Personal care company The Honest Company (NASDAQ:HNST) announced better-than-expected results in Q4 FY2023, with revenue up 10.3% year on year to $90.26 million. It made a GAAP profit of $0.01 per share, improving from its loss of $0.14 per share in the same quarter last year.

The Honest Company (HNST) Q4 FY2023 Highlights:

- Revenue: $90.26 million vs analyst estimates of $84.14 million (7.3% beat)

- Adjusted EBITDA: $4.3 million vs analyst estimates of ($2.3) million LOSS

- EPS: $0.01 vs analyst estimates of -$0.08 ($0.09 beat)

- Encouraging 2024 and longer-term guidance: low-to-mid single digit percentage revenue growth and positive low-single digit to mid-single digit millions adjusted EBITDA; improving to 4% to 6% annual revenue growth and continued adjusted EBITDA margin expansion beyond 2024

- Free Cash Flow of $9.67 million, up 83.5% from the previous quarter

- Gross Margin (GAAP): 33.5%, up from 27.5% in the same quarter last year

- Market Capitalization: $285.5 million

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ:HNST) sells diapers and wipes, skin care products, and household cleaning products.

Initially conceived as a response to the lack of eco-friendly products for children, the company's first products included diapers without chemicals and biodegradable wipes, among other products. Since then, The Honest Company's growth has largely been through organic (rather than through acquisition) expansion of its existing product portfolio.

Today, The Honest Company sells not only baby products but also moisturizers and creams, cosmetics, and home cleaning supplies, for example. The unifying theme continues to be safe and sustainable products free of harmful chemicals. As such, the core customer consists of parents and individuals who care about what goes on and in their bodies as well as how their consumption habits impact the environment. These Honest Company loyalists tend to be middle to higher-income and educated.

The Honest Company's products can be found in a variety of retail channels, including major brick-and-mortar stores such as Target (NYSE:TGT), Walmart (NYSE:WMT), and Whole Foods (owned by Amazon, NASDAQ:AMZN). Their presence in these well-established retailers has contributed to their widespread accessibility.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors in the personal care products market that are increasingly their focus on natural and eco-friendly products include Procter & Gamble (NYSE:PG), Kimberly-Clark (NYSE:KMB), and private companies such as Seventh Generation and Babyganics .Sales Growth

The Honest Company is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

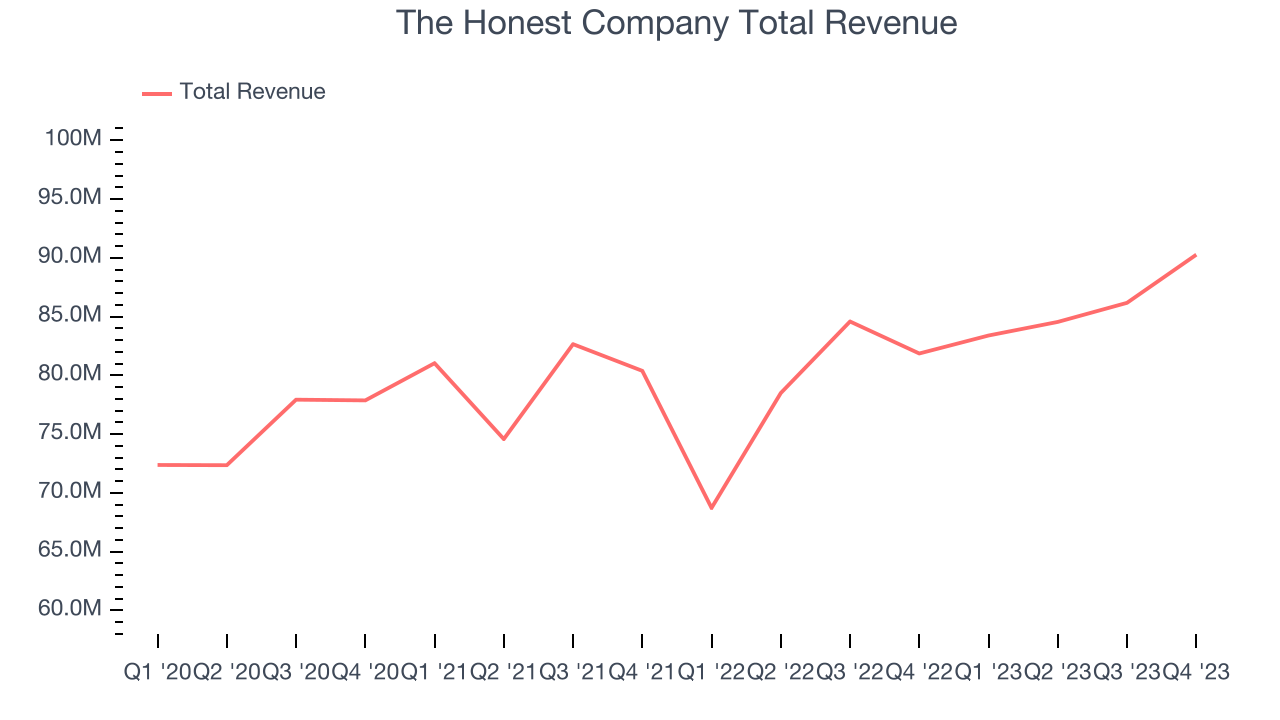

As you can see below, the company's annualized revenue growth rate of 4.6% over the last three years was weak for a consumer staples business.

This quarter, The Honest Company reported robust year-on-year revenue growth of 10.3%, and its $90.26 million in revenue exceeded Wall Street's estimates by 7.3%. Looking ahead, Wall Street expects sales to grow 1.6% over the next 12 months, a deceleration from this quarter.

Gross Margin & Pricing Power

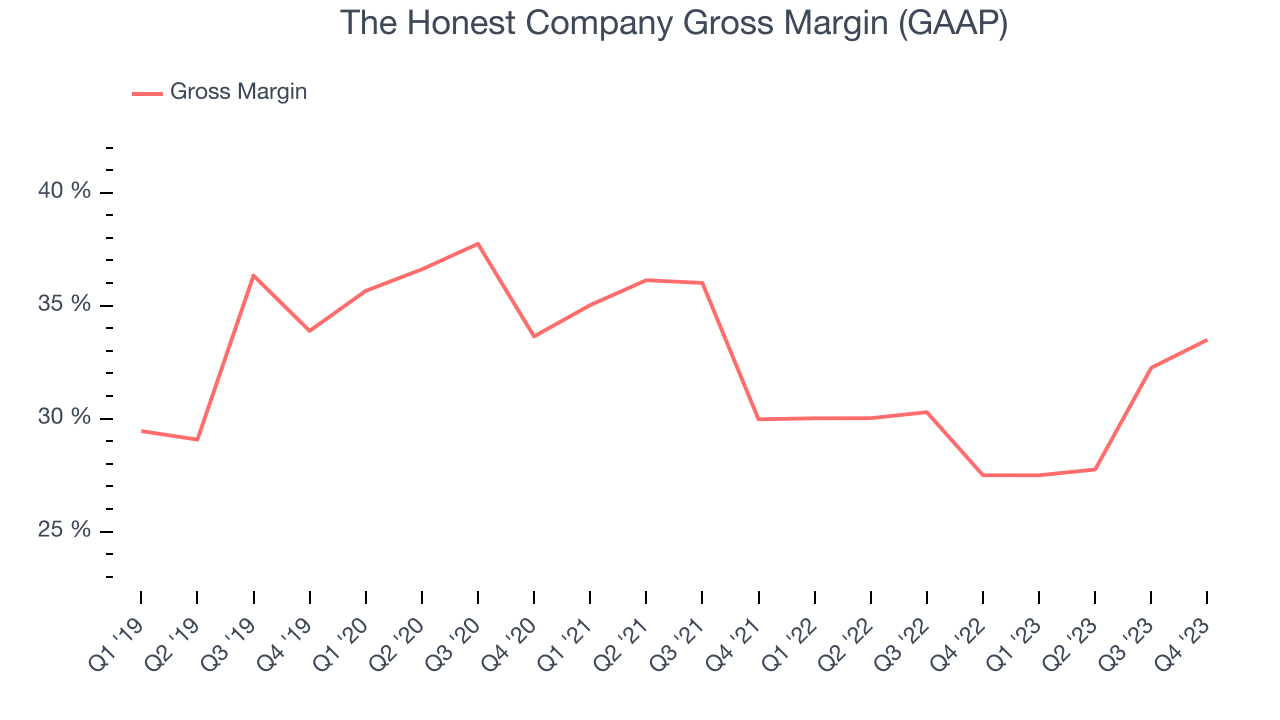

The Honest Company's gross profit margin came in at 33.5% this quarter, up 6 percentage points year on year. That means for every $1 in revenue, a chunky $0.67 went towards paying for raw materials, production of goods, and distribution expenses.

The Honest Company has subpar unit economics for a consumer staples company, making it difficult to invest in areas such as marketing and talent to grow its brand. As you can see above, it's averaged a 29.9% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 3.1% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

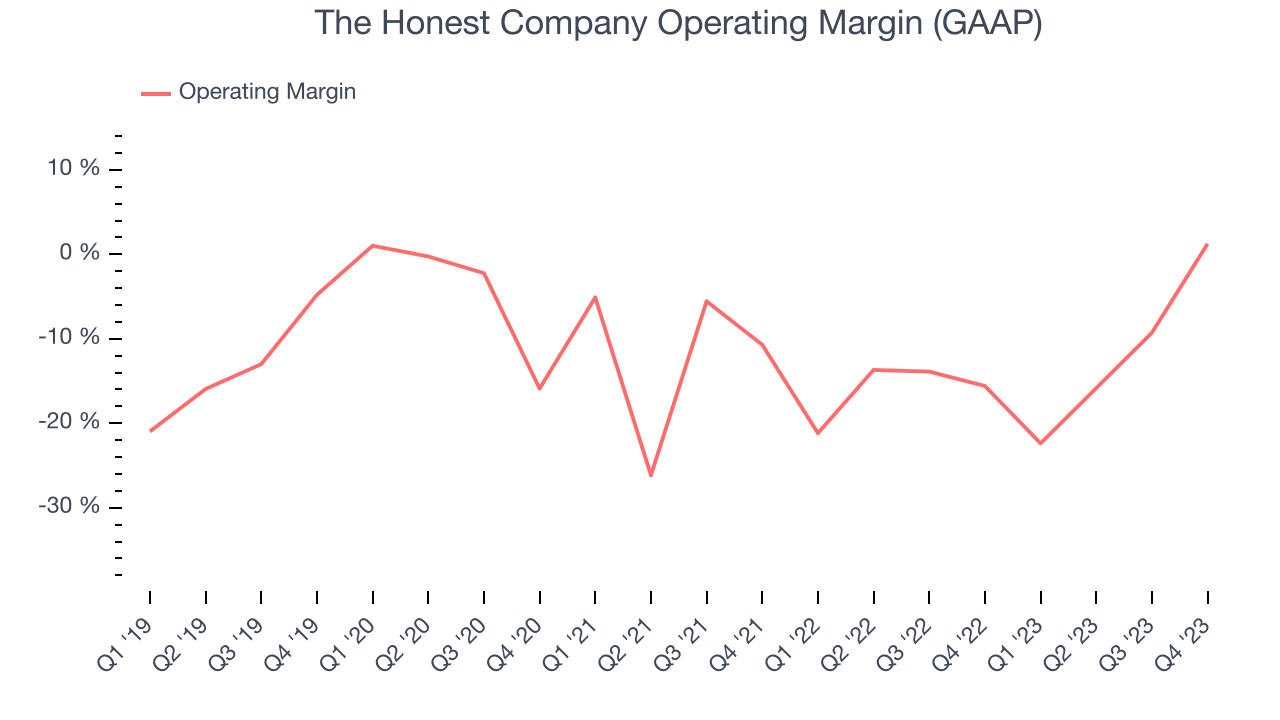

This quarter, The Honest Company generated an operating profit margin of 1.3%, up 16.8 percentage points year on year. This increase was encouraging, and we can infer The Honest Company was more efficient with its expenses because its operating margin expanded more than its gross margin.

Although The Honest Company was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 13.5% over the last two years. This performance isn't ideal as unprofitable publicly traded companies are a minority in the consumer staples sector given its stability. However, The Honest Company's margin has improved by 4.6 percentage points on average over the last year, an encouraging sign for shareholders. The tide could be turning.

Although The Honest Company was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 13.5% over the last two years. This performance isn't ideal as unprofitable publicly traded companies are a minority in the consumer staples sector given its stability. However, The Honest Company's margin has improved by 4.6 percentage points on average over the last year, an encouraging sign for shareholders. The tide could be turning.EPS

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

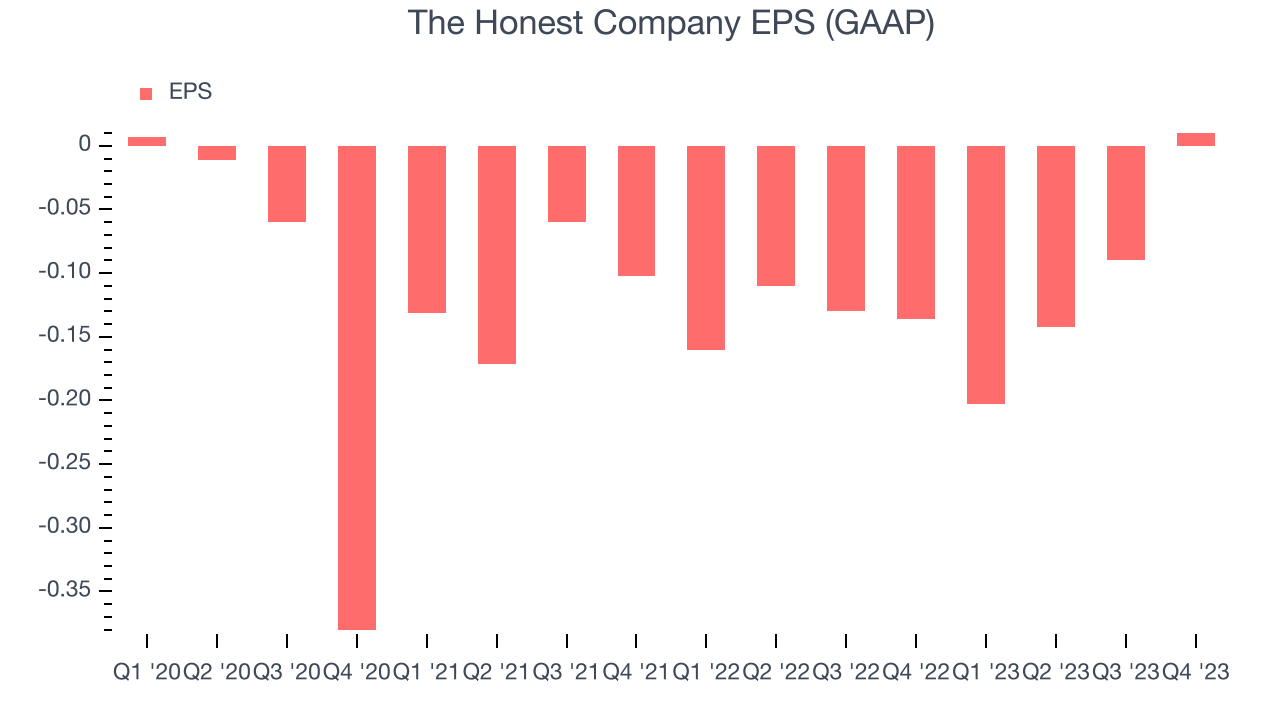

In Q4, The Honest Company reported EPS at $0.01, up from negative $0.14 in the same quarter a year ago. This print easily cleared Wall Street's estimates, and shareholders should be content with the results.

Between FY2020 and FY2023, The Honest Company cut its earnings losses. Its EPS has improved by 1.4% on average each year.

On the bright side, Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 49.8% year-on-year increase in EPS.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

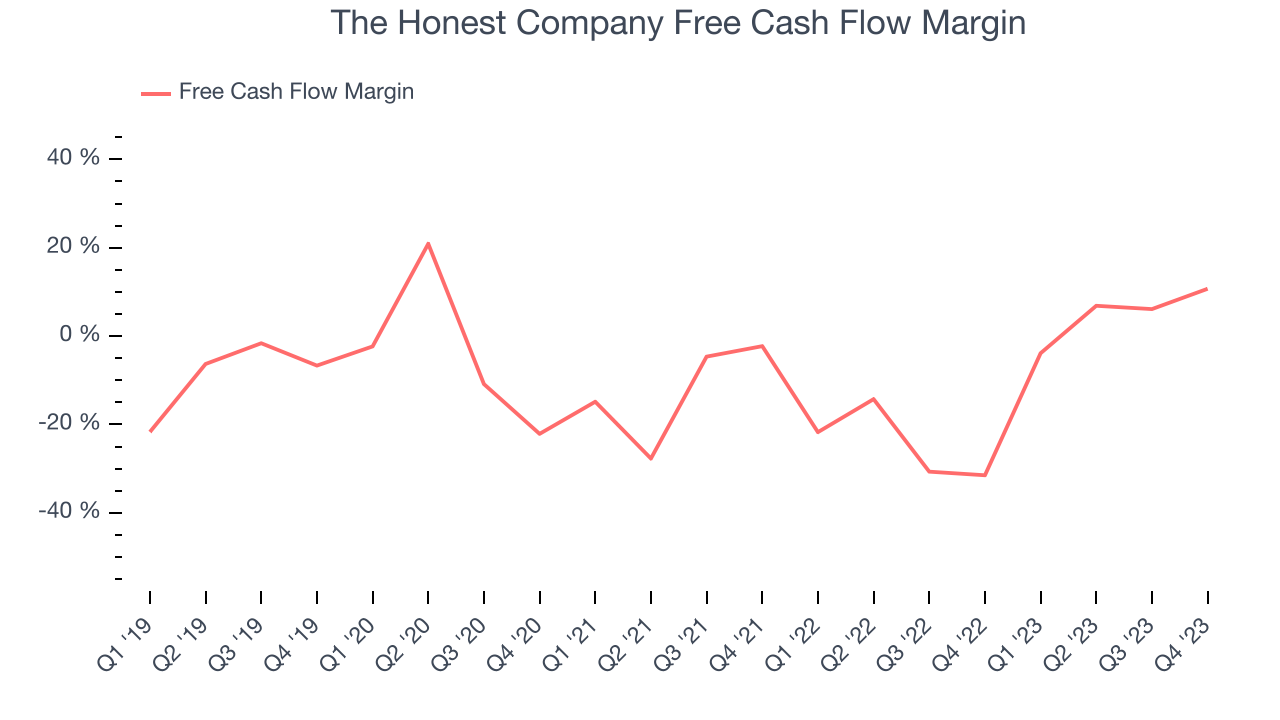

The Honest Company's free cash flow came in at $9.67 million in Q4, representing a 10.7% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to positive this quarter.

While The Honest Company posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, The Honest Company's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer staples sector, averaging negative 9.2%. However, its margin has averaged year-on-year increases of 29.9 percentage points over the last 12 months, showing the company is taking action to improve its situation.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

The Honest Company's five-year average ROIC was negative 35.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

Key Takeaways from The Honest Company's Q4 Results

We were impressed by how significantly The Honest Company blew past analysts' revenue, adjusted EBITDA, and EPS expectations this quarter. The market was expecting negative EBITDA and the company delivered positive EBITDA. Full year 2024 guidance for revenue calls for "low-to-mid single digit percentage" revenue growth and "positive low-single digit to mid-single digit millions adjusted EBITDA", which is encouraging. Even better news is that beyond 2024, this algorithm will improve to 4% to 6% annual revenue growth and continued adjusted EBITDA margin expansion. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 29% after reporting and currently trades at $4 per share.

Is Now The Time?

The Honest Company may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of The Honest Company, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last three years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its brand caters to a niche market. On top of that, its relatively low ROIC suggests it has struggled to grow profits historically.

While we've no doubt one can find things to like about The Honest Company, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $2.65 per share right before these results (compared to the current share price of $4), implying they didn't see much short-term potential in The Honest Company.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.