Beverage company Keurig Dr Pepper (NASDAQ:KDP) reported Q1 CY2024 results topping analysts' expectations, with revenue up 3.4% year on year to $3.47 billion. It made a non-GAAP profit of $0.38 per share, improving from its profit of $0.34 per share in the same quarter last year.

Keurig Dr Pepper (KDP) Q1 CY2024 Highlights:

- Revenue: $3.47 billion vs analyst estimates of $3.41 billion (1.6% beat)

- EPS (non-GAAP): $0.38 vs analyst estimates of $0.35 (10% beat)

- KDP reaffirmed its 2024 guidance "for constant currency net sales growth in a mid-single-digit range and EPS (non-GAAP) growth in a high-single-digit range"

- Gross Margin (GAAP): 55.9%, up from 52% in the same quarter last year

- Free Cash Flow was -$73 million, down from $143 million in the previous quarter

- Sales Volumes were down 0.3% year on year

- Market Capitalization: $44.87 billion

Born out of a 2018 merger between coffee company Keurig Green Mountain and beverage company Dr Pepper Snapple, Keurig Dr Pepper (NASDAQ:KDP) boasts a powerhouse portfolio of beverages.

The company’s evolution is a complicated web of mergers and acquisitions. We won’t go through all the details, but prior to that 2018 combination, Keurig Green Mountain was born out of Keurig’s revolutionary single-serve technology and Green Mountain’s high-quality beans and roasting. Dr Pepper was a storied soda company that combined with Snapple when their two parent companies (Cadbury Schweppes and Triarc, respectively) merged in 2008.

Today, Keurig Dr Pepper’s portfolio boasts soda brands Dr Pepper, Canada Dry, 7Up, and A&W. Coffee brands include Keurig, Green Mountain, Van Houtte, and Krispy Kreme Coffee. Snapple, Mott’s, and Hawaiian Punch are the featured juice brands. The core customer is therefore quite broad–everyone from adults who need that morning brew to kids with a sweet tooth and everyone in between.

The company's products are widely available in grocery stores, supermarkets, convenience stores, restaurants, vending machines, and movie theaters globally. Keurig Dr Pepper’s scale leads to strong distribution and prominent shelf placement for its products.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors that offer beverages and snacks include Coca-Cola (NYSE:KO), PepsiCo (NASDAQ:PEP), and Monster Beverage (NASDAQ:MNST).Sales Growth

Keurig Dr Pepper is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

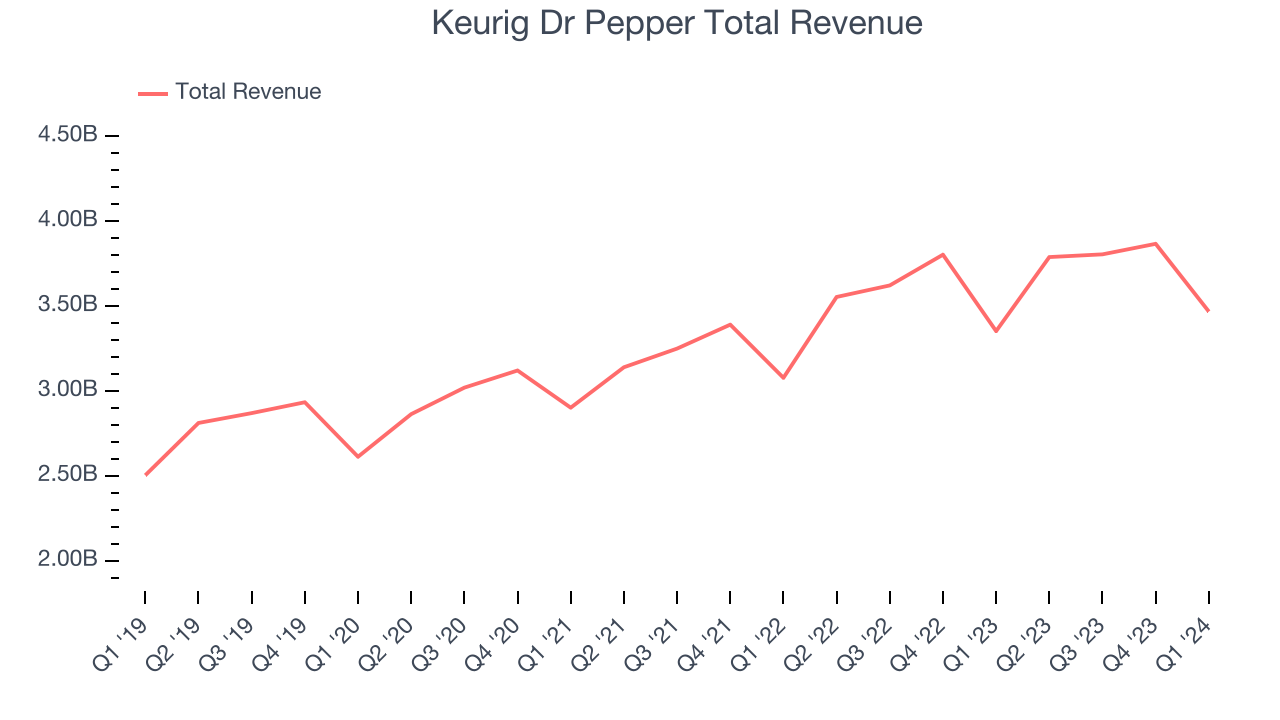

As you can see below, the company's annualized revenue growth rate of 7.8% over the last three years was decent for a consumer staples business.

This quarter, Keurig Dr Pepper reported decent year-on-year revenue growth of 3.4%, and its $3.47 billion in revenue topped Wall Street's estimates by 1.6%. Looking ahead, Wall Street expects sales to grow 3.7% over the next 12 months, an acceleration from this quarter.

Volume Growth

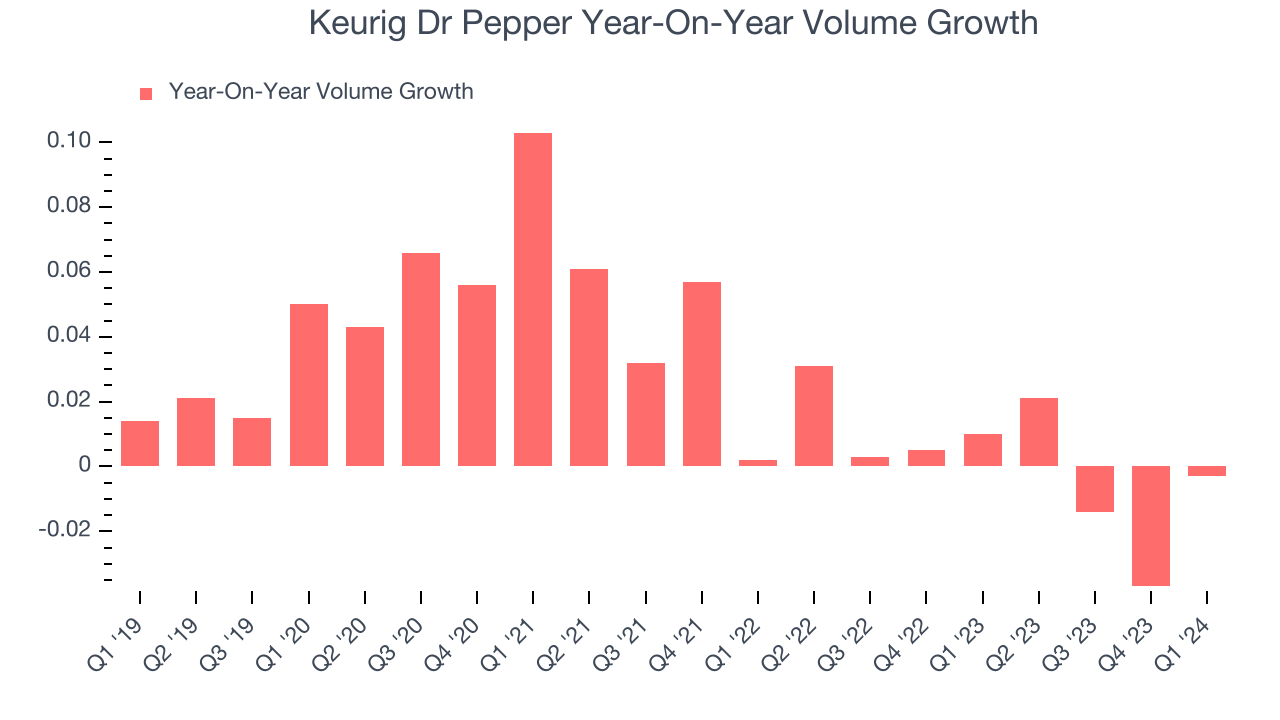

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Keurig Dr Pepper's quarterly sales volumes have, on average, stayed about the same over the last two years. This stability is normal because the quantity demanded for consumer staples products typically doesn't see much volatility.

In Keurig Dr Pepper's Q1 2024, year on year sales volumes were flat. By the company's standards, this result was a meaningful deceleration from the 1% year-on-year increase it posted 12 months ago. We'll be watching Keurig Dr Pepper closely to see if it can reaccelerate demand for its products.

Gross Margin & Pricing Power

Gross profit margins tell us how much money a company gets to keep after paying for the direct costs of the goods it sells.

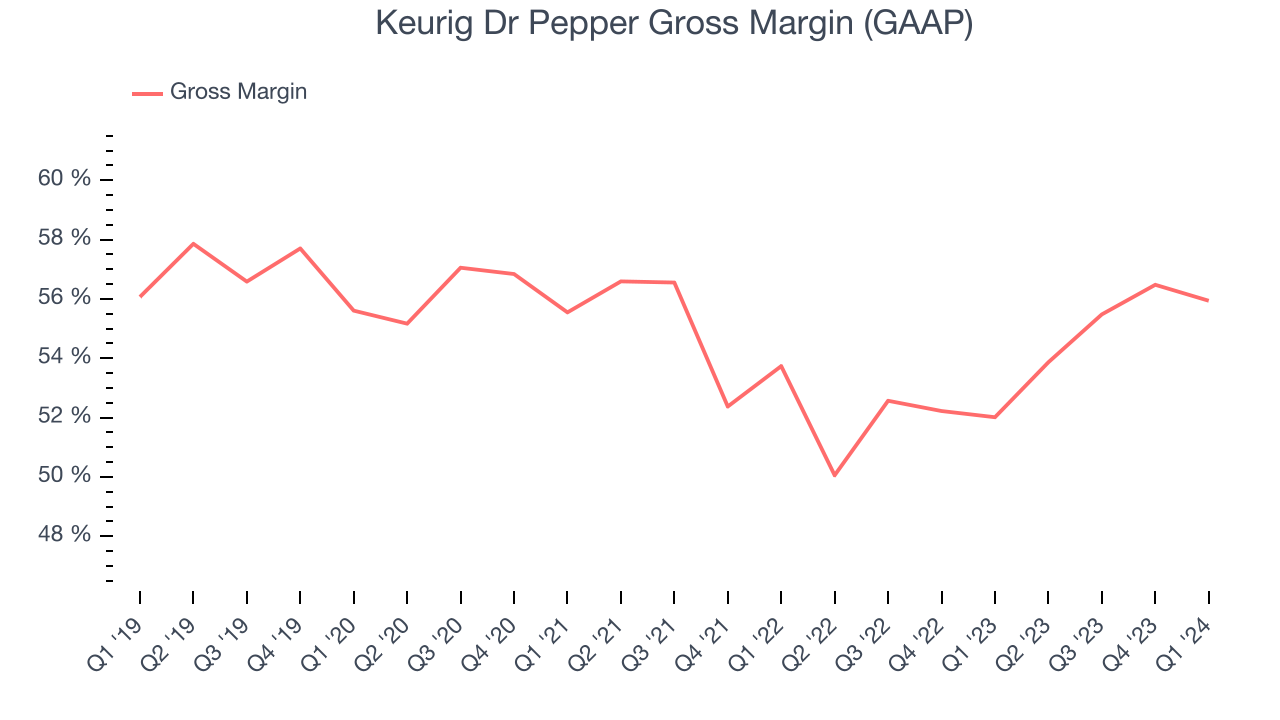

This quarter, Keurig Dr Pepper's gross profit margin was 55.9%, up 3.9 percentage points year on year. That means for every $1 in revenue, $0.44 went towards paying for raw materials, production of goods, and distribution expenses.

Keurig Dr Pepper has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see above, it's averaged an exceptional 53.6% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 7.2% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

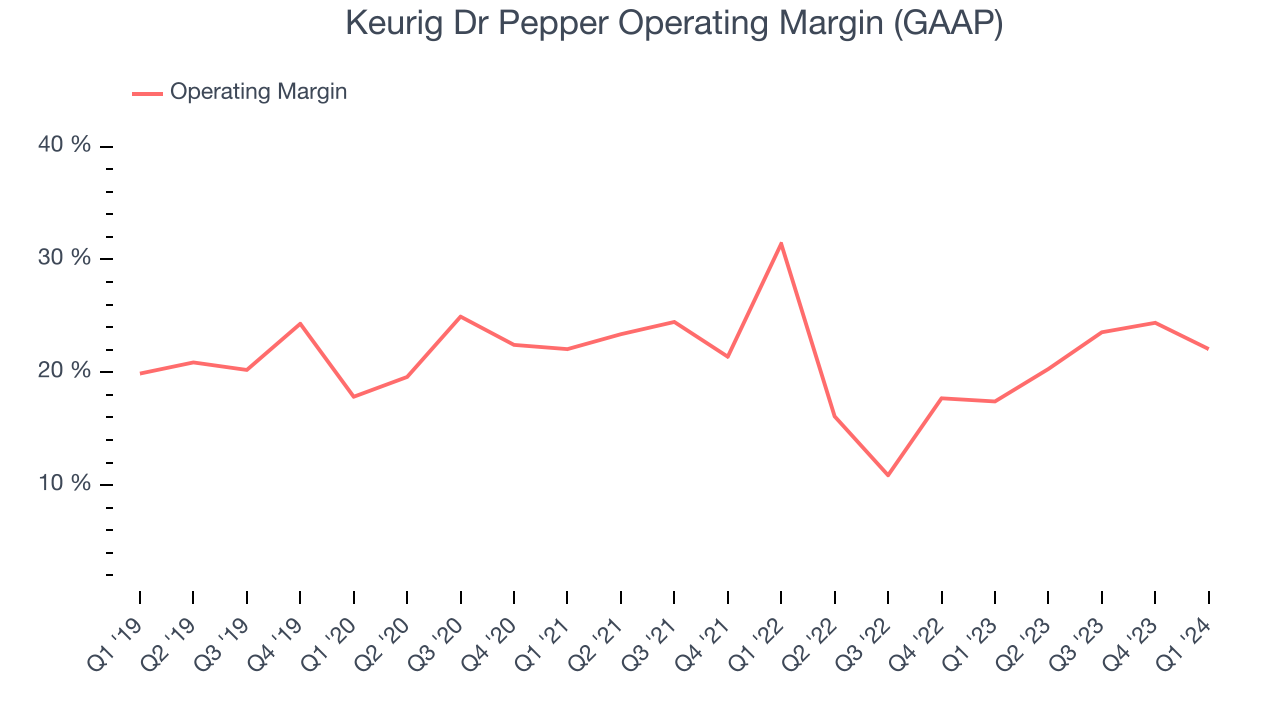

In Q1, Keurig Dr Pepper generated an operating profit margin of 22.1%, up 4.6 percentage points year on year. This increase was encouraging, and we can infer Keurig Dr Pepper was more efficient with its expenses because its operating margin expanded more than its gross margin.

Zooming out, Keurig Dr Pepper has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 19.1%. On top of that, its margin has improved by 7.1 percentage points on average over the last year, a great sign for shareholders.

Zooming out, Keurig Dr Pepper has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 19.1%. On top of that, its margin has improved by 7.1 percentage points on average over the last year, a great sign for shareholders. EPS

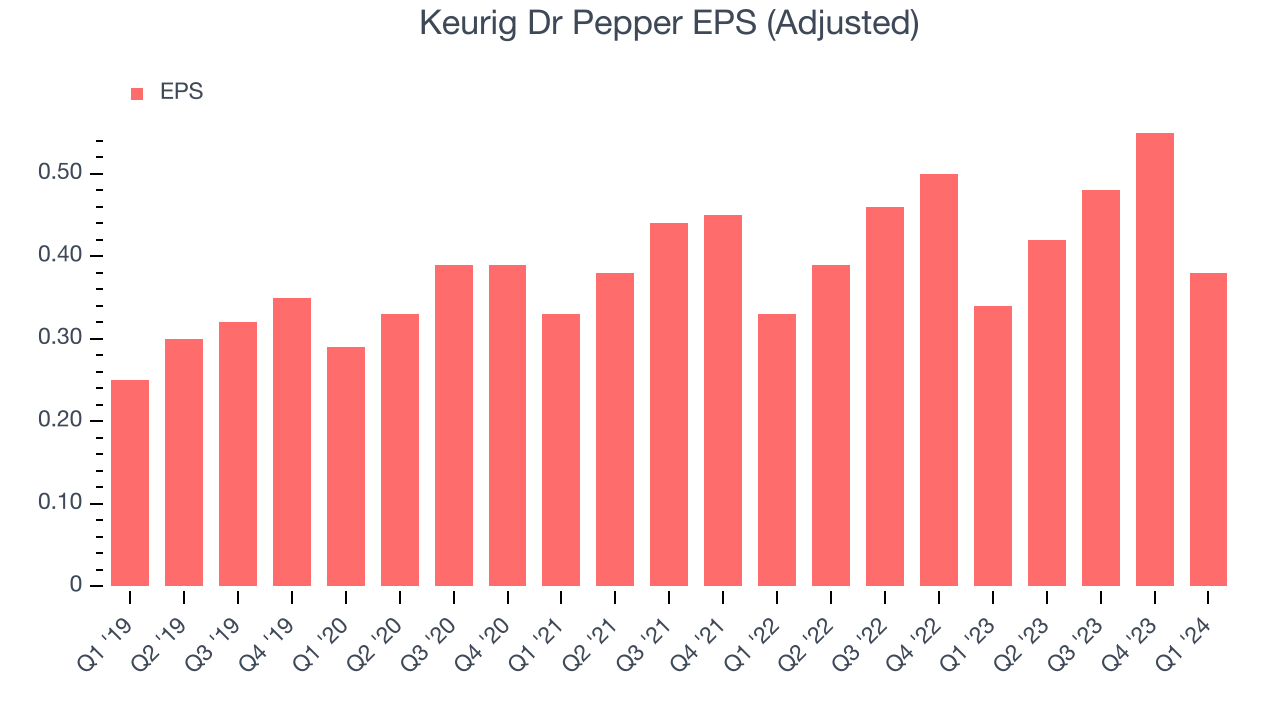

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Keurig Dr Pepper reported EPS at $0.38, up from $0.34 in the same quarter a year ago. This print beat Wall Street's estimates by 10%.

Between FY2021 and FY2024, Keurig Dr Pepper's EPS grew 27.1%, translating into a decent 8.3% compounded annual growth rate.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 5.9% year-on-year increase in EPS.

Cash Is King

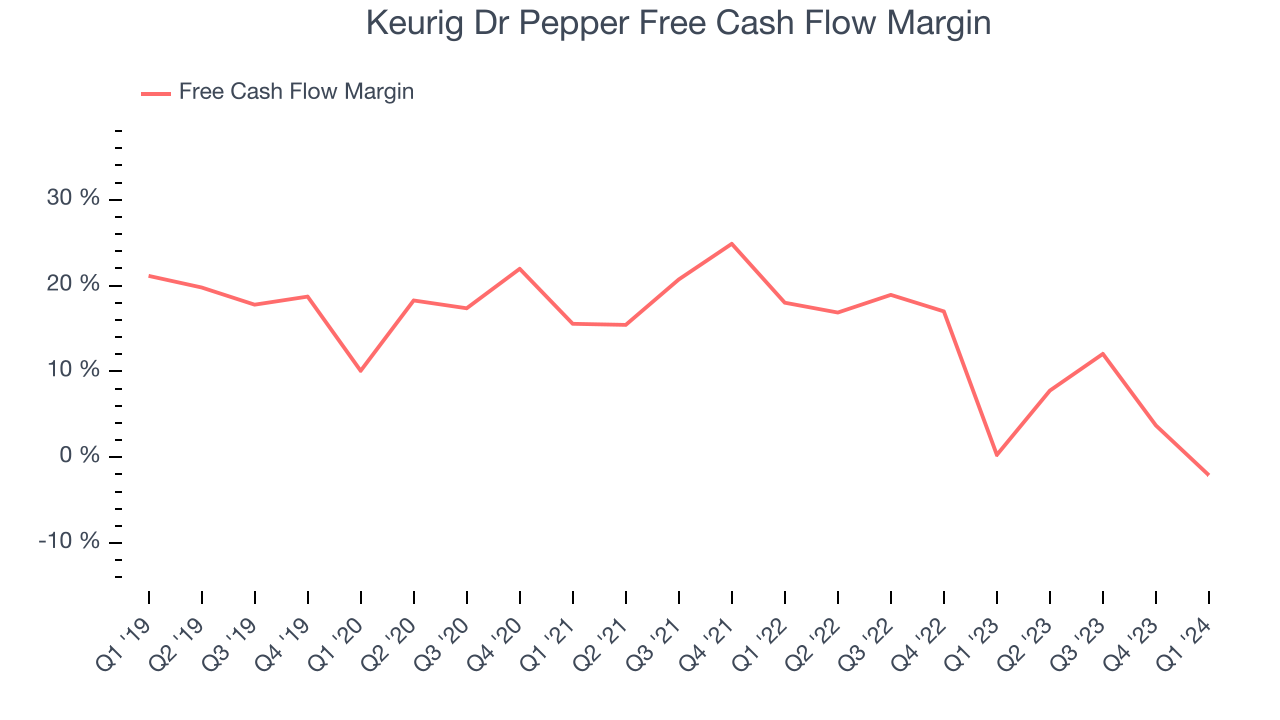

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Keurig Dr Pepper burned through $73 million of cash in Q1, representing a negative 2.1% free cash flow margin. The company shifted to cash flow negative from cash flow positive in the same quarter last year, which caught our eye as we'd like consumer staples companies to have more consistent performance.

Over the last eight quarters, Keurig Dr Pepper has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin has averaged 9.4%, above the broader consumer staples sector. However, its margin has averaged year-on-year declines of 8 percentage points over the last 12 months. Some investors are likely unhappy with these results and would hope to see a reversal soon.

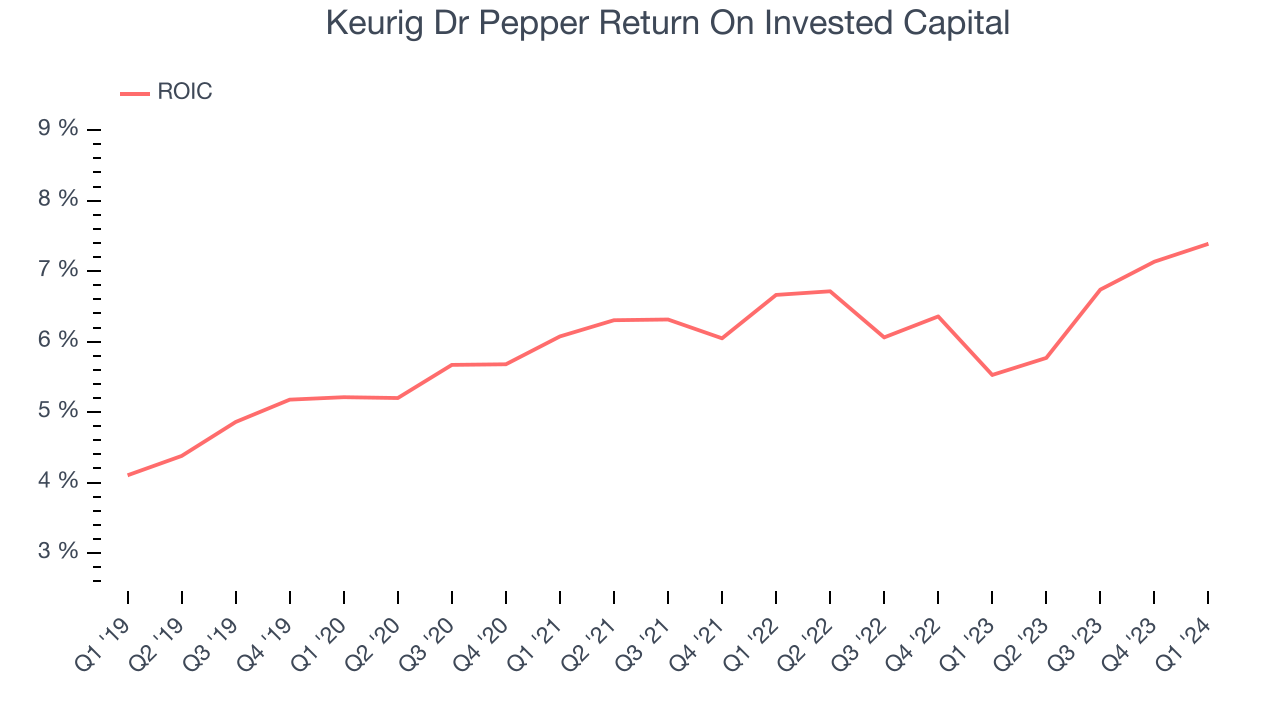

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Keurig Dr Pepper's five-year average ROIC was 6.2%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Keurig Dr Pepper's ROIC has stayed the same over the last few years. If the company wants to become an investable business, it will need to increase its returns.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Keurig Dr Pepper reported $317 million of cash and $14.84 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $4.40 billion of EBITDA over the last 12 months, we view Keurig Dr Pepper's 3.3x net-debt-to-EBITDA ratio as safe. We also see its $295 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Keurig Dr Pepper's Q1 Results

It was good to see Keurig Dr Pepper beat analysts' revenue, gross margin, and EPS expectations this quarter. That the company maintained previous full year guidance for sales and EPS growth means the operating environment and demand trends remain consistent with what the company observed about three months ago. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 3.5% after reporting and currently trades at $33.49 per share.

Is Now The Time?

Keurig Dr Pepper may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Keurig Dr Pepper isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been decent over the last three years, its mediocre ROIC suggests it has grown profits at a slow pace historically. And while its impressive gross margins are a wonderful starting point for the overall profitability of the business, the downside is its projected EPS for the next year is lacking.

Keurig Dr Pepper's price-to-earnings ratio based on the next 12 months is 16.7x. In the end, beauty is in the eye of the beholder. While Keurig Dr Pepper wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $34.86 per share right before these results (compared to the current share price of $33.49).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.