Healthcare software provider Health Catalyst (NASDAQ:HCAT) reported results ahead of analysts' expectations in Q4 FY2023, with revenue up 8.6% year on year to $75.08 million. On the other hand, next quarter's revenue guidance of $74.5 million was less impressive, coming in 5.4% below analysts' estimates. It made a non-GAAP profit of $0.02 per share, improving from its loss of $0.05 per share in the same quarter last year.

Health Catalyst (HCAT) Q4 FY2023 Highlights:

- Revenue: $75.08 million vs analyst estimates of $73.59 million (2% beat)

- EPS (non-GAAP): $0.02 vs analyst estimates of -$0.01 ($0.03 beat)

- Revenue Guidance for Q1 2024 is $74.5 million at the midpoint, below analyst estimates of $78.75 million

- Management's revenue guidance for the upcoming financial year 2024 is $308 million at the midpoint, missing analyst estimates by 5.1% and implying 4.1% growth (vs 7.2% in FY2023)

- Free Cash Flow was -$21.92 million, down from $24,000 in the previous quarter

- Gross Margin (GAAP): 40.6%, down from 46.9% in the same quarter last year

- Market Capitalization: $524.9 million

Founded by healthcare professionals Tom Burton and Steve Barlow in 2008, Health Catalyst (NASDAQ:HCAT) provides data and analytics technology to healthcare organizations, enabling them to improve care and lower costs.

Healthcare sector is undergoing a major digital transformation, but as funds are poured into the digitization of health care records and processes, organizations are confronted with the reality that gathering the data is just the first step toward actually lowering costs and improving care, and the real challenge is making that information useful. To be able to succeed in today’s healthcare environment, hospitals need data from 50 to 150 different sources, but often or able to access less than 10, as they are typically running a number of siloed systems that are unable to communicate with each other and are generating data that is very difficult to query and analyze.

To solve these problems, Health Catalyst provides a centralized software platform that enables organizations to aggregate data from healthcare sources inside and outside of the hospital and manage it all in one place. This data then flows into Health Catalyst’s data analysis software that has been tailored for healthcare use and is even able to provide organizations with AI-enabled predictive capabilities that are powered by data that Health Catalyst accumulated from more than 100 million patient records. And because hospitals are often struggling with enough competent IT personnel, a large part of the business is providing expert services to help healthcare providers derive meaningful insights and actually improve patient outcomes, reduce healthcare costs and enhance customer experience.

For example, a small hospital in Louisiana was within six months able to decrease sepsis mortality rate to half of the national average. Sepsis is a growing problem in the United States, and it is a serious medical condition caused by a strong immune response to infection that can lead to very severe and potentially fatal outcomes. The hospital set up a new screening tool and an online dashboard that showed them how often the sepsis treatment protocol is applied, how well the screening is done, and how quickly the physicians are getting to see the patients. Then they used Health Catalyst to help them identify cases that need further scrutiny and zoom in on individual patients and providers, and intervene as needed.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the silo-ed data.

Health Catalyst competes with Epic Systems, Cerner (NASDAQ:CERN), and IBM (NYSE:IBM), as well as general-purpose data management platforms such as Snowflake (NYSE:SNOW), Teradata (NYSE:TDC), and Cloudera (NYSE:CLDR).

Sales Growth

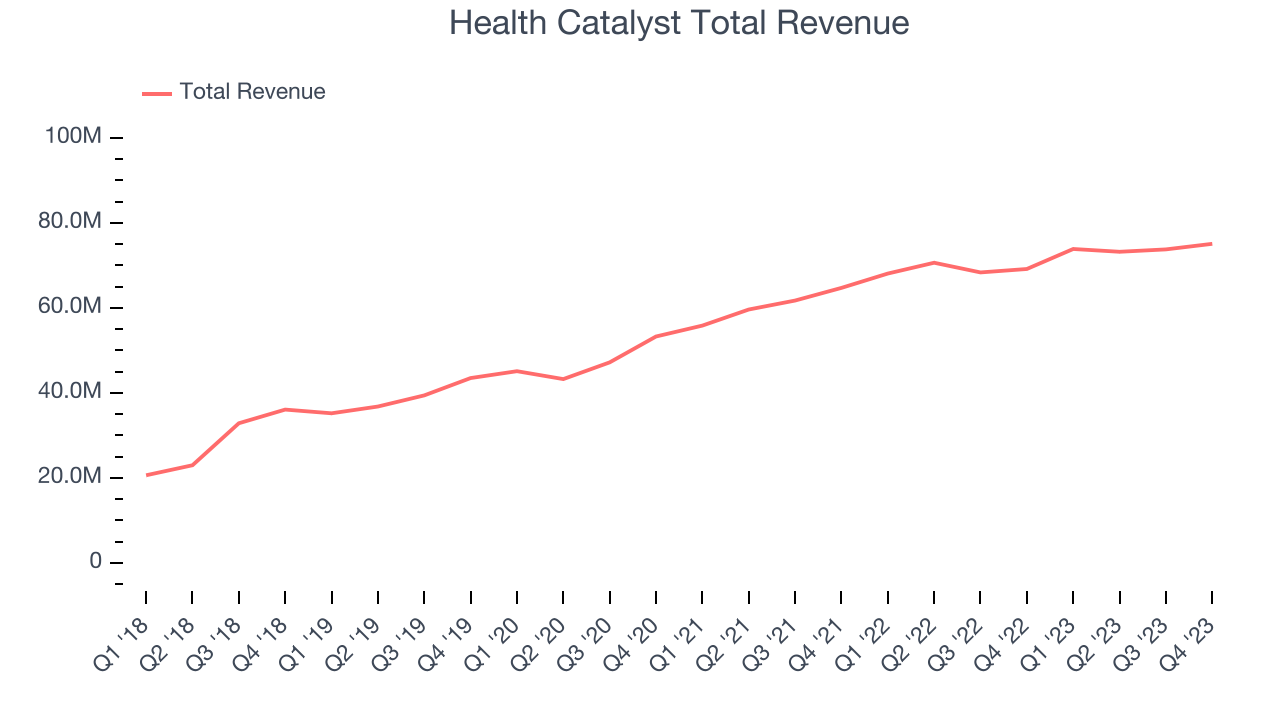

As you can see below, Health Catalyst's revenue growth has been unremarkable over the last two years, growing from $64.72 million in Q4 FY2021 to $75.08 million this quarter.

Health Catalyst's quarterly revenue was only up 8.6% year on year, which might disappoint some shareholders. However, we can see that the company's revenue grew by $1.31 million quarter on quarter, re-accelerating from $560,000 in Q3 2023.

Next quarter's guidance suggests that Health Catalyst is expecting revenue to grow 0.9% year on year to $74.5 million, slowing down from the 8.5% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $308 million at the midpoint, growing 4.1% year on year compared to the 7.1% increase in FY2023.

Profitability

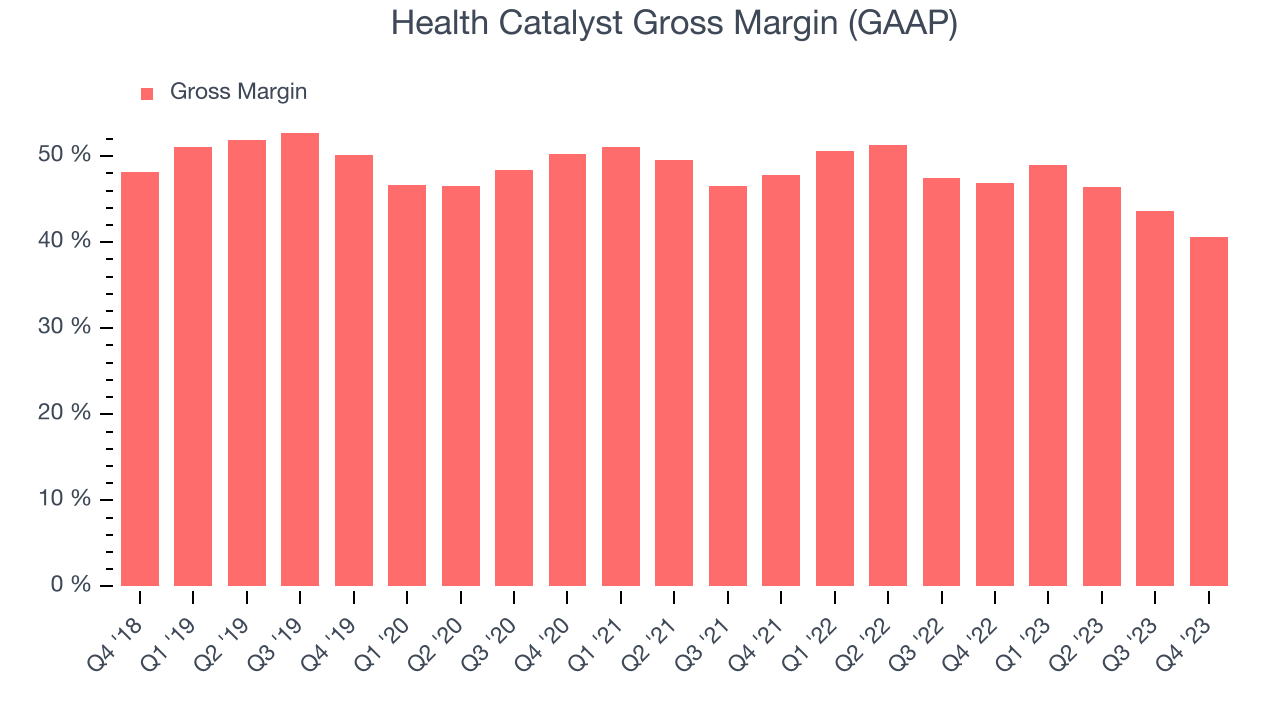

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Health Catalyst's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 40.6% in Q4.

That means that for every $1 in revenue the company had $0.41 left to spend on developing new products, sales and marketing, and general administrative overhead. Health Catalyst's gross margin is poor for a SaaS business and it's deteriorated even further over the last year. This is probably the opposite direction that shareholders would like to see it go.

Cash Is King

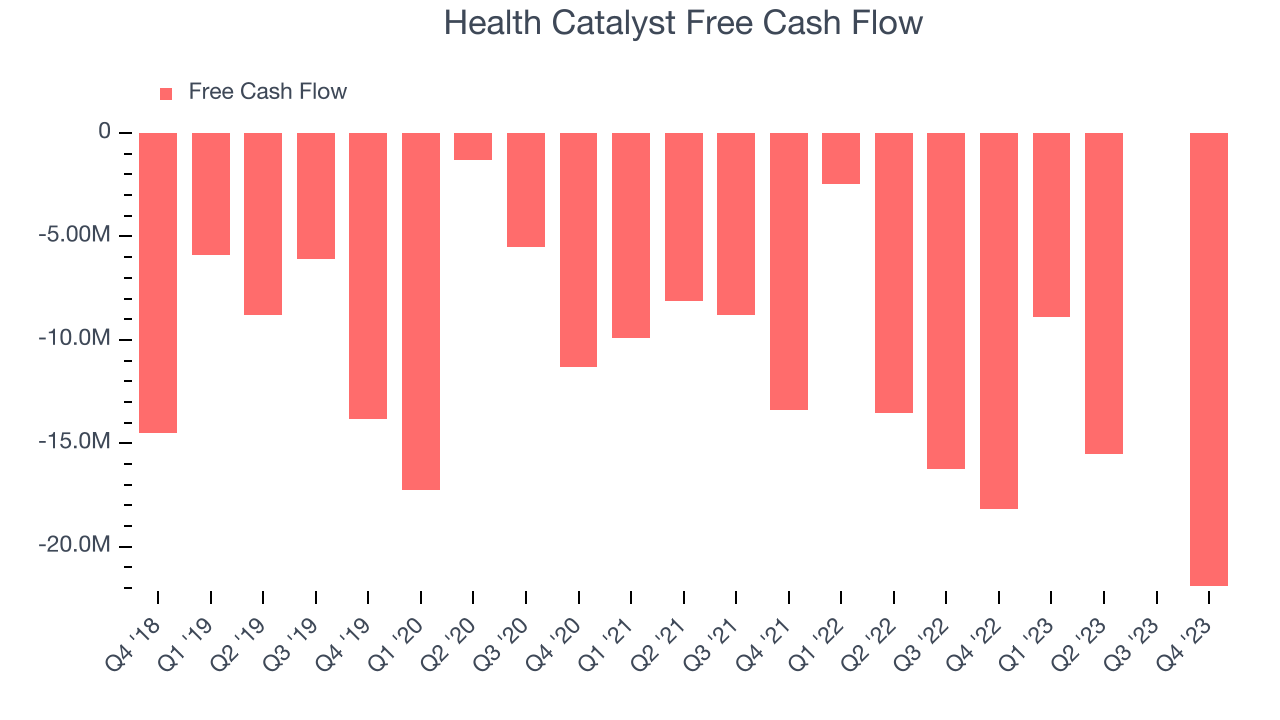

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Health Catalyst burned through $21.92 million of cash in Q4, increasing its cash burn by 20.5% year on year.

Health Catalyst has burned through $46.27 million of cash over the last 12 months, resulting in a negative 15.6% free cash flow margin. This low FCF margin stems from Health Catalyst's constant need to reinvest in its business to stay competitive.

Key Takeaways from Health Catalyst's Q4 Results

It was good to see Health Catalyst beat analysts' revenue expectations this quarter. That stood out as a positive in these results. On the other hand, its full-year revenue guidance was below expectations and cash burn increased. Overall, this was a mixed quarter for Health Catalyst. The stock is up 2.6% after reporting and currently trades at $8.69 per share.

Is Now The Time?

When considering an investment in Health Catalyst, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Health Catalyst, we'll be cheering from the sidelines. Its , and analysts expect growth to deteriorate from here. And while its efficient customer acquisition is better than many similar companies, the downside is its gross margins show its business model is much less lucrative than the best software businesses. On top of that, its growth is coming at a cost of significant cash burn.

Health Catalyst's price-to-sales ratio based on the next 12 months is 1.5x, suggesting that the market does have lower expectations of the business, relative to the high growth tech stocks. While we have no doubt one can find things to like about the company, we think there might be better opportunities in the market and at the moment don't see many reasons to get involved.

Wall Street analysts covering the company had a one-year price target of $12.43 per share right before these results (compared to the current share price of $8.69).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.