Cloud infrastructure automation platform HashiCorp reported Q3 FY2024 results topping analysts' expectations, with revenue up 16.6% year on year to $146.1 million. On the other hand, next quarter's revenue guidance of $149 million was in line with expectations. It made a GAAP loss of $0.20 per share, improving from its loss of $0.38 per share in the same quarter last year.

Is now the time to buy HashiCorp? Find out by accessing our full research report, it's free.

HashiCorp (HCP) Q3 FY2024 Highlights:

- Revenue: $146.1 million vs analyst estimates of $143.3 million (2% beat)

- EPS (non-GAAP): $0.03 vs analyst estimates of -$0.04 ($0.07 beat)

- Revenue Guidance for Q4 2024 is $149 million at the midpoint, roughly in line with what analysts were expecting

- Free Cash Flow of $5.72 million is up from -$36.63 million in the previous quarter

- Net Revenue Retention Rate: 119%, down from 124% in the previous quarter

- Customers: 4,354, up from 4,217 in the previous quarter

- Gross Margin (GAAP): 82.5%, in line with the same quarter last year

Initially created as a research project at the University of Washington, HashiCorp (NASDAQ:HCP) provides software that helps companies operate their own applications in a multi-cloud environment.

Developer Operations

As Marc Andreessen says, "software is eating the world" which means the volume of software produced is exploding. But building software is complex and difficult work which drives demand for software tools that help increase the speed, quality, and security of software deployment.

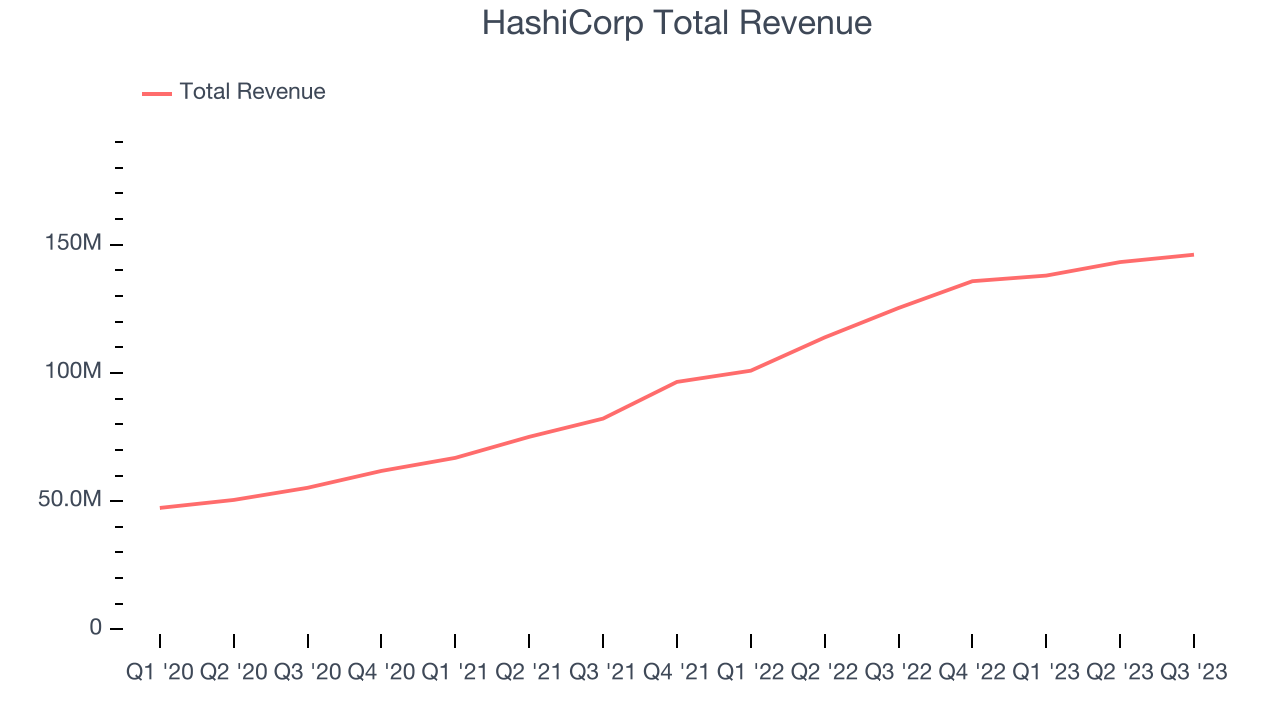

Sales Growth

As you can see below, HashiCorp's revenue growth has been impressive over the last two years, growing from $82.22 million in Q3 FY2022 to $146.1 million this quarter.

This quarter, HashiCorp's quarterly revenue was once again up 16.6% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $2.88 million in Q3 compared to $5.26 million in Q2 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter, HashiCorp is guiding for a 8.9% year-on-year revenue decline to $149 million, a further deceleration from the 40.7% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 14.4% over the next 12 months before the earnings results announcement.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

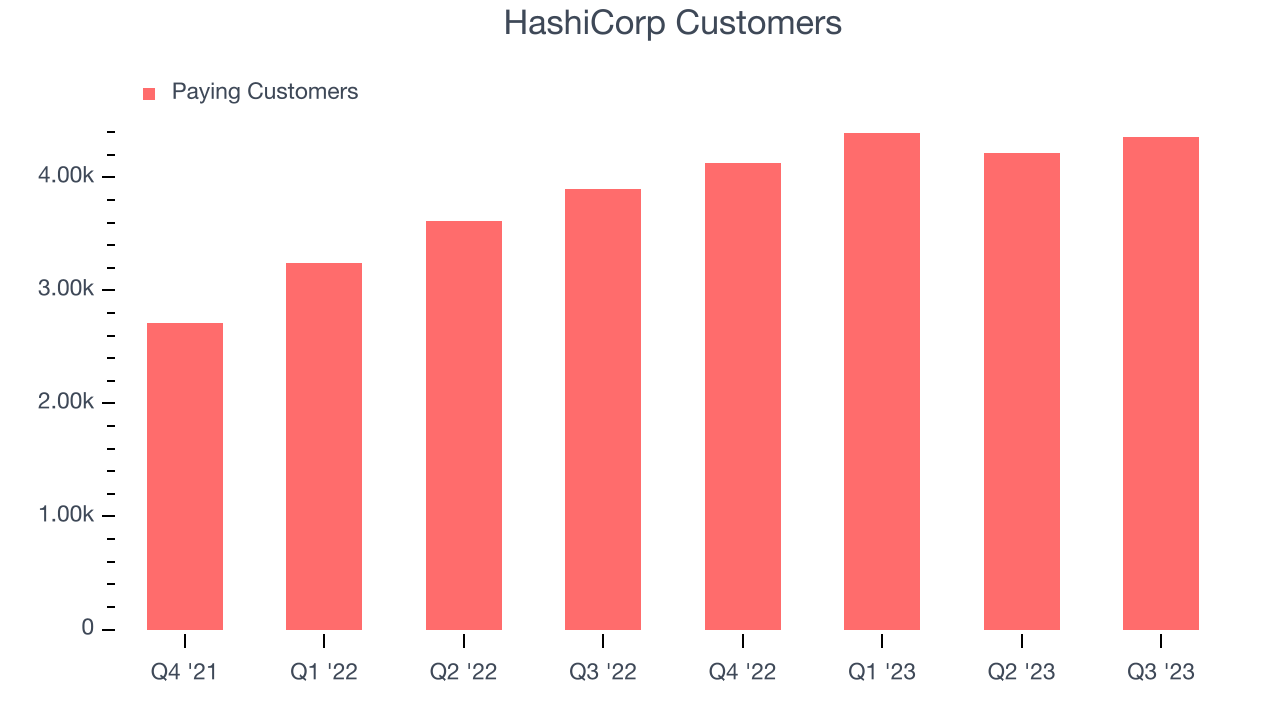

Customer Growth

HashiCorp reported 4,354 customers at the end of the quarter, an increase of 137 from the previous quarter. That's a little better customer growth than last quarter and in line with what we've seen in past quarters, demonstrating that the company has the sales momentum required to drive continued growth. We've no doubt shareholders will take this as an indication that HashiCorp's go-to-market strategy is running smoothly.

Key Takeaways from HashiCorp's Q3 Results

With a market capitalization of $4.83 billion, HashiCorp is among smaller companies, but its more than $729.8 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

We enjoyed seeing HashiCorp materially improve its gross margin this quarter. We were also glad it had many new large contract wins. On the other hand, its net revenue retention fell and its remaining performance obligations (RPO) came in below Wall Street's estimates. RPO is a leading indicator of demand and can be used as a proxy for the company's backlog. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. Investors were likely spooked by the RPO miss, however, and the stock is down 16.2% after reporting, trading at $20.89 per share.

So should you invest in HashiCorp right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.