Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Kura Sushi (NASDAQ:KRUS) and the best and worst performers in the sit-down dining industry.

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 13 sit-down dining stocks we track reported a slower Q2. As a group, revenues were in line with analysts’ consensus estimates.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

sit-down dining stocks have held steady amidst all this with average share prices relatively unchanged since the latest earnings results.

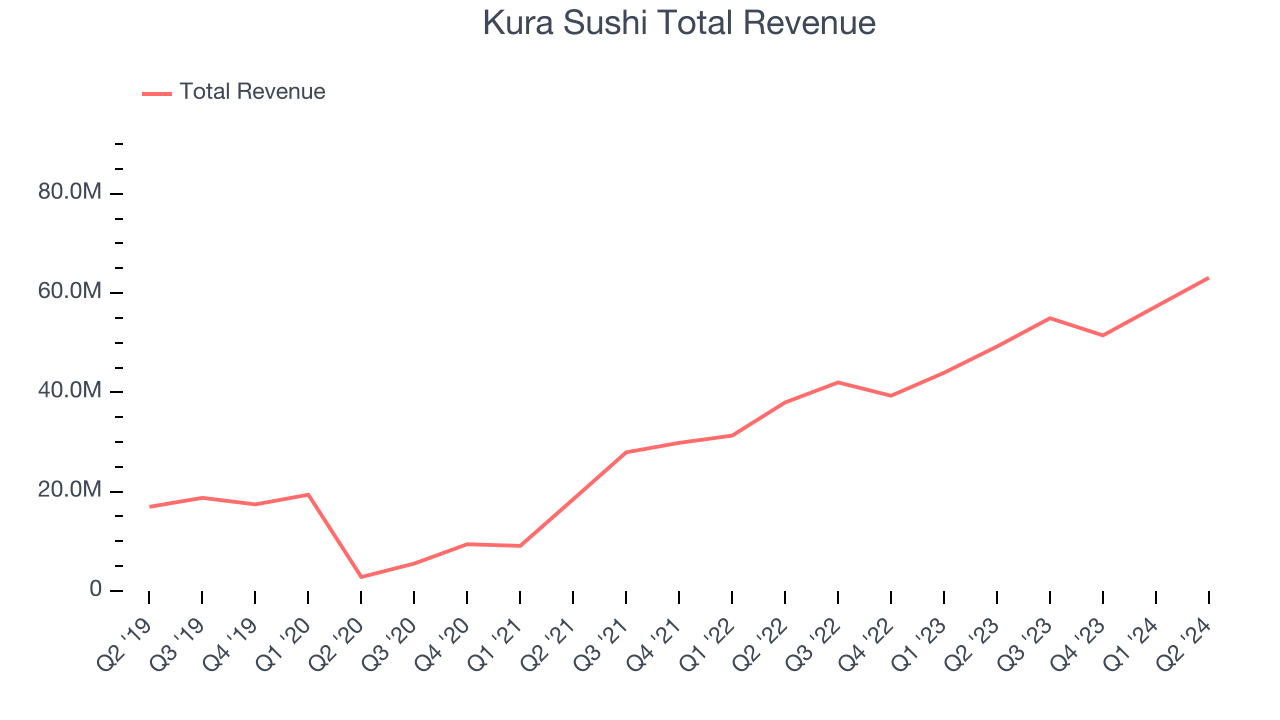

Kura Sushi (NASDAQ:KRUS)

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ:KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

Kura Sushi reported revenues of $63.08 million, up 28.1% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a miss of analysts’ earnings estimates and full-year revenue guidance missing analysts’ expectations.

Hajime Uba, President and Chief Executive Officer of Kura Sushi, stated, “We believe the current headwinds are macro-driven and transitory, but with the difficulty in predicting the duration of macroeconomic shifts, we believe the most prudent course of action is to position ourselves to be able to continue to deliver strong financial results and uninterrupted progress on our core strategic goals of at least 20% annual unit growth, G&A leverage, and operational excellence regardless of the broader economic environment. While the third quarter results were unexpected, nothing has changed about Kura Sushi’s tremendous potential.”

Interestingly, the stock is up 42.2% since reporting and currently trades at $83.28.

Read our full report on Kura Sushi here, it’s free.

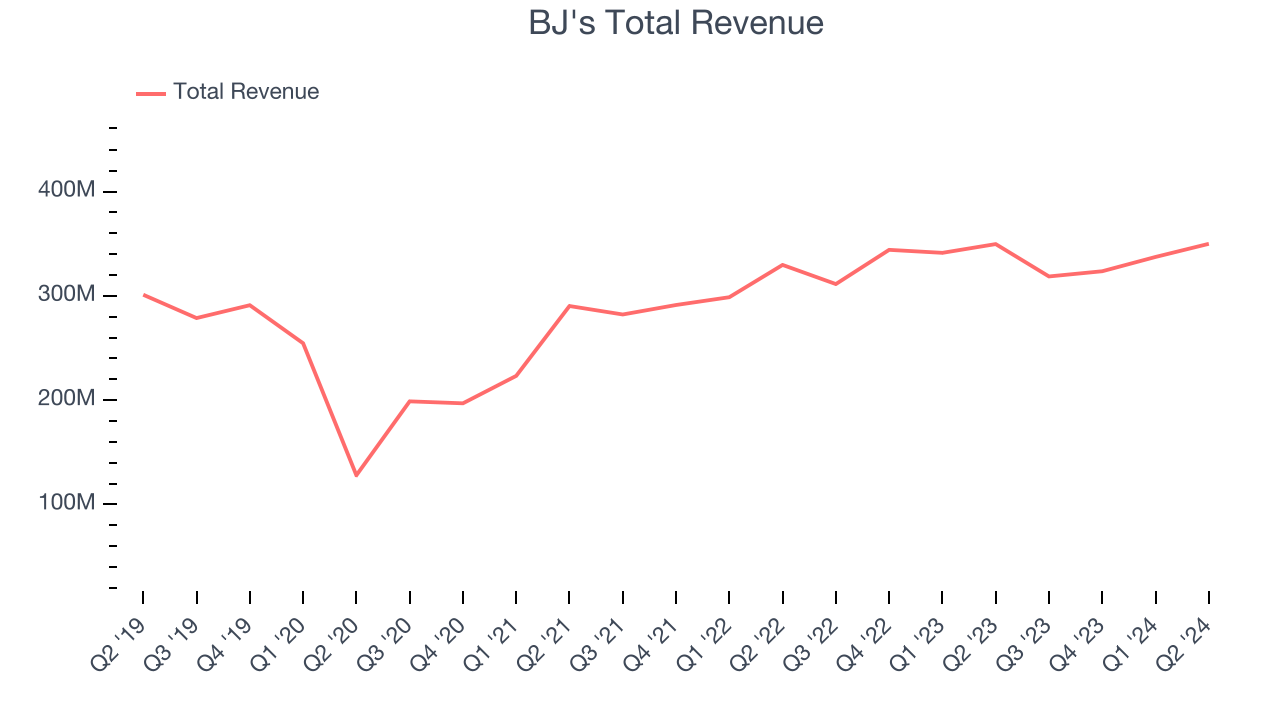

Best Q2: BJ's (NASDAQ:BJRI)

Founded in 1978 in California, BJ’s Restaurants (NASDAQ:BJRI) is a chain of restaurants whose menu features classic American dishes, often with a twist.

BJ's reported revenues of $349.9 million, flat year on year, in line with analysts’ expectations. The business had a very strong quarter with a solid beat of analysts’ earnings estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 18.6% since reporting. It currently trades at $30.33.

Is now the time to buy BJ's? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Denny's (NASDAQ:DENN)

Open around the clock, Denny’s (NASDAQ:DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

Denny's reported revenues of $115.9 million, flat year on year, falling short of analysts’ expectations by 2.6%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

As expected, the stock is down 13.6% since the results and currently trades at $6.63.

Read our full analysis of Denny’s results here.

First Watch (NASDAQ:FWRG)

Based on a nautical reference to the first work shift aboard a ship, First Watch (NASDAQ:FWRG) is a chain of breakfast and brunch restaurants whose menu is heavily-focused on eggs and griddle items such as pancakes.

First Watch reported revenues of $258.6 million, up 19.5% year on year. This number was in line with analysts’ expectations. It was a strong quarter as it also put up a solid beat of analysts’ earnings estimates.

The stock is up 9.7% since reporting and currently trades at $15.66.

Read our full, actionable report on First Watch here, it’s free.

Red Robin (NASDAQ:RRGB)

Known for its bottomless steak fries, Red Robin (NASDAQ:RRGB) is a chain of casual restaurants specializing in burgers and general American fare.

Red Robin reported revenues of $300.2 million, flat year on year. This result beat analysts’ expectations by 2.7%. Overall, it was a strong quarter as it also put up full-year revenue guidance topping analysts’ expectations.

The stock is down 7.2% since reporting and currently trades at $4.40.

Read our full, actionable report on Red Robin here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.