Shareholders of Hudson Technologies would probably like to forget the past six months even happened. The stock dropped 38.6% and now trades at $5.89. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the drawdown, is now an opportune time to buy HDSN? Find out in our full research report, it’s free.

Why Does HDSN Stock Spark Debate?

Founded in 1991, Hudson Technologies (NASDAQ:HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Two Positive Attributes:

1. Long-Term EPS Growth Is Outstanding

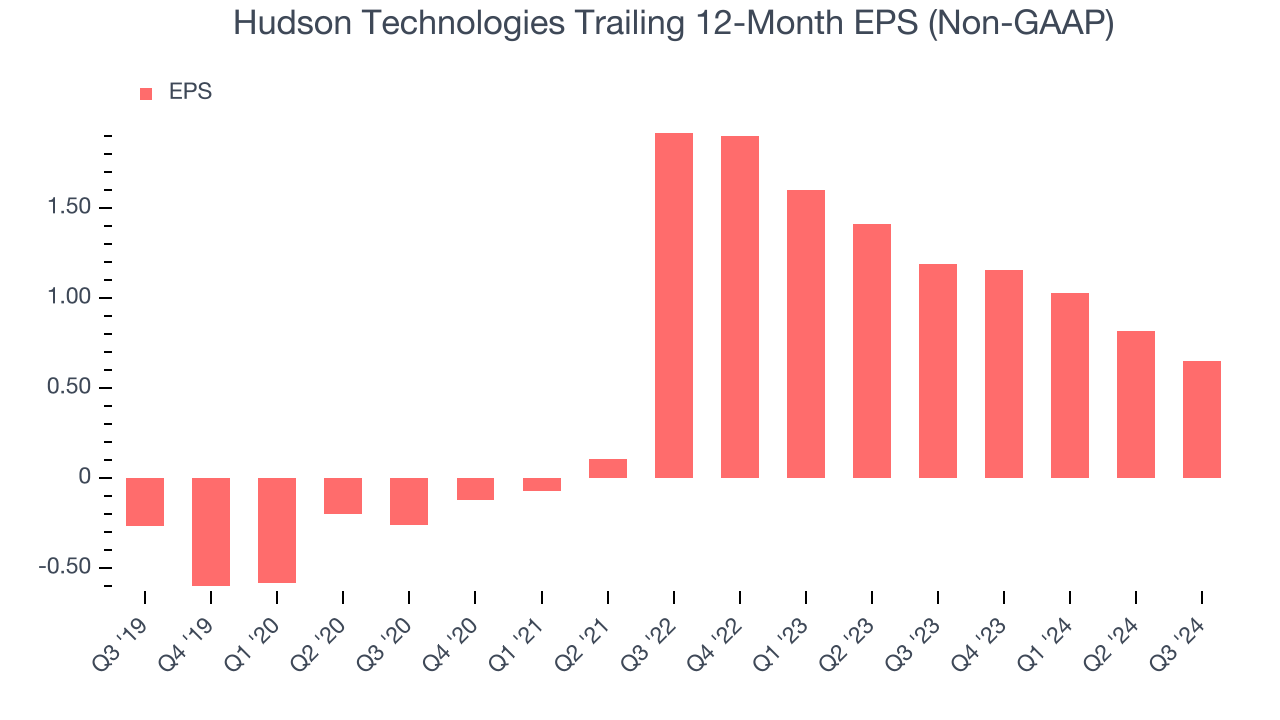

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth was profitable.

Hudson Technologies’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

2. Excellent Free Cash Flow Boosts Reinvestment Potential

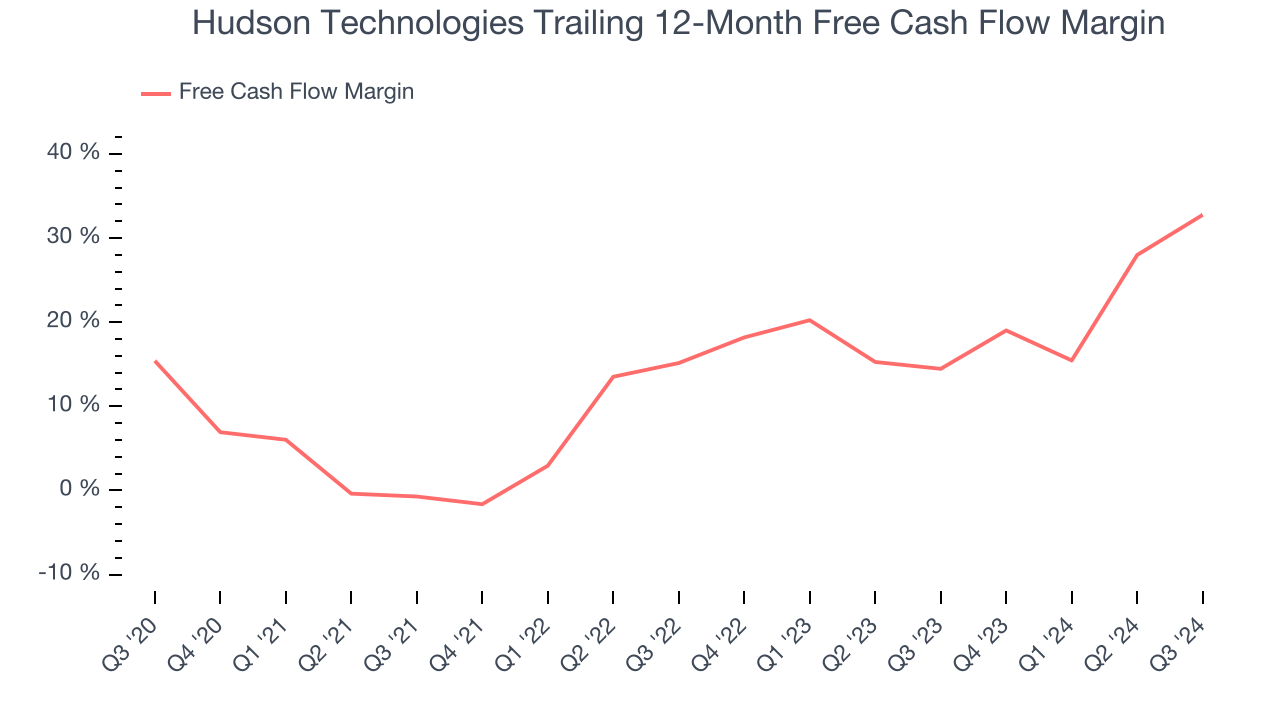

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Hudson Technologies has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 16.3% over the last five years.

One Reason to be Careful:

Revenue Tumbling Downwards

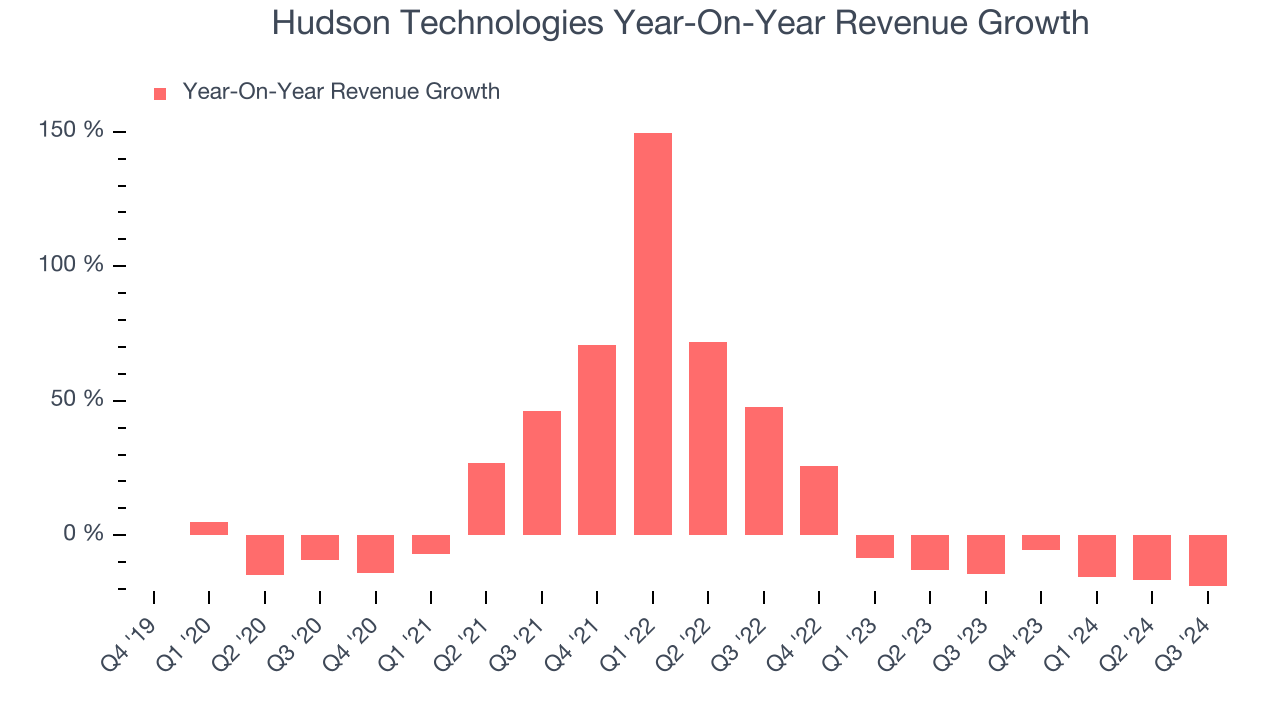

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Hudson Technologies’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 11.5% over the last two years.

Final Judgment

Hudson Technologies’s merits more than make up for its flaws. With the recent decline, the stock trades at 4.9x forward EV-to-EBITDA (or $5.89 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Hudson Technologies

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.