Financial services company Robinhood (NASDAQ:HOOD) beat analysts' expectations in Q4 FY2023, with revenue up 23.9% year on year to $471 million. It made a non-GAAP profit of $0.13 per share, improving from its loss of $0.01 per share in the same quarter last year.

Robinhood (HOOD) Q4 FY2023 Highlights:

- Revenue: $471 million vs analyst estimates of $452.8 million (4% beat)

- EPS (non-GAAP): $0.13 vs analyst estimates of $0.07 ($0.05 beat)

- Free Cash Flow of $954 million is up from -$978 million in the previous quarter

- Gross Margin (GAAP): 84.7%, up from 66.1% in the same quarter last year

- Funded Customers: 23.4 million, up 400,000 year on year

- Market Capitalization: $13.6 billion

With a mission to “democratize finance”, Robinhood (NASDAQ:HOOD) is an online platform enabling the commission-free trading of stocks, exchange-traded funds, and cryptocurrencies.

Traditionally, the average person would need to pay high commission fees to brokers to place buy and sell orders. Robinhood’s founders, Vlad Tenev and Baiju Bhatt (both former mathematicians and roommates at Stanford), sought to lower the barriers to entry by pioneering commission-free trading.

Commission-free trading was made possible through the company’s algorithms, which take customer orders and route them to market makers such as Citadel in exchange for a percentage of the bid-ask spread on a trade. This is called payment for order flow, and it historically made up a large chunk of Robinhood’s revenue.

Investors under the age of 35 comprise a majority of Robinhood's user base as the company has no required minimums to open an account and initially focused on building for mobile devices. Besides trading, other services such as cash management, retirement accounts, and credit/debit cards are integrated into its platform. The company also offers users a subscription called “Robinhood Gold”, which gives access to premium features such as extended trading hours, higher cash balance yields, margin trading, and research reports.

Today, Robinhood not only generates revenue from payment for order flow but also the subscription fees from Robinhood Gold, interest on margin trading loans, and interest on users’ uninvested cash. Its long-term strategy is to increase its funded customers and assets under custody so it can become a one-stop shop for consumers’ finances.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Robinhood’s competitors include Charles Schwab (NYSE:SCHW), Fidelity (NYSE:FNF), Interactive Brokers (NASDAQ:IBKR), Coinbase (NASDAQ:COIN), and private companies M1 Finance and Webull.Sales Growth

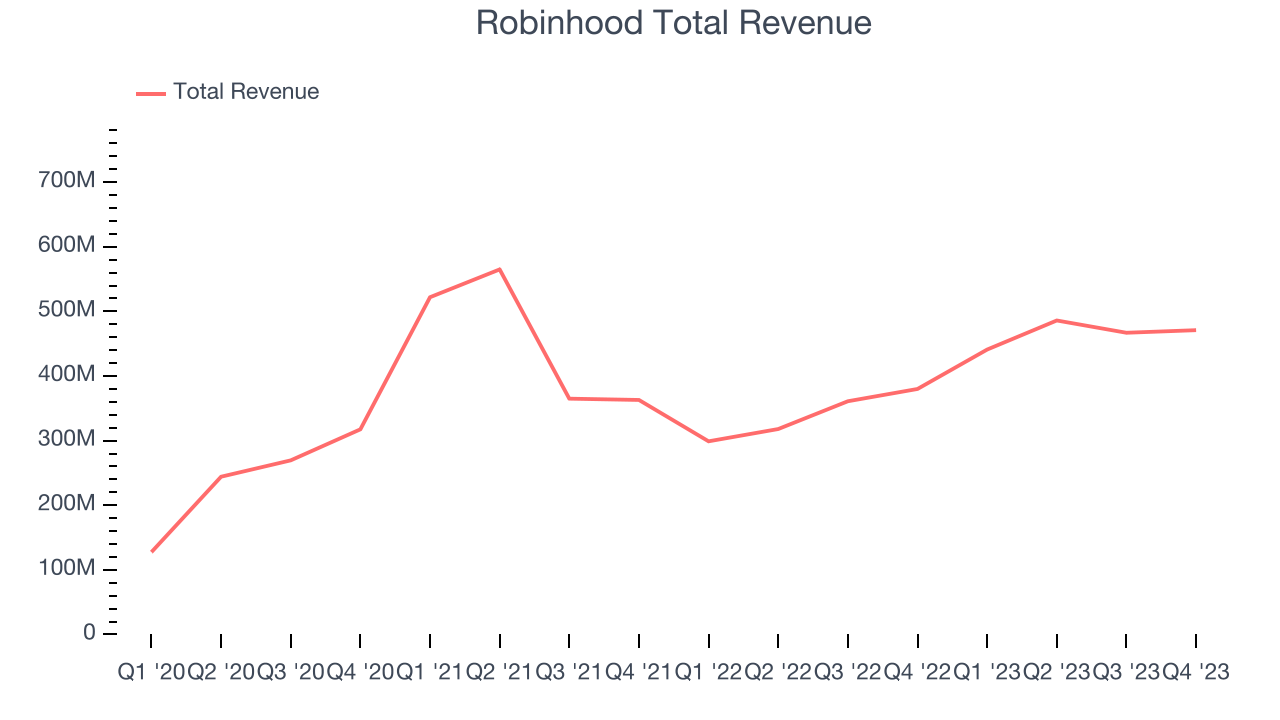

Robinhood's revenue growth over the last three years has been impressive, averaging 46.8% annually. This quarter, Robinhood beat analysts' estimates and reported decent 23.9% year-on-year revenue growth.

Usage Growth

As an online marketplace, Robinhood generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

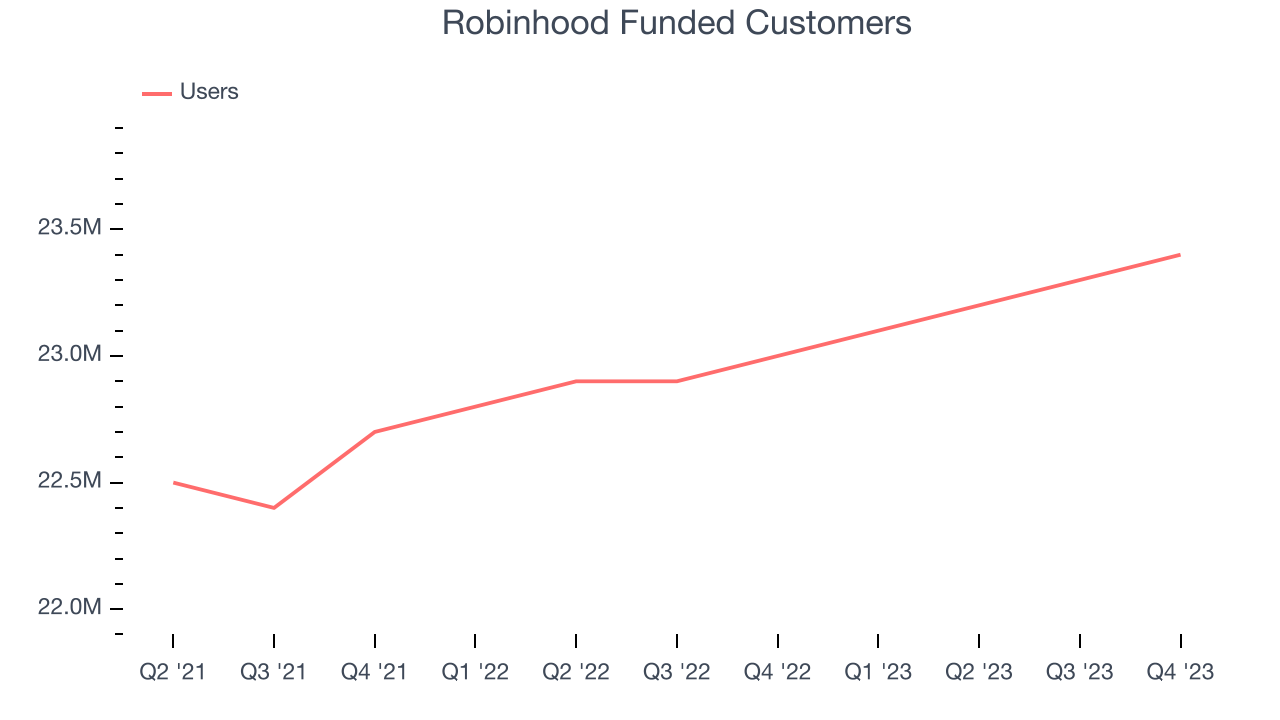

Over the last two years, Robinhood's users, a key performance metric for the company, grew 1.6% annually to 23.4 million. This is one of the lowest rates of growth in the consumer internet sector.

In Q4, Robinhood added 400,000 users, translating into 1.7% year-on-year growth.

Revenue Per User

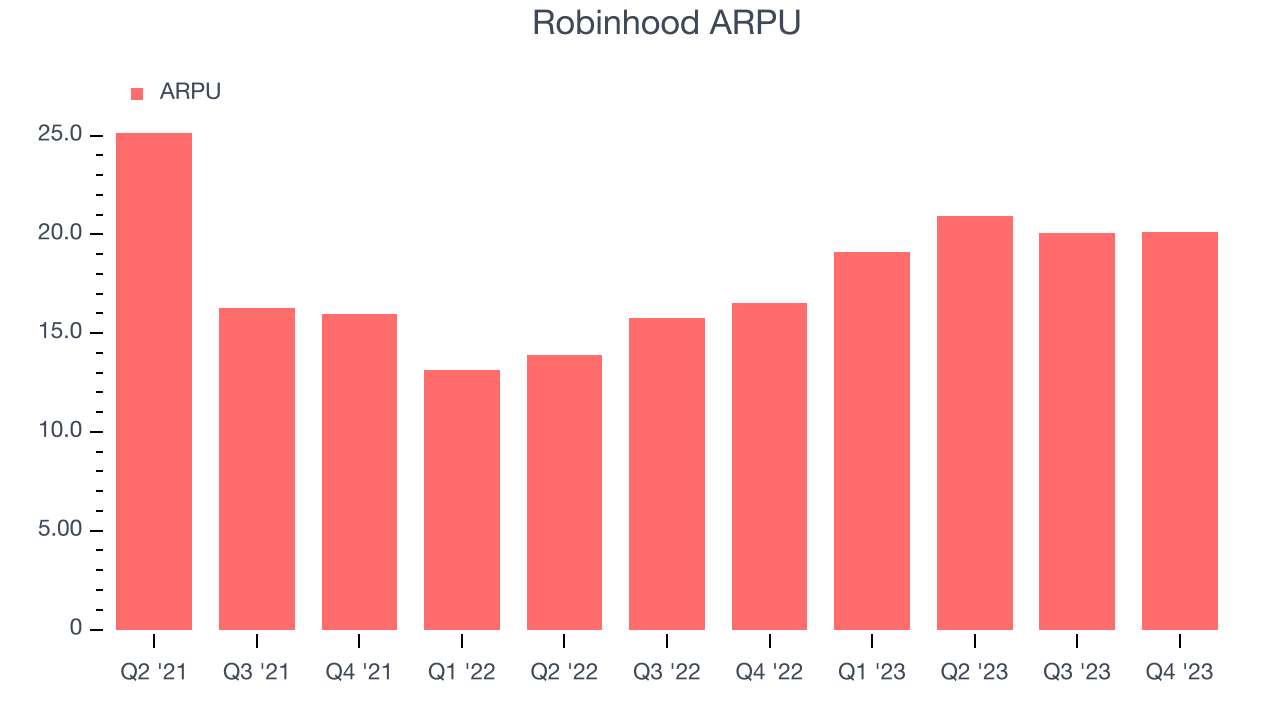

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Robinhood because it measures how much the company earns in transaction fees from each user. Furthermore, ARPU gives us unique insights as it's a function of a user's average order size and Robinhood's take rate, or "cut", on each order.

Robinhood's ARPU growth has been impressive over the last two years, averaging 14.4%. The company's ability to increase prices while growing its users demonstrates its platform's value, as its users continue to spend more each year. This quarter, ARPU grew 21.8% year on year to $20.13 per user.

Pricing Power

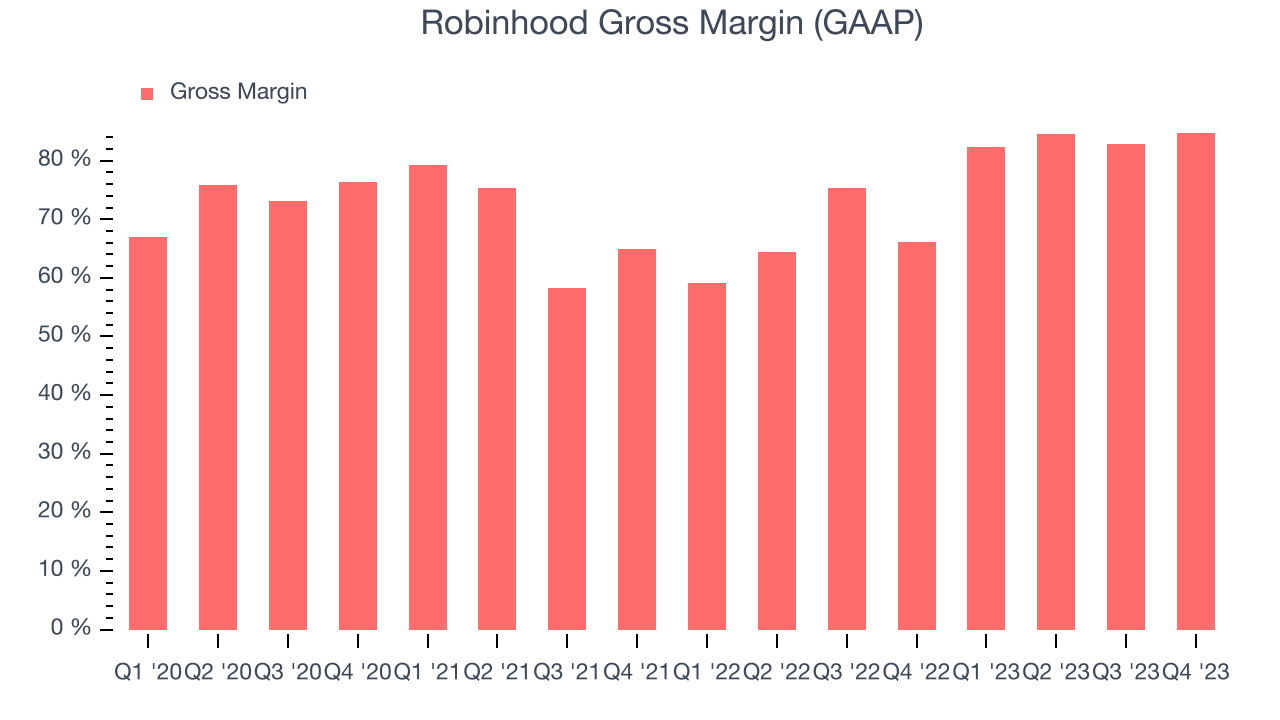

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Robinhood's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 84.7% this quarter, up 18.7 percentage points year on year.

For online marketplaces like Robinhood, these aforementioned costs typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification. After paying for these expenses, Robinhood had $0.85 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Gross margins have been trending up over the last 12 months, averaging 83.6%. Robinhood's margins are some of the highest in the consumer internet sector, enabling it to fund large investments in product and marketing during periods of rapid growth to stay one step ahead of the competition.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like Robinhood grow from a combination of product virality, paid advertisement, and incentives.

Robinhood is extremely efficient at acquiring new users, spending only 7.5% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and customer acquisition advantages from scale, giving Robinhood the freedom to invest its resources into new growth initiatives while maintaining optionality.

Profitability & Free Cash Flow

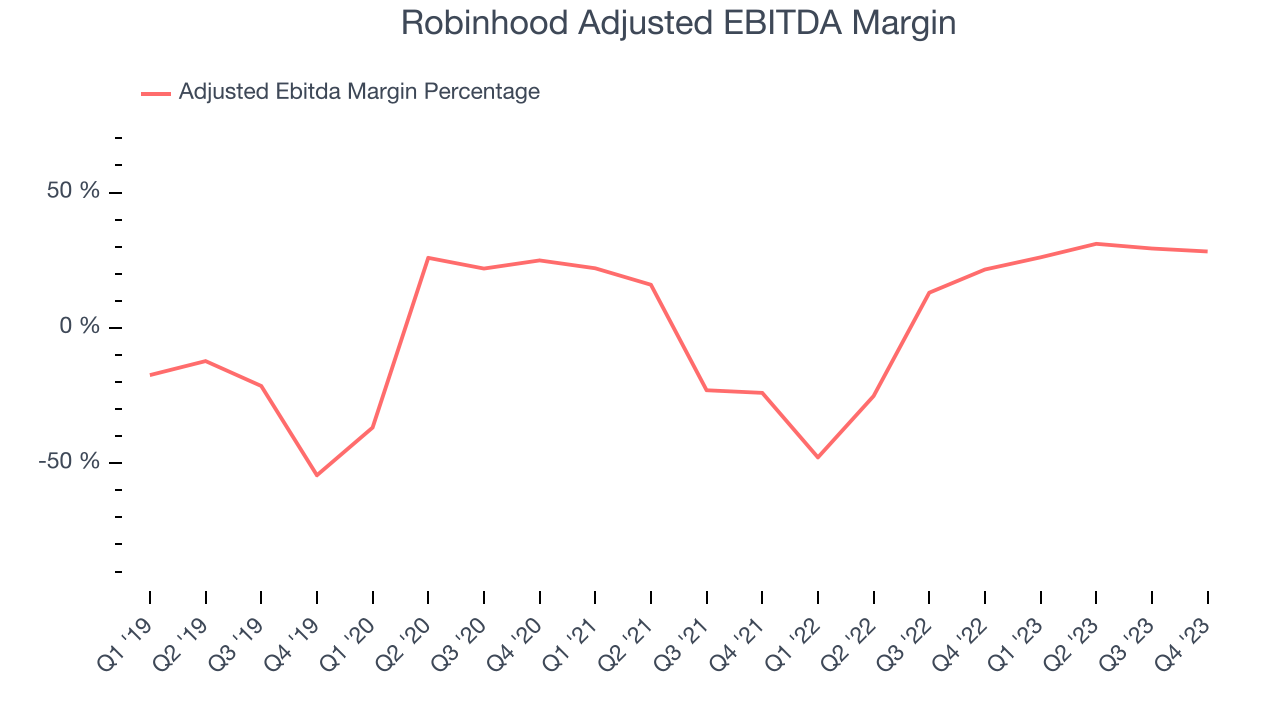

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Robinhood's EBITDA was $133 million this quarter, translating into a 28.2% margin. Additionally, Robinhood has demonstrated extremely high profitability over the last four quarters, with average EBITDA margins of 28.7%.

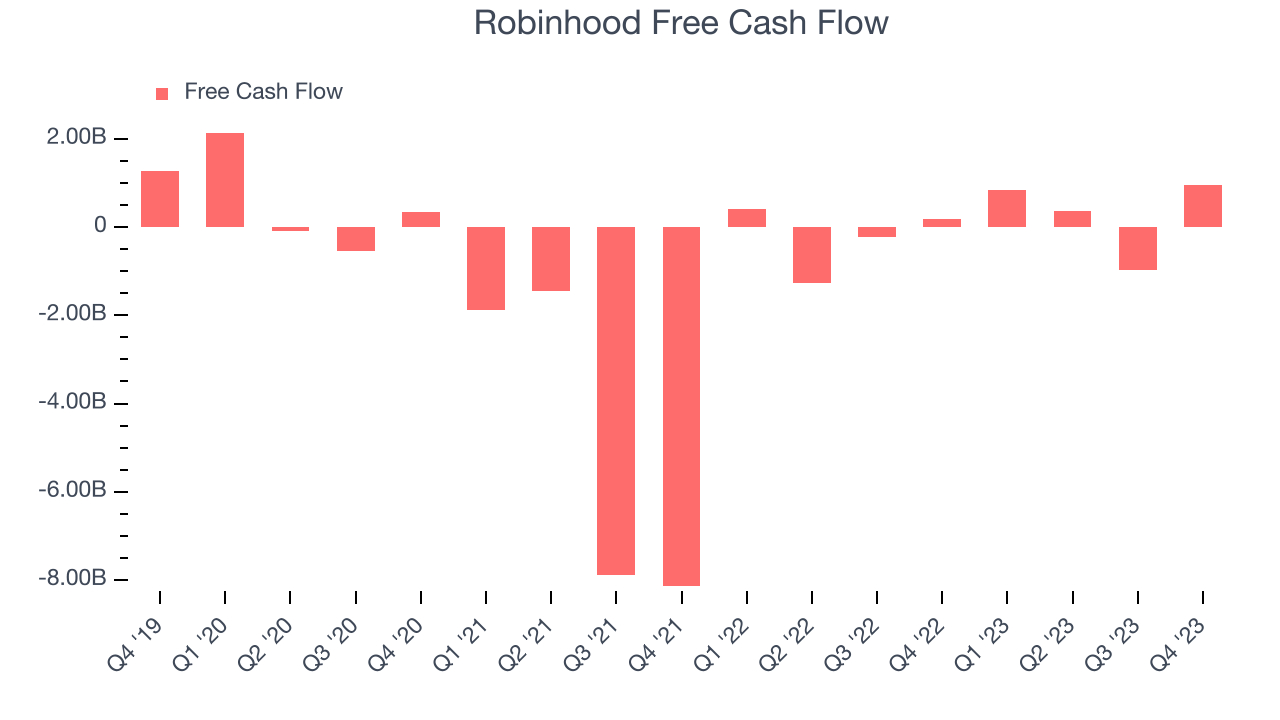

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Robinhood's free cash flow came in at $954 million in Q4, up 458% year on year.

Robinhood has generated $1.17 billion in free cash flow over the last 12 months, an eye-popping 62.9% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Robinhood's Q4 Results

It was great to see Robinhood beat analysts' revenue expectations this quarter. We were also glad it produced solid revenue growth. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 2.9% after reporting and currently trades at $16.05 per share.

Is Now The Time?

When considering an investment in Robinhood, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are numerous reasons why we think Robinhood is one of the best consumer internet companies out there. While we'd expect growth rates to moderate from here, its revenue growth has been exceptional over the last three years. And while its growth in users has been lackluster, the good news is its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, its impressive gross margins are a wonderful starting point for the overall profitability of the business.

At the moment Robinhood trades at 23.3x next 12 months EV-to-EBITDA. Looking at the consumer internet landscape today, Robinhood's qualities really stand out, and we really like it at this price.

Wall Street analysts covering the company had a one-year price target of $12.74 per share right before these results (compared to the current share price of $16.05).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.