Fast-food chain Jack in the Box (NASDAQ:JACK) reported Q1 FY2024 results beating Wall Street analysts' expectations, with revenue down 7.5% year on year to $487.5 million. It made a non-GAAP profit of $1.95 per share, down from its profit of $2.01 per share in the same quarter last year.

Jack in the Box (JACK) Q1 FY2024 Highlights:

- Revenue: $487.5 million vs analyst estimates of $481.6 million (1.2% beat)

- EPS (non-GAAP): $1.95 vs analyst expectations of $1.96 (small miss)

- Free Cash Flow was -$61.5 million, down from $14.65 million in the previous quarter

- Gross Margin (GAAP): 48.3%, up from 30.2% in the same quarter last year

- Jack in the Box Same-Store Sales were up 0.8% year on year (miss, Del Taco concept beat on same-store sales)

- Store Locations: 2,192 at quarter end, decreasing by 586 over the last 12 months

- Market Capitalization: $1.44 billion

Delighting customers since its inception in 1951, Jack in the Box (NASDAQ:JACK) is a distinctive fast-food chain known for its bold flavors, innovative menu items, and quirky marketing.

The company was founded by Robert Peterson, who previously ran a chain of drive-in diners called “Topsy’s”. Seeking to improve its operations, Robert experimented by installing two-way intercom devices into its parking lots so that cars could communicate more efficiently with staff. These test locations were named “Jack in the Box”, and the modern-day “drive-thru” concept was born.

Jack in the Box offers a diverse selection of burgers, sandwiches, tacos, and much more, providing an exciting dining experience for guests of all ages. The company's commitment to culinary creativity is evident in its ever-evolving menu, which showcases a mix of classic favorites such as the Jumbo Jack and inventive new offerings like the Munchie Meal, which at one point was only available between the hours of 9pm and 5am.

Beyond its eclectic menu, Jack in the Box is known for its playful and humorous marketing campaigns featuring the iconic Jack Box character. This witty and often irreverent mascot adds a unique touch to the brand.

Like most fast-food chains, customers can enjoy their meals via a convenient drive-thru (which Jack in the Box pioneered) or comfy indoor seating.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Fast-food competitors include Burger King and Popeyes (owned by Restaurant Brands, NYSE:QSR), McDonald’s (NYSE:MCD), Wendy’s (NASDAQ:WEN), and Taco Bell and KFC (owned by Yum! Brands, NYSE:YUM).Sales Growth

Jack in the Box is larger than most restaurant chains and benefits from economies of scale, giving it an edge over its smaller competitors.

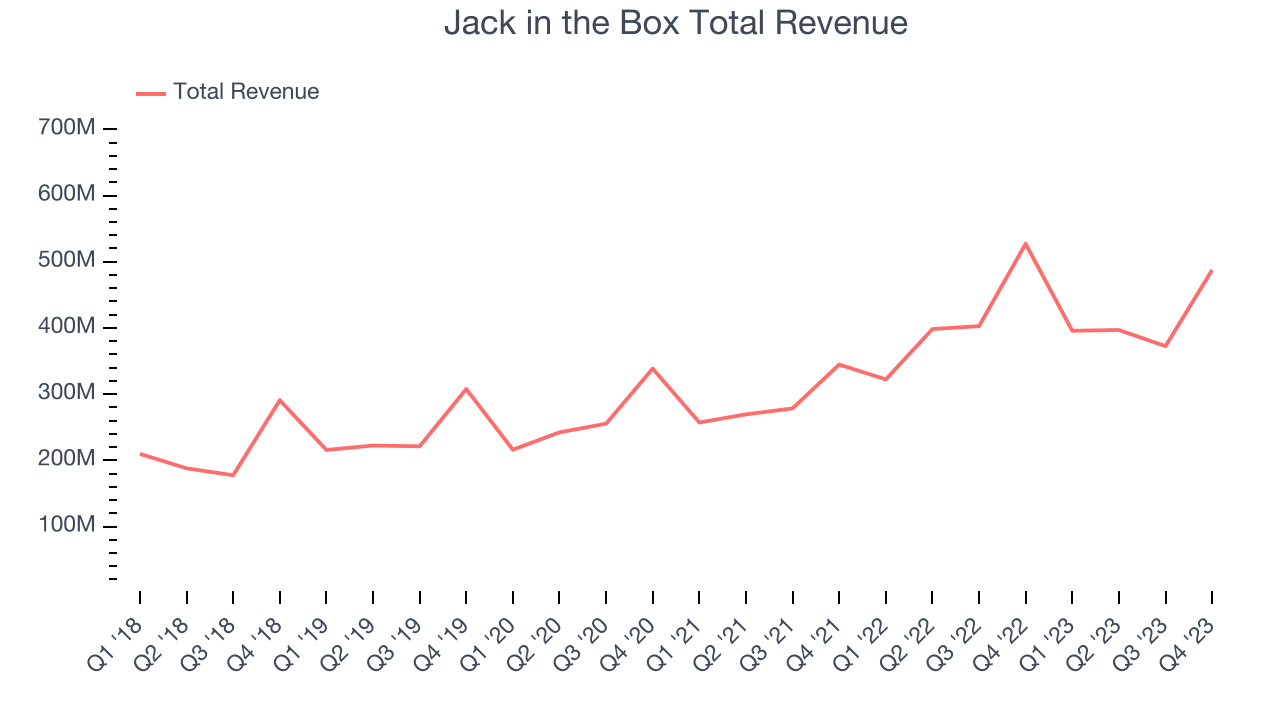

As you can see below, the company's annualized revenue growth rate of 14.3% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was impressive despite closing restaurants, suggesting that growth was driven by increased sales at existing, established dining locations.

This quarter, Jack in the Box's revenue fell 7.5% year on year to $487.5 million but beat Wall Street's estimates by 1.2%. Looking ahead, Wall Street expects revenue to decline 3.9% over the next 12 months.

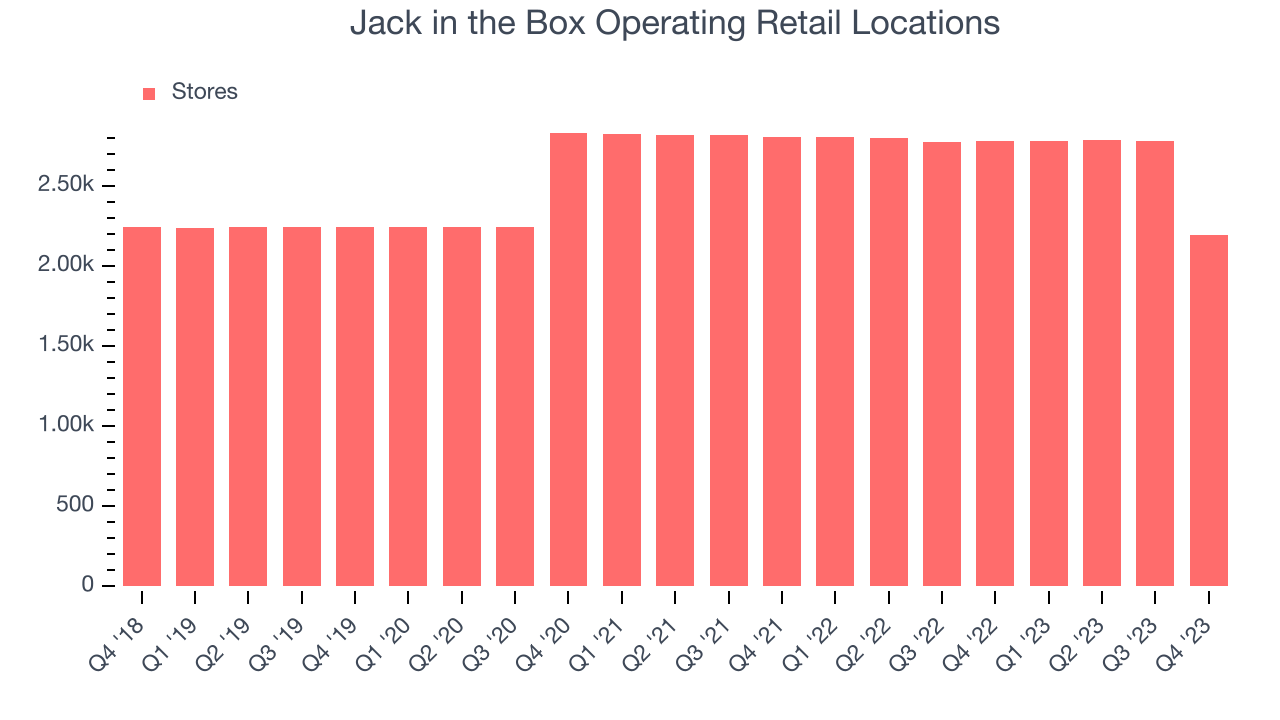

Number of Stores

When a chain like Jack in the Box is shuttering restaurants, it usually means that demand for its meals is waning, and the company is responding by closing underperforming locations to improve profitability. Jack in the Box's restaurant count shrank by 586, or 21.1%, over the last 12 months to 2,192 total locations in the most recently reported quarter.

Taking a step back, Jack in the Box has generally closed its restaurants over the last two years, averaging 3.3% annual declines in locations. A smaller restaurant base means Jack in the Box must rely on higher foot traffic, larger order sizes, or price increases at existing restaurants to fuel revenue growth.

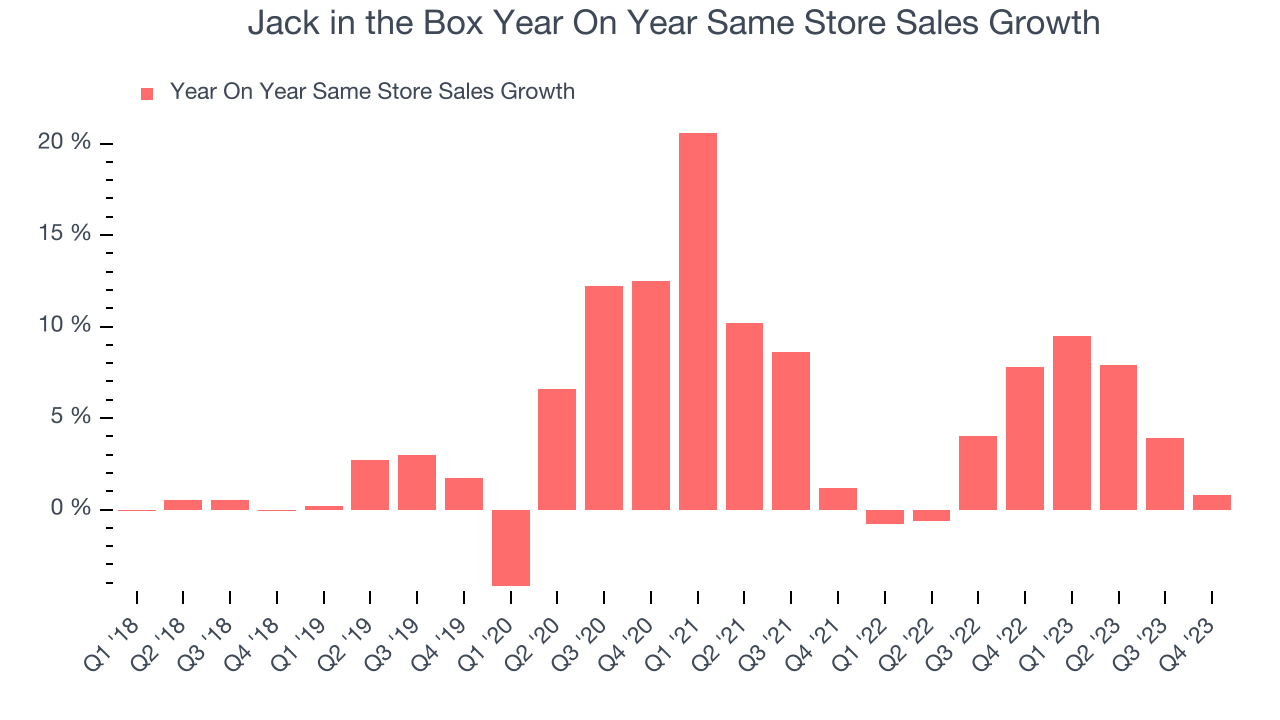

Same-Store Sales

Jack in the Box's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 3.7% year on year. Given its declining physical footprint over the same period, this performance stems from increased foot traffic at existing restaurants, which is sometimes a side effect of reducing the total number of locations.

In the latest quarter, Jack in the Box's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 6.9% year-on-year increase it posted 12 months ago. We'll be watching Jack in the Box closely to see if it can reaccelerate growth.

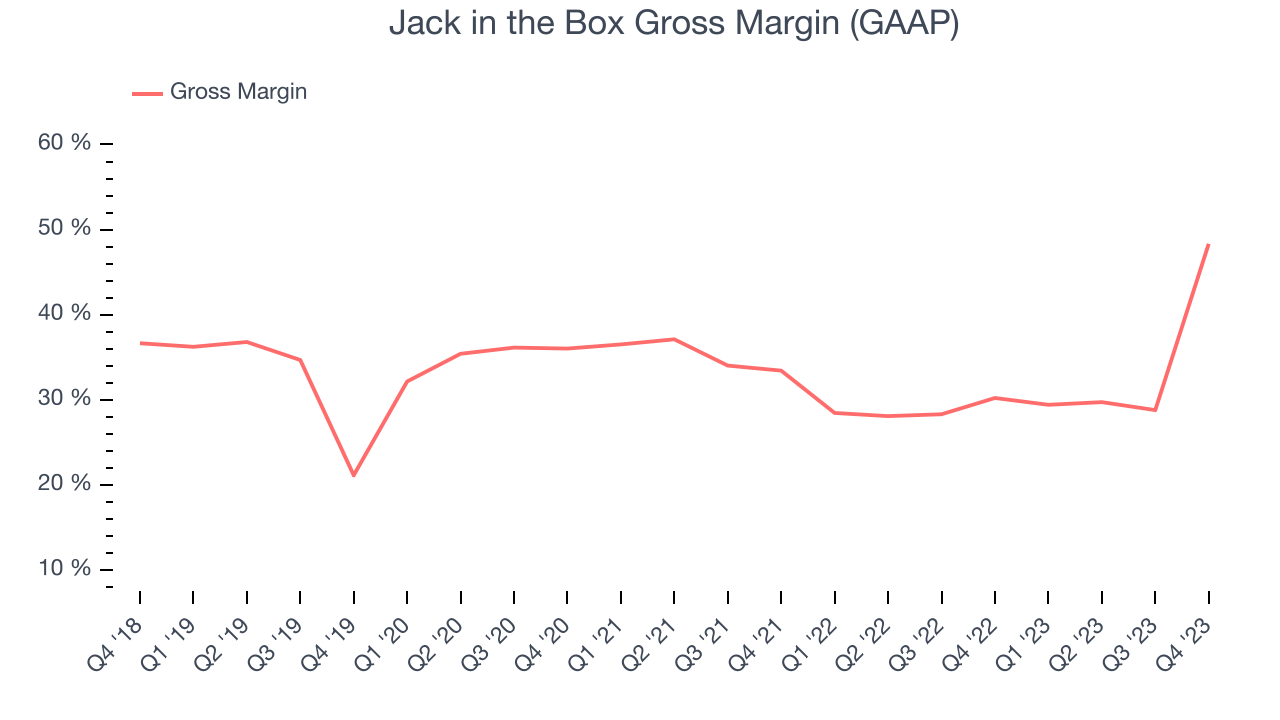

Gross Margin & Pricing Power

Gross profit margins tell us how much money a restaurant gets to keep after paying for the direct costs of the meals it sells.

In Q1, Jack in the Box's gross profit margin was 48.3%. up 18.1 percentage points year on year. This means the company makes $0.32 for every $1 in revenue before accounting for its operating expenses.

Jack in the Box has good unit economics for a restaurant company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see above, it's averaged a healthy 31.9% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 17.7% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more stable input costs (such as ingredients and transportation expenses).

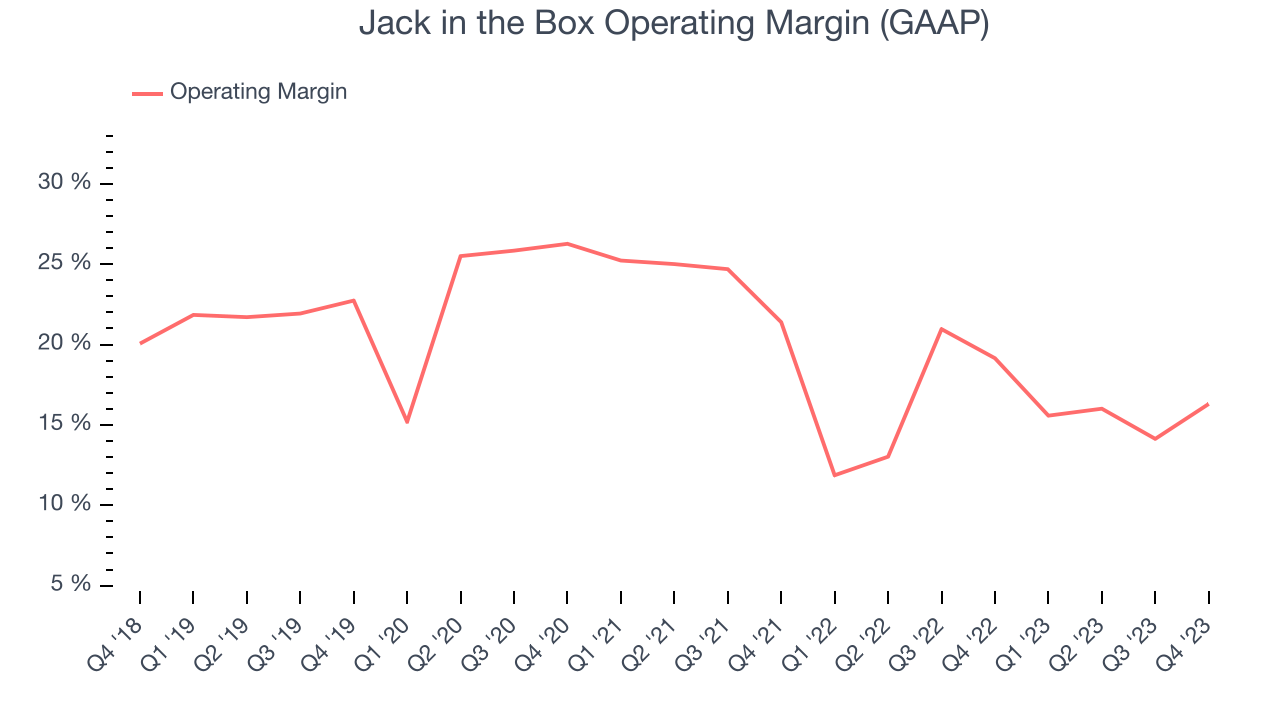

Operating Margin

Operating margin is an important measure of profitability for restaurants as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Jack in the Box generated an operating profit margin of 16.3%, down 2.8 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by poor cost controls or weaker leverage on fixed costs.

Zooming out, Jack in the Box has managed its expenses well over the last two years. It's demonstrated solid profitability for a restaurant business, producing an average operating margin of 16.1%. However, Jack in the Box's margin has declined, on average, by 1.1 percentage points each year. Although this isn't the end of the world, investors are likely hoping for better results in the future.

Zooming out, Jack in the Box has managed its expenses well over the last two years. It's demonstrated solid profitability for a restaurant business, producing an average operating margin of 16.1%. However, Jack in the Box's margin has declined, on average, by 1.1 percentage points each year. Although this isn't the end of the world, investors are likely hoping for better results in the future. EPS

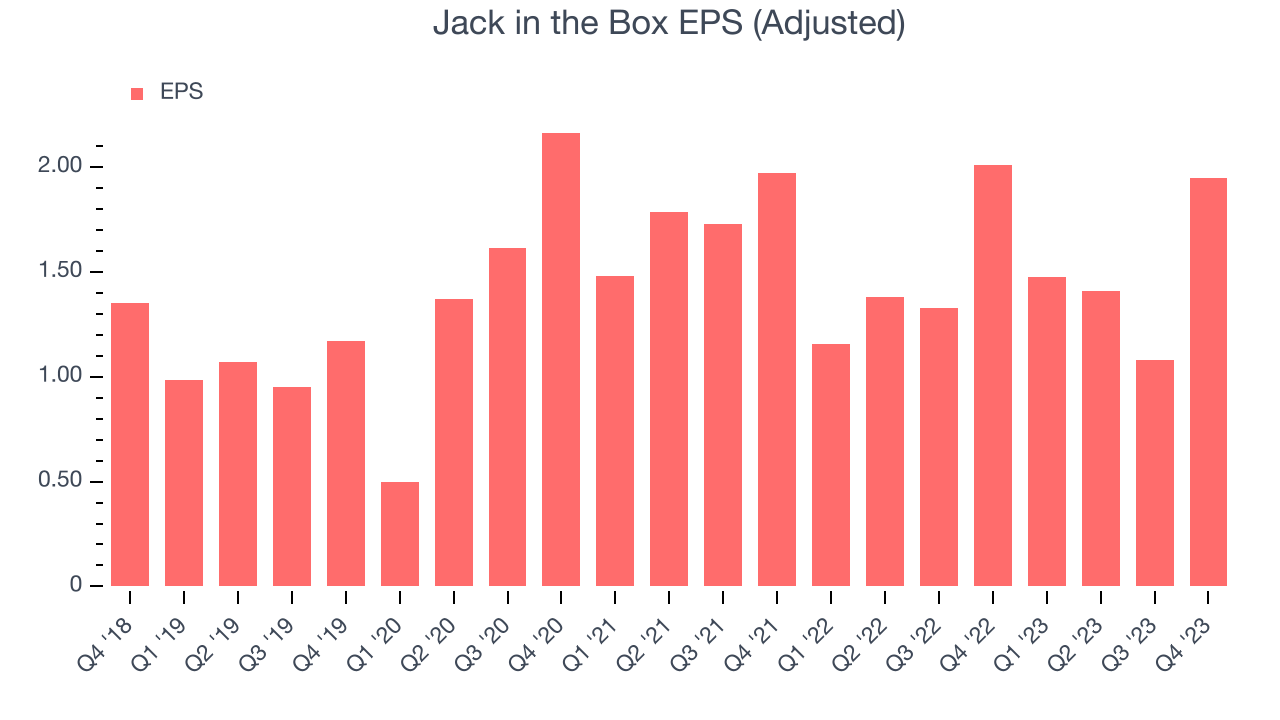

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Jack in the Box reported EPS at $1.95, down from $2.01 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2020 and FY2024, Jack in the Box's adjusted diluted EPS grew 42.9%, translating into an unimpressive 9.3% compounded annual growth rate.

On the bright side, Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 11.1% year-on-year increase in EPS.

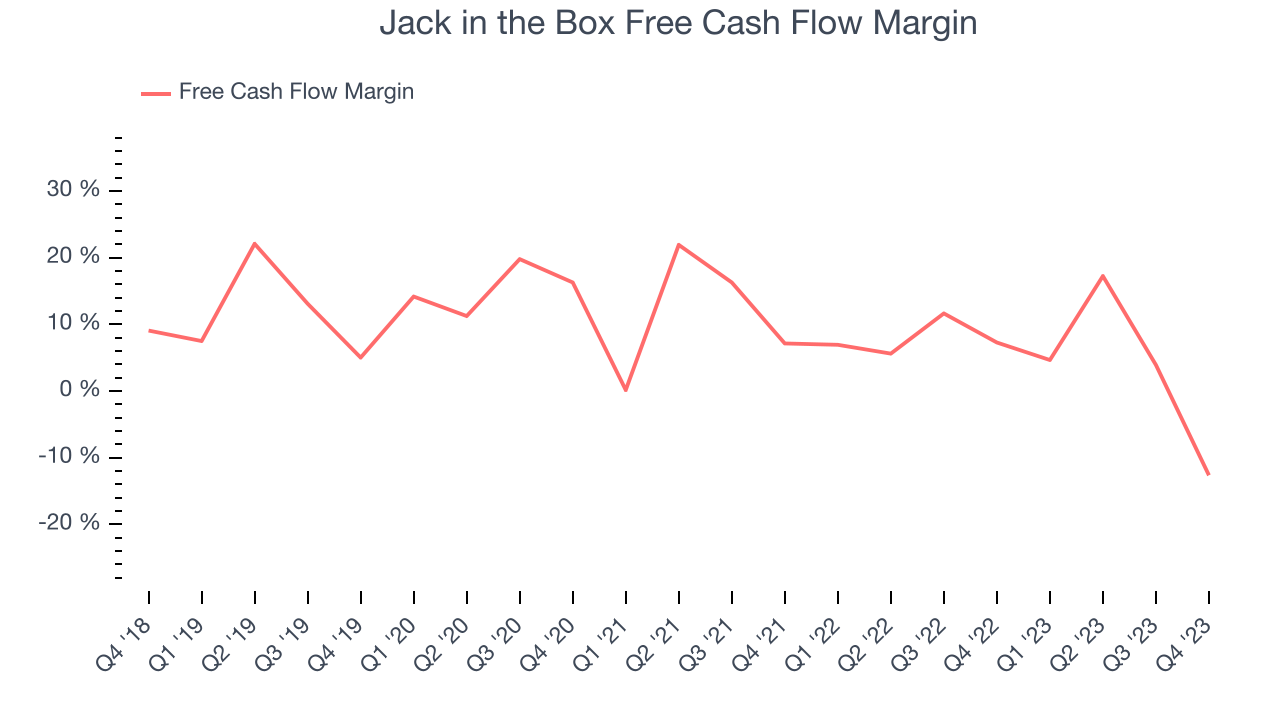

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Jack in the Box burned through $61.5 million of cash in Q1, representing a negative 12.6% free cash flow margin. The company shifted to cash flow negative from cash flow positive in the same quarter last year, which happened for several reasons including (but not limited to) seasonality or unforeseen, one-time events.

Over the last two years, Jack in the Box has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 5.2%, slightly better than the broader restaurant sector. However, its margin has averaged year-on-year declines of 5.5 percentage points. This drop came from higher operational or borrowing costs as it opened fewer restaurants.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Jack in the Box hasn't been the highest-quality company lately, it historically did a solid job investing in profitable business initiatives. Its five-year average ROIC was 12.8%, higher than most restaurant companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Jack in the Box's ROIC over the last two years averaged 5.2 percentage point decreases each year. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Jack in the Box's Q1 Results

While same-store sales for the main Jack in the Box concept missed, revenue still managed to outperform. Although gross margin beat, operating profit was roughly in line, leading to a penny miss on the EPS line. Overall, we think this was a fine quarter. The stock is flat after reporting and currently trades at $73.95 per share.

Is Now The Time?

Jack in the Box may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Jack in the Box, we'll be cheering from the sidelines. Although its revenue growth has been good over the last four years, its falling restaurant base has made it challenging to grow revenue. And while its sturdy operating margins show it has disciplined expense controls, the downside is its projected EPS for the next year is lacking.

Jack in the Box's price-to-earnings ratio based on the next 12 months is 11.1x. While we've no doubt one can find things to like about Jack in the Box, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $88.26 per share right before these results (compared to the current share price of $73.95).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.