Fast-food chain Jack in the Box (NASDAQ:JACK) fell short of analysts' expectations in Q2 CY2024, with revenue down 7% year on year to $369.2 million. It made a non-GAAP profit of $1.65 per share, improving from its profit of $1.41 per share in the same quarter last year.

Is now the time to buy Jack in the Box? Find out by accessing our full research report, it's free.

Jack in the Box (JACK) Q2 CY2024 Highlights:

- Revenue: $369.2 million vs analyst estimates of $371.8 million (small miss)

- EPS (non-GAAP): $1.65 vs analyst estimates of $1.51 (9.3% beat)

- EBITDA guidance for the full year is $322.5 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 47.3%, up from 29.7% in the same quarter last year

- EBITDA Margin: 21.4%, in line with the same quarter last year

- Free Cash Flow was -$40.92 million compared to -$5.59 million in the previous quarter

- Locations: 2,195 at quarter end, down from 2,785 in the same quarter last year

- Same-Store Sales fell 2.2% year on year (6.7% in the same quarter last year)

- Market Capitalization: $1.02 billion

“I am proud of our teams and how they continue to enhance the guest experience and deliver operational improvements during a challenging sales environment for our entire industry,” said Darin Harris, Jack in the Box Chief Executive Officer.

Delighting customers since its inception in 1951, Jack in the Box (NASDAQ:JACK) is a distinctive fast-food chain known for its bold flavors, innovative menu items, and quirky marketing.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

Jack in the Box is larger than most restaurant chains and benefits from economies of scale, giving it an edge over its smaller competitors.

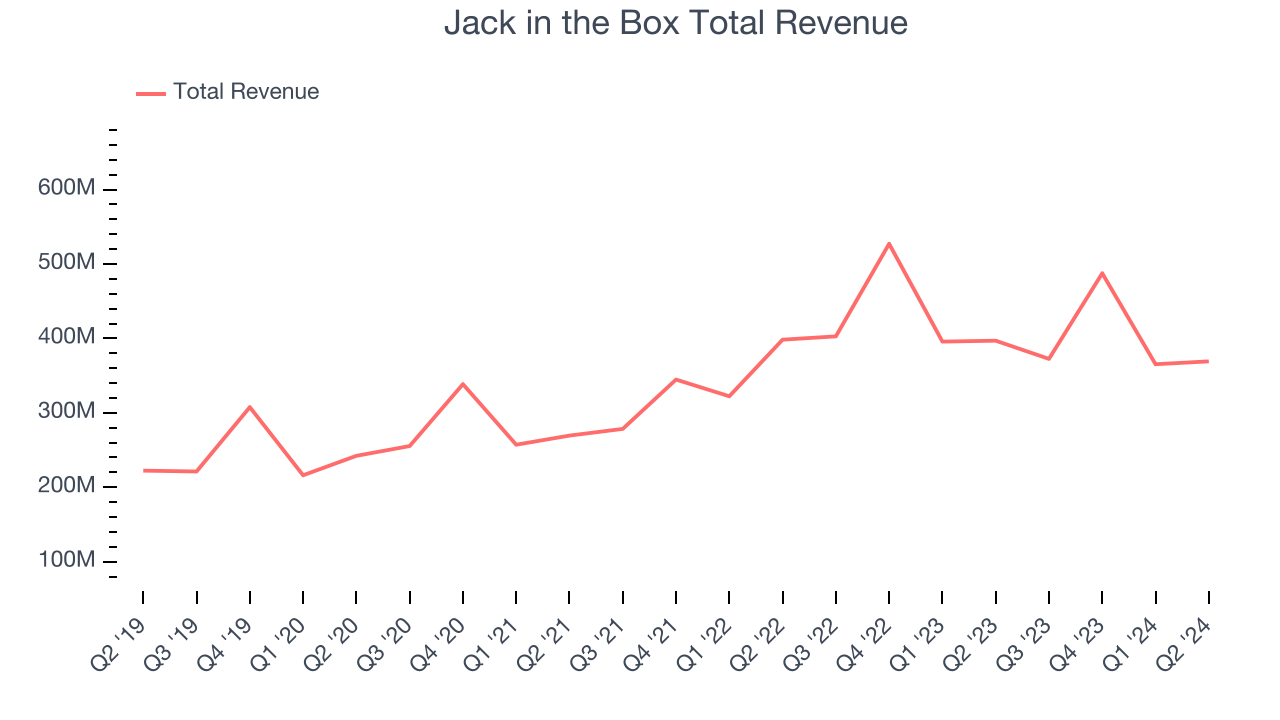

As you can see below, the company's annualized revenue growth rate of 12% over the last five years was solid despite closing restaurants, suggesting that growth was driven by increased sales at existing, established dining locations.

This quarter, Jack in the Box missed Wall Street's estimates and reported a rather uninspiring 7% year-on-year revenue decline, generating $369.2 million in revenue. Looking ahead, Wall Street expects revenue to decline 1.7% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

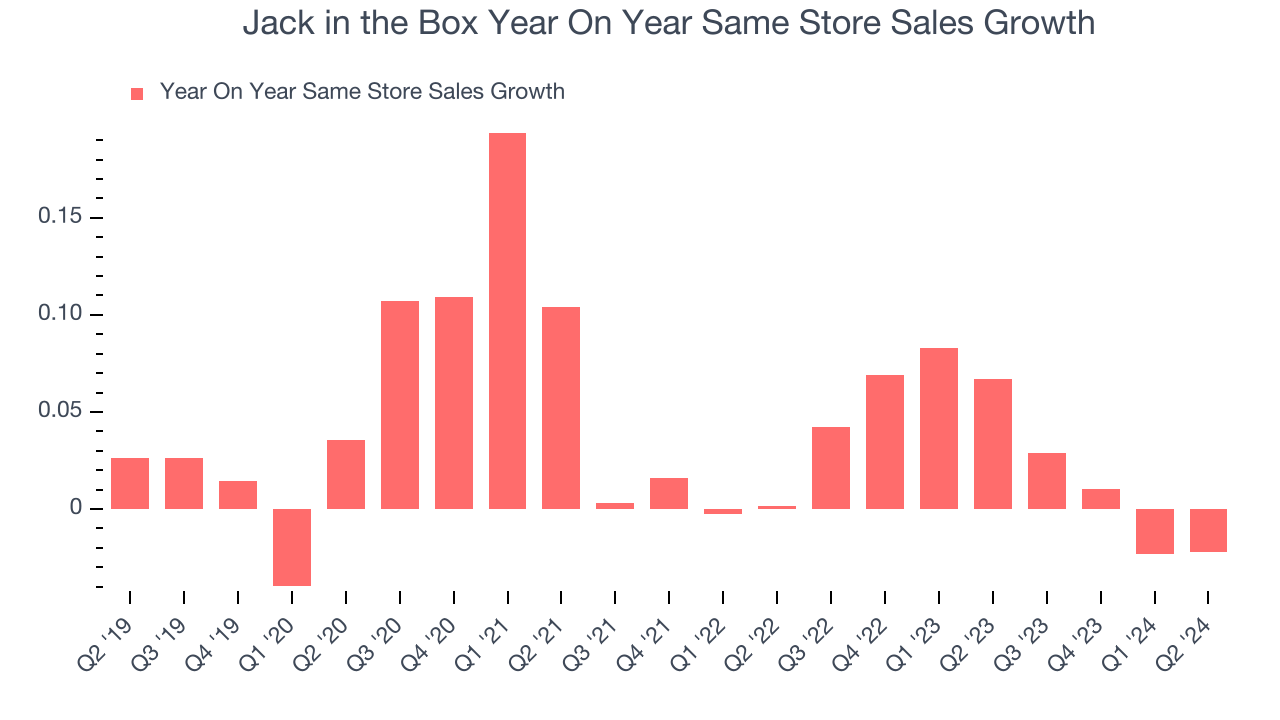

Jack in the Box's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 3.2% year on year. Given its declining physical footprint over the same period, this performance stems from increased foot traffic at existing restaurants, which is sometimes a side effect of reducing the total number of locations.

In the latest quarter, Jack in the Box's same-store sales fell 2.2% year on year. This decline was a reversal from the 6.7% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Jack in the Box's Q2 Results

We were impressed by how significantly Jack in the Box blew past analysts' gross margin expectations this quarter. We were also happy its EPS narrowly outperformed Wall Street's estimates. On the other hand, its revenue unfortunately missed analysts' expectations. We note a one-time goodwill impairment of $163 million caused it to miss analysts' operating income projections. Overall, we think this was a decent quarter, but the market was likely expecting more. The stock traded down 4.4% to $51 immediately after reporting.

So should you invest in Jack in the Box right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.