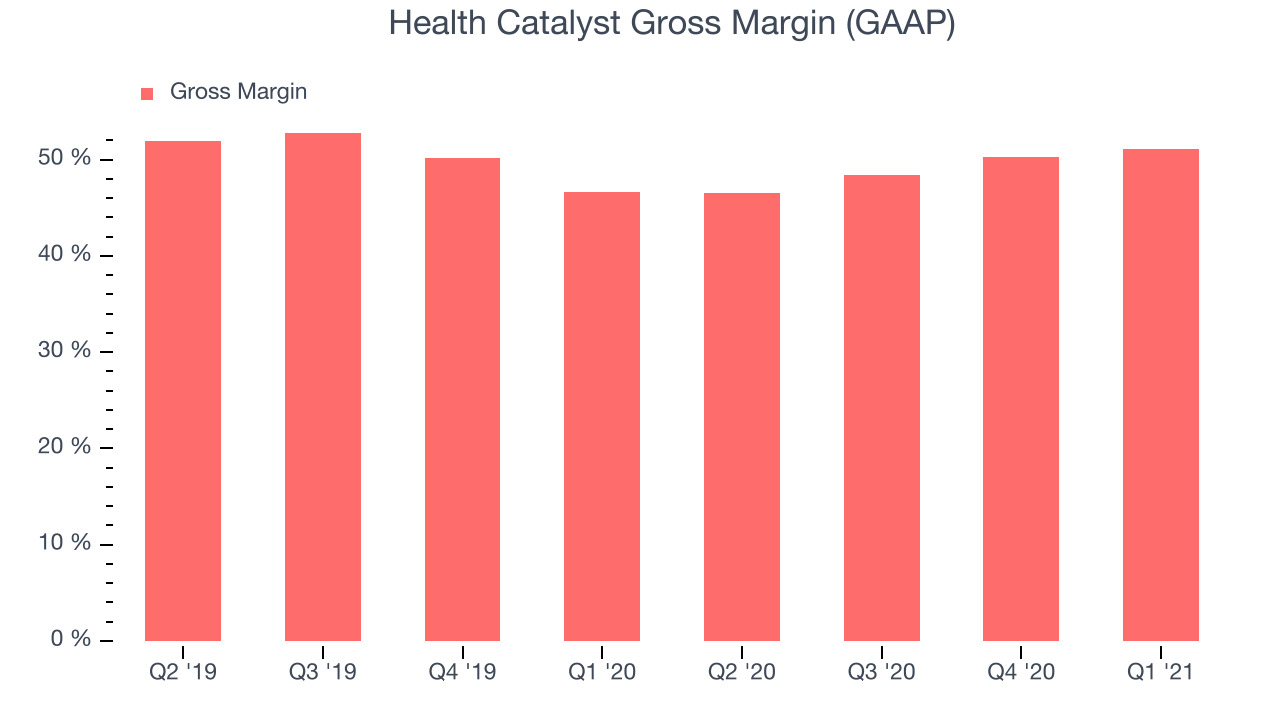

- Gross Margin (GAAP): 51%, up from 50.2% previous quarter

“In the first quarter of 2021, I am pleased to share that we achieved strong performance across our business, including exceeding the mid-point of our quarterly guidance for both revenue and Adjusted EBITDA,” said Dan Burton, CEO of Health Catalyst. “I am also happy to report that in the most recent team member engagement and satisfaction survey, independently administered by the Gallup organization, team member satisfaction scores at Health Catalyst measured in the 96th percentile."

Understanding Complexity In Healthcare Administration

Steven Barlow and Tom Burton founded Health Catalyst in 2008 after working together on a similar data analytics system for Intermountain Healthcare. A few years later, the pair were joined by Tom's brother Dan, who became the first external investor and CEO of the company. Today, Health Catalyst (NASDAQ:HCAT) helps healthcare organisations to improve by analyzing their interactions with patients, staff, governments and insurance companies.

When hospitals and healthcare networks have access to data analytics they can improve outcomes both in terms of patient care and profits. For example, data analysis might reveal that a hospital has high re-admissions for sepsis, relative to others, and so target that area for improvement. Alternatively, many organisations face administrative costs and poor customer experience when insurance companies deny claims in the first instance, even if they are subsequently permitted. Better understanding the source of these denials has allowed some customers to significantly reduce them.

The more experience Health Catalyst gains, in helping healthcare organisations, the better positioned it is relative to competitors, because it can more effectively benchmark clients against other clients. Health Catalyst generates revenue from its subscription based Data Operating System (DOS), and from professional services for more specific tasks.

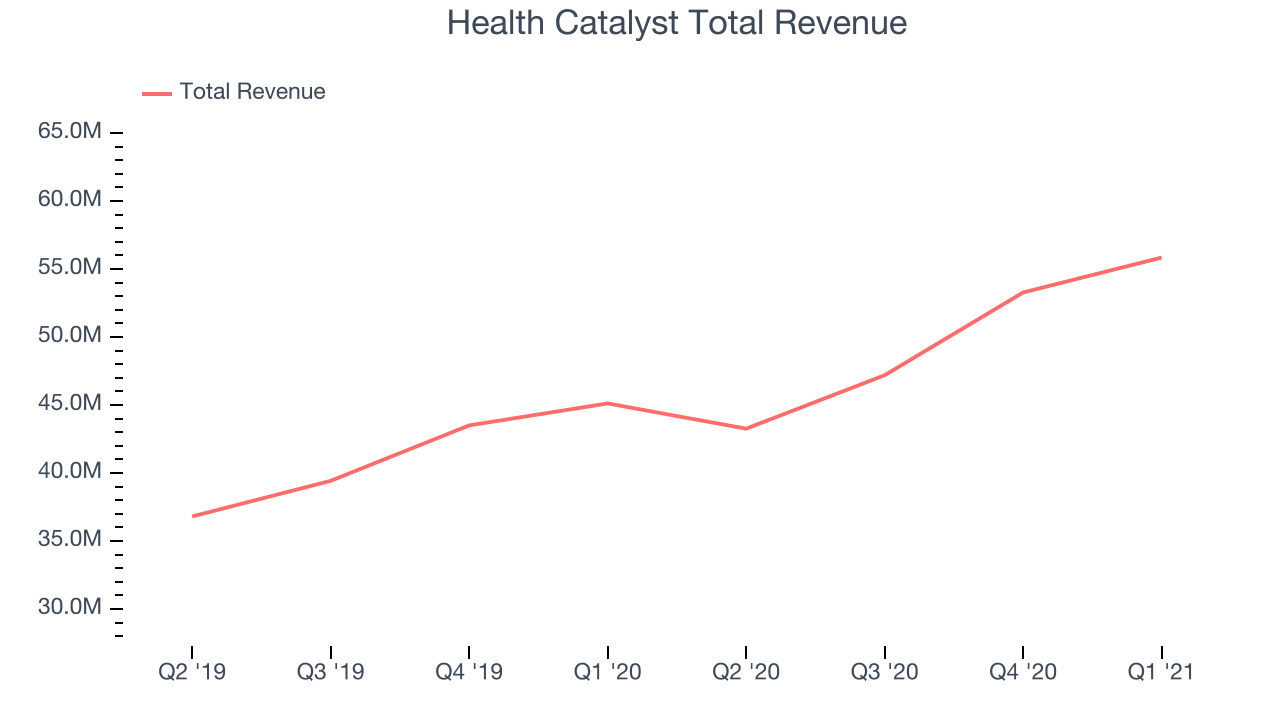

As you can see below, Health Catalyst's revenue growth has been strong over the last twelve months, growing from $45.1 million to $55.8 million.

This quarter, Health Catalyst's quarterly revenue was once again up a very solid 23.7% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $2.56 million in Q1, compared to $6.08 million in Q4 2020. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

A Mix Of Software Revenue And Professional Services

Health Catalyst's DOS is an attractive product for investors because it has reasonably good margins, even though it does come with significant data storage costs. However, the company's professional services gross profit margin is much lower, meaning that overall Health Catalyst has much lower margins than the best quality software as a service companies. As our healthcare data becomes more available electronically, Health Catalyst's subscription Data Operating System would ideally grow faster than professional services, thus improving margins overall.

Health Catalyst's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 51% in Q1. That means that for every $1 in revenue the company had $0.51 left to spend on developing new products, marketing & sales and the general administrative overhead. While it improved significantly from previous quarter this is still a low gross margin for a SaaS company and we would like to see the improvements to continue.

Key Takeaways from Health Catalyst's Q1 Results

With market capitalisation of $2.42 billion and more than $266.4 million in cash, the company has the capacity to continue to prioritise growth.

We enjoyed the positive outlook Health Catalyst provided for the next quarter’s revenue. And we were also excited to see it that it outperformed analysts' revenue expectations. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. Therefore, we think Health Catalyst will look more attractive to growth investors after these results.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.