Sushi restaurant chain Kura Sushi (NASDAQ:KRUS) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 20.2% year on year to $66.01 million. On the other hand, the company’s full-year revenue guidance of $277 million at the midpoint came in 3.7% below analysts’ estimates. Its GAAP loss of $0.46 per share was 995% below analysts’ consensus estimates.

Is now the time to buy Kura Sushi? Find out by accessing our full research report, it’s free.

Kura Sushi (KRUS) Q3 CY2024 Highlights:

- Revenue: $66.01 million vs analyst estimates of $64.02 million (3.1% beat)

- EPS: -$0.46 vs analyst estimates of -$0.04 (-$0.42 miss)

- EBITDA: $5.50 million vs analyst estimates of $4.54 million (21.1% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $277 million at the midpoint, missing analyst estimates by 3.7% and implying 16.5% growth (vs 27.4% in FY2024)

- Gross Margin (GAAP): 18.7%, down from 21.4% in the same quarter last year

- Operating Margin: -8.8%, down from 4.1% in the same quarter last year

- EBITDA Margin: 8.3%, down from 11.4% in the same quarter last year

- Locations: 64 at quarter end, up from 50 in the same quarter last year

- Same-Store Sales fell 3.1% year on year (6.5% in the same quarter last year)

- Market Capitalization: $1.12 billion

Hajime Uba, President and Chief Executive Officer of Kura Sushi, stated, “In fiscal 2024, we succeeded on our key goals of achieving over 20%-unit growth and maintaining best-in-class restaurant-level operating profit margins. I am tremendously excited for this fiscal year 2025 and what we can achieve in respect to these goals. Fiscal year 2025 is an opportunity to demonstrate the next level of Kura Sushi’s potential, and I am incredibly grateful for the excellent work by our team members who have positioned us so well for the new year.”

Company Overview

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ:KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

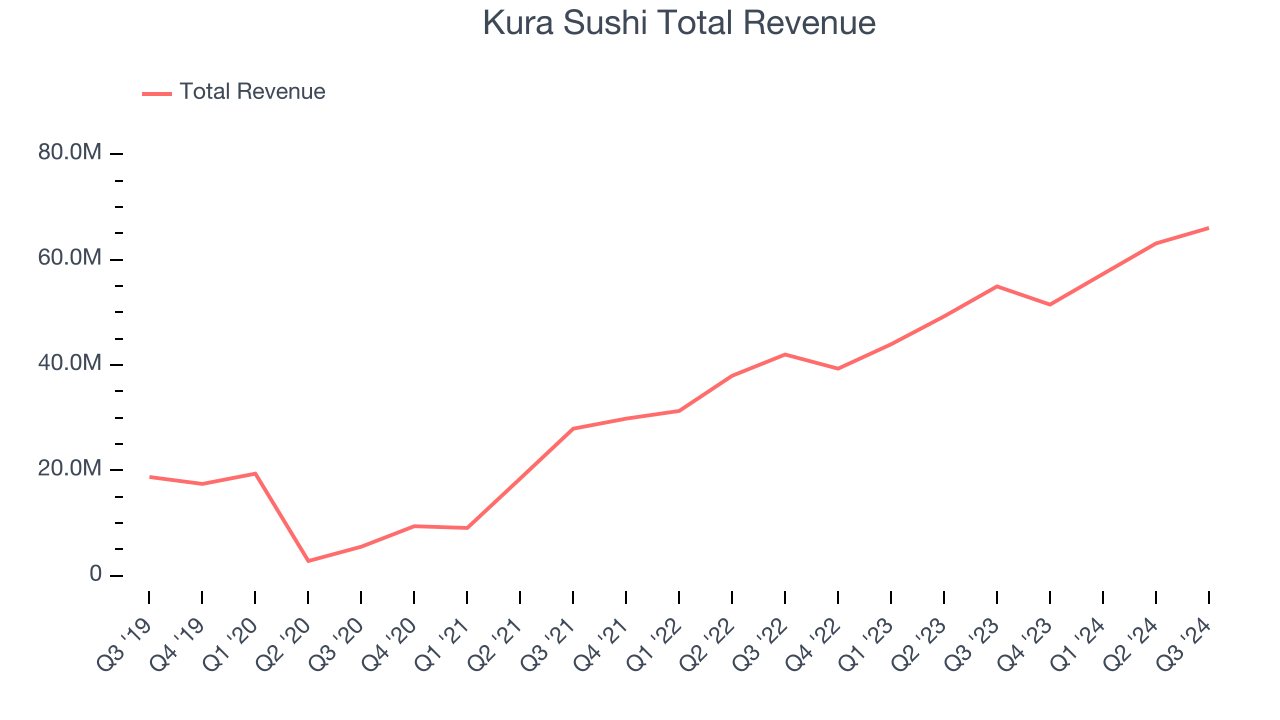

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Kura Sushi is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new restaurants.

As you can see below, Kura Sushi grew its sales at an incredible 29.9% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Kura Sushi reported robust year-on-year revenue growth of 20.2%, and its $66.01 million of revenue topped Wall Street estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 19.9% over the next 12 months, a deceleration versus the last five years. Still, this projection is healthy and shows the market is factoring in success for its offerings.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Restaurant Performance

Number of Restaurants

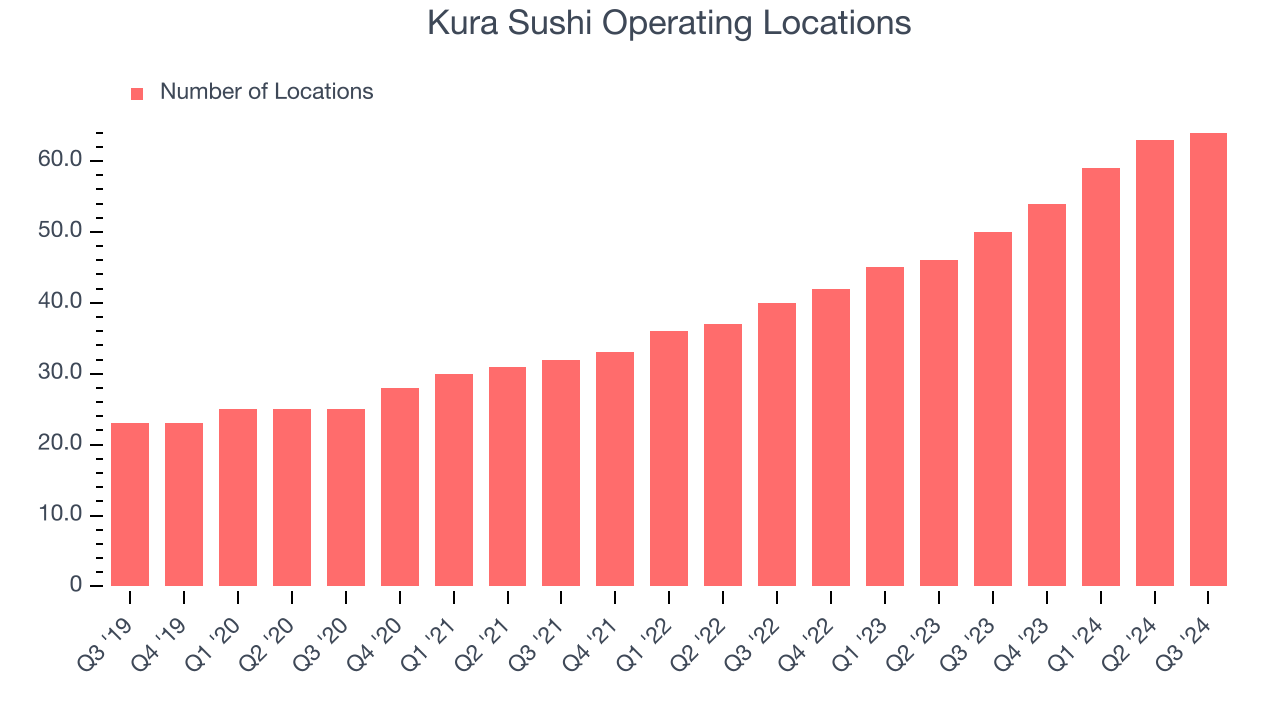

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Kura Sushi sported 64 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip and averaged 28.3% annual growth, among the fastest in the restaurant sector. This gives it a chance to scale into a mid-sized business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

Same-Store Sales

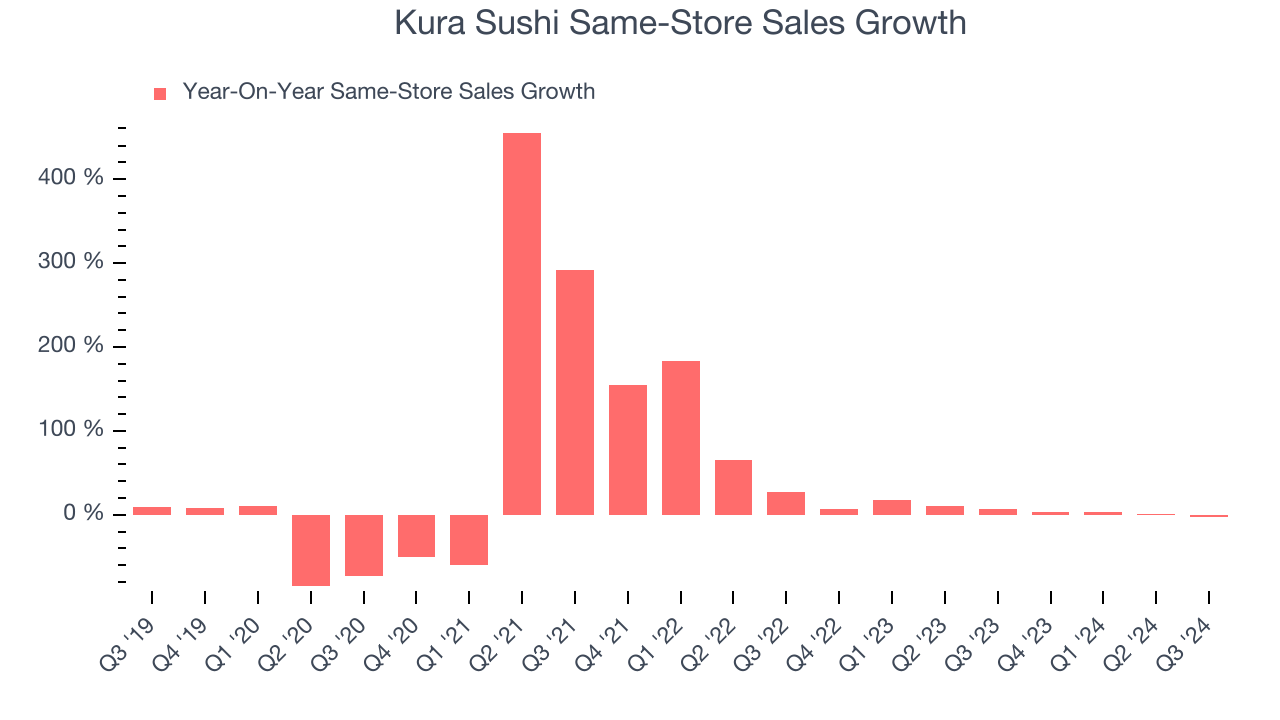

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth for restaurants open for at least a year.

Kura Sushi has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 5.7%. This performance along with its meaningful buildout of new restaurants suggest it’s playing some aggressive offense.

In the latest quarter, Kura Sushi’s same-store sales fell by 3.1% annually. This decline was a reversal from the 6.5% year-on-year increase it posted 12 months ago. We’ll keep a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Kura Sushi’s Q3 Results

We were impressed by how significantly Kura Sushi blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed analysts’ expectations and its EPS missed Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 7.9% to $95 immediately after reporting.

Is Kura Sushi an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.