Athletic apparel and footwear retailer Hibbett (NASDAQ:HIBB) reported Q3 FY2024 results topping analysts' expectations, with revenue flat year on year at $431.9 million. Turning to EPS, Hibbett made a GAAP profit of $2.05 per share, improving from its profit of $1.94 per share in the same quarter last year.

Is now the time to buy Hibbett? Find out by accessing our full research report, it's free.

Hibbett (HIBB) Q3 FY2024 Highlights:

- Revenue: $431.9 million vs analyst estimates of $416.6 million (3.7% beat)

- EPS: $2.05 vs analyst estimates of $1.17 (74.6% beat based on better-than-expected margins)

- Gross Margin (GAAP): 33.9%, down from 34.3% in the same quarter last year (beat)

- Same-Store Sales were down 2.7% year on year (small beat)

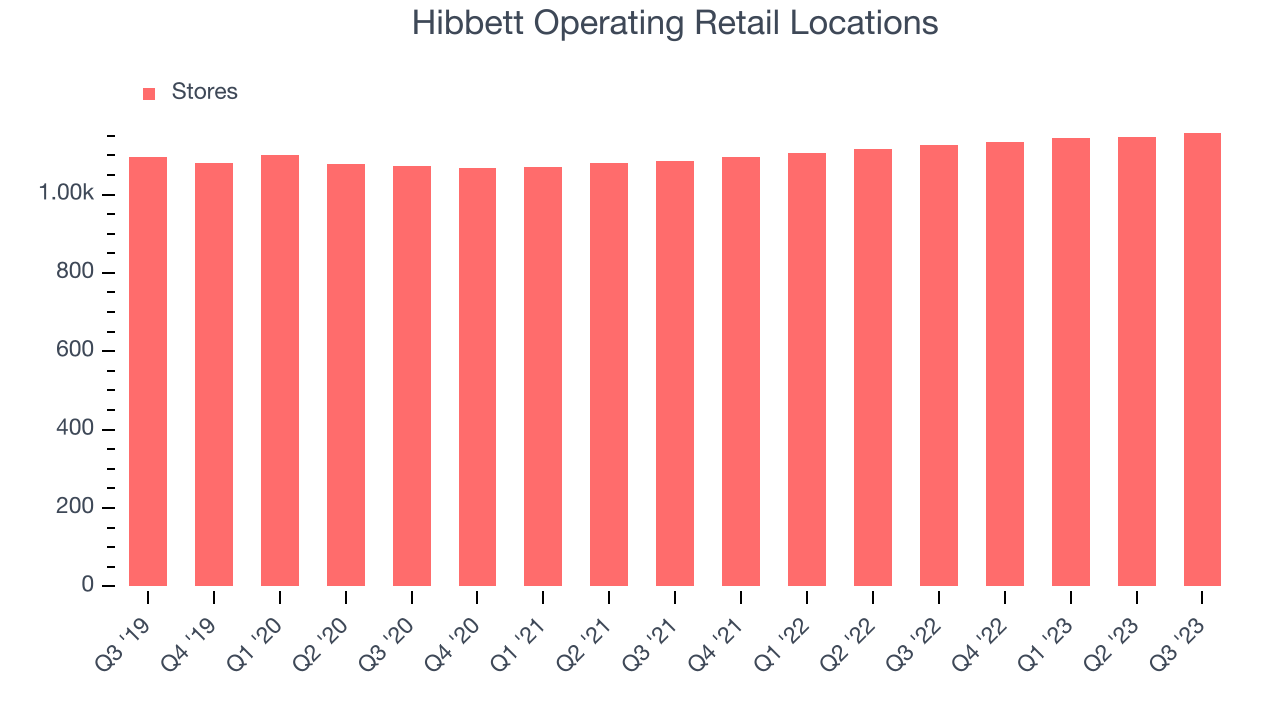

- Store Locations: 1,158 at quarter end, increasing by 32 over the last 12 months

Mike Longo, President and Chief Executive Officer, stated, “Our solid financial results for the third quarter of Fiscal 2024 reflect our ability to consistently execute our strategy, and we believe we continue to gain market share in a challenging retail environment. Our sales were in line with our expectations, boosted by a strong back-to-school season during the first month of the quarter. We also benefited from a more normal seasonal schedule of new launch products throughout the quarter, with a positive response from our loyal customers to the latest trend-relevant brands and products.”

With a focus on small and mid-sized markets, Hibbett (NASDAQ:HIBB) is a specialty retailer that sells athletic apparel and footwear as well as select sports equipment.

Athletic Apparel and Footwear Retailer

Apparel and footwear was once a category thought to be relatively safe from major e-commerce penetration because of the need to try on, touch, and feel products, but the category is now meaningfully transacted online. Everyone still needs clothes and shoes to go outside unless they want some curious (or horrified) looks. But this ongoing digitization is forcing apparel and footwear retailers–that once only had brick-and-mortar stores–to respond with omnichannel offerings. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stagnate, so the evolution of clothing and shoes sellers marches on.

Sales Growth

Hibbett is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

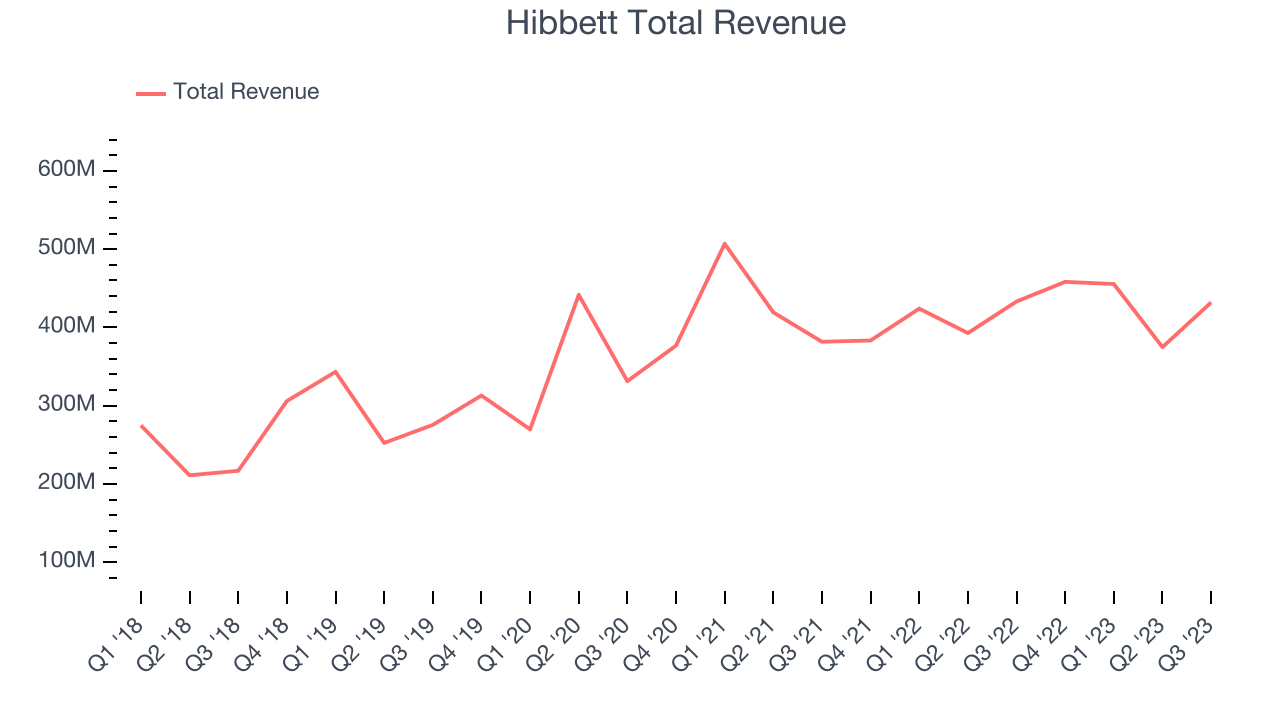

As you can see below, the company's annualized revenue growth rate of 10% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was decent as it opened new stores and expanded its reach.

This quarter, Hibbett's revenue fell 0.3% year on year to $431.9 million but beat Wall Street's estimates by 3.7%. Looking ahead, analysts expect sales to grow 4.1% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Number of Stores

A retailer's store count often determines on how much revenue it can generate.

When a retailer like Hibbett is opening new stores, it usually means it's investing for growth because demand is greater than supply. Hibbett's store count increased by 32 locations, or 2.8%, over the last 12 months to 1,158 total retail locations in the most recently reported quarter.

Over the last two years, the company has generally opened new stores and averaged 3.2% annual growth in its physical footprint, which is decent and on par with the broader sector. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

Hibbett's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 1.2% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Hibbett's same-store sales fell 2.7% year on year. This decline was a reversal from the 9.9% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Hibbett's Q3 Results

With a market capitalization of $664.6 million and more than $29.58 million in cash on hand, Hibbett can continue prioritizing growth.

We liked how a small same-store sales beat led to revenue above expectations. Much better margins and expense control led to EPS blowing past analysts' expectations this quarter. While same-store sales and net sales guidance for the full year were maintained, the company raised EPS guidance well above expectations based on a combination of expectations for lower operating expenses, lower interest expense, and a smaller number of shares outstanding. Zooming out, we think this was a very good quarter that should have most shareholders cheering. The stock is flat after reporting and currently trades at $53.62 per share.

Hibbett may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.