Semiconductor maker Himax Technologies (NASDAQ:HIMX) reported Q1 CY2024 results topping analysts' expectations, with revenue down 15% year on year to $207.6 million. It made a GAAP profit of $0.07 per share, down from its profit of $0.09 per share in the same quarter last year.

Himax (HIMX) Q1 CY2024 Highlights:

- Revenue: $207.6 million vs analyst estimates of $203.4 million (2% beat)

- EPS: $0.07 vs analyst estimates of $0.05 ($0.02 beat)

- Qualitative guidance: "With that being said, Company believes Q1 will be the low point for this year and sees sales starting to pick up in Q2, especially in the automotive sector. With several other upcoming demand catalysts on the horizon, including major sporting events and festival shopping seasons, business momentum is expected to continue to steadily improve throughout the second half."

- Gross Margin (GAAP): 29.3%, up from 28.1% in the same quarter last year

- Inventory Days Outstanding: 125, in line with the previous quarter

- Free Cash Flow of $53.74 million, similar to the previous quarter

- Market Capitalization: $912.1 million

Taiwan-based Himax Technologies (NASDAQ:HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax was founded in 2001 by B.S. Wu, who pioneered flat panel technologies at Chimei Electronics as CTO. In March of 2006, Himax went public with a listing on the NASDAQ exchange.

Himax products primarily address the flat panel display industry. These products are critical components of displays ranging from TVs to driver displays to mobile phones and tablets. Himax’s emerging technologies include products such as WiseEye AI Image Sensing, which brings computer vision AI to endpoint devices such as smart doors and locks with extremely low power requirements.

The company’s customers are primarily panel manufacturers and mobile device module manufacturers, who in turn design their products for consumer end-use products such as notebook computers, desktop monitors, and TVs. Because Himax operates primarily in a fabless model that utilizes third-party foundries, the company relies on semiconductor manufacturing service providers for wafer fabrication, assembly, testing, and packaging.

Competitors in fabless display imaging semiconductors include Fitipower Integrated Technology (TPE:4961), FocalTech Systems (TPE:3545), Novatek Microelectronics (TPE:3034), and Raydium Semiconductor Corporation (TPE:3592).Sales Growth

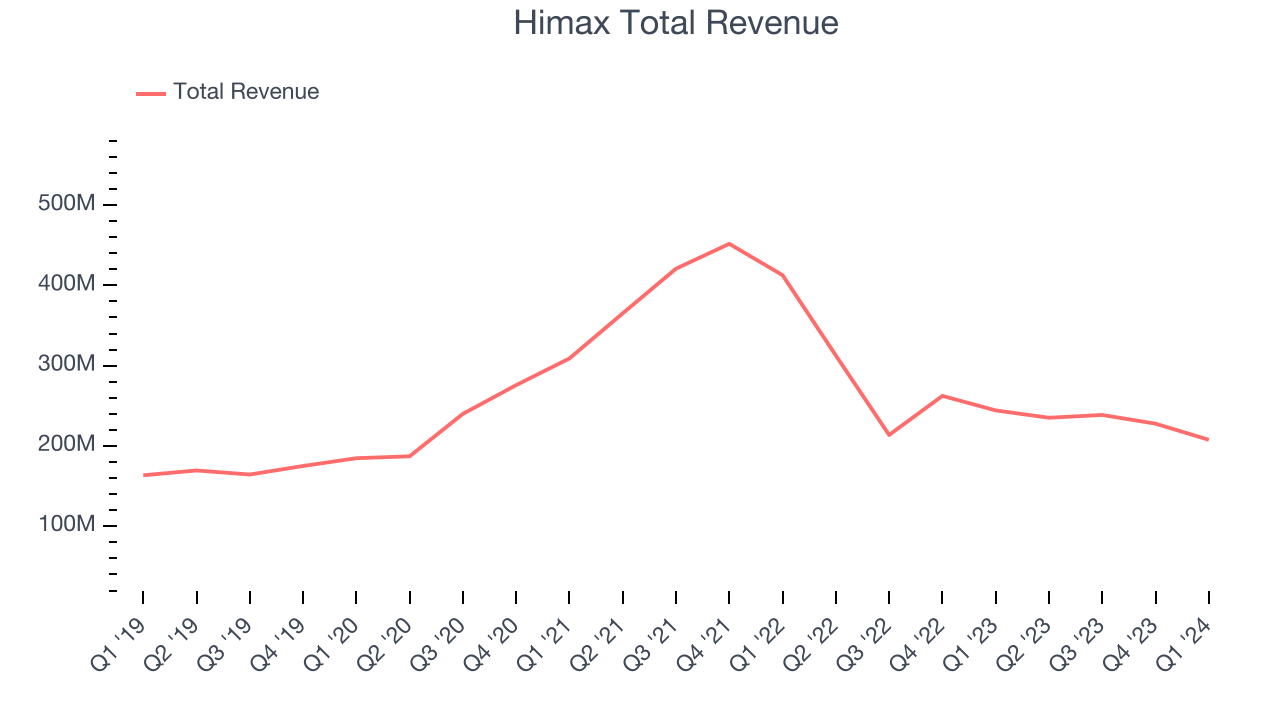

Himax's revenue growth over the last three years has been unimpressive, averaging 6.7% annually. This quarter, its revenue declined from $244.2 million in the same quarter last year to $207.6 million. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Even though Himax surpassed analysts' revenue estimates, this was a slow quarter for the company as its revenue dropped 15% year on year. This could mean that the current downcycle is deepening.

Product Demand & Outstanding Inventory

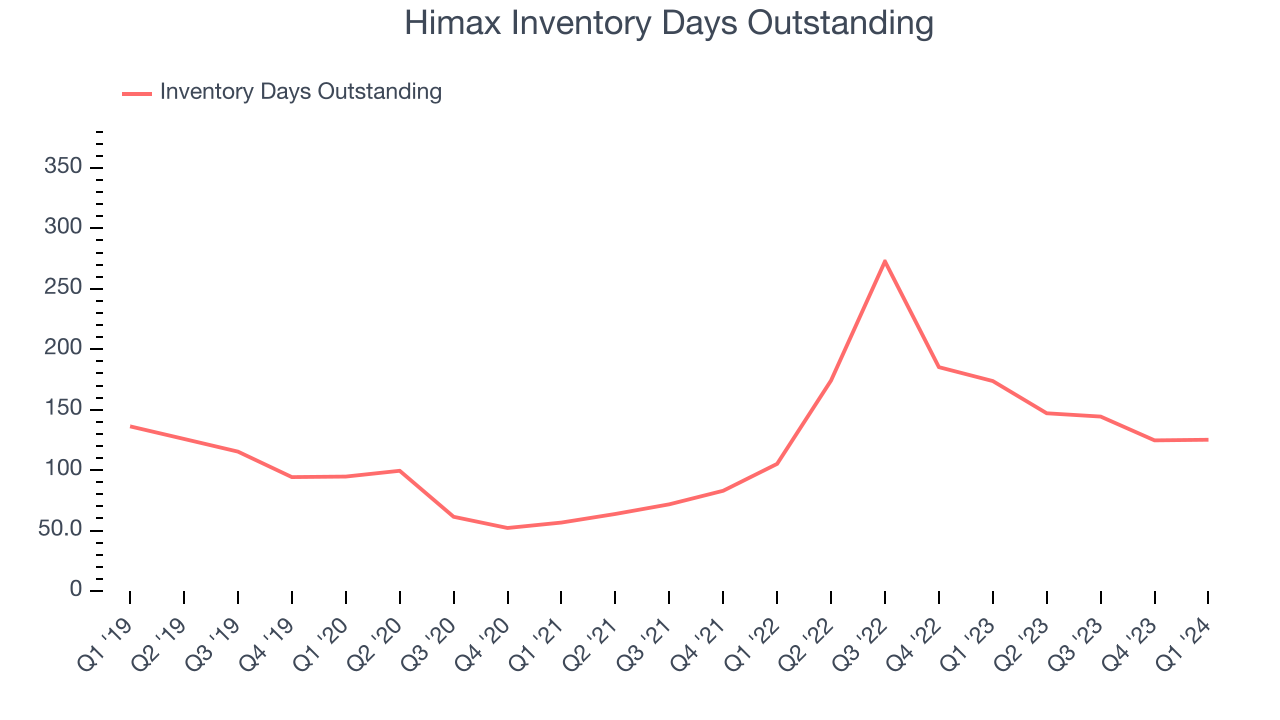

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Himax's DIO came in at 125, which is 7 days above its five-year average, suggesting that the company's inventory levels are higher than what we've seen in the past.

Pricing Power

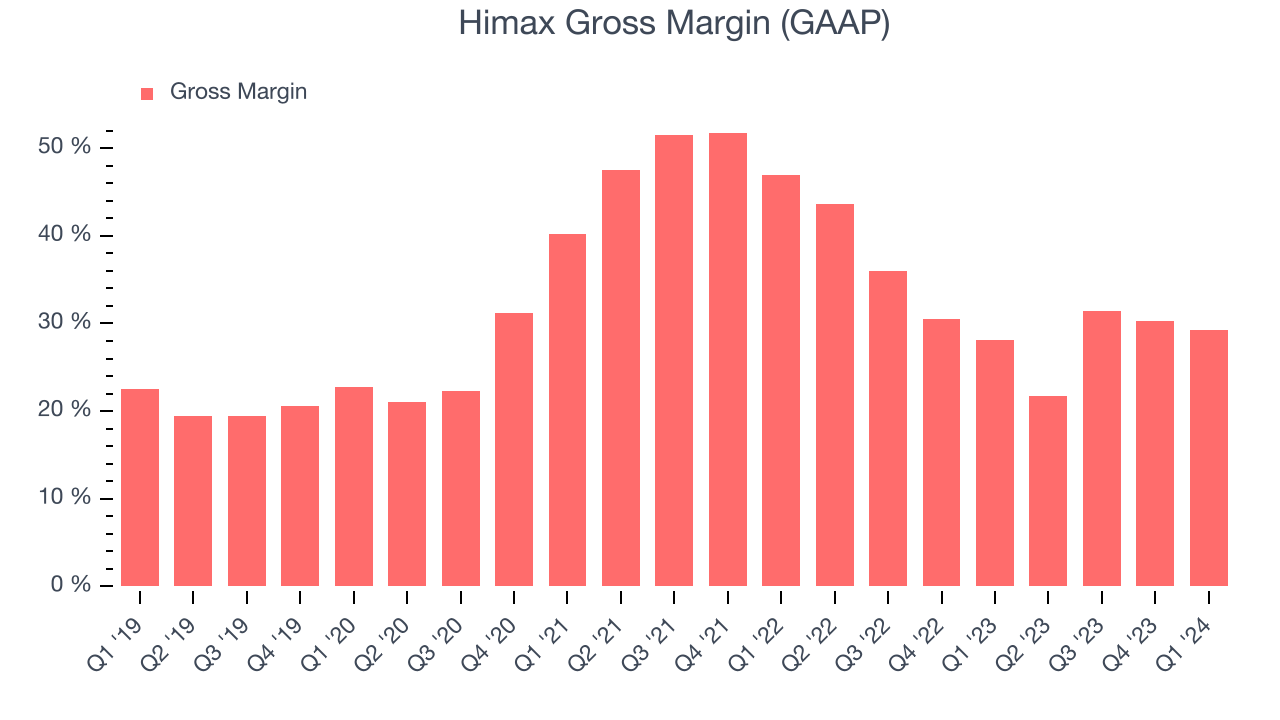

In the semiconductor industry, a company's gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor. Himax's gross profit margin, which shows how much money the company gets to keep after paying key materials, input, and manufacturing costs, came in at 29.3% in Q1, up 1.2 percentage points year on year.

Himax's gross margins have been trending down over the last 12 months, averaging 28.1%. This weakness isn't great as Himax's margins are already far below other semiconductor companies and suggest shrinking pricing power and loose cost controls.

Earnings, Cash & Competitive Moat

Analysts covering Himax expect earnings per share to grow 59.1% over the next 12 months, although estimates will likely change after earnings.

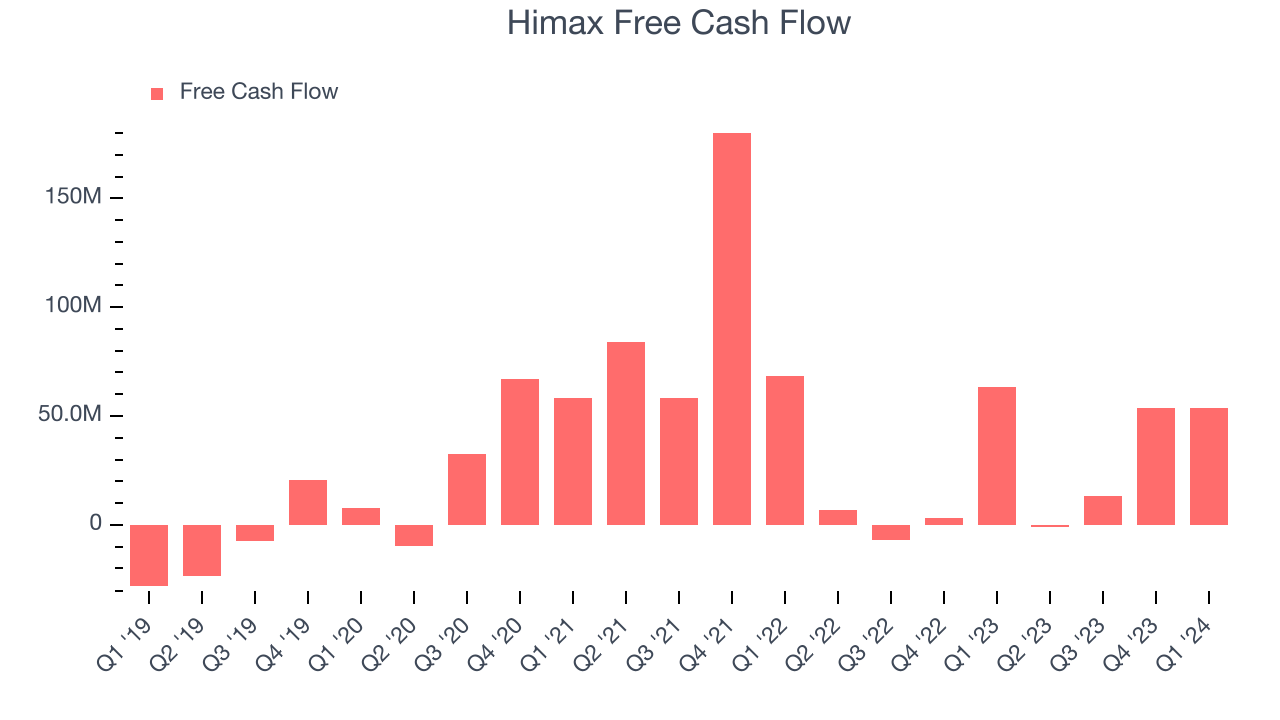

Although earnings are important, we believe cash is king because you can't use accounting profits to pay the bills. Himax's free cash flow came in at $53.74 million in Q1, down 15.4% year on year.

Himax has generated $119.7 million in free cash flow over the last 12 months, or 13.2% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

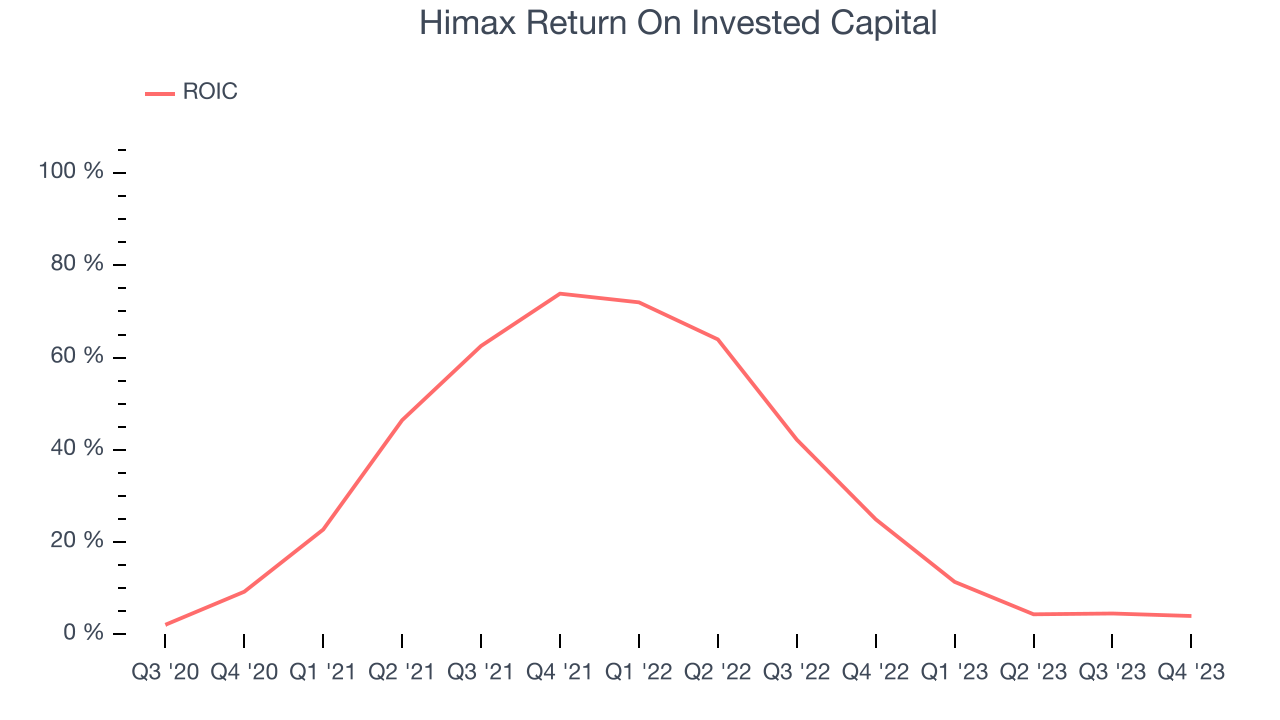

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Himax's five-year average ROIC was 35.4%, placing it among the best semiconductor companies. Just as you’d like your investment dollars to generate returns, Himax's invested capital has produced excellent profits.

Key Takeaways from Himax's Q1 Results

It was good to see Himax improve its gross margin this quarter. We were also glad its revenue outperformed Wall Street's estimates. The company stated that "Q1 will be the low point for this year and sees sales starting to pick up in Q2, especially in the automotive sector. With several other upcoming demand catalysts on the horizon, including major sporting events and festival shopping seasons, business momentum is expected to continue to steadily improve throughout the second half." Overall, this was a solid quarter for Himax. The stock is up 5.5% after reporting and currently trades at $5.5 per share.

Is Now The Time?

Himax may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Although we have other favorites, we understand the arguments that Himax isn't a bad business. Although its revenue growth has been uninspiring over the last three years with analysts expecting growth to slow from here, its stellar ROIC suggests it has been a well-run company historically. Investors should still be cautious, however, as its gross margin indicate some combination of pricing pressures or rising production costs.

Himax's price-to-earnings ratio based on the next 12 months is 19.0x. In the end, beauty is in the eye of the beholder. While Himax wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $6.40 per share right before these results (compared to the current share price of $5.50).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.