Apple device management company, Jamf (NASDAQ:JAMF) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 15.1% year on year to $152.1 million. The company expects next quarter's revenue to be around $151.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.14 per share, improving from its profit of $0.05 per share in the same quarter last year.

Jamf (JAMF) Q1 CY2024 Highlights:

- Revenue: $152.1 million vs analyst estimates of $149.2 million (2% beat)

- EPS (non-GAAP): $0.14 vs analyst estimates of $0.12 (21.3% beat)

- Revenue Guidance for Q2 CY2024 is $151.5 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $620.5 million at the midpoint

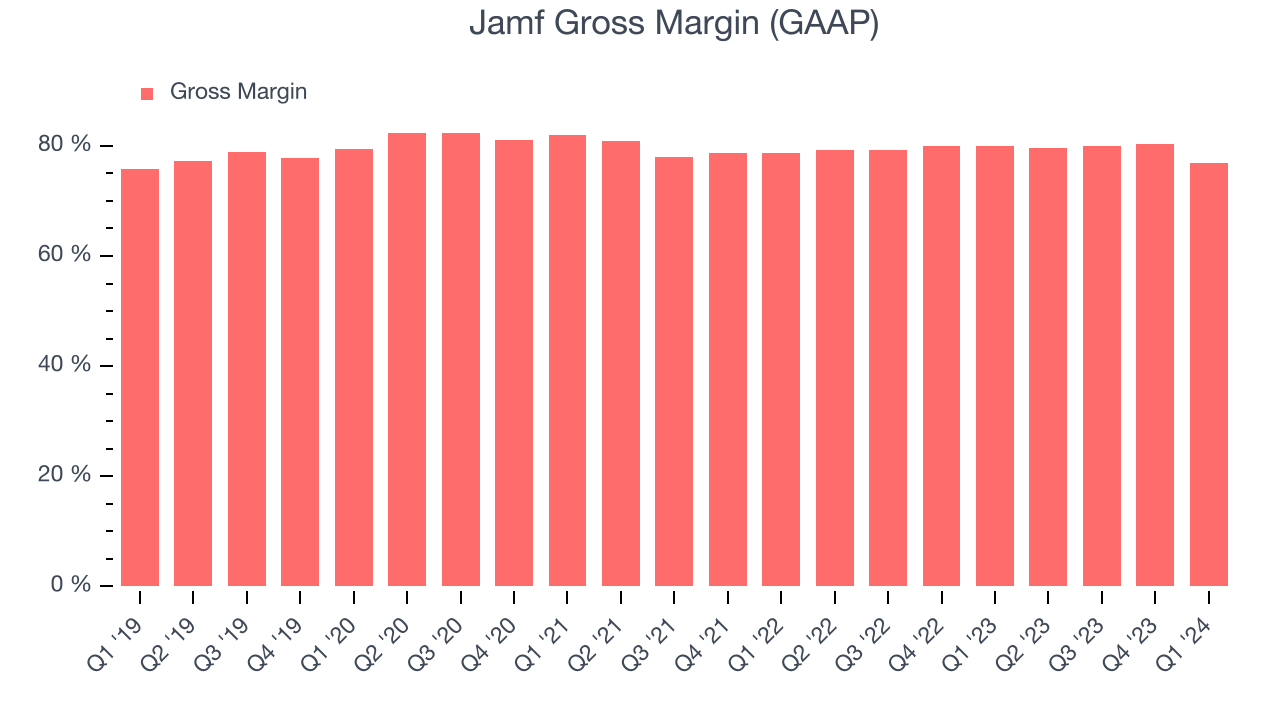

- Gross Margin (GAAP): 76.9%, down from 80% in the same quarter last year

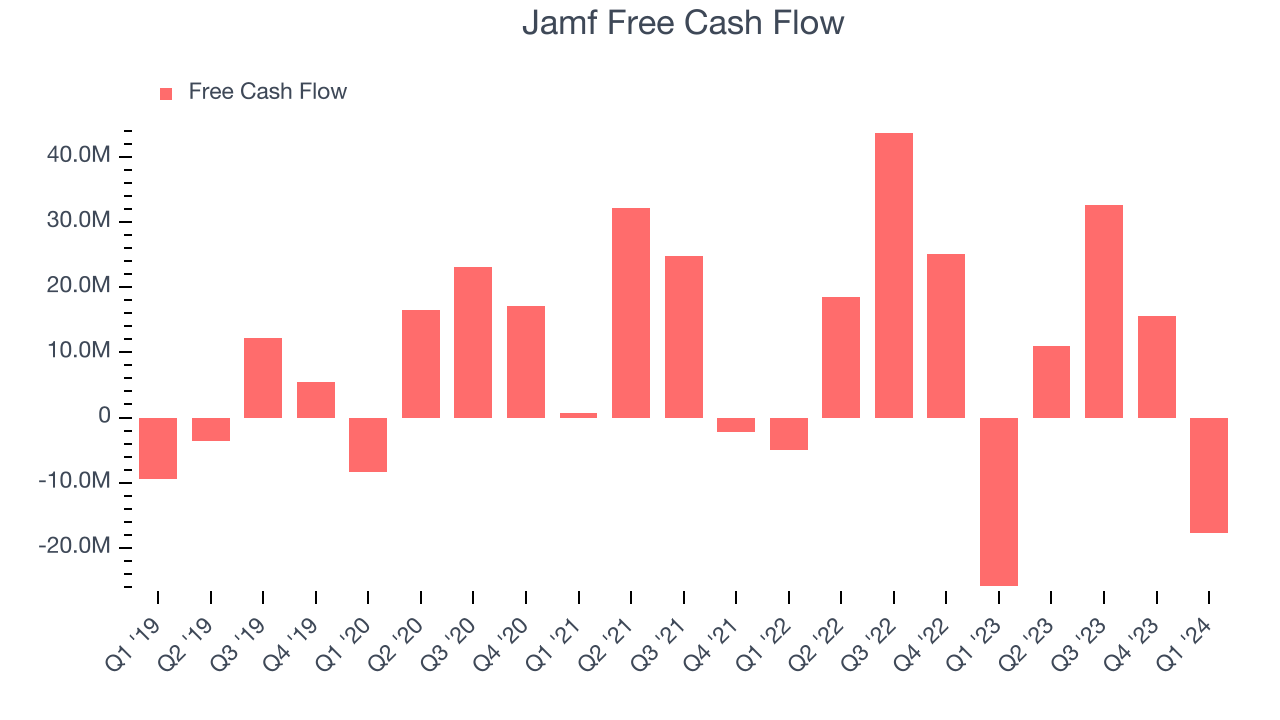

- Free Cash Flow was -$17.66 million, down from $15.51 million in the previous quarter

- Market Capitalization: $2.70 billion

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ:JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

Apple is known for making user-friendly computing devices and it is not surprising that the demand for its products has grown over the years. As their adoption became widespread across the business and education world, so did the need to manage these devices at scale. Keeping hundreds and thousands of devices up-to-date, with all the necessary apps installed and required level of security enforced can be really time consuming, and if it was to be done manually it would require a large number of IT technicians.

Jamf’s software provides the IT department with an online dashboard where they can see the status of every device, and remotely install updates, apps and security fixes. By providing the tools to make the process of managing Apple products simple and easy, Jamf drives productivity within organizations and also frees up more IT resources that could be deployed to tackle more important problems.

For example, when a public school needed to shift to remote learning, Jamf helped to deploy thousands of iPads and Macs to its students. Instead of the school’s IT team spending weeks manually setting up every device, using Jamf they were able to create a software package and automatically install it on every device within a few hours. It connected students without access to the internet to WiFi hotspots provided by the school, installed remote collaboration apps and provided the students with access to learning materials, ensuring that they were able to continue learning remotely without an interruption.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Jamf competes with cross-platform enterprise providers such as VMware (NYSE:VMW) or Microsoft’s Intune (NASDAQ:MSFT) and smaller companies like Addigy and Kandji. Apple is also showing interest in the device management space via its Business Essentials offering targeted at small and medium sized businesses.

Sales Growth

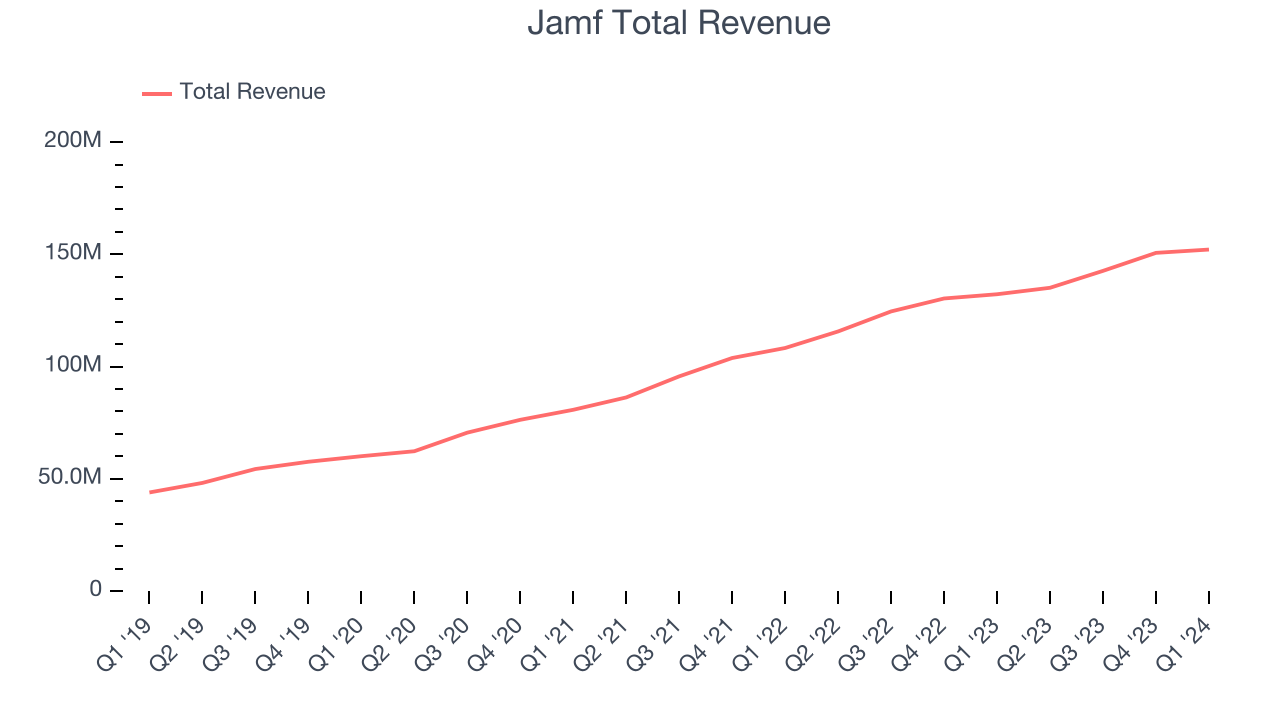

As you can see below, Jamf's revenue growth has been strong over the last three years, growing from $80.73 million in Q1 2021 to $152.1 million this quarter.

This quarter, Jamf's quarterly revenue was once again up 15.1% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $1.48 million in Q1 compared to $8.02 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Jamf is expecting revenue to grow 12.1% year on year to $151.5 million, slowing down from the 16.8% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 9.3% over the next 12 months before the earnings results announcement.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Jamf's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 76.9% in Q1.

That means that for every $1 in revenue the company had $0.77 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite its decline over the last year, Jamf's impressive gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Jamf burned through $17.66 million of cash in Q1 , increasing its cash burn by 31.9% year on year.

Jamf has generated $41.29 million in free cash flow over the last 12 months, or 7.1% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Jamf's Q1 Results

It was encouraging to see Jamf narrowly top analysts' revenue expectations this quarter. On the other hand, its billings unfortunately missed analysts' expectations and its gross margin shrunk. Overall, this was a mediocre quarter for Jamf. The company is down 1.2% on the results and currently trades at $19.5 per share.

Is Now The Time?

Jamf may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Although we have other favorites, we understand the arguments that Jamf isn't a bad business. We'd expect growth rates to moderate from here, but its revenue growth has been strong over the last three years. And while its low free cash flow margins give it little breathing room, the good news is its impressive gross margins indicate excellent business economics.

Jamf's price-to-sales ratio based on the next 12 months is 4.0x, suggesting the market is expecting more moderate growth relative to the hottest software stocks. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Jamf, it seems to be trading at a reasonable price right now.

Wall Street analysts covering the company had a one-year price target of $23.38 right before these results (compared to the current share price of $19.50).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.