Sushi restaurant chain Kura Sushi (NASDAQ:KRUS) announced better-than-expected results in Q1 CY2024, with revenue up 30.4% year on year to $57.29 million. The company expects the full year's revenue to be around $244.5 million, in line with analysts' estimates. It made a GAAP loss of $0.09 per share, improving from its loss of $0.10 per share in the same quarter last year.

Is now the time to buy Kura Sushi? Find out by accessing our full research report, it's free.

Kura Sushi (KRUS) Q1 CY2024 Highlights:

- Revenue: $57.29 million vs analyst estimates of $56.64 million (1.1% beat)

- EPS: -$0.09 vs analyst estimates of -$0.04 (-$0.05 miss)

- The company lifted its revenue guidance for the full year from $241.5 million to $244.5 million at the midpoint, a 1.2% increase

- Gross Margin (GAAP): 16.2%, down from 18% in the same quarter last year

- Same-Store Sales were up 3% year on year

- Store Locations: 60 at quarter end, increasing by 15 over the last 12 months

- Market Capitalization: $1.16 billion

Hajime Uba, President and Chief Executive Officer of Kura Sushi, stated, “I‘m very pleased to report the ongoing strength of our business as we progress through a record fiscal year. It was unprecedented for us when we announced a guidance raise so early in the year with our first quarter call, and being able to follow the next quarter with another guidance raise demonstrates our incredible confidence in the business. We’ve opened 10 restaurants to date, putting us well on track for our new unit guidance and giving us the confidence to upgrade our revenue guidance. For our second quarter, we leveraged G&A year-over-year as a percentage of sales by 190 basis points, and grew Adjusted EBITDA by 23%. We’ve introduced new projects such as DoorDash, and our operations teams have more than risen to the challenge of implementing them. I’m extremely proud of everyone’s efforts, and want to acknowledge all of our team members and thank them for creating so much great news.”

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ:KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

Kura Sushi is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

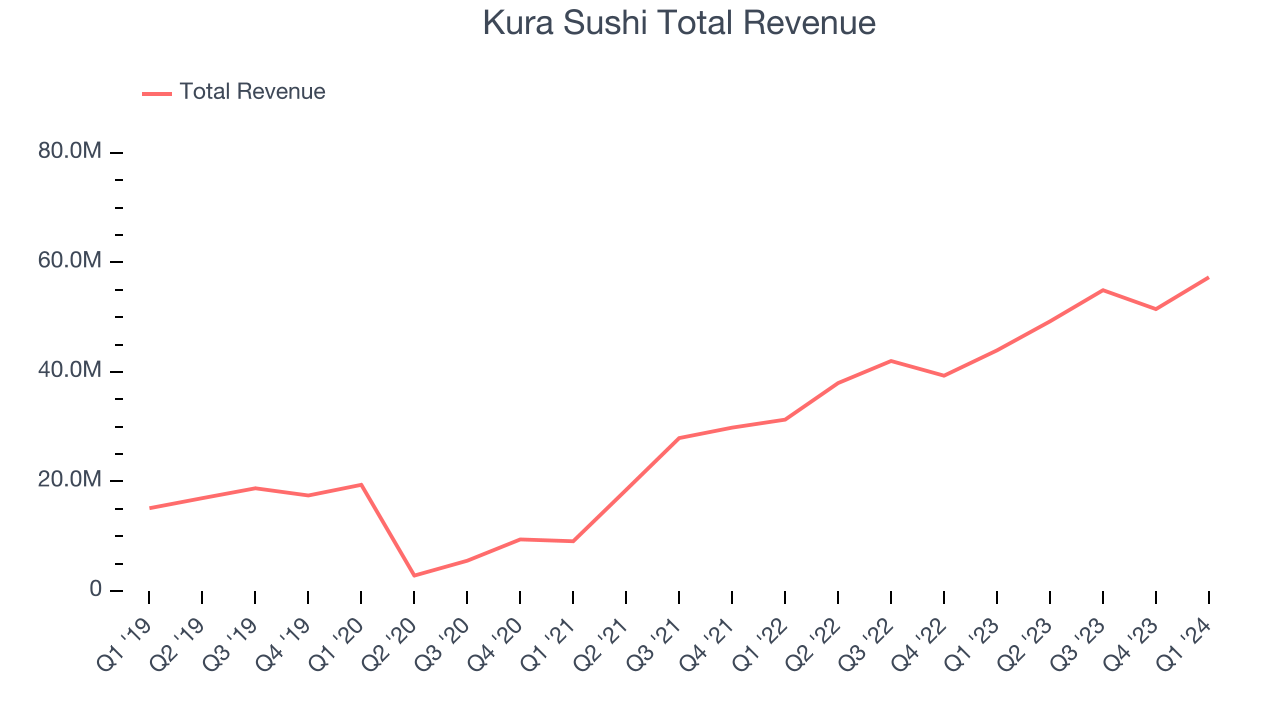

As you can see below, the company's annualized revenue growth rate of 30.2% over the last five years was incredible as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Kura Sushi reported wonderful year-on-year revenue growth of 30.4%, and its $57.29 million in revenue exceeded Wall Street's estimates by 1.1%. Looking ahead, Wall Street expects sales to grow 27.2% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its restaurants that have been open for at least a year, give or take. This is a key performance indicator because it measures organic growth and demand.

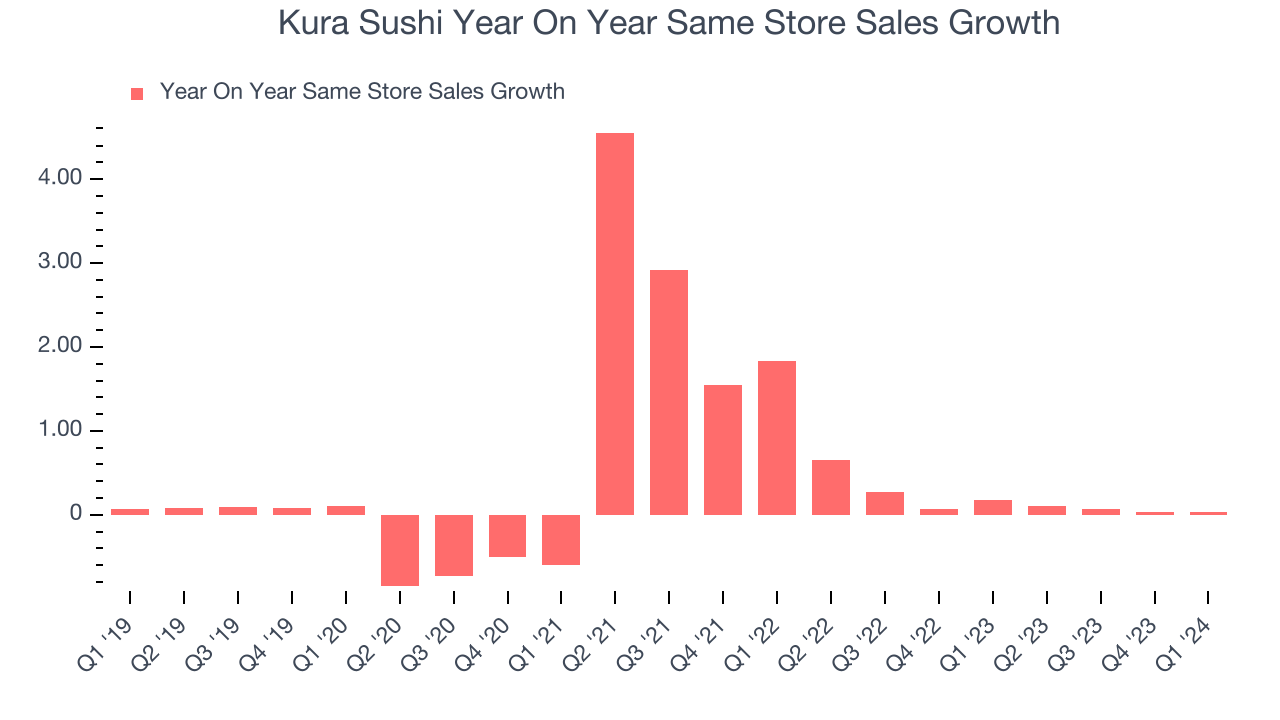

Kura Sushi has been one of the most successful restaurants over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 17.6%. This performance suggests its rapid buildout of new restaurants is justified. When a chain has strong demand, more locations should help it reach more customers seeking its meals and boost revenue growth.

In the latest quarter, Kura Sushi's same-store sales rose 3% year on year. By the company's standards, this growth was a meaningful deceleration from the 17.4% year-on-year increase it posted 12 months ago. We'll be watching Kura Sushi closely to see if it can reaccelerate growth.

Key Takeaways from Kura Sushi's Q1 Results

It was good to see Kura Sushi beat analysts' revenue expectations as it opened five new restaurants during the quarter. On the other hand, its EPS missed Wall Street's expectations, but the market doesn't seem to care because the company lifted its full-year revenue guidance after providing it for the first time just last quarter.

Given management's confidence in the business, Kura Sushi will continue rapidly opening new restaurants (it's opened 10 new locations to date). Furthermore, the company announced a new project with DoorDash to deliver its meals. Both these facts show it is pursuing a high-growth strategy.

Zooming out, we think this was a decent quarter, showing that the company is staying on track. The stock is up 2.7% after reporting and currently trades at $106.99 per share.

So should you invest in Kura Sushi right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.