Outdoor recreational products company Johnson Outdoors (NASDAQ:JOUT) beat analysts' expectations in Q1 CY2024, with revenue down 13% year on year to $175.9 million. It made a GAAP profit of $0.21 per share, down from its profit of $1.45 per share in the same quarter last year.

Johnson Outdoors (JOUT) Q1 CY2024 Highlights:

- Revenue: $175.9 million vs analyst estimates of $158.8 million (10.8% beat)

- Operating profit: ($0.3) million vs analyst estimates of $4.5 million (large miss)

- EPS: $0.21 vs analyst estimates of $0.50 (-$0.29 miss)

- Gross Margin (GAAP): 34.9%, down from 37.3% in the same quarter last year

- Market Capitalization: $433.9 million

Operating in locations worldwide, Johnson Outdoors (NASDAQ:JOUT) specializes in innovative outdoor recreational products for adventurers worldwide.

Johnson Outdoors, established in 1970 by Samuel C. Johnson as a subdivision of SC Johnson, set out to produce outdoor equipment that enhances adventure experiences. The company has built a strong reputation by developing durable equipment that meets the demands of the natural environment and improves user comfort and satisfaction.

The company’s product range is extensive, featuring fishing boats, diving gear, camping supplies, and outdoor clothing, all engineered to address the varied needs of outdoor enthusiasts. Johnson Outdoors aims to provide products that facilitate safer and more accessible outdoor activities, while also improving the enjoyment of such experiences through innovative design and quality.

Johnson Outdoors generates revenue through multiple channels, including direct sales, partnerships with retailers, and online transactions. The company’s focus on continual product innovation has attracted a broad customer base, from casual weekend explorers to seasoned outdoor professionals.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors engaged in manufacturing outdoor recreation equipment include Brunswick (NYSE:BC), YETI (NYSE:YETI), and Vista Outdoor (NYSE:VSTO).Sales Growth

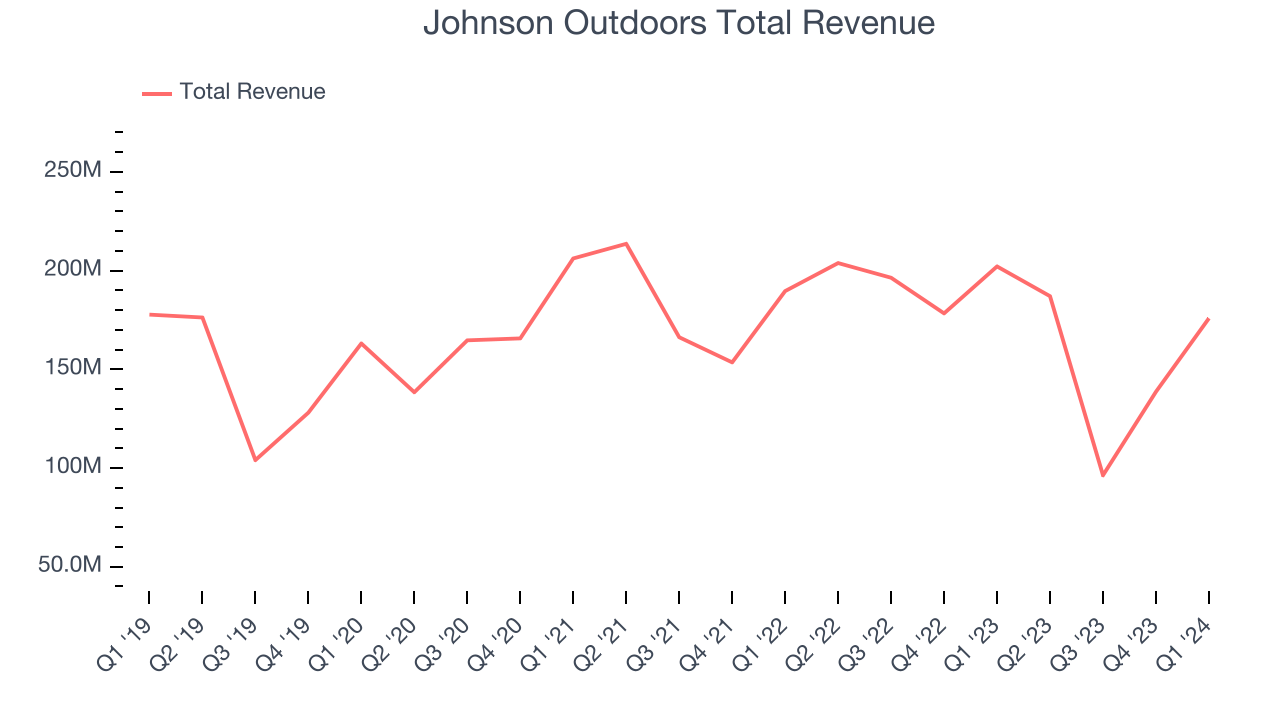

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Johnson Outdoors's annualized revenue growth rate of 1.9% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Johnson Outdoors's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 9.1% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Johnson Outdoors's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 9.1% over the last two years.

This quarter, Johnson Outdoors's revenue fell 13% year on year to $175.9 million but beat Wall Street's estimates by 10.8%. Looking ahead, Wall Street expects sales to grow 4.8% over the next 12 months, an acceleration from this quarter.

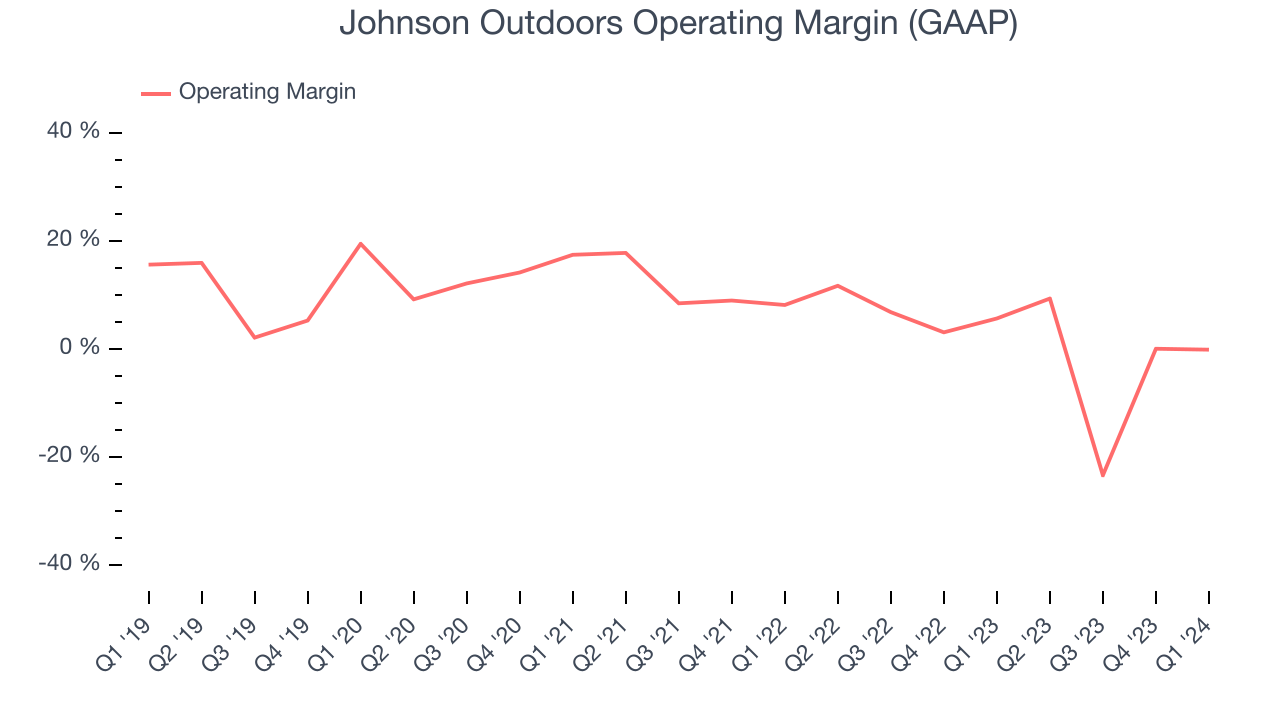

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Johnson Outdoors was profitable over the last two years but held back by its large expense base. Its average operating margin of 3.5% has been paltry for a consumer discretionary business.

In Q1, Johnson Outdoors generated an operating profit margin of negative 0.1%, down 5.8 percentage points year on year.

Over the next 12 months, Wall Street expects Johnson Outdoors to become profitable. Analysts are expecting the company’s LTM operating margin of negative 0.9% to rise to positive 4.6%.EPS

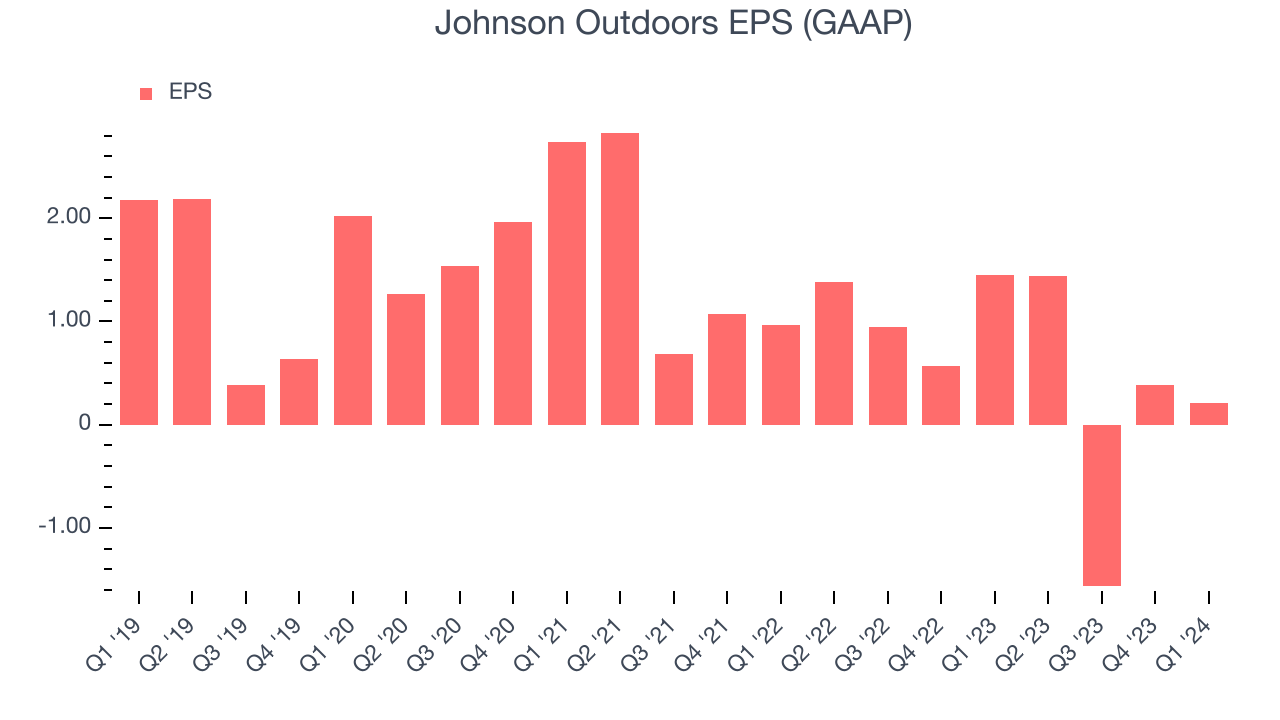

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Johnson Outdoors's EPS dropped 148%, translating into 19.9% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, Johnson Outdoors reported EPS at $0.21, down from $1.45 in the same quarter last year. This print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street expects Johnson Outdoors to grow its earnings. Analysts are projecting its LTM EPS of $0.46 to climb by 470% to $2.64.

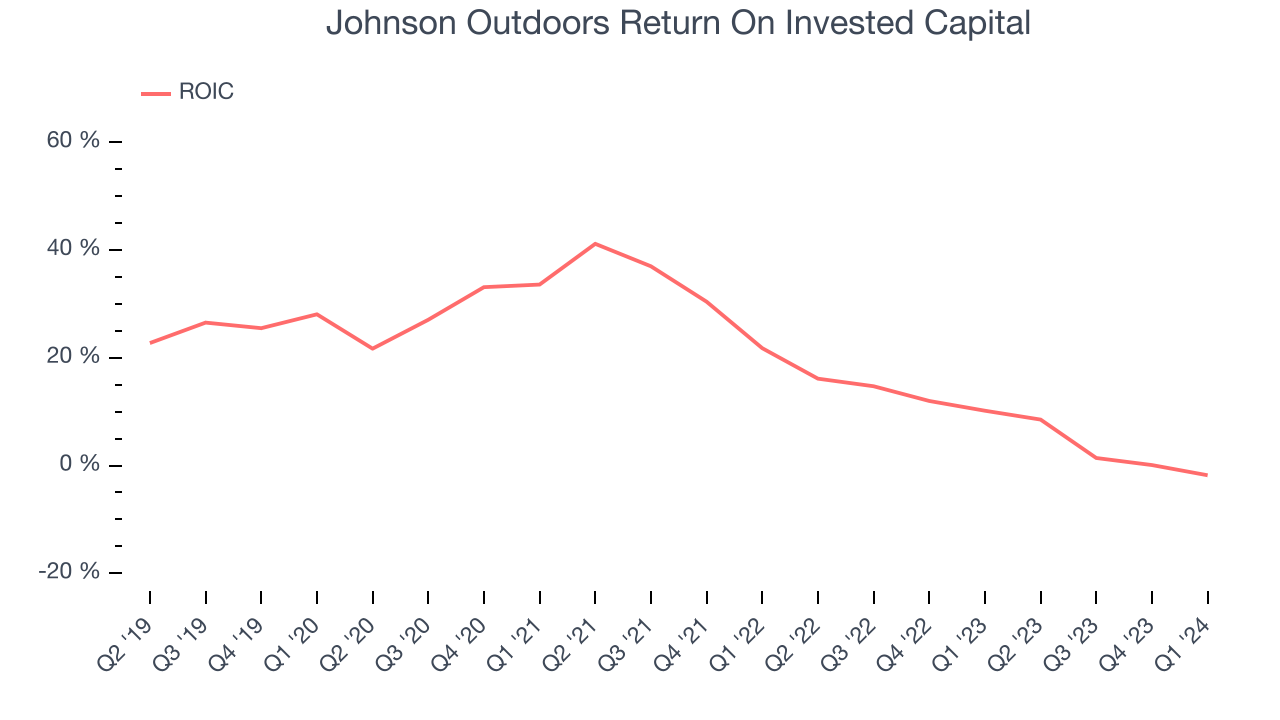

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Johnson Outdoors hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a solid job investing in profitable business initiatives. Its five-year average return on invested capital was 18.4%, higher than most consumer discretionary companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Johnson Outdoors's ROIC significantly decreased over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Johnson Outdoors's Q1 Results

Johnson Outdoors missed on operating profit by a meaningful amount. The company called out "challenging marketplace conditions" and added that it is "continuing to work hard to improve our cost structure and reduce inventory levels," Overall, this was a mediocre quarter for Johnson Outdoors. The stock is flat after reporting and currently trades at $42.61 per share.

Is Now The Time?

Johnson Outdoors may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Johnson Outdoors, we'll be cheering from the sidelines. Its revenue growth has been weak over the last five years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last five years makes it hard to trust. On top of that, its low free cash flow margins give it little breathing room.

Johnson Outdoors's price-to-earnings ratio based on the next 12 months is 16.1x. While we've no doubt one can find things to like about Johnson Outdoors, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $66 per share right before these results (compared to the current share price of $42.61).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.