Sushi restaurant chain Kura Sushi (NASDAQ:KRUS) reported results in line with analysts' expectations in Q2 CY2024, with revenue up 28.1% year on year to $63.08 million. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $236 million at the midpoint. It made a GAAP loss of $0.05 per share, down from its profit of $0.16 per share in the same quarter last year.

Is now the time to buy Kura Sushi? Find out by accessing our full research report, it's free.

Kura Sushi (KRUS) Q2 CY2024 Highlights:

- Revenue: $63.08 million vs analyst estimates of $63.1 million (small miss)

- EPS: -$0.05 vs analyst estimates of $0.03 (-$0.08 miss)

- The company dropped its revenue guidance for the full year from $244.5 million to $236 million at the midpoint, a 3.5% decrease

- Gross Margin (GAAP): 17.3%, down from 21.1% in the same quarter last year

- Locations: 64 at quarter end, up from 46 in the same quarter last year

- Same-Store Sales were flat year on year (10.3% in the same quarter last year)

- Market Capitalization: $695.9 million

Hajime Uba, President and Chief Executive Officer of Kura Sushi, stated, “We believe the current headwinds are macro-driven and transitory, but with the difficulty in predicting the duration of macroeconomic shifts, we believe the most prudent course of action is to position ourselves to be able to continue to deliver strong financial results and uninterrupted progress on our core strategic goals of at least 20% annual unit growth, G&A leverage, and operational excellence regardless of the broader economic environment. While the third quarter results were unexpected, nothing has changed about Kura Sushi’s tremendous potential.”

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ:KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

Kura Sushi is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

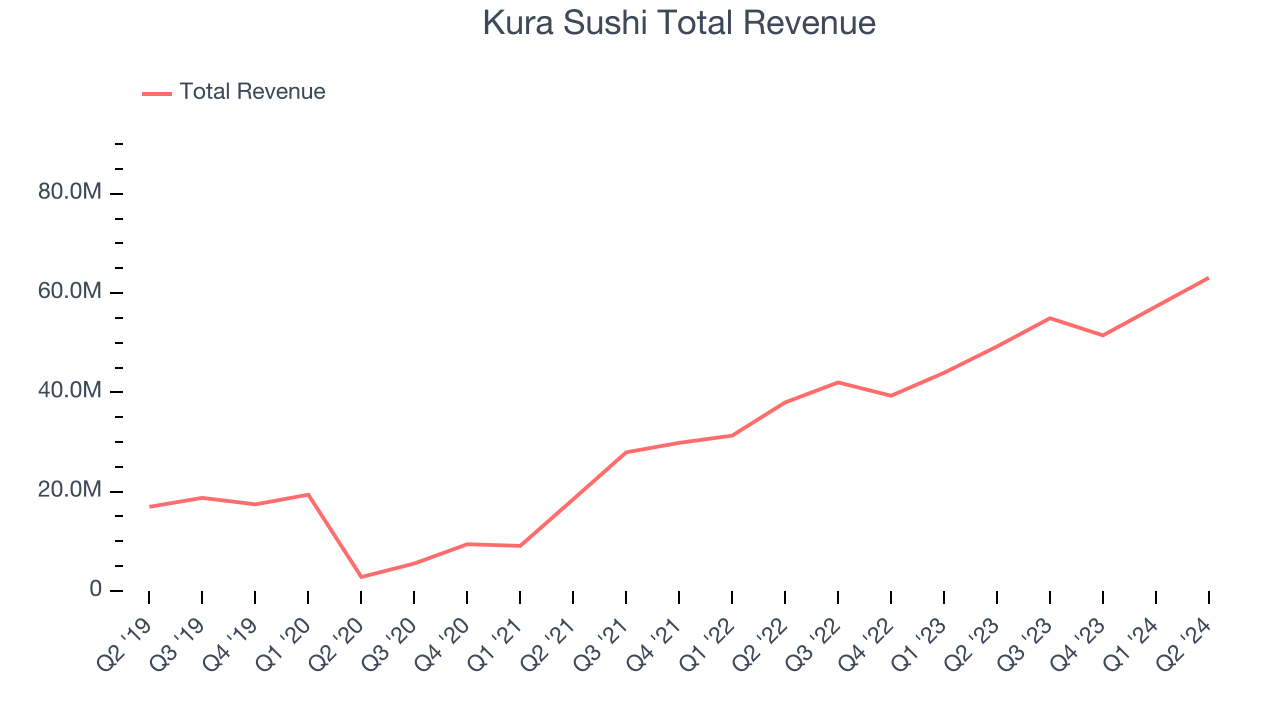

As you can see below, the company's annualized revenue growth rate of 30.4% over the last five years was incredible as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Kura Sushi generated an excellent 28.1% year-on-year revenue growth rate, but its $63.08 million in revenue fell short of Wall Street's high expectations. Looking ahead, Wall Street expects sales to grow 22.1% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for restaurants.

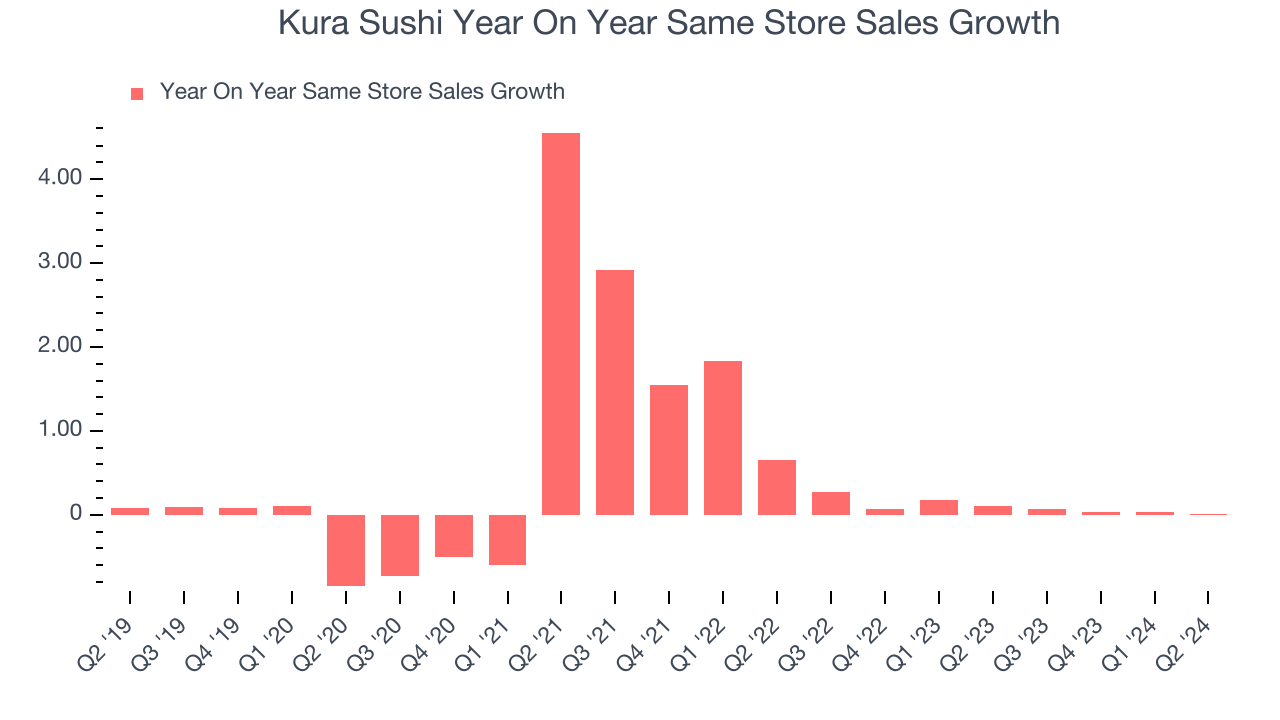

Kura Sushi's demand has outpaced the broader restaurant sector over the last eight quarters. On average, the company has grown its same-store sales by a robust 9.5% year on year. With positive same-store sales growth amid an increasing number of restaurants, Kura Sushi is reaching more diners and growing sales.

In the latest quarter, Kura Sushi's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 10.3% year-on-year increase it posted 12 months ago. We'll be watching Kura Sushi closely to see if it can reaccelerate growth.

Key Takeaways from Kura Sushi's Q2 Results

We struggled to find many strong positives in these results. Its revenue, gross margin, and EPS missed analysts' expectations. Overall, this was a mediocre quarter for Kura Sushi. The stock remained flat at $59.04 immediately after reporting.

So should you invest in Kura Sushi right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.