Tax and accounting software provider, Intuit (NASDAQ:INTU) reported results in line with analysts' expectations in Q2 FY2024, with revenue up 11.3% year on year to $3.39 billion. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $16 billion at the midpoint. It made a non-GAAP profit of $2.63 per share, improving from its profit of $2.20 per share in the same quarter last year.

Intuit (INTU) Q2 FY2024 Highlights:

- Revenue: $3.39 billion vs analyst estimates of $3.39 billion

- EPS (non-GAAP): $2.63 vs analyst estimates of $2.31 (13.9% beat)

- The company reconfirmed its revenue guidance for the full year of $16 billion at the midpoint

- Free Cash Flow of $550 million is up from -$181 million in the previous quarter

- Gross Margin (GAAP): 75.8%, in line with the same quarter last year

- Market Capitalization: $178.7 billion

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

For many small and medium sized businesses, managing accounting, payroll, and taxes are difficult and time consuming and often are handled by an accountant which is an unnecessarily expensive use of resources, or Excel-like spreadsheets which don’t have sufficient functionality.

Intuit is the originator of easy to use tax and accounting software, from the first version of Quicken in the mid-1980s to today’s suite of well known cloud-based SaaS offerings including TurboTax and Quickbooks that run the spectrum of small business accounting software. In recent years, Intuit has made acquisitions extending its functionality into personal finance through the acquisitions of Mint.com and Credit Karma, and email marketing with Mailchimp.

The company has long held a significant market share of software aimed at individuals and SMBs. TurboTax accounted for a third of total IRS tax returns in 2020, including the majority of those that submitted do-it-yourself returns. With an installed base of over 6m users which accounts for over 1/3rd of global SMBs with fewer than 20 employees. The huge installed base has allowed Intuit to build a recognizable brand over the decades, with the vast majority of customers coming directly to Intuit through digital marketing channels.

Tax Software

The demand for easy to use, integrated cloud based finance software that integrates tax and accounting operations continues to rise in tandem with the difficulty workers find trying to use existing accounting tools like spreadsheets given the growing volume of finance data littered across a multitude of enterprise applications. A related demand driver is the secular increase of e-commerce and rising adoption of modern point of sales and payments platforms which easily integrate with backend financial software.

Intuit’s main competitors are a mix of accounting software providers like Microsoft’s Dynamics (NASDAQ:MSFT), Sage Group (LSE: SGE), Xero (ASX:XRO) and payroll processors such as ADP (NASDAQ:ADP), Paychex (NASDAQ:PAYX), and Paycom (NYSE:PAYC).

Sales Growth

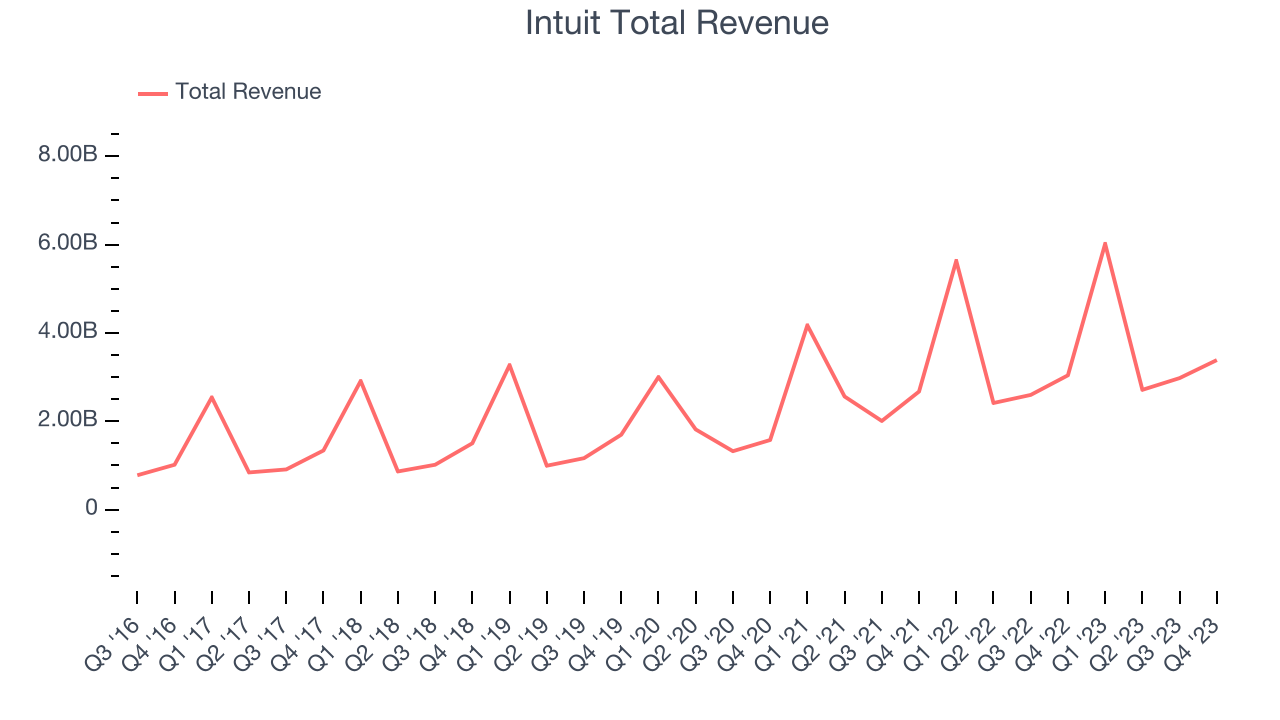

As you can see below, Intuit's revenue growth has been decent over the last two years, growing from $2.67 billion in Q2 FY2022 to $3.39 billion this quarter.

This quarter its quarterly revenue was still up 11.3% year on year. We can see that Intuit's revenue increased by $408 million quarter on quarter, which is a solid improvement from the $266 million increase in Q1 2024. Shareholders should applaud the re-acceleration of growth.

Looking ahead, analysts covering the company were expecting sales to grow 11.8% over the next 12 months before the earnings results announcement.

Profitability

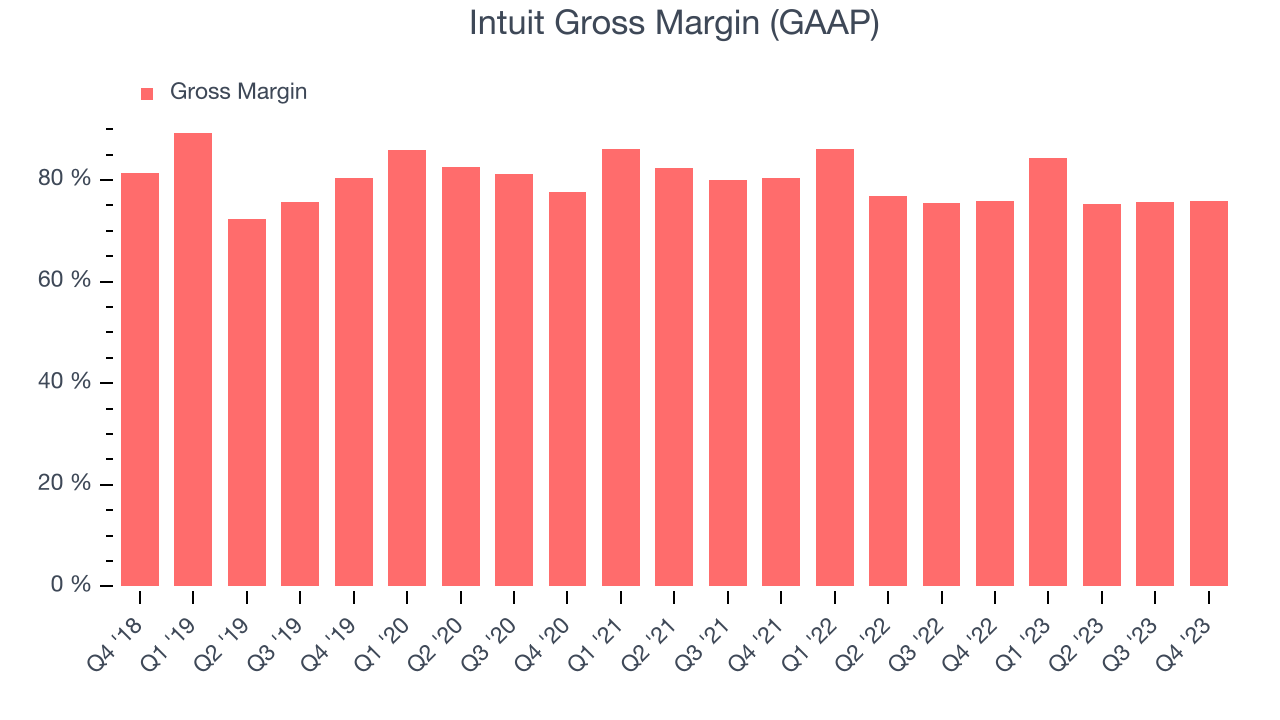

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Intuit's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 75.8% in Q2.

That means that for every $1 in revenue the company had $0.76 left to spend on developing new products, sales and marketing, and general administrative overhead. Intuit's impressive gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that Intuit is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

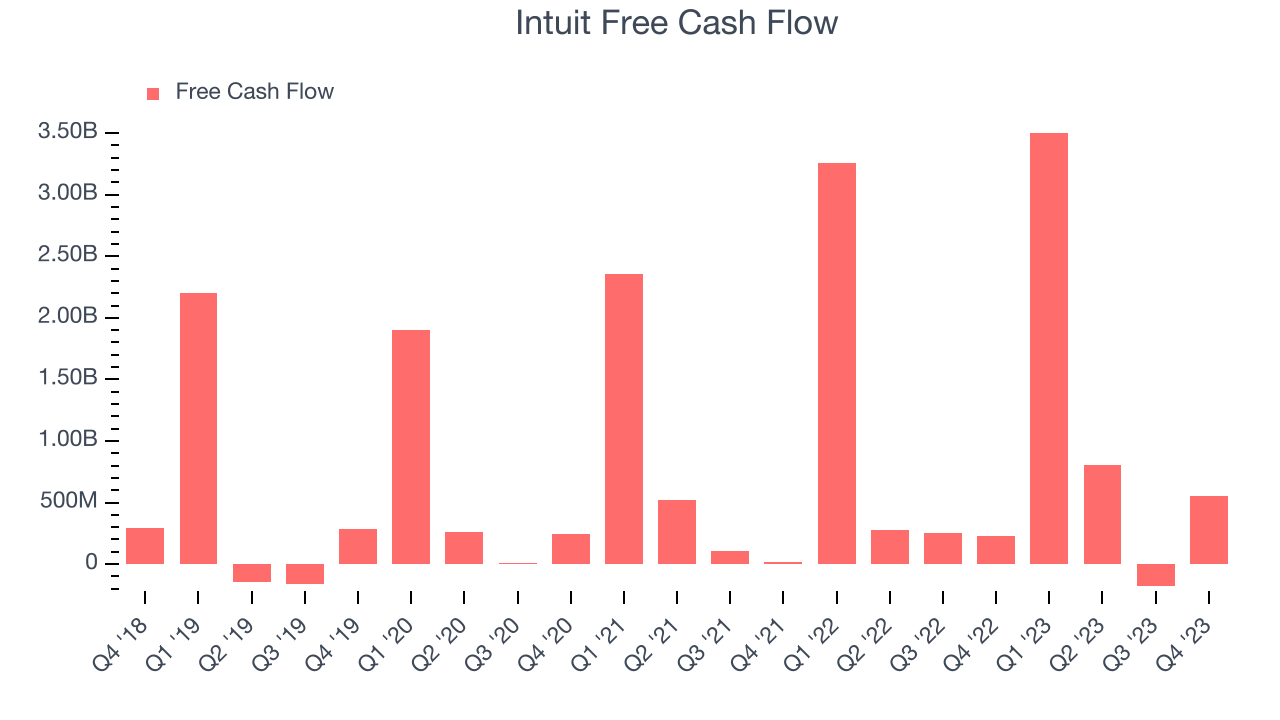

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Intuit's free cash flow came in at $550 million in Q2, up 140% year on year.

Intuit has generated $4.68 billion in free cash flow over the last 12 months, an eye-popping 31% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Intuit's Q2 Results

This was mostly an in-line quarter for Intuit. EPS beat was a positive, while revenue guidance on the lower side of analyst expectations was the weaker part of the report. The company is down 1.9% on the results and currently trades at $645 per share.

Is Now The Time?

Intuit may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Intuit is a good business. We'd expect growth rates to moderate from here, but its revenue growth has been decent. On top of that, its bountiful generation of free cash flow empowers it to invest in growth initiatives and its very efficient customer acquisition hints at the potential for strong profitability.

Intuit's price-to-sales ratio based on the next 12 months of 11.1x indicates that the market is certainly optimistic about its growth prospects. There's definitely a lot of things to like about Intuit and looking at the tech landscape right now, it seems that the company trades at a pretty interesting price point.

Wall Street analysts covering the company had a one-year price target of $645.27 per share right before these results (compared to the current share price of $645).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.