Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Intuit (NASDAQ:INTU), and the best and worst performers in the finance and HR software group.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 17 finance and HR software stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 3.17%, while on average next quarter revenue guidance was 2.1% above consensus. Tech stocks have been under pressure since the end of last year, but finance and HR software stocks held their ground better than others, with share price down 1.64% since earnings, on average.

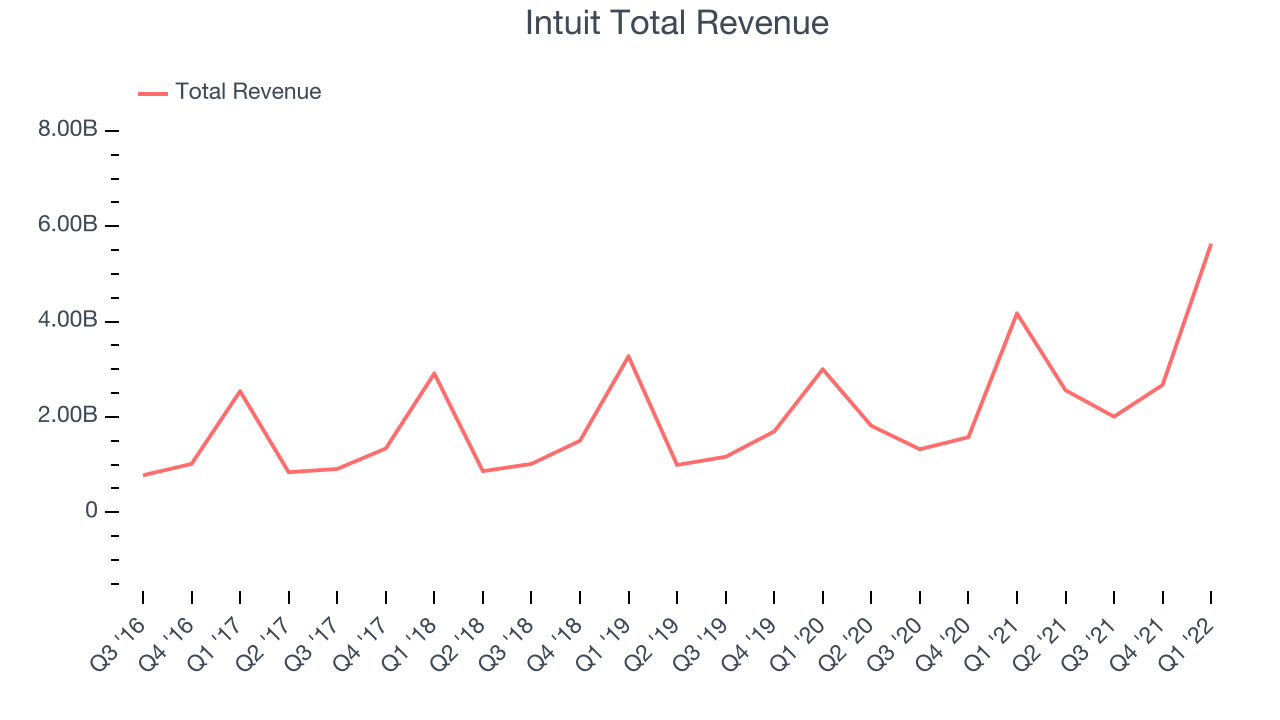

Intuit (NASDAQ:INTU)

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Intuit reported revenues of $5.63 billion, up 34.9% year on year, beating analyst expectations by 2.16%. It was a very strong quarter for the company, with a significant improvement in gross margin.

The stock is up 6.74% since the results and currently trades at $384.

We think Intuit is a good business, but is it a buy today? Read our full report here, it's free.

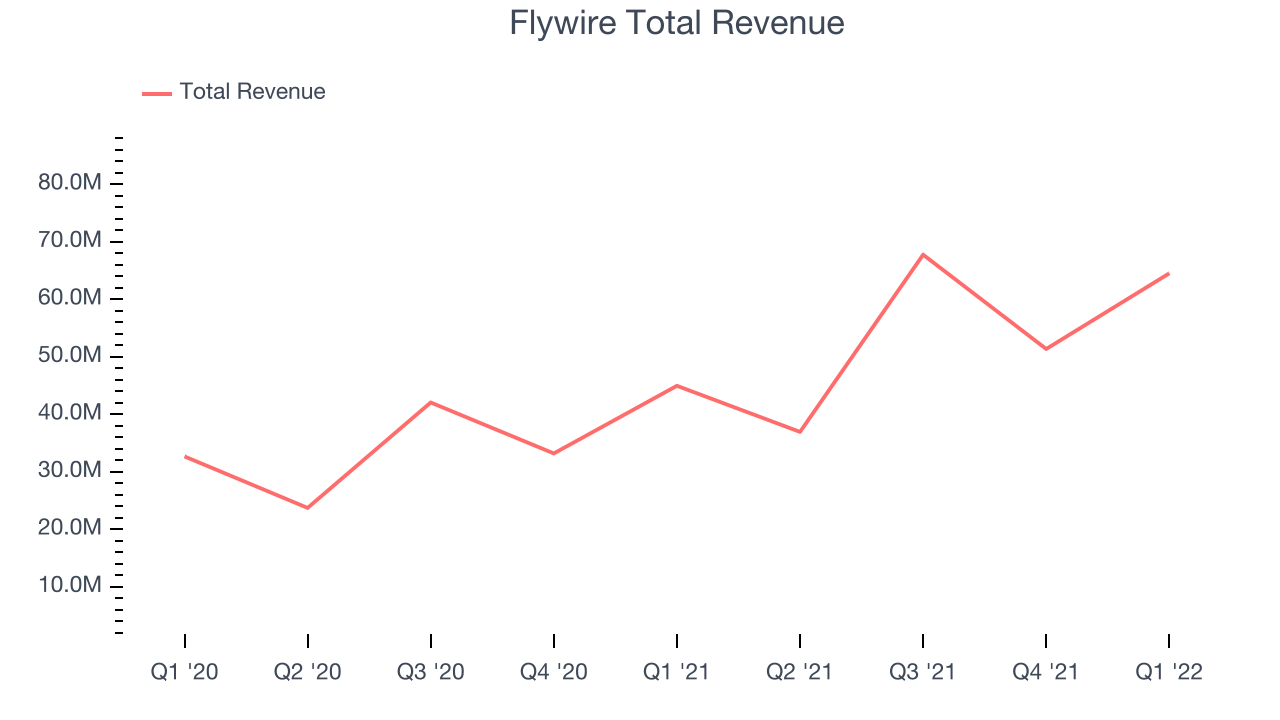

Best Q1: Flywire (NASDAQ:FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire reported revenues of $64.5 million, up 43.4% year on year, beating analyst expectations by 13.5%. It was an exceptional quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

Flywire scored the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is down 12.8% since the results and currently trades at $18.40.

Is now the time to buy Flywire? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $93.1 million, up 16% year on year, beating analyst expectations by 1.03%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and decelerating growth in large customers.

The stock is down 4.51% since the results and currently trades at $9.10.

Read our full analysis of Zuora's results here.

Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $166.1 million, up 53.8% year on year, beating analyst expectations by 3%. It was a mixed quarter for the company, with an exceptional revenue growth but a decline in gross margin.

The stock is up 29.9% since the results and currently trades at $8.63.

Read our full, actionable report on Marqeta here, it's free.

Paylocity (NASDAQ:PCTY)

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ:PCTY) is a provider of payroll and human resources software for small and medium-sized enterprises.

Paylocity reported revenues of $245.9 million, up 32.2% year on year, beating analyst expectations by 1.79%. It was a very strong quarter for the company, with a significant improvement in gross margin.

The stock is up 0.19% since the results and currently trades at $189.41.

Read our full, actionable report on Paylocity here, it's free.

The author has no position in any of the stocks mentioned