Cloud infrastructure automation platform HashiCorp beat analysts' expectations in Q1 CY2024, with revenue up 16.4% year on year to $160.6 million. It made a non-GAAP profit of $0.05 per share, improving from its loss of $0.07 per share in the same quarter last year.

Is now the time to buy HashiCorp? Find out by accessing our full research report, it's free.

HashiCorp (HCP) Q1 CY2024 Highlights:

- Expected to be acquired by IBM for $35 per share

- Revenue: $160.6 million vs analyst estimates of $153.2 million (4.8% beat)

- EPS (non-GAAP): $0.05 vs analyst estimates of -$0.01 ($0.06 beat)

- Gross Margin (GAAP): 81.1%, in line with the same quarter last year

- Free Cash Flow of $25.39 million, up from $7.28 million in the previous quarter

- Net Revenue Retention Rate: 113%, down from 115% in the previous quarter

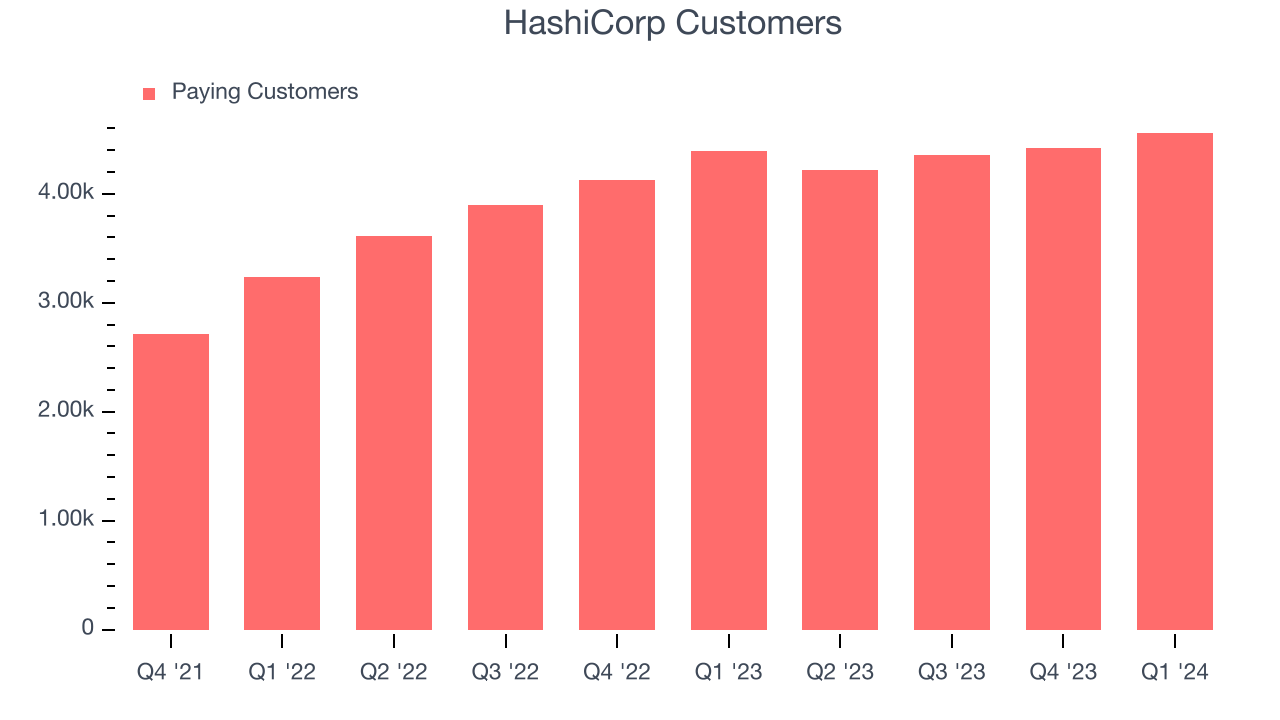

- Customers: 4,558, up from 4,423 in the previous quarter

- Billings: $120.7 million at quarter end, up 7.6% year on year

- Market Capitalization: $6.73 billion

Initially created as a research project at the University of Washington, HashiCorp (NASDAQ:HCP) provides software that helps companies operate their own applications in a multi-cloud environment.

Developer Operations

As Marc Andreessen says, "software is eating the world" which means the volume of software produced is exploding. But building software is complex and difficult work which drives demand for software tools that help increase the speed, quality, and security of software deployment.

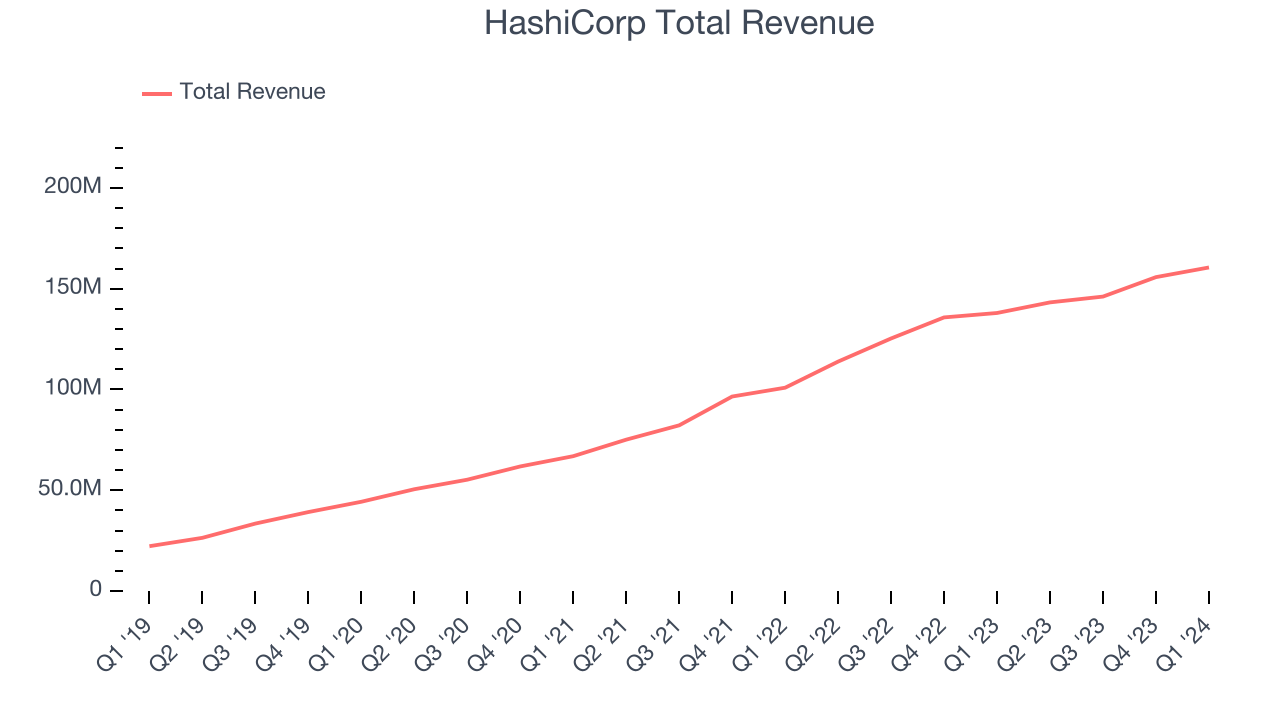

Sales Growth

As you can see below, HashiCorp's revenue growth has been very strong over the last three years, growing from $66.91 million in Q1 2022 to $160.6 million this quarter.

This quarter, HashiCorp's quarterly revenue was once again up 16.4% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $4.80 million in Q1 compared to $9.66 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Looking ahead, analysts covering the company were expecting sales to grow 10.3% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Customer Growth

HashiCorp reported 4,558 customers at the end of the quarter, an increase of 135 from the previous quarter. That's a little better customer growth than last quarter and quite a bit above the typical growth we've seen in past quarters, demonstrating that the business has strong sales momentum. We've no doubt shareholders will take this as an indication that HashiCorp's go-to-market strategy is working very well.

Key Takeaways from HashiCorp's Q1 Results

It was good to see HashiCorp beat analysts' revenue expectations this quarter. On the other hand, its billings unfortunately missed analysts' expectations and its gross margin decreased. Overall, the results could have been better, but it doesn't matter because the company is expected to be acquired by IBM for $35 per share. The deal was announced on April 24, 2024 and is expected to close by the end of the year. The stock is flat after reporting and currently trades at $33.43 per share.

HashiCorp may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.