Healthcare software provider Health Catalyst (NASDAQ:HCAT) announced better-than-expected results in the Q4 FY2022 quarter, with revenue up 6.87% year on year to $69.2 million. The company expects that next quarter's revenue would be around $71.3 million, which is the midpoint of the guidance range. That was roughly in line with analyst expectations. Health Catalyst made a GAAP loss of $35.8 million, improving on its loss of $49 million, in the same quarter last year.

Is now the time to buy Health Catalyst? Access our full analysis of the earnings results here, it's free.

Health Catalyst (HCAT) Q4 FY2022 Highlights:

- Revenue: $69.2 million vs analyst estimates of $68.3 million (1.32% beat)

- EPS (non-GAAP): -$0.05 vs analyst estimates of -$0.11

- Revenue guidance for Q1 2023 is $71.3 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for upcoming financial year 2023 is $292.5 million at the midpoint, missing analyst estimates by 2.06% and predicting 5.89% growth (vs 14.5% in FY2022)

- Free cash flow was negative $18.2 million, compared to negative free cash flow of $13.2 million in previous quarter

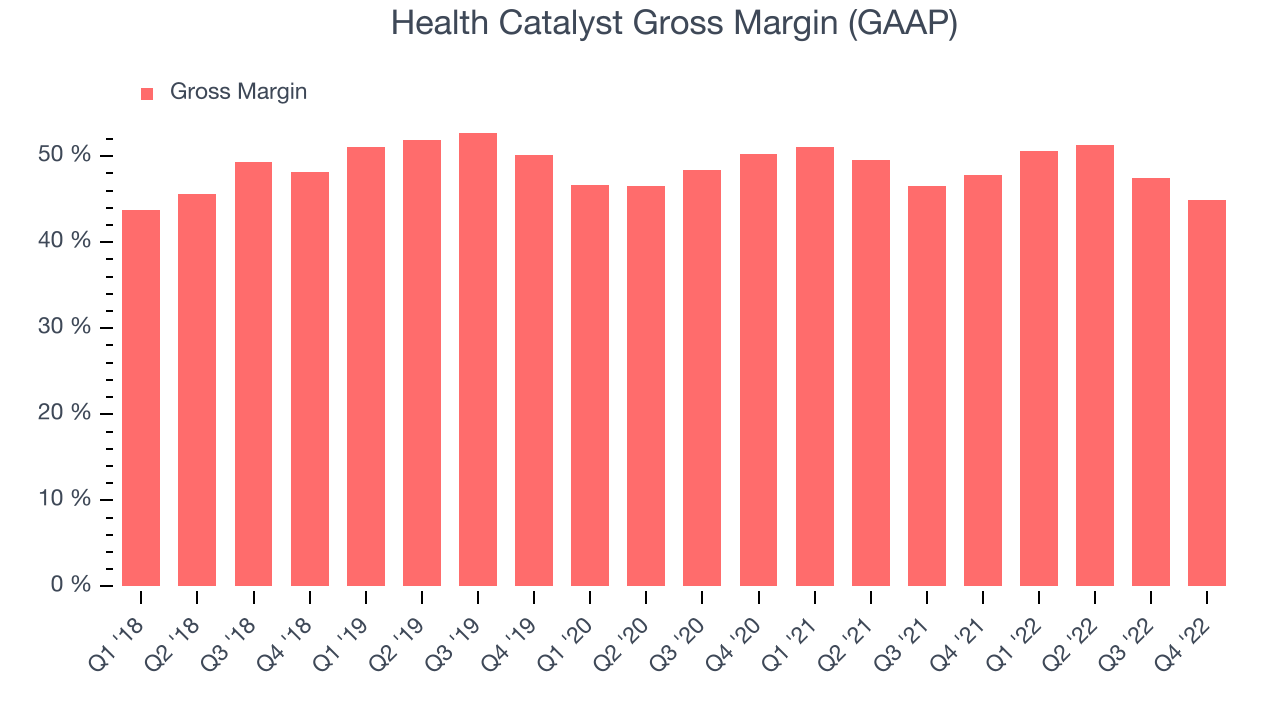

- Gross Margin (GAAP): 44.9%, down from 47.8% same quarter last year

“In the fourth quarter of 2022, I am pleased to share that we achieved strong performance across our business, including exceeding the mid-point of our quarterly guidance for both revenue and Adjusted EBITDA. For the full year 2022, I am also excited to share that our Adjusted EBITDA outperformed the mid-point of the original full year guidance we provided entering 2022, demonstrating continued operating leverage in our business despite lower annual revenue growth for 2022 as compared to our initial guidance for 2022.” said Dan Burton, CEO of Health Catalyst.

Founded by healthcare professionals Tom Burton and Steve Barlow in 2008, Health Catalyst (NASDAQ:HCAT) provides data and analytics technology to healthcare organizations, enabling them to improve care and lower costs.

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the silo-ed data.

Sales Growth

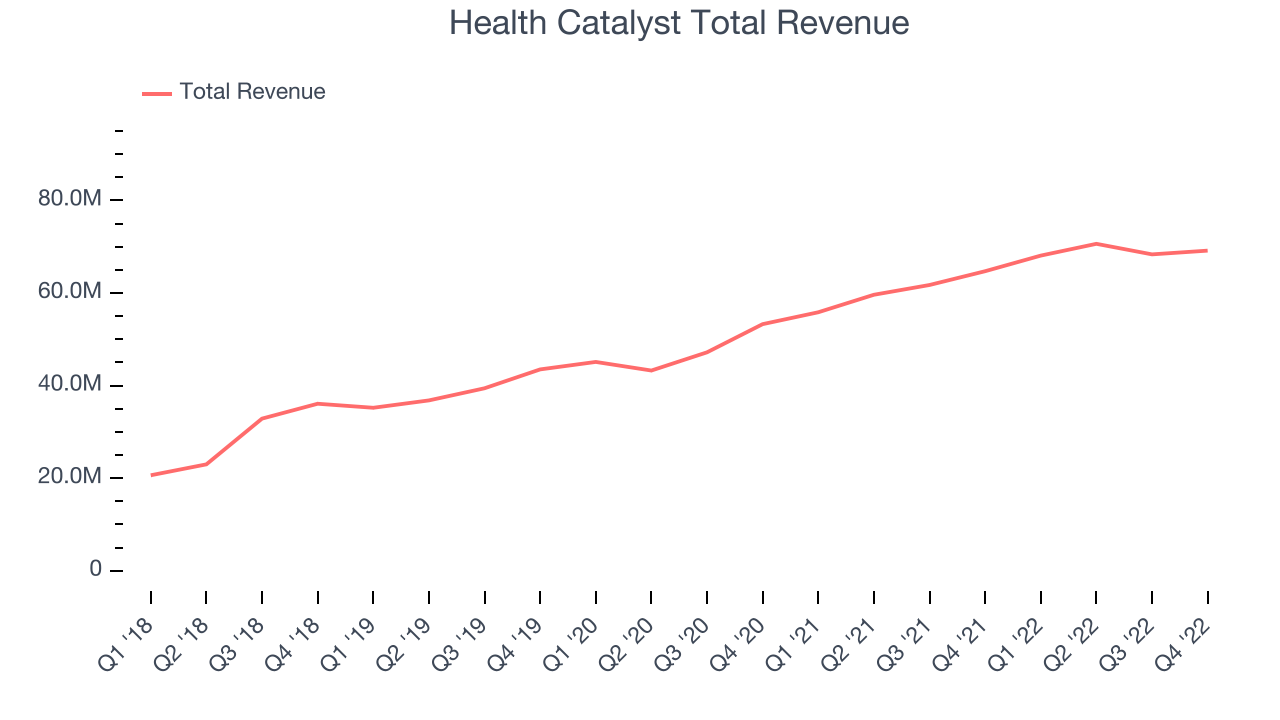

As you can see below, Health Catalyst's revenue growth has been strong over the last two years, growing from quarterly revenue of $53.3 million in Q4 FY2020, to $69.2 million.

Health Catalyst's quarterly revenue was only up 6.87% year on year, which might disappoint some shareholders. On top of that, revenue increased $808 thousand quarter on quarter, a strong improvement on the $2.28 million decrease in Q3 2022, and a sign of acceleration of growth, which is very nice to see indeed.

Guidance for the next quarter indicates Health Catalyst is expecting revenue to grow 4.72% year on year to $71.3 million, slowing down from the 21.9% year-over-year increase in revenue the company had recorded in the same quarter last year. For the upcoming financial year management expects revenue to be $292.5 million at the midpoint, growing 5.89% compared to 14.2% increase in FY2022.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Health Catalyst's gross profit margin, an important metric measuring how much money there is left after paying for servers, licenses, technical support and other necessary running expenses was at 44.9% in Q4.

That means that for every $1 in revenue the company had $0.45 left to spend on developing new products, marketing & sales and the general administrative overhead. This would be considered a low gross margin for a SaaS company and it has dropped significantly from the previous quarter, which is probably the opposite of what shareholders would like it to do.

Key Takeaways from Health Catalyst's Q4 Results

Since it has still been burning cash over the last twelve months it is worth keeping an eye on Health Catalyst’s balance sheet, but we note that with a market capitalization of $730.9 million and more than $363.5 million in cash, the company has the capacity to continue to prioritise growth over profitability.

Health Catalyst topped analysts’ revenue expectations this quarter, even if just narrowly. That feature of these results really stood out as a positive. On the other hand, it was unfortunate to see that Health Catalyst's revenue guidance for the full year missed analysts' expectations and the revenue guidance for next year indicates quite a significant slowdown in growth. Overall, it seems to us that this was a complicated quarter for Health Catalyst. The company is down 0.57% on the results and currently trades at $13.9 per share.

Health Catalyst may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.