Applied informatics company Iteris (NASDAQCM:ITI) reported Q2 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 5.1% year on year to $45.78 million. Revenue guidance for the full year also exceeded analysts' estimates but next quarter's guidance of $46 million was less impressive, coming in 3.7% below expectations. It made a GAAP profit of $0.01 per share, down from its profit of $0.05 per share in the same quarter last year.

Is now the time to buy Iteris? Find out by accessing our full research report, it's free.

Iteris (ITI) Q2 CY2024 Highlights:

- Revenue: $45.78 million vs analyst estimates of $44.18 million (3.6% beat)

- EPS: $0.01 vs analyst expectations of $0.02

- Revenue Guidance for Q3 CY2024 is $46 million at the midpoint, below analyst estimates of $47.79 million

- The company lifted its revenue guidance for the full year from $44.5 million to $191 million at the midpoint, a 329% increase

- Gross Margin (GAAP): 37.9%, in line with the same quarter last year

- EBITDA Margin: 6.3%

- Market Capitalization: $173.9 million

“We are pleased to report another quarter of solid organic revenue growth year-over-year, especially given the challenging prior year comparison,” said Joe Bergera, president and CEO of Iteris.

Originally serving as a business incubator for technology companies, Iteris (NASDAQCM:ITI) provides applied informatics for transportation and agriculture.

Inspection Instruments

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

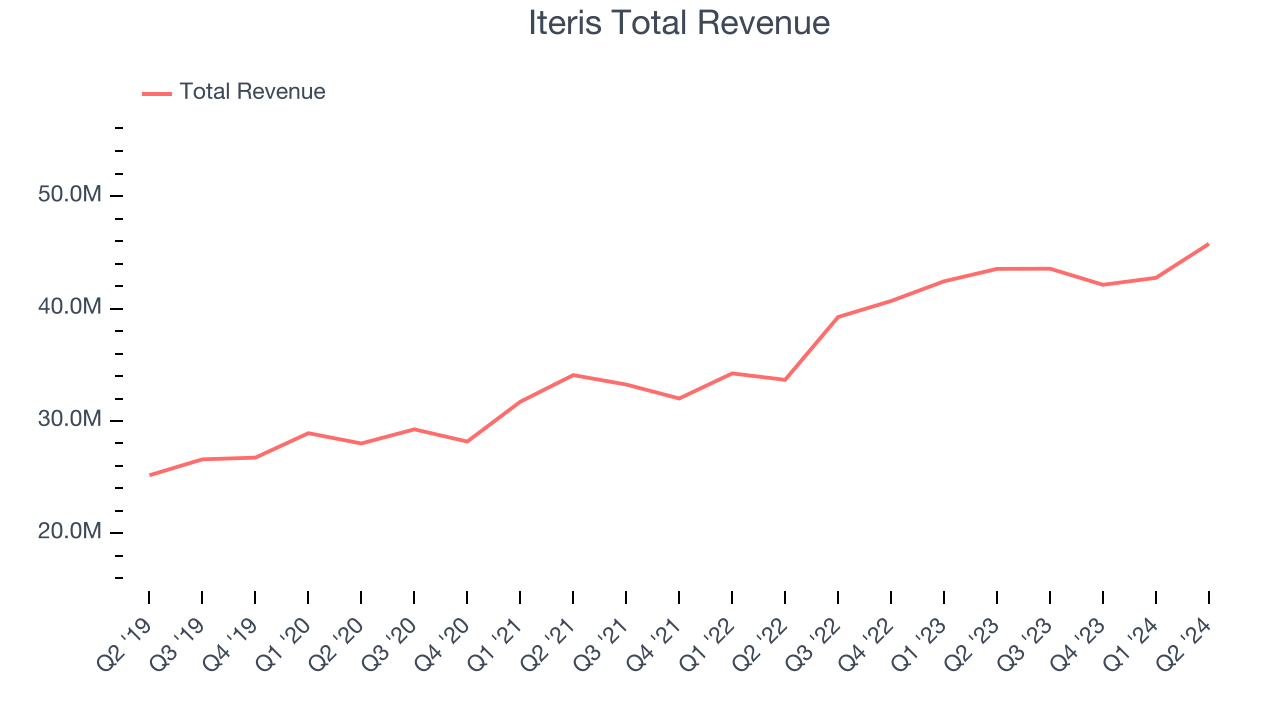

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Luckily, Iteris's sales grew at an impressive 11.9% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Iteris's offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Iteris's annualized revenue growth of 14.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Iteris reported solid year-on-year revenue growth of 5.1%, and its $45.78 million of revenue outperformed Wall Street's estimates by 3.6%. The company is guiding for revenue to rise 5.6% year on year to $46 million next quarter, slowing from the 11% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 12.2% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

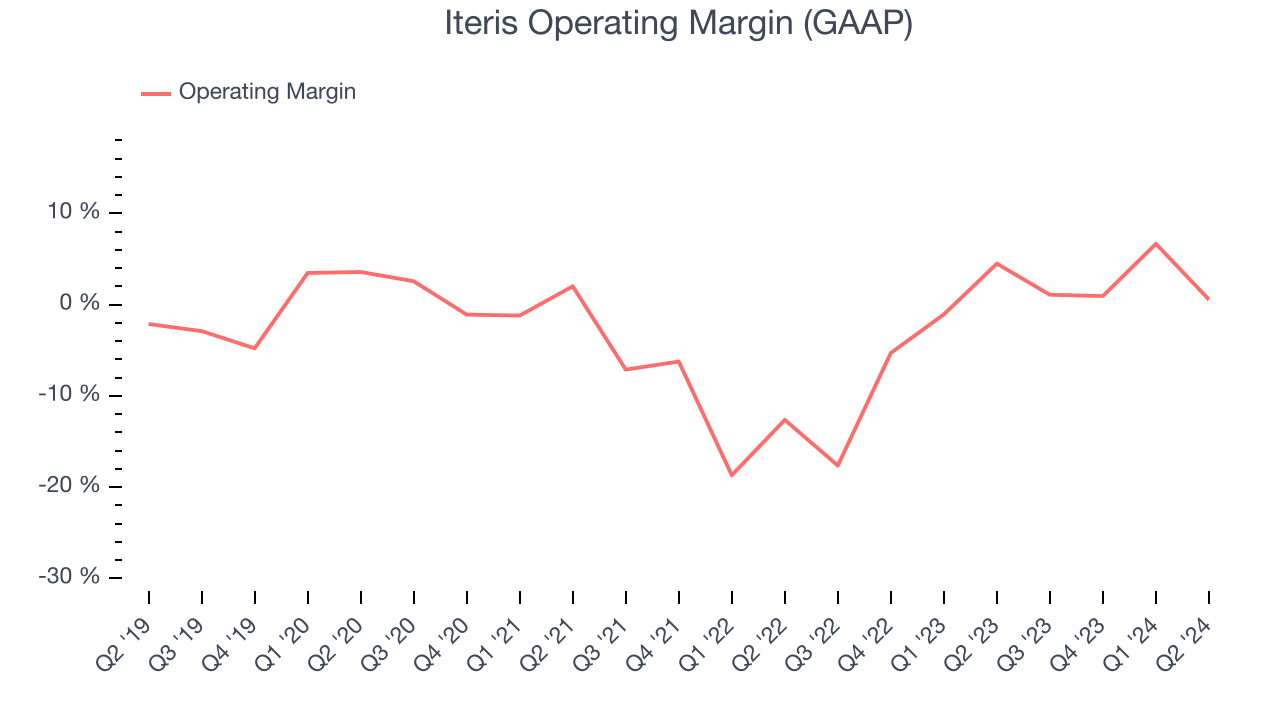

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Although Iteris broke even this quarter from an operational perspective, it's generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2.5% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It's hard to trust that Iteris can endure a full cycle.

On the bright side, Iteris's annual operating margin rose by 2.3 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Iteris's breakeven margin was down 3.9 percentage points year on year. Since Iteris's operating margin decreased more than its gross margin, we can assume the company was recently less efficient because expenses such as sales, marketing, R&D, and administrative overhead increased.

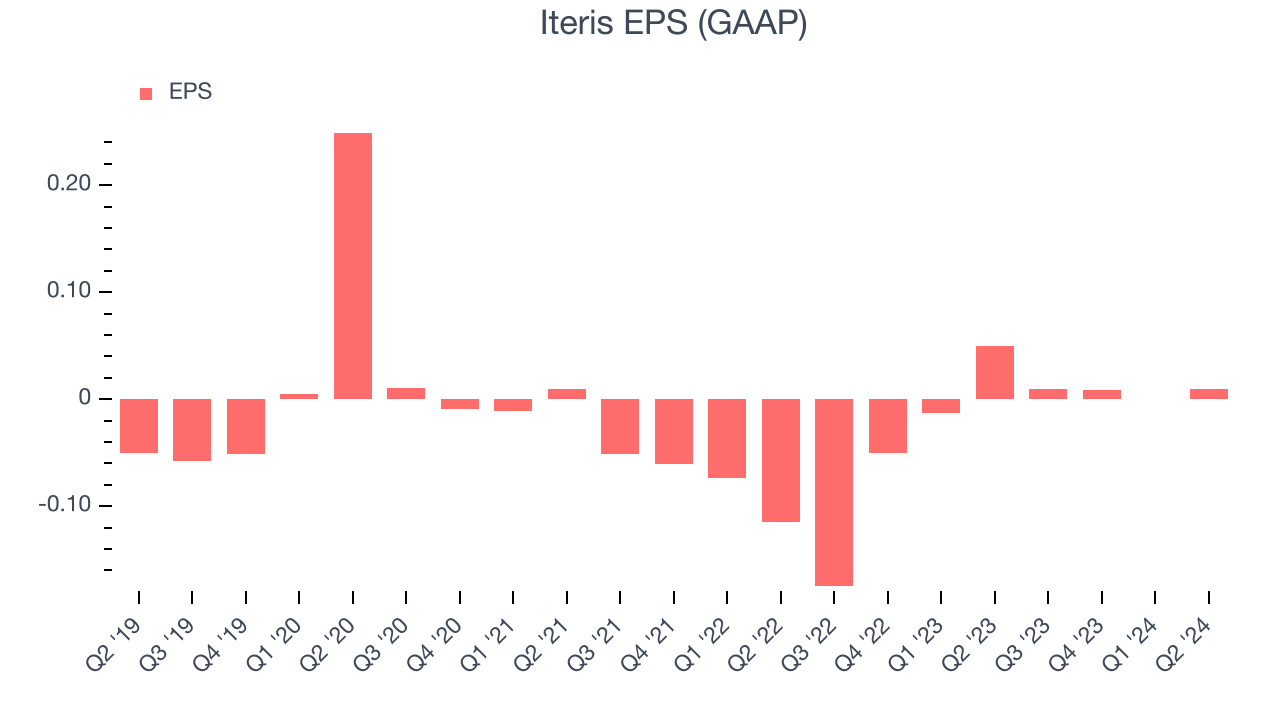

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Iteris's full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it's at an inflection point.

In Q2, Iteris reported EPS at $0.01, down from $0.05 in the same quarter last year. This print missed analysts' estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Iteris to perform poorly. Analysts are projecting its EPS of $0.03 in the last year to hit $0.22.

Key Takeaways from Iteris's Q2 Results

We were impressed by how significantly Iteris blew past analysts' revenue expectations this quarter. We were also glad it lifted its full-year revenue guidance, which came in higher than Wall Street's estimates. On the other hand, its slightly EPS missed. Overall, this quarter featured some positives but wasn't perfect. The stock traded down 1.6% to $4.21 immediately following the results.

So should you invest in Iteris right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.