Snack food company J&J Snack Foods (NASDAQ:JJSF) reported Q1 CY2024 results topping analysts' expectations, with revenue up 6.5% year on year to $359.7 million. It made a non-GAAP profit of $0.84 per share, improving from its profit of $0.36 per share in the same quarter last year.

J&J Snack Foods (JJSF) Q1 CY2024 Highlights:

- Revenue: $359.7 million vs analyst estimates of $340.6 million (5.6% beat)

- EPS (non-GAAP): $0.84 vs analyst estimates of $0.59 (41.4% beat)

- Gross Margin (GAAP): 30.1%, up from 26.8% in the same quarter last year

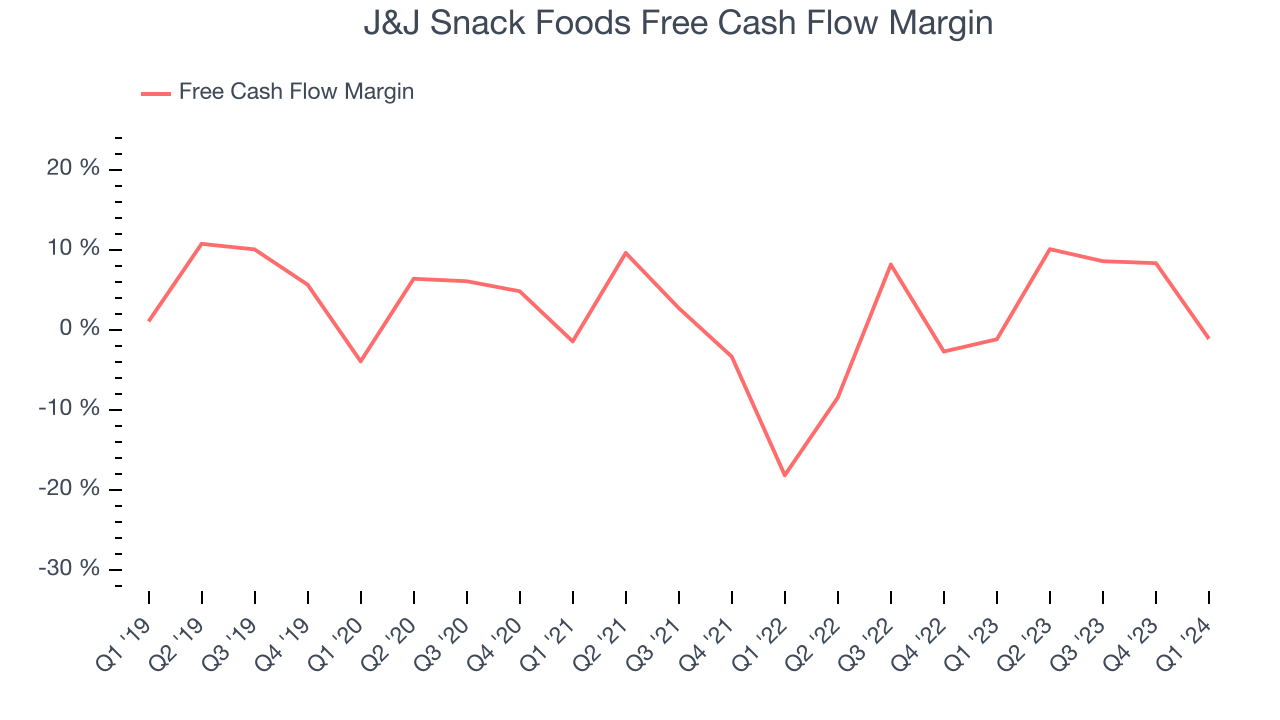

- Free Cash Flow was -$3.95 million, down from $29.02 million in the previous quarter

- Market Capitalization: $2.68 billion

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ:JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

The company was founded in 1971 by Gerald B. Shreiber after he bought J&J Soft Pretzel company at an auction. From this humble beginning of selling pretzels to schools and local businesses, J&J Snack Foods expanded its product portfolio organically. It also acquired other businesses, with its 1987 purchase of ICEE as a major milestone.

Today, J&J Snack Foods boasts an eclectic mix of products including pretzels, ice cream products, and churros. As such, the company’s core customer is someone in search of a treat at home or in venues such as movie theaters or baseball stadiums.

For the retail customer, the company’s products can be found in supermarkets, convenience stores, and entertainment venues. Beyond this, J&J Snack Foods sells its offerings to food service businesses. This is how their soft pretzels, Dippin’ Dots, and churros find their way into concession stands of ballparks and theme parks.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors in the snack food space include PepsiCo (NASDAQ:PEP), Nestle (SWX:NESN), and Utz Brands (NYSE:UTZ).Sales Growth

J&J Snack Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

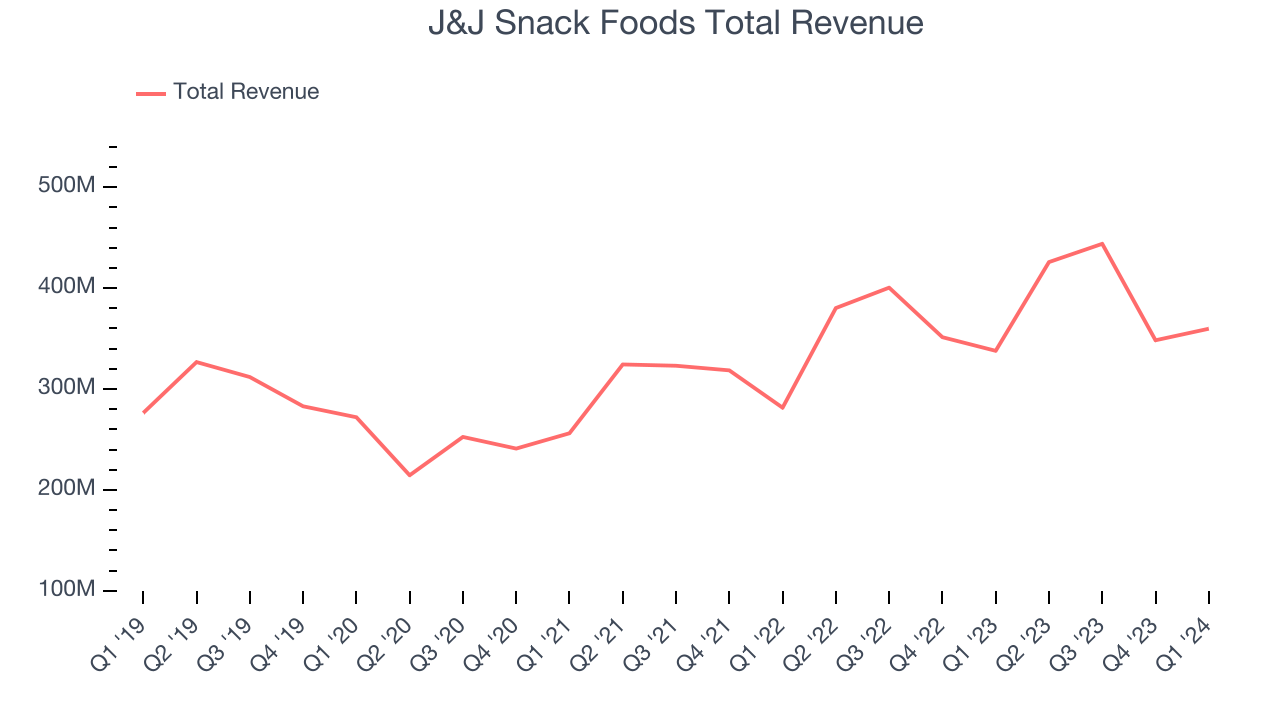

As you can see below, the company's annualized revenue growth rate of 17.8% over the last three years was impressive for a consumer staples business.

This quarter, J&J Snack Foods reported solid year-on-year revenue growth of 6.5%, and its $359.7 million in revenue outperformed Wall Street's estimates by 5.6%.

Gross Margin & Pricing Power

Gross profit margins tell us how much money a company gets to keep after paying for the direct costs of the goods it sells.

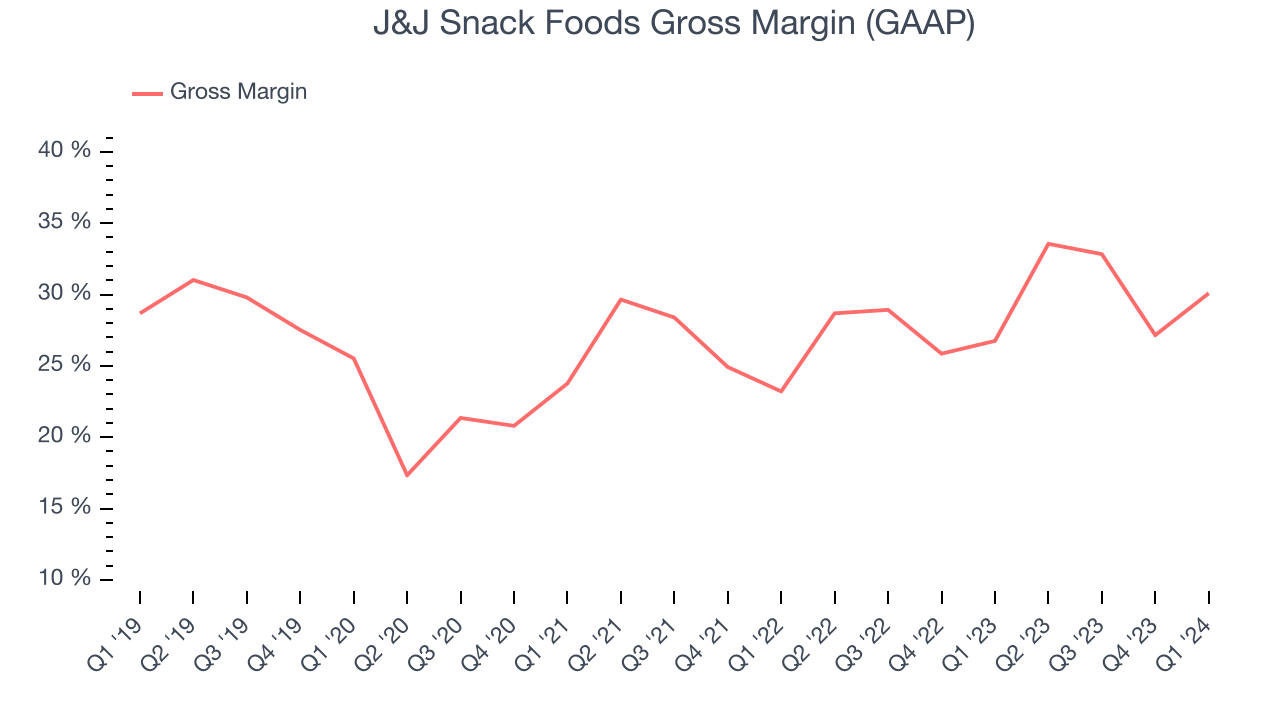

J&J Snack Foods's gross profit margin came in at 30.1% this quarter, up 3.3 percentage points year on year. That means for every $1 in revenue, a chunky $0.70 went towards paying for raw materials, production of goods, and distribution expenses.

J&J Snack Foods has subpar unit economics for a consumer staples company, making it difficult to invest in areas such as marketing and talent to grow its brand. As you can see above, it's averaged a 29.5% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 12% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

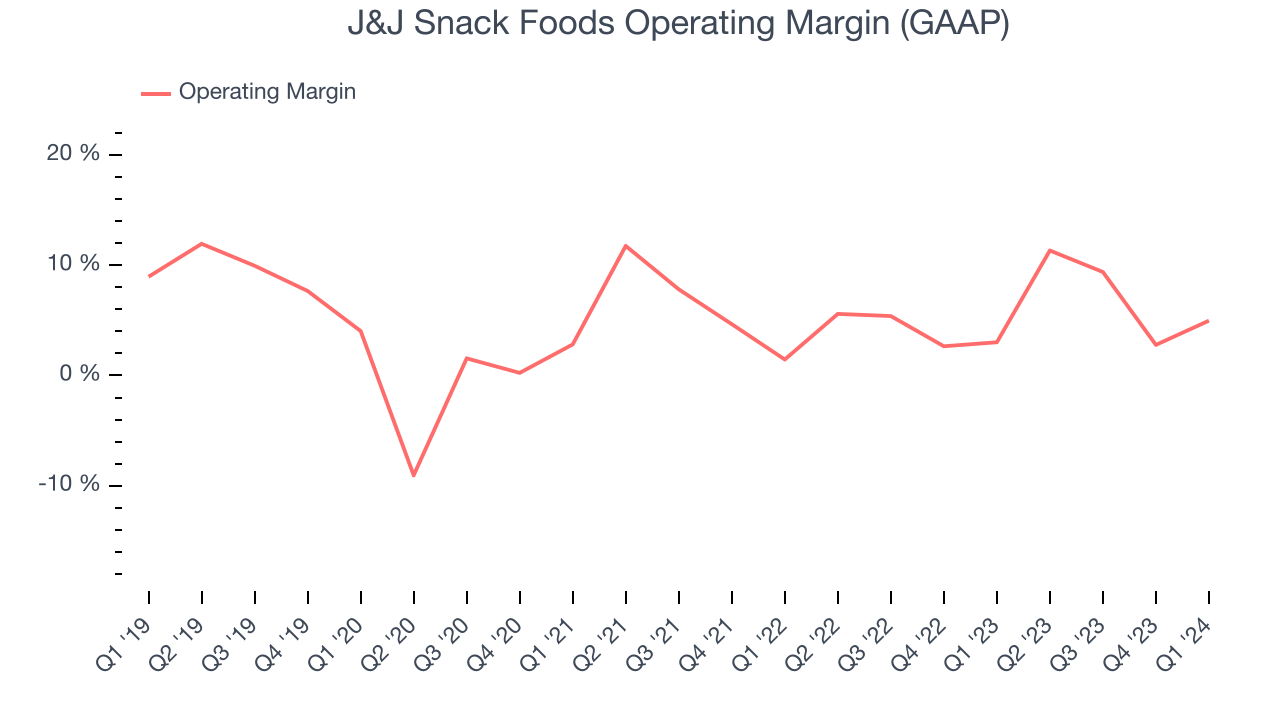

In Q1, J&J Snack Foods generated an operating profit margin of 5%, up 2 percentage points year on year. This increase was encouraging, and we can infer J&J Snack Foods had stronger pricing power and lower raw materials/transportation costs because its gross margin expanded more than its operating margin.

Zooming out, J&J Snack Foods was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer staples business, producing an average operating margin of 5.9%. However, J&J Snack Foods's margin has improved by 3.2 percentage points on average over the last year, an encouraging sign for shareholders. The tide could be turning.

Zooming out, J&J Snack Foods was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer staples business, producing an average operating margin of 5.9%. However, J&J Snack Foods's margin has improved by 3.2 percentage points on average over the last year, an encouraging sign for shareholders. The tide could be turning.EPS

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

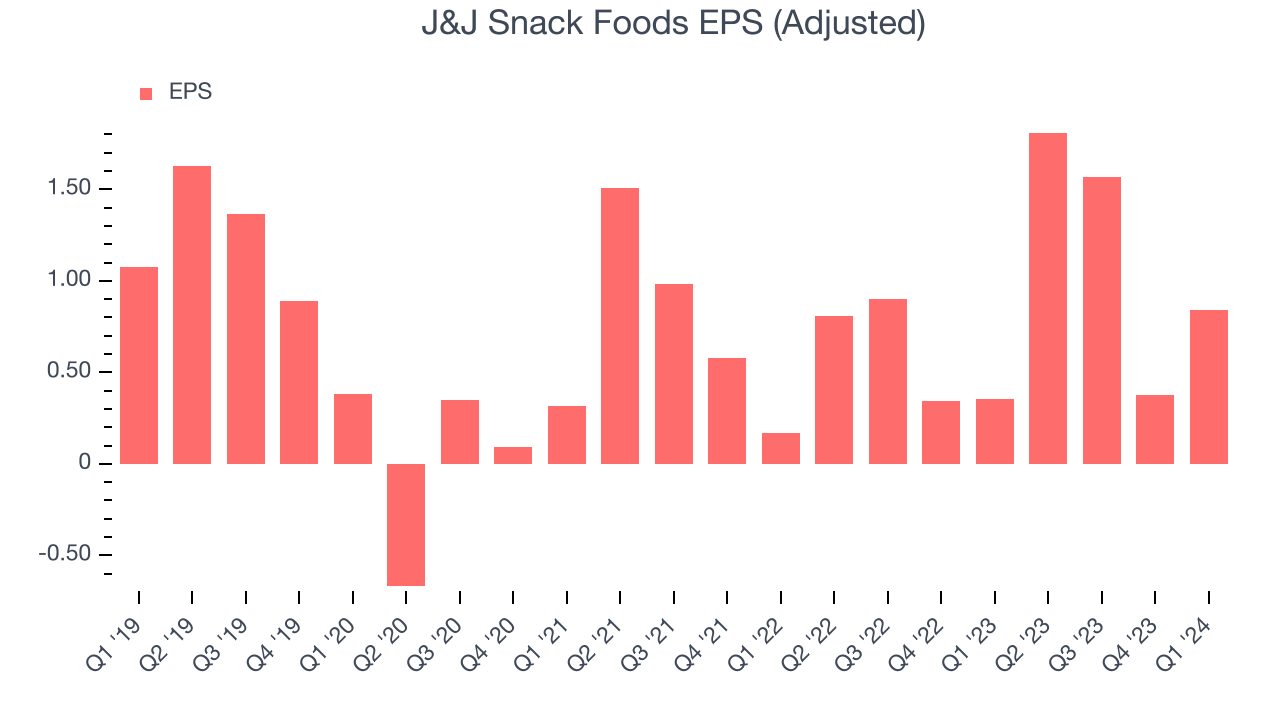

In Q1, J&J Snack Foods reported EPS at $0.84, up from $0.36 in the same quarter a year ago. This print beat Wall Street's estimates by 41.4%.

Between FY2021 and FY2024, J&J Snack Foods's EPS grew 5,118%, translating into an astounding 274% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period, showing that J&J Snack Foods has excelled in managing its expenses.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 15.5% year-on-year increase in EPS.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

J&J Snack Foods burned through $3.95 million of cash in Q1, in line with its cash burn last year. This result represents a negative 1.1% free cash flow margin.

Over the last eight quarters, J&J Snack Foods has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 3.1%, subpar for a consumer staples business. However, its margin has averaged year-on-year increases of 7.6 percentage points over the last 12 months. Continued momentum should improve its cash flow prospects.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

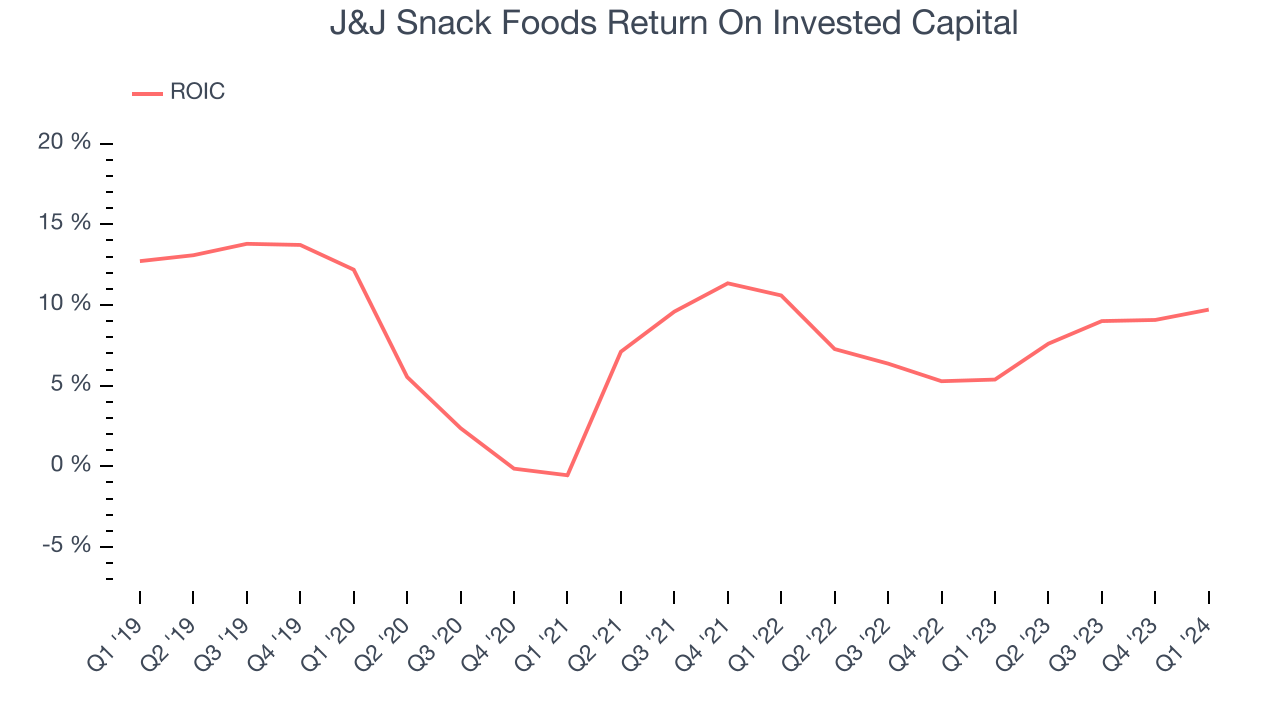

J&J Snack Foods's five-year average ROIC was 7.5%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, J&J Snack Foods's ROIC averaged 1.7 percentage point increases. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

J&J Snack Foods is a profitable, well-capitalized company with $43.65 million of cash and $17 million of debt, meaning it could pay back all its debt tomorrow and still have $26.65 million of cash on its balance sheet. This net cash position gives J&J Snack Foods the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from J&J Snack Foods's Q1 Results

We were impressed by how significantly J&J Snack Foods blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates as it produced higher sales volumes than anticipated. Specifically, its new churros product led the way with 24% year-on-year growth and now represents $30.8 million in revenue - a large chunk of this comes from its partnership with the fast-food restaurant chain Subway. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 4.3% after reporting and currently trades at $143.61 per share.

Is Now The Time?

J&J Snack Foods may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that J&J Snack Foods isn't a bad business. First off, its revenue growth has been good over the last three years. And while its brand caters to a niche market, its EPS growth over the last three years has been fantastic.

J&J Snack Foods's price-to-earnings ratio based on the next 12 months is 26.0x. There are things to like about J&J Snack Foods and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $174 per share right before these results (compared to the current share price of $143.61).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.