Intel (NASDAQ:INTC) Q4 Sales Beat Estimates But Stock Drops

Max Juang /

January 25, 2024

Computer processor maker Intel (NASDAQ:INTC) reported results ahead of analysts' expectations in Q4 FY2023, with revenue up 9.7% year on year to $15.41 billion. On the other hand, next quarter's revenue guidance of $12.7 billion was less impressive, coming in 10.3% below analysts' estimates. It made a non-GAAP profit of $0.54 per share, improving from its profit of $0.10 per share in the same quarter last year.

Is now the time to buy Intel? Find out in our full research report.

Intel (INTC) Q4 FY2023 Highlights:

- Market Capitalization: $207 billion

- Revenue: $15.41 billion vs analyst estimates of $15.17 billion (1.5% beat)

- EPS (non-GAAP): $0.54 vs analyst estimates of $0.45 (20.3% beat)

- Revenue Guidance for Q1 2024 is $12.7 billion at the midpoint, below analyst estimates of $14.16 billion

- EPS (non-GAAP) Guidance for Q1 2024 is $0.13 per share at the midpoint, below analyst estimates of $0.32

- Free Cash Flow was -$1.31 billion, down from $943 million in the previous quarter

- Inventory Days Outstanding: 121, down from 128 in the previous quarter

- Gross Margin (GAAP): 45.7%, up from 39.2% in the same quarter last year

“We delivered strong Q4 results, surpassing expectations for the fourth consecutive quarter with revenue at the higher end of our guidance,” said Pat Gelsinger, Intel CEO.

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is the leading manufacturer of computer processors and graphics chips.

Processors and Graphics Chips

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

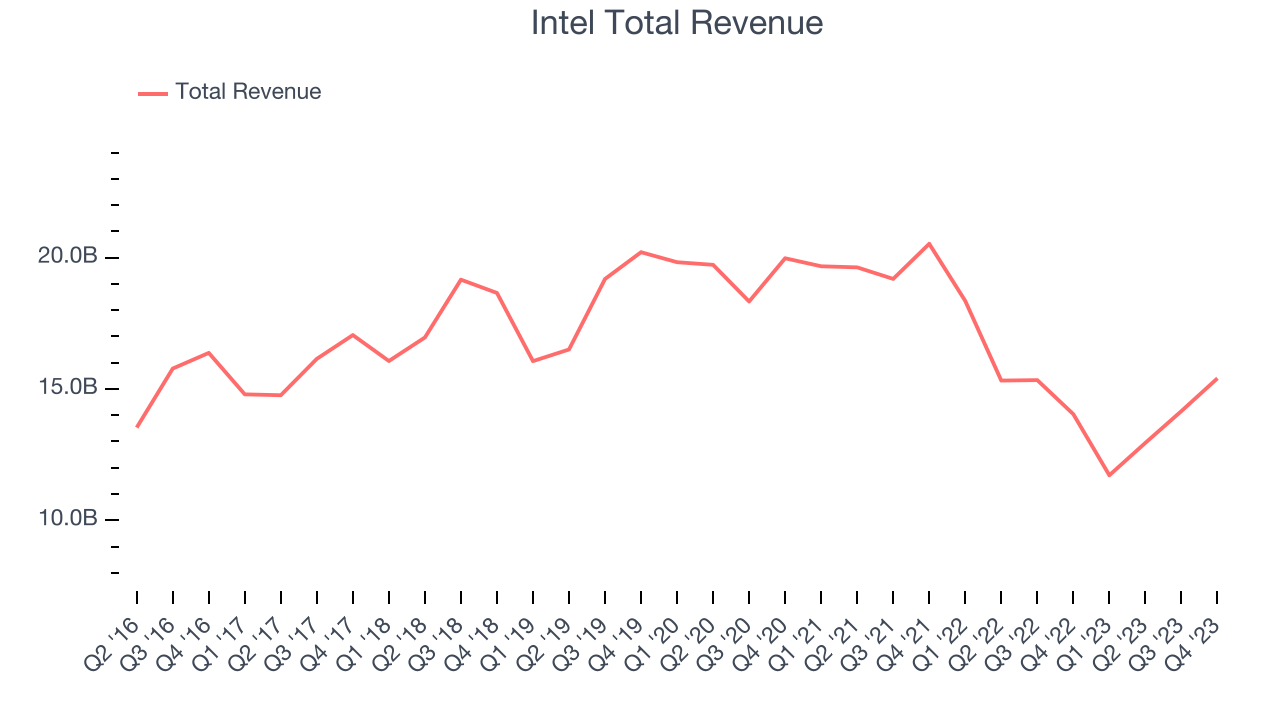

Sales Growth

Intel's revenue has been declining over the last three years, dropping by 10.3% on average per year. As you can see below, this was a weaker quarter for the company, with revenue growing from $14.04 billion in the same quarter last year to $15.41 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

While Intel beat analysts' revenue estimates, this was a sluggish quarter for the company as its revenue only grew 9.7% year on year. Intel's growth, however, flipped from negative to positive this quarter. This encouraging sign will likely be welcomed by shareholders.

Intel returned to positive revenue growth this quarter and its management team expects the trend to continue. The company is guiding to 8.4% year-on-year growth next quarter, and analysts seem to agree, forecasting 13% growth over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

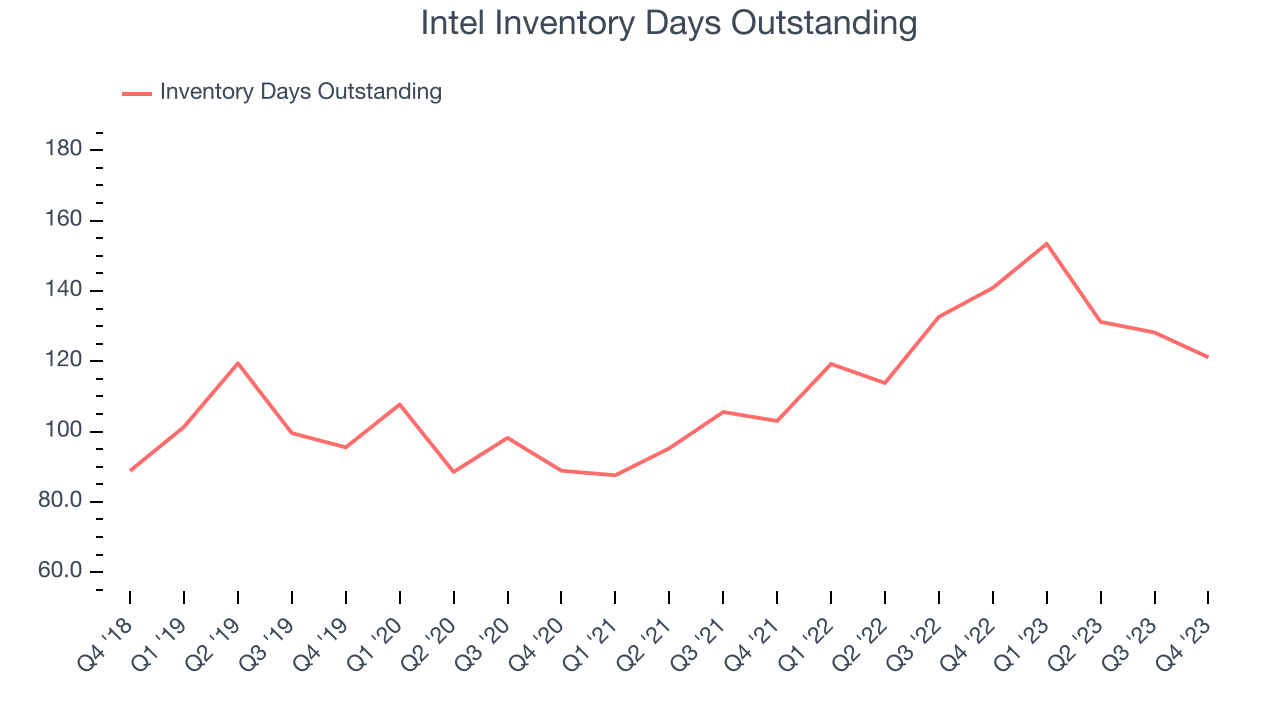

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Intel's DIO came in at 121, which is 10 days above its five-year average. These numbers suggest that despite the recent decrease, the company's inventory levels are higher than what we've seen in the past.

Key Takeaways from Intel's Q4 Results

We were impressed by Intel's revenue and EPS beats vs. analyst expectations this quarter. Gross margin improved year on year and beat expectations as well. However, revenue and EPS guidance for Q1'24 were both well below expectations, causing the stock to drop 4.7% to $47.20 per share.

Intel may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.