IPG Photonics (NASDAQ:IPGP) Misses Q1 Sales Targets

Adam Hejl 2024/04/30 8:00 am EDT

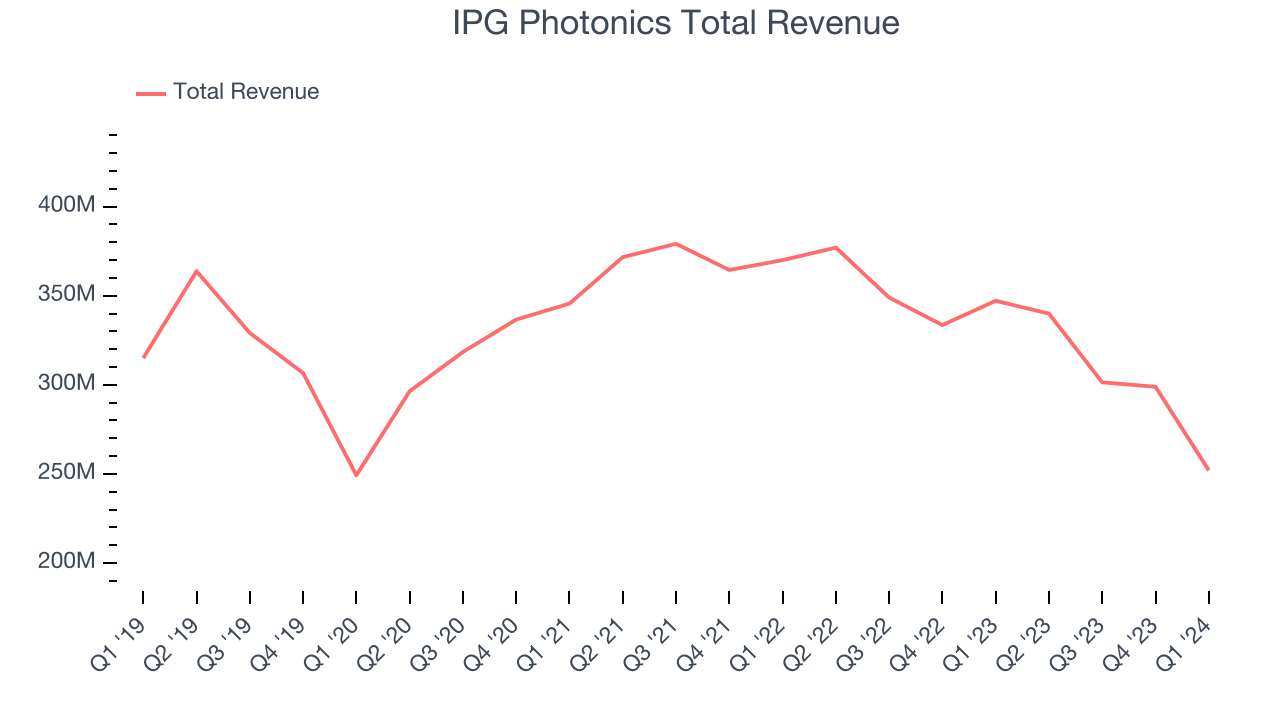

Fiber laser manufacturer IPG Photonics (NASDAQ:IPGP) fell short of analysts' expectations in Q1 CY2024, with revenue down 27.4% year on year to $252 million. Next quarter's revenue guidance of $255 million also underwhelmed, coming in 6.6% below analysts' estimates. It made a GAAP profit of $0.52 per share, down from its profit of $1.26 per share in the same quarter last year.

IPG Photonics (IPGP) Q1 CY2024 Highlights:

- Revenue: $252 million vs analyst estimates of $253.7 million (0.7% miss)

- EPS: $0.52 vs analyst estimates of $0.48 (8.3% beat)

- Revenue Guidance for Q2 CY2024 is $255 million at the midpoint, below analyst estimates of $273 million

- EPS Guidance for Q2 CY2024 is $0.45 at the midpoint, below analyst estimates of $0.68

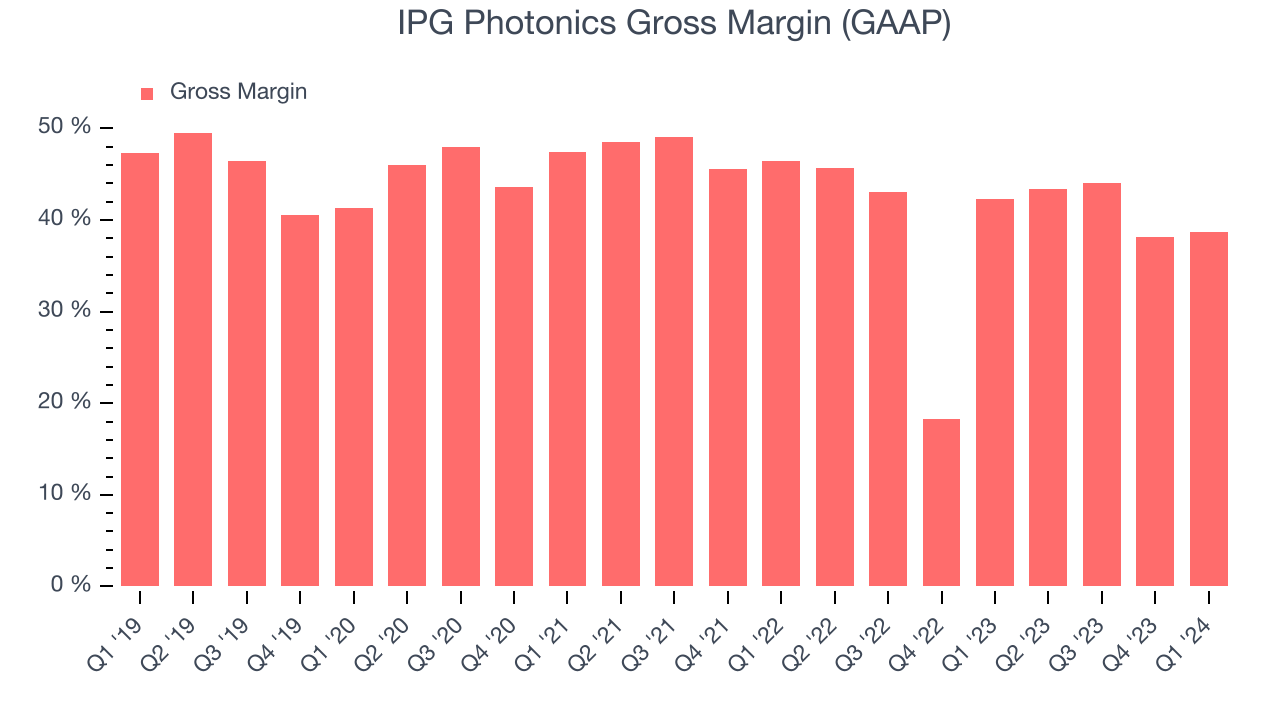

- Gross Margin (GAAP): 38.7%, down from 42.3% in the same quarter last year

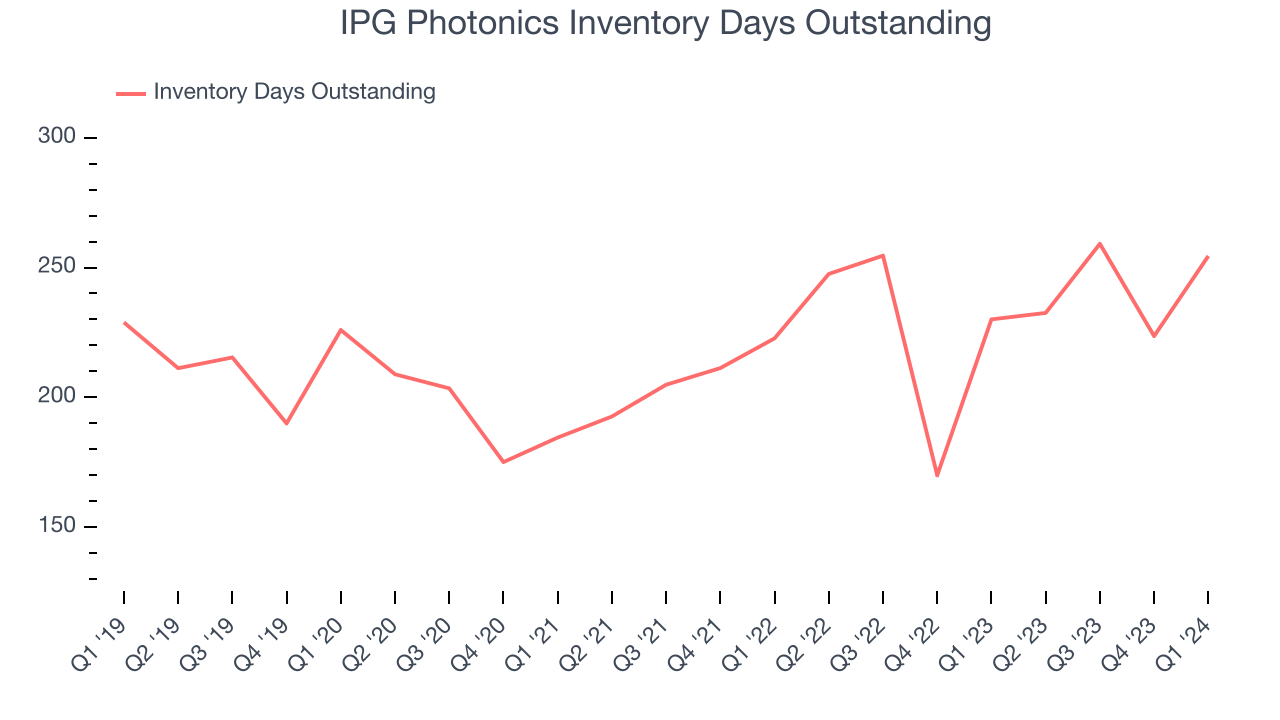

- Inventory Days Outstanding: 254, up from 224 in the previous quarter

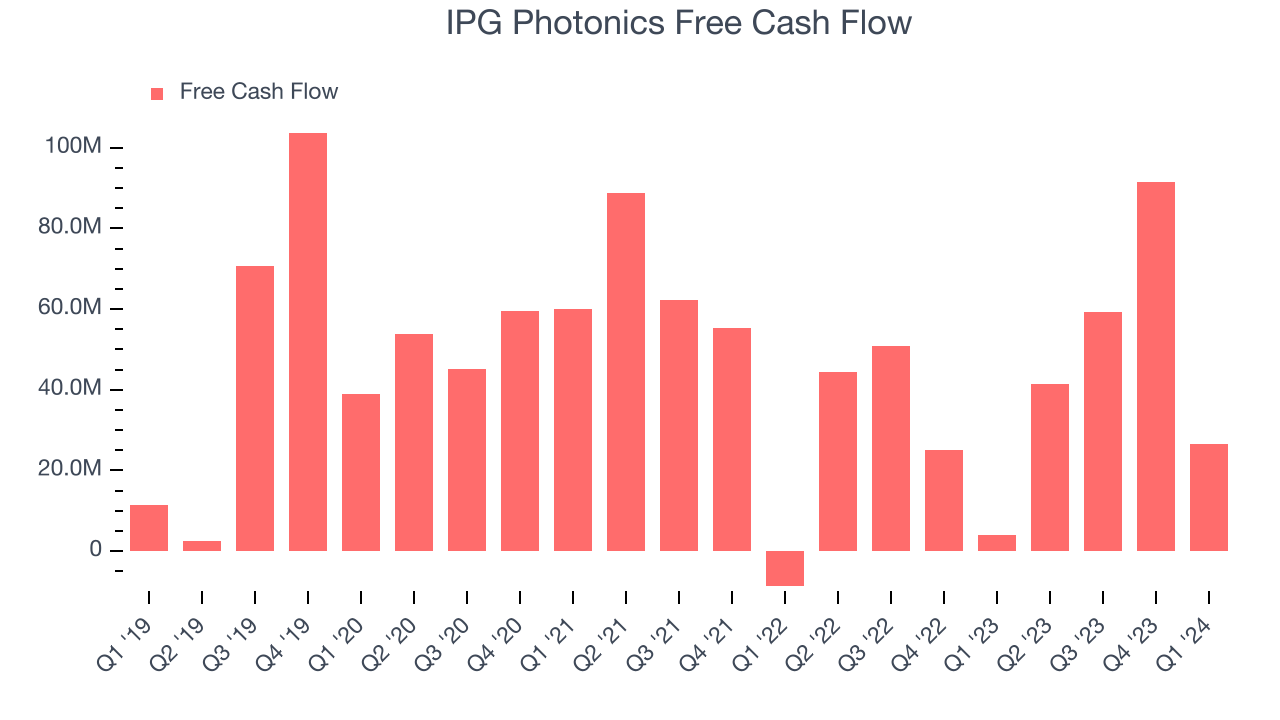

- Free Cash Flow of $26.54 million, down 71% from the previous quarter

- Market Capitalization: $4.08 billion

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

IPG Photonics was founded in 1990 by Valentin Gapontsev, a Russian physicist. Gapontsev pioneered a proprietary all-fiber technology platform for fiber lasers and amplifiers. IPG went public in 2007 and was included in the S&P 500 in 2018.

A laser converts electrical energy to optical energy that can be focused and shaped, creating a concentrated beam that causes materials to melt, vaporize or otherwise change their character. In materials processing, lasers are gaining market share from traditional machine tools (e.g. saws, presses) because of the greater precision, processing speeds, and flexibility.

Semiconductor manufacturers employ lasers for key steps such as lithography (3D relief images on the substrate) and annealing (heating wafers to change electrical properties). With regards to annealing, for example, IPG Photonics’ lasers can create extremely localized heating with fine depth penetration control and precise positioning; this allows target structures to be heated without affecting other surrounding heat-sensitive materials. The company also offers complementary products used with IPG’s lasers such as optical cables and beam switches to deliver and apply the lasers. Other than semiconductor applications, the most common uses for IPG’s products are industrial cutting/welding, 3D printing, and marking/engraving.

Competitors offering laser products for materials processing include Coherent (NASDAQ:COHR), Laserline, Lumentum (NASDAQ:LITE), and Maxphotonics.Sales Growth

IPG Photonics's revenue has been declining over the last three years, dropping by 1.9% on average per year. This quarter, its revenue declined from $347.2 million in the same quarter last year to $252 million. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

IPG Photonics had a difficult quarter as revenue dropped 27.4% year on year, missing analysts' estimates by 0.7%. This could mean that the current downcycle is deepening.

IPG Photonics may be headed for an upturn. Although the company is guiding for a year-on-year revenue decline of 25% next quarter, analysts are expecting revenue to grow 2.5% over the next 12 months.

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, IPG Photonics's DIO came in at 254, which is 39 days above its five-year average, suggesting that the company's inventory has grown to higher levels than we've seen in the past.

Pricing Power

In the semiconductor industry, a company's gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor. IPG Photonics's gross profit margin, which shows how much money the company gets to keep after paying key materials, input, and manufacturing costs, came in at 38.7% in Q1, down 3.6 percentage points year on year.

IPG Photonics's gross margins have been trending up over the last 12 months, averaging 41.3%. This is a welcome development, as IPG Photonics's margins are below the industry average, and rising margins could suggest improved demand and pricing power.

Profitability

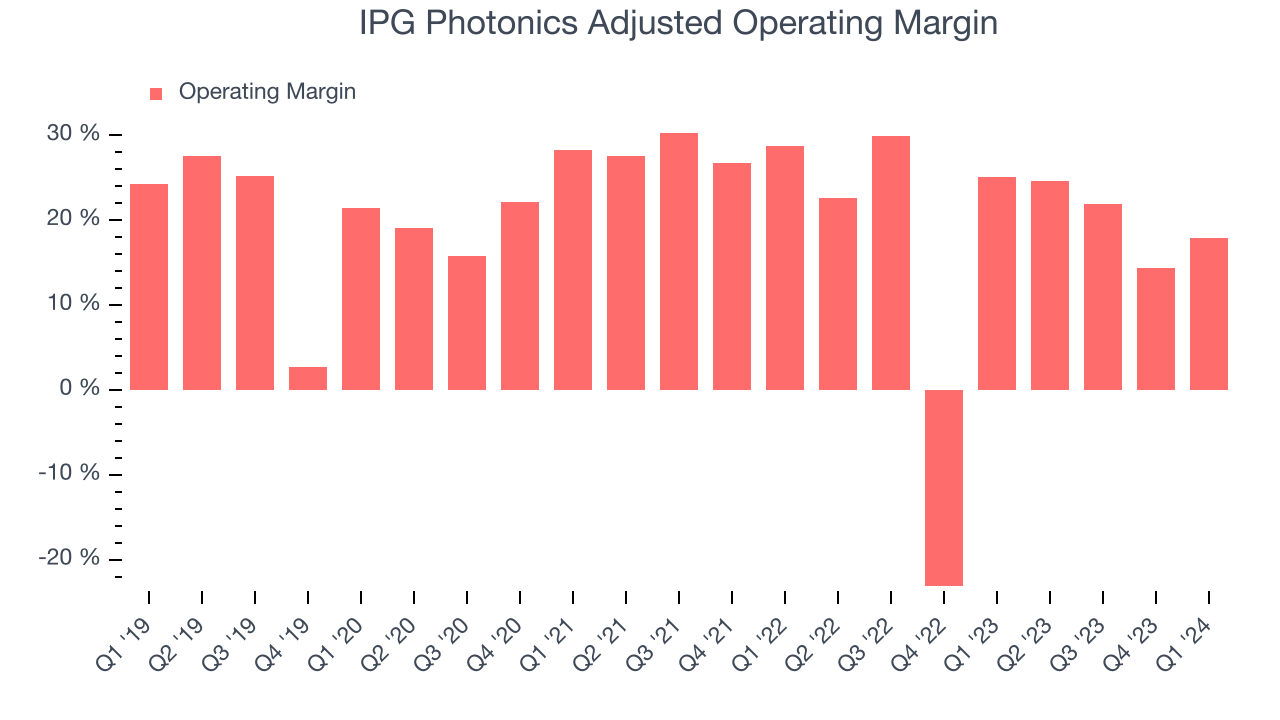

IPG Photonics reported an operating margin of 17.9% in Q1, down 7.2 percentage points year on year. Operating margins are one of the best measures of profitability because they tell us how much money a company takes home after manufacturing its products, marketing and selling them, and, importantly, keeping them relevant through research and development.

IPG Photonics's operating margins have been trending up over the last year, averaging 20.5%. This is a welcome development for IPG Photonics, whose cost structure isn't as efficient as it could be, as indicated by its slightly below-average margins.

Earnings, Cash & Competitive Moat

Wall Street expects earnings per share to decline 7.9% over the next 12 months, although estimates will likely change after earnings.

Although earnings are important, we believe cash is king because you can't use accounting profits to pay the bills. IPG Photonics's free cash flow came in at $26.54 million in Q1, up an awesome 578% year on year.

As you can see above, IPG Photonics produced $218.8 million in free cash flow over the last 12 months, a solid 18.4% of revenue. This FCF margin is above average for semiconductor companies and should put IPG Photonics in a relatively strong position to invest in future growth initiatives.

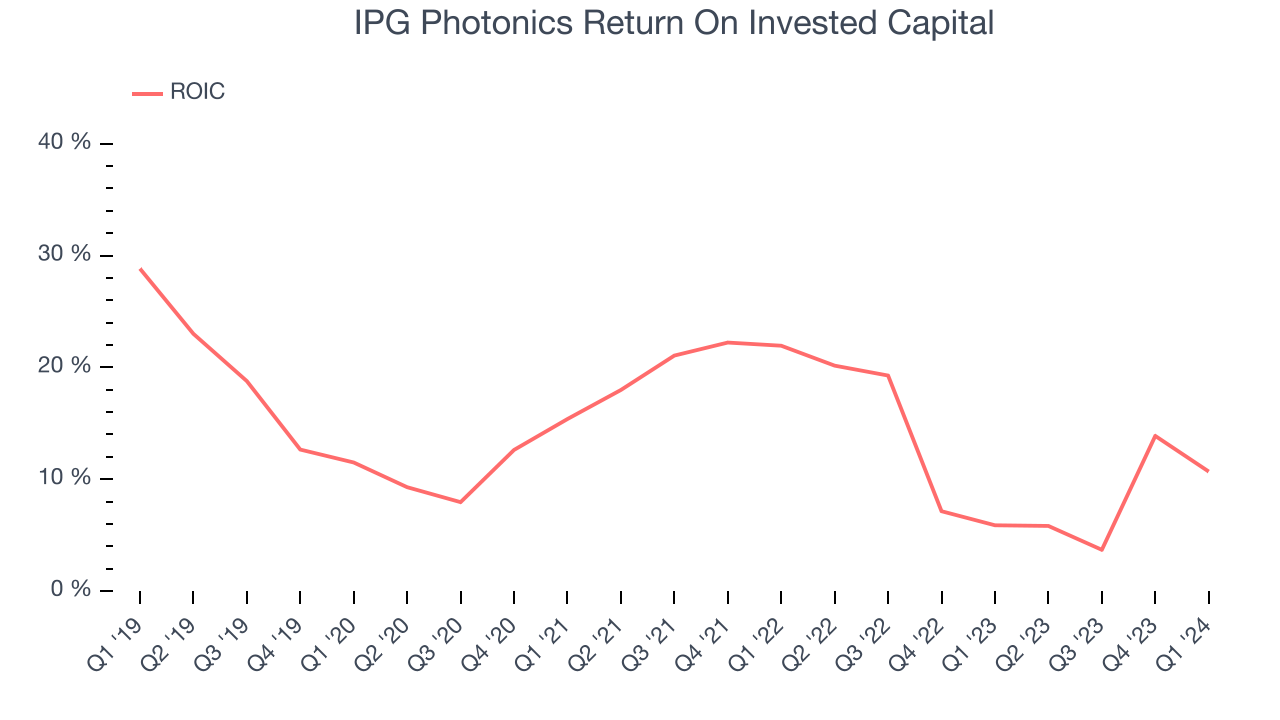

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

IPG Photonics's five-year average ROIC was 13.1%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, IPG Photonics's ROIC averaged 5.2 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

IPG Photonics is a profitable, well-capitalized company with $1.14 billion of cash and no debt. This position gives IPG Photonics the freedom to borrow money, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from IPG Photonics's Q1 Results

The quarter was mixed, with revenue missing while EPS beat. The company's revenue and EPS guidance for next quarter both missed analysts' expectations and its operating margin shrunk. Management tried to put a positive spin around things, saying that "Despite a challenging first quarter, our book-to-bill was slightly above one for the first time since the first quarter last year, which may indicate that industrial demand is stabilizing and could start to improve modestly later in the year." Overall, this was a mediocre quarter for IPG Photonics. The company is down 4% on the results and currently trades at $85 per share.

Is Now The Time?

When considering an investment in IPG Photonics, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in the case of IPG Photonics, we'll be cheering from the sidelines. Its revenue has declined over the last three years, and analysts expect growth to deteriorate from here. And while its solid free cash flow generation gives it re-investment options, the downside is its relatively low ROIC suggests it has struggled to grow profits historically. On top of that, its gross margins are weaker than its semiconductor peers we look at.

IPG Photonics's price-to-earnings ratio based on the next 12 months is 24.6x. While we've no doubt one can find things to like about IPG Photonics, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $108.36 per share right before these results (compared to the current share price of $85).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.