Cloud infrastructure automation platform HashiCorp reported results ahead of analysts’ expectations in Q2 CY2024, with revenue up 15.3% year on year to $165.1 million. It made a non-GAAP profit of $0.08 per share, improving from its loss of $0.10 per share in the same quarter last year.

Is now the time to buy HashiCorp? Find out by accessing our full research report, it’s free.

HashiCorp (HCP) Q2 CY2024 Highlights:

- Note IBM announced an acquisition of HCP in April 2024--the deal has not yet closed

- Revenue: $165.1 million vs analyst estimates of $157.2 million (5.1% beat)

- EPS (non-GAAP): $0.08 vs analyst estimates of $0 ($0.08 beat)

- Gross Margin (GAAP): 81.7%, up from 79.9% in the same quarter last year

- Free Cash Flow was -$11.2 million, down from $25.39 million in the previous quarter

- Net Revenue Retention Rate: 110%, down from 113% in the previous quarter

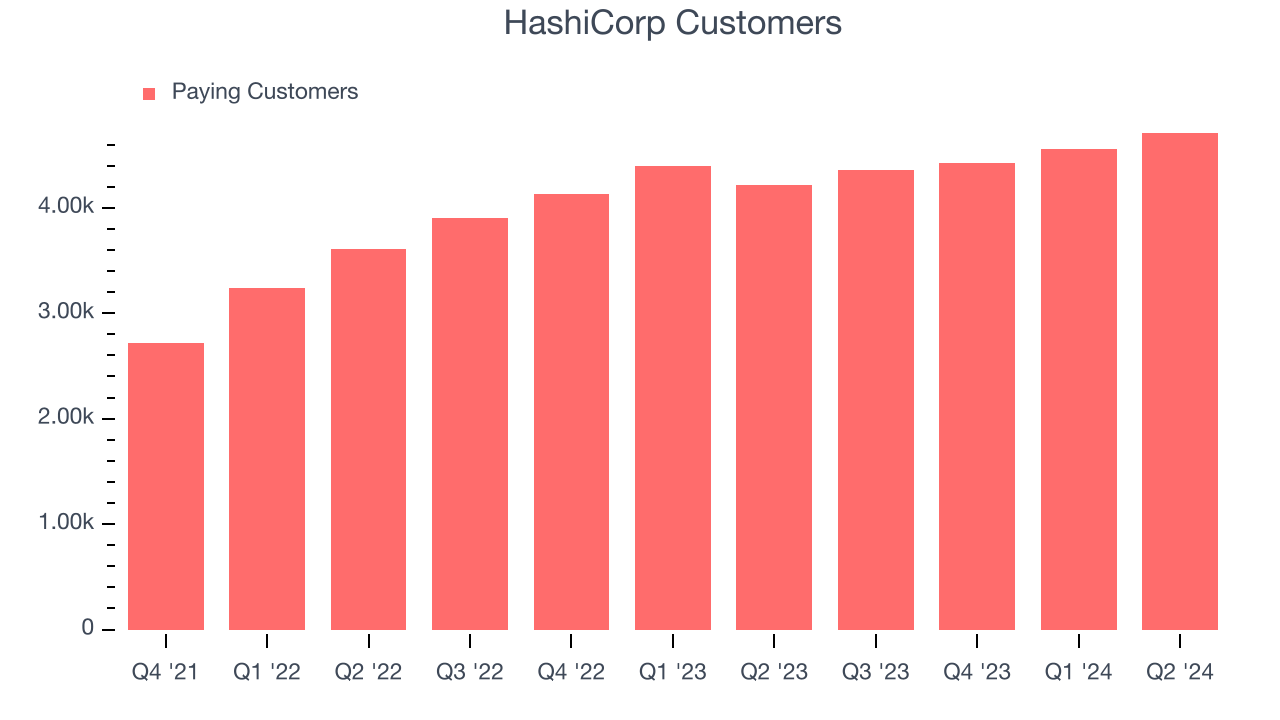

- Customers: 4,709, up from 4,558 in the previous quarter

- Billings: $176.3 million at quarter end, up 10% year on year

- Market Capitalization: $6.80 billion

“The HashiCorp team delivered another solid performance in Q2 of FY25, with revenue growth of 15% year-over-year, and 10% growth in $100K customers year-over-year,” said Dave McJannet, CEO, HashiCorp.

Initially created as a research project at the University of Washington, HashiCorp (NASDAQ:HCP) provides software that helps companies operate their own applications in a multi-cloud environment.

Developer Operations

As Marc Andreessen says, "software is eating the world" which means the volume of software produced is exploding. But building software is complex and difficult work which drives demand for software tools that help increase the speed, quality, and security of software deployment.

Sales Growth

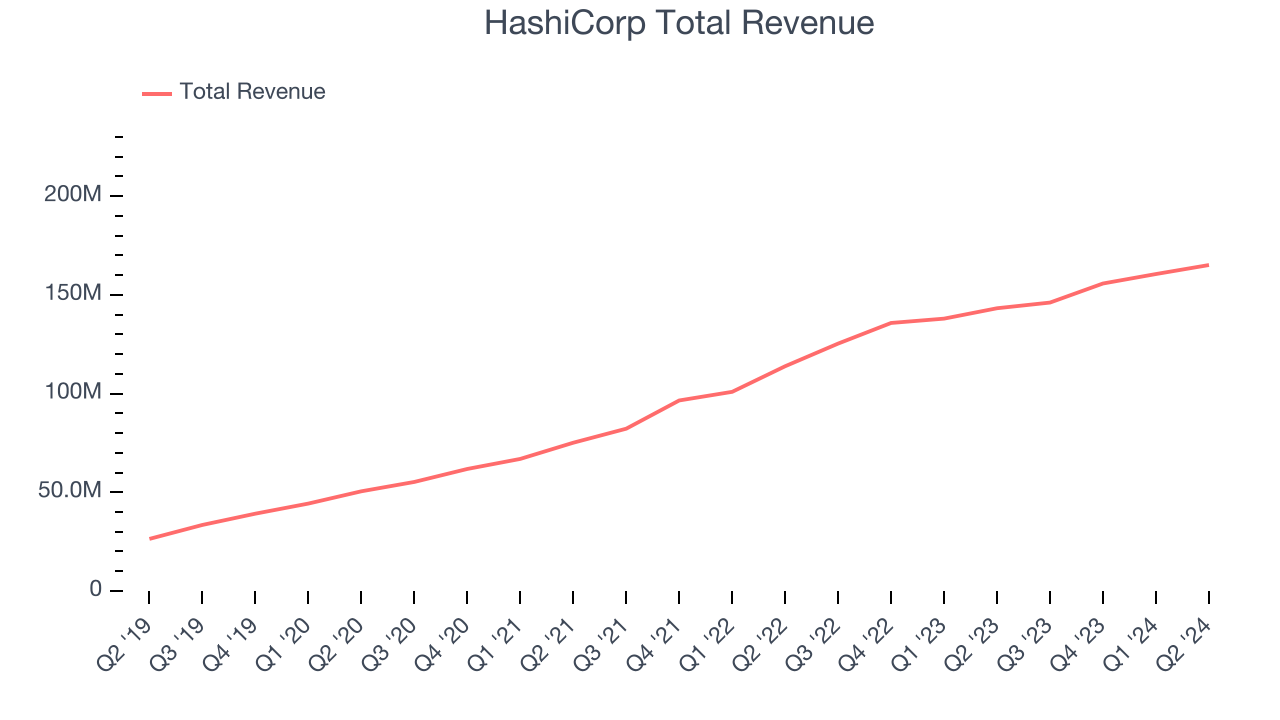

As you can see below, HashiCorp’s 34.3% annualized revenue growth over the last three years has been excellent, and its sales came in at $165.1 million this quarter.

This quarter, HashiCorp’s quarterly revenue was once again up 15.3% year on year. We can see that HashiCorp’s revenue increased by $4.56 million in Q2, which was roughly the same growth rate observed in Q1 CY2024. This steady quarter-on-quarter growth shows that the company can maintain its paced growth trajectory.

Looking ahead, analysts covering the company were expecting sales to grow 11.2% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Customer Growth

HashiCorp reported 4,709 customers at the end of the quarter, an increase of 151 from the previous quarter. That’s a little better customer growth than last quarter and quite a bit above the typical growth we’ve seen in past quarters, demonstrating that the business has strong sales momentum. We’ve no doubt shareholders will take this as an indication that HashiCorp’s go-to-market strategy is working very well.

Key Takeaways from HashiCorp’s Q2 Results

We enjoyed seeing HashiCorp exceed analysts’ revenue and EPS expectations this quarter. On the other hand, its net revenue retention declined and its new large contract wins shrunk. Overall, this was a mixed quarter but still solid. The stock remained flat at $33.80 immediately after reporting. Note that IBM announced an acquisition of HashiCorp in April of this year. The deal has not yet closed.

HashiCorp may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.