Semiconductor manufacturing equipment maker KLA Corporation (NASDAQ:KLAC) beat analysts' expectations in Q1 CY2024, with revenue down 3% year on year to $2.36 billion. Guidance for next quarter's revenue was also optimistic at $2.5 billion at the midpoint, 2.8% above analysts' estimates. It made a non-GAAP profit of $5.26 per share, down from its profit of $5.49 per share in the same quarter last year.

KLA Corporation (KLAC) Q1 CY2024 Highlights:

- Revenue: $2.36 billion vs analyst estimates of $2.32 billion (1.7% beat)

- EPS (non-GAAP): $5.26 vs analyst estimates of $5.06 (4% beat)

- Revenue Guidance for Q2 CY2024 is $2.5 billion at the midpoint, above analyst estimates of $2.43 billion

- Gross Margin (GAAP): 57.9%, down from 58.7% in the same quarter last year

- Inventory Days Outstanding: 275, down from 283 in the previous quarter

- Free Cash Flow of $838.2 million, up 53.7% from the previous quarter

- Market Capitalization: $88.79 billion

Formed by the 1997 merger of the two leading semiconductor yield management companies, KLA Corporation (NASDAQ:KLAC) is the leading supplier of equipment used to measure and inspect semiconductor chips.

KLA sells the tools used by semiconductor foundries and memory chip producers to inspect semiconductors and measure their precise dimensions throughout the manufacturing process, from the wafers to patterning to final production. Today, accuracy and defect detection in the semiconductor manufacturing process is becoming even more crucial as chip sizes continue to shrink, making it increasingly difficult to find defects. As the cost to create chips has gone up, even a small irregularity early on in the manufacturing process can render a chip useless, costing companies time and money.

KLA is the dominant provider of process control systems, maintaining around 50% market share for more than a decade, or 4x its closest competitor. It works closely with its customers to develop specific tools for specific semiconductor manufacturing processes. In recent years it has looked to expand its addressable market and the 2019 acquisition of Orbotech extended its business into printed circuit boards and flat panel displays.

KLACs primary peers and competitors are Applied Materials (NASDAQ:AMAT), ASML (NASDAQ:ASML) Lam Research (NASDA:LCRX), and Tokyo Electron (TSE:8035).Semiconductor Manufacturing

The semiconductor capital (manufacturing) equipment group has become highly concentrated over the past decade. Suppliers have consolidated, and the increasing cost of innovation have made it unaffordable to almost everybody, except the largest companies, to produce leading edge chips. The result of the increased industry concentration has been higher operating margins and free cash generation through the cycle. Despite this structural improvement, the businesses can still be quite volatile, as demand fluctuations for the semiconductor equipment are magnified by the already cyclical nature of underlying semiconductor demand.

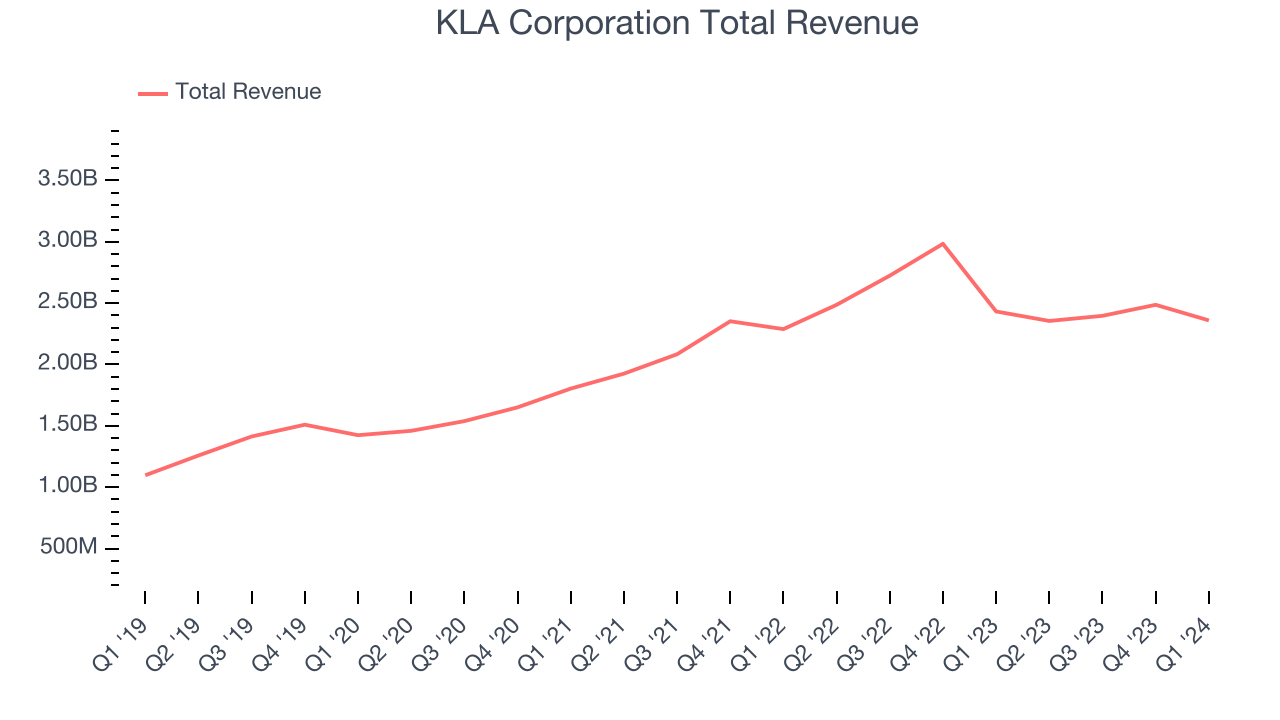

Sales Growth

KLA Corporation's revenue growth over the last three years has been mediocre, averaging 16.1% annually. But as you can see below, its revenue declined from $2.43 billion in the same quarter last year to $2.36 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Even though KLA Corporation surpassed analysts' revenue estimates, this was a slow quarter for the company as its revenue dropped 3% year on year. This could mean that the current downcycle is deepening.

KLA Corporation looks like it's on the cusp of a rebound, as it's guiding to 6.2% year-on-year revenue growth for the next quarter. Analysts seem to agree as consesus estimates call for 10.8% growth over the next 12 months.

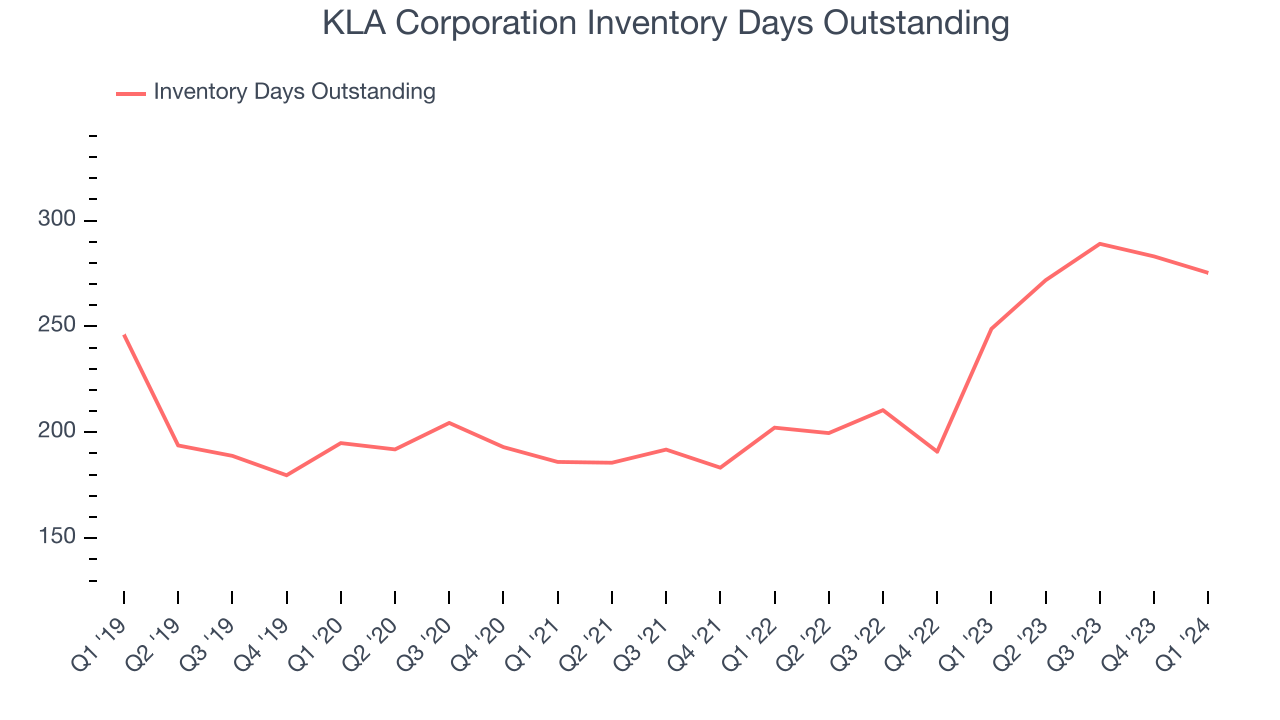

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, KLA Corporation's DIO came in at 275, which is 62 days above its five-year average. These numbers suggest that despite the recent decrease, the company's inventory levels are higher than what we've seen in the past.

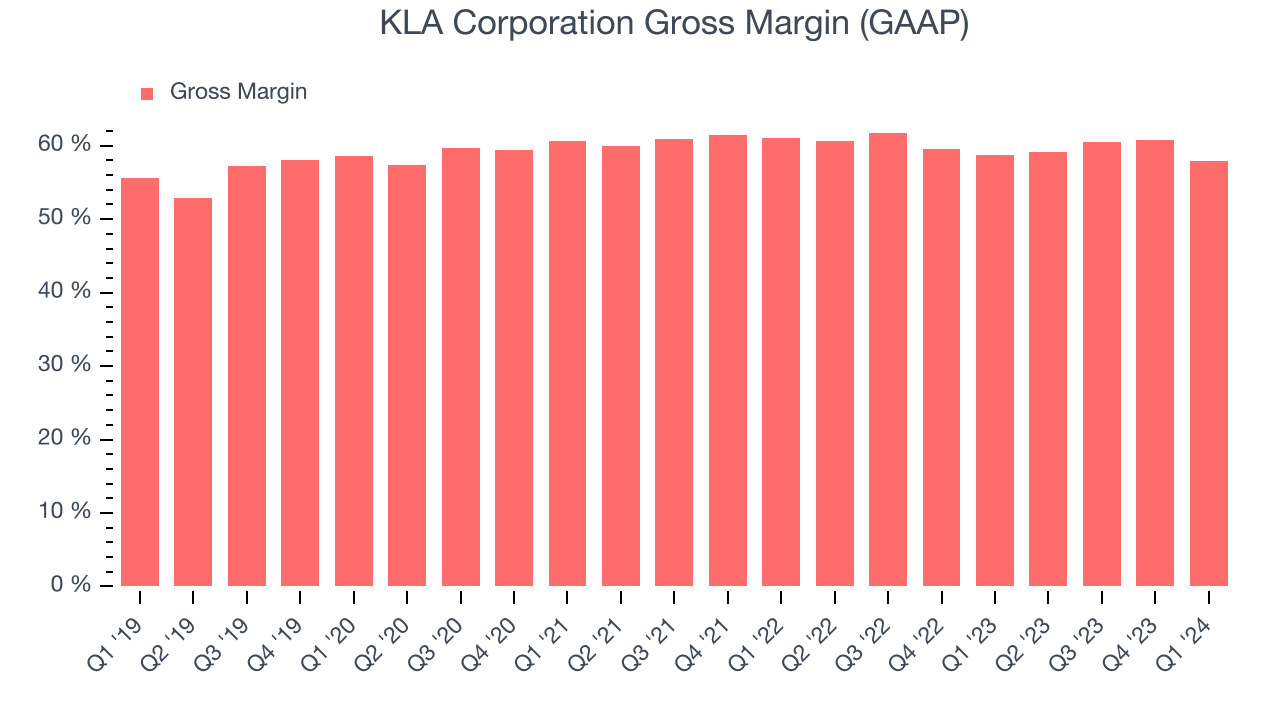

Pricing Power

In the semiconductor industry, a company's gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor. KLA Corporation's gross profit margin, which shows how much money the company gets to keep after paying key materials, input, and manufacturing costs, came in at 57.9% in Q1, down 0.8 percentage points year on year.

KLA Corporation's gross margins have been stable over the past year, averaging 59.6%. The company's unit economics remain ahead of its semiconductor peers, pointing to its solid competitive offering, disciplined cost controls, and lack of meaningful pricing pressure.

Earnings, Cash & Competitive Moat

Analysts covering KLA Corporation expect earnings per share to grow 17.4% over the next 12 months, although estimates will likely change after earnings.

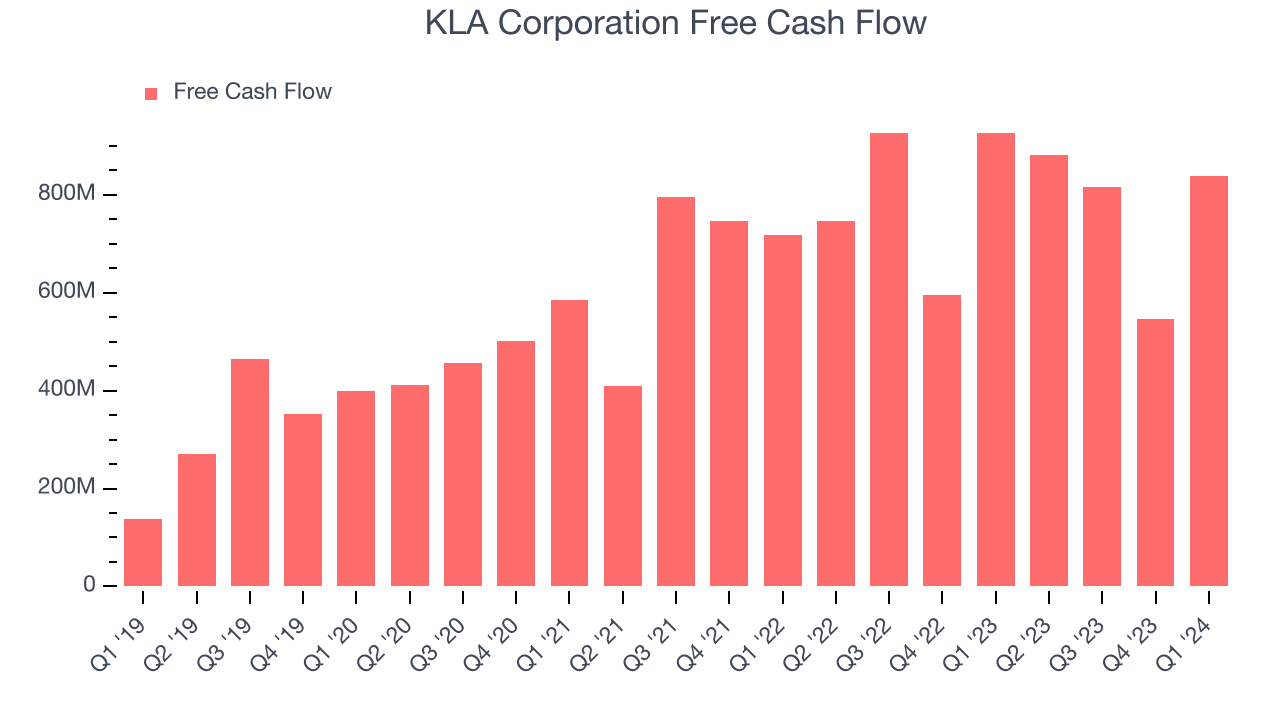

Although earnings are important, we believe cash is king because you can't use accounting profits to pay the bills. KLA Corporation's free cash flow came in at $838.2 million in Q1, down 9.5% year on year.

As you can see above, KLA Corporation produced $3.08 billion in free cash flow over the last 12 months, an eye-popping 32.1% of revenue. This is a great result; KLA Corporation's free cash flow conversion places it among the best semiconductor companies and, if sustainable, puts the company in an advantageous position to invest in new products while remaining resilient during industry downturns.

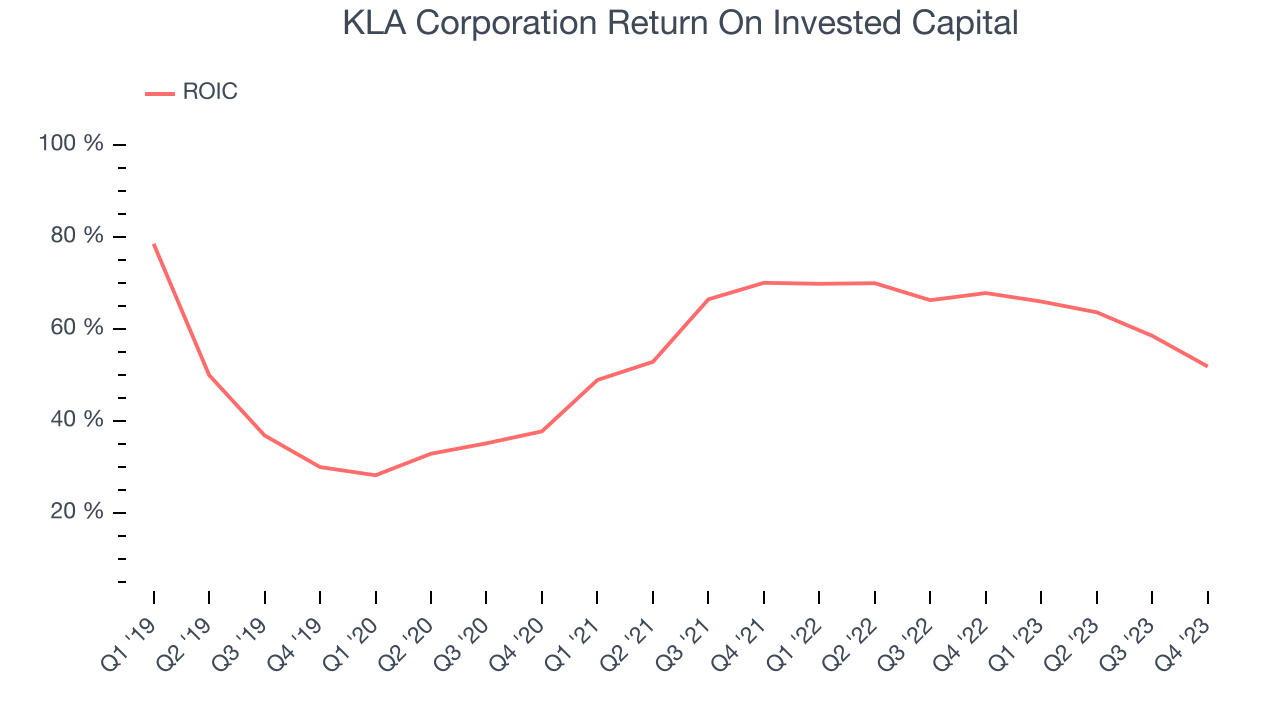

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

KLA Corporation's five-year average ROIC was 53.3%, placing it among the best semiconductor companies. Just as you’d like your investment dollars to generate returns, KLA Corporation's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, KLA Corporation's ROIC has significantly increased. The company has historically shown the ability to generate good returns, and its rising ROIC is a great sign. It could suggest its competitive advantage or profitable business opportunities are expanding.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Key Takeaways from KLA Corporation's Q1 Results

We enjoyed seeing KLA Corporation exceed analysts' revenue and EPS expectations this quarter, driven by better-than-expected performance in its semiconductor process control segment. We were also glad next quarter's revenue and EPS guidance were higher than Wall Street's estimates. Management noted it expects business momentum to continue throughout the year as it reiterated that market conditions have stabilized over the last few quarters. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 1.1% after reporting and currently trades at $681.8 per share.

Is Now The Time?

When considering an investment in KLA Corporation, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are numerous reasons why we think KLA Corporation is one of the best semiconductor companies out there. While we'd expect growth rates to moderate from here, its revenue growth has been solid over the last three years. Additionally, its powerful free cash generation enables it to sustainably invest in growth initiatives while maintaining an ample cash cushion, and its stellar ROIC suggests it has been a well-run company historically.

KLA Corporation's price-to-earnings ratio based on the next 12 months is 25.5x. Looking at the semiconductors landscape today, KLA Corporation's qualities really stand out, and we really like it at this price.

Wall Street analysts covering the company had a one-year price target of $696.44 per share right before these results (compared to the current share price of $681.80), implying they saw upside in buying KLA Corporation in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.