Sushi restaurant chain Kura Sushi (NASDAQ:KRUS) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 30.4% year on year to $57.29 million. The company expects the full year's revenue to be around $244.5 million, in line with analysts' estimates. It made a GAAP loss of $0.09 per share, improving from its loss of $0.10 per share in the same quarter last year.

Kura Sushi (KRUS) Q1 CY2024 Highlights:

- Revenue: $57.29 million vs analyst estimates of $56.64 million (1.1% beat)

- EPS: -$0.09 vs analyst estimates of -$0.04 (-$0.05 miss)

- The company lifted its revenue guidance for the full year from $241.5 million to $244.5 million at the midpoint, a 1.2% increase

- Gross Margin (GAAP): 16.2%, down from 18% in the same quarter last year

- Same-Store Sales were up 3% year on year

- Store Locations: 60 at quarter end, increasing by 15 over the last 12 months

- Market Capitalization: $1.16 billion

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ:KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

It was originally established in 1977 as a modest 40-seat sushi restaurant in Osaka, Japan. Founder Kunihiko Tanaka aimed to provide quality sushi at an affordable price while ensuring a unique dining experience for customers. The uniqueness came by way of the conveyor belt, which not only entertained customers but also allowed them to efficiently pick dishes.

Today, Kura Sushi continues to focus on providing high-quality sushi at affordable prices. There are recognizable items such as the salmon skin roll and the spicy tuna roll as well as soups and noodles. Innovation also remains a focus, and Kura Sushi boasts touch screen ordering and digital payment capabilities.

The core Kura Sushi customer is a mix of sushi aficionados looking for an affordable yet authentic experience, tech-savvy diners who appreciate the digital integration, and families who find the conveyor belt model fun and engaging. Kura Sushi locations tend to be a mix of futuristic and cozy. Seating is primarily arranged around the famous conveyor belt, allowing every customer direct access to the moving dishes. In addition, there are booths and tables where families or larger groups can sit together more comfortably. The aesthetic is modern and bright, with hints of traditional Japanese design elements.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

There are no other publicly-traded sushi restaurant chains, but competitors offering entertaining or lively dining experiences include El Pollo Loco (NASDAQ:LOCO), Brinker International (NYSE:EAT), Dine Brands (NYSE:DIN), and The Cheesecake Factory (NASDAQ:CAKE). Sushi Land is a private sushi chain that competes with Kura Sushi.Sales Growth

Kura Sushi is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

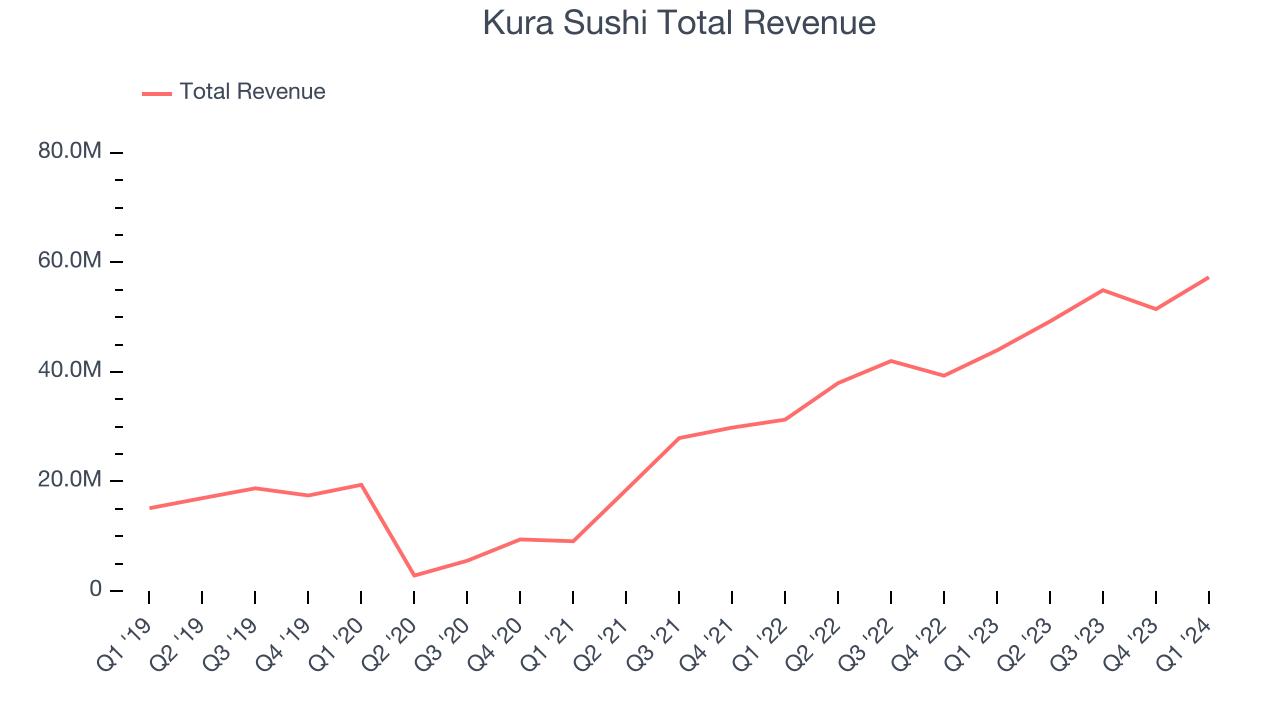

As you can see below, the company's annualized revenue growth rate of 30.2% over the last five years was incredible as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Kura Sushi reported wonderful year-on-year revenue growth of 30.4%, and its $57.29 million in revenue exceeded Wall Street's estimates by 1.1%. Looking ahead, Wall Street expects sales to grow 27.2% over the next 12 months, a deceleration from this quarter.

Number of Stores

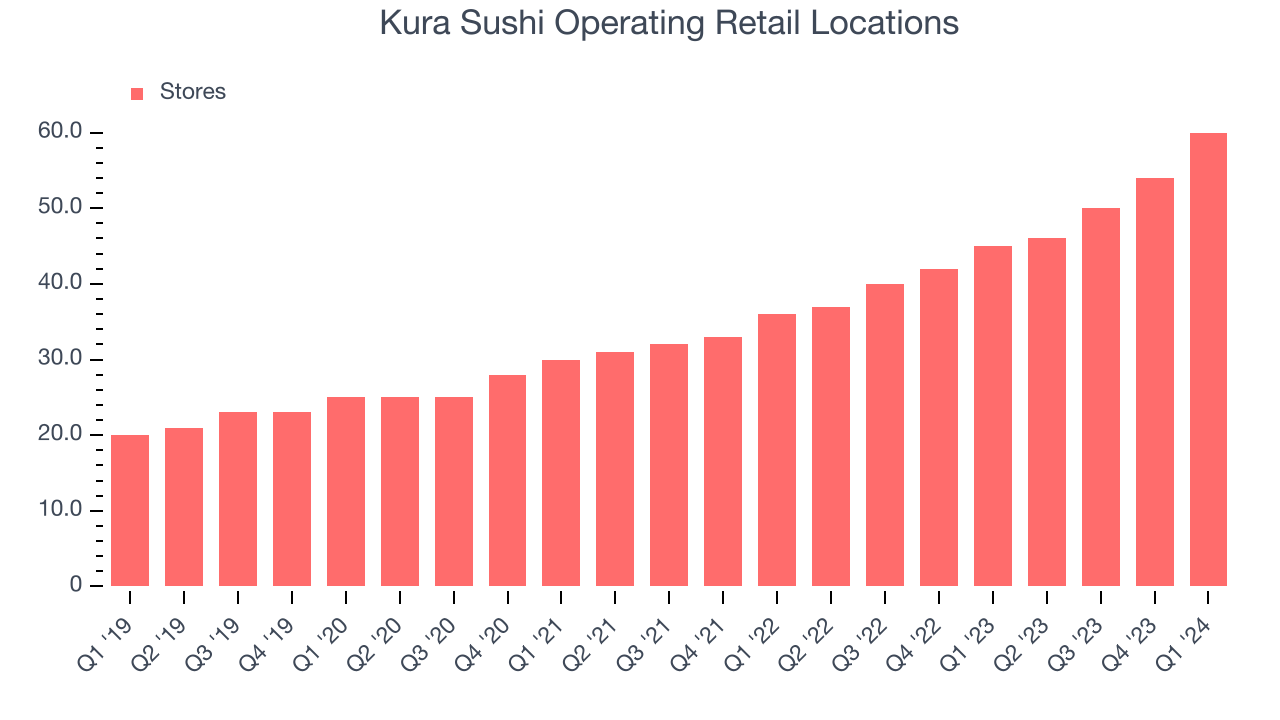

When a chain like Kura Sushi is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Since last year, Kura Sushi's restaurant count increased by 15, or 33.3%, to 60 locations in the most recently reported quarter.

Taking a step back, Kura Sushi has rapidly opened new restaurants over the last eight quarters, averaging 26% annual increases in new locations. This growth is much higher than other restaurant businesses and gives Kura Sushi a chance to scale towards a mid-sized company over time. Analyzing a restaurant's location growth is important because expansion means Kura Sushi has more opportunities to feed customers and generate sales.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for restaurants.

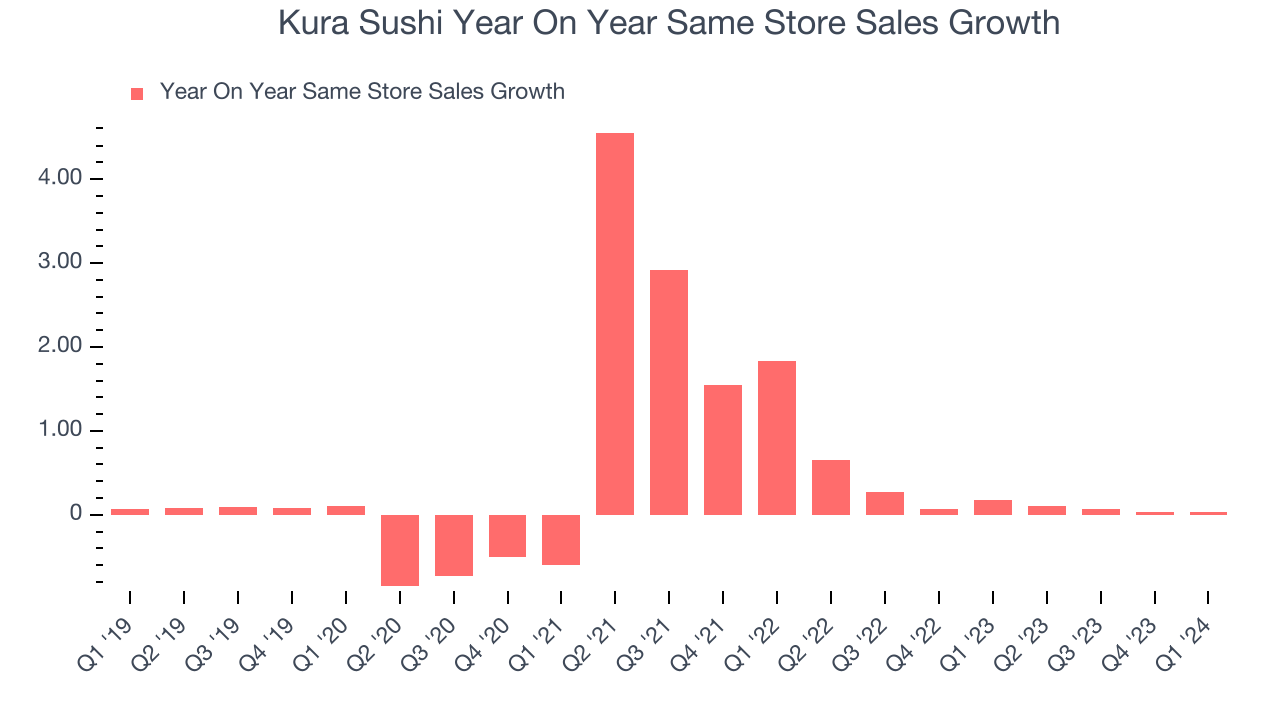

Kura Sushi has been one of the most successful restaurants over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 17.6%. This performance suggests its rapid buildout of new restaurants is justified. When a chain has strong demand, more locations should help it reach more customers seeking its meals and boost revenue growth.

In the latest quarter, Kura Sushi's same-store sales rose 3% year on year. By the company's standards, this growth was a meaningful deceleration from the 17.4% year-on-year increase it posted 12 months ago. We'll be watching Kura Sushi closely to see if it can reaccelerate growth.

Gross Margin & Pricing Power

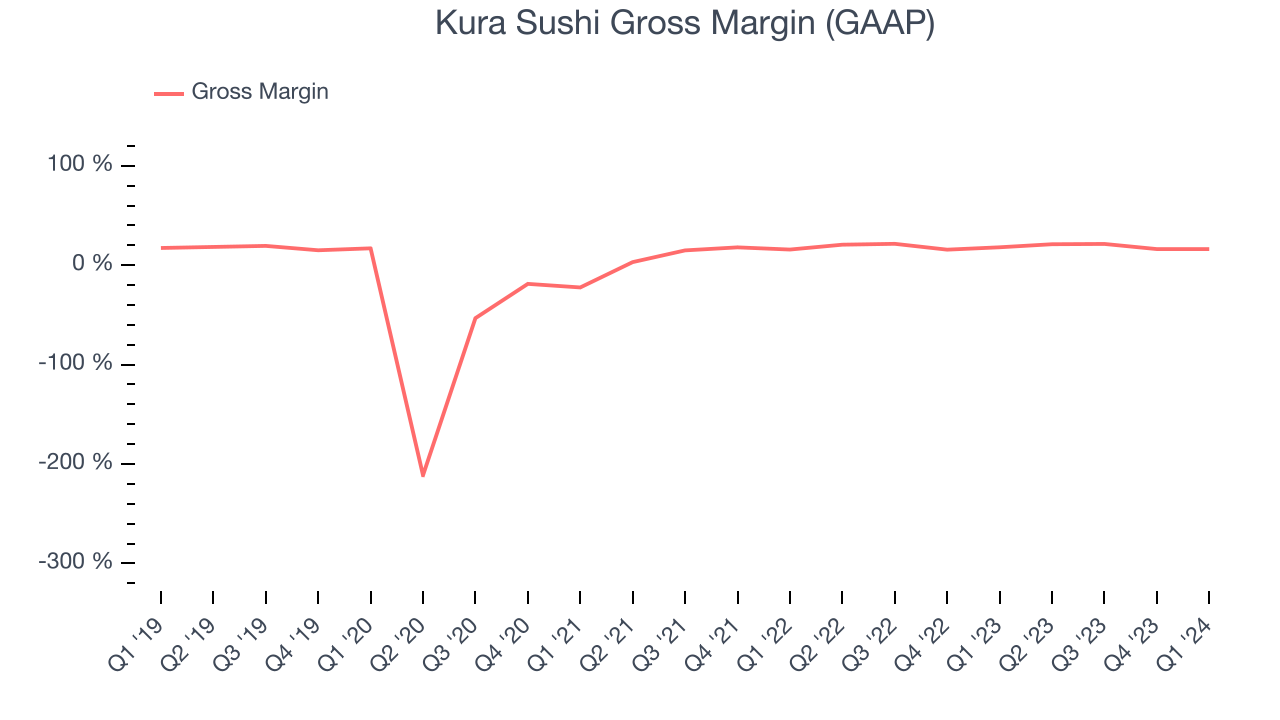

In Q1, Kura Sushi's gross profit margin was 16.2%. down 1.8 percentage points year on year. This means the company makes $0.19 for every $1 in revenue before accounting for its operating expenses.

Kura Sushi has poor unit economics for a restaurant company, leaving it with little room for error if things go awry. As you can see above, it's averaged a 18.8% gross margin over the last two years. Its margin has also been trending down over the last year, averaging 1.2% year-on-year decreases each quarter. If this trend continues, it could suggest a more competitive environment where Kura Sushi has diminishing pricing power and less favorable input costs (such as ingredients and transportation expenses).

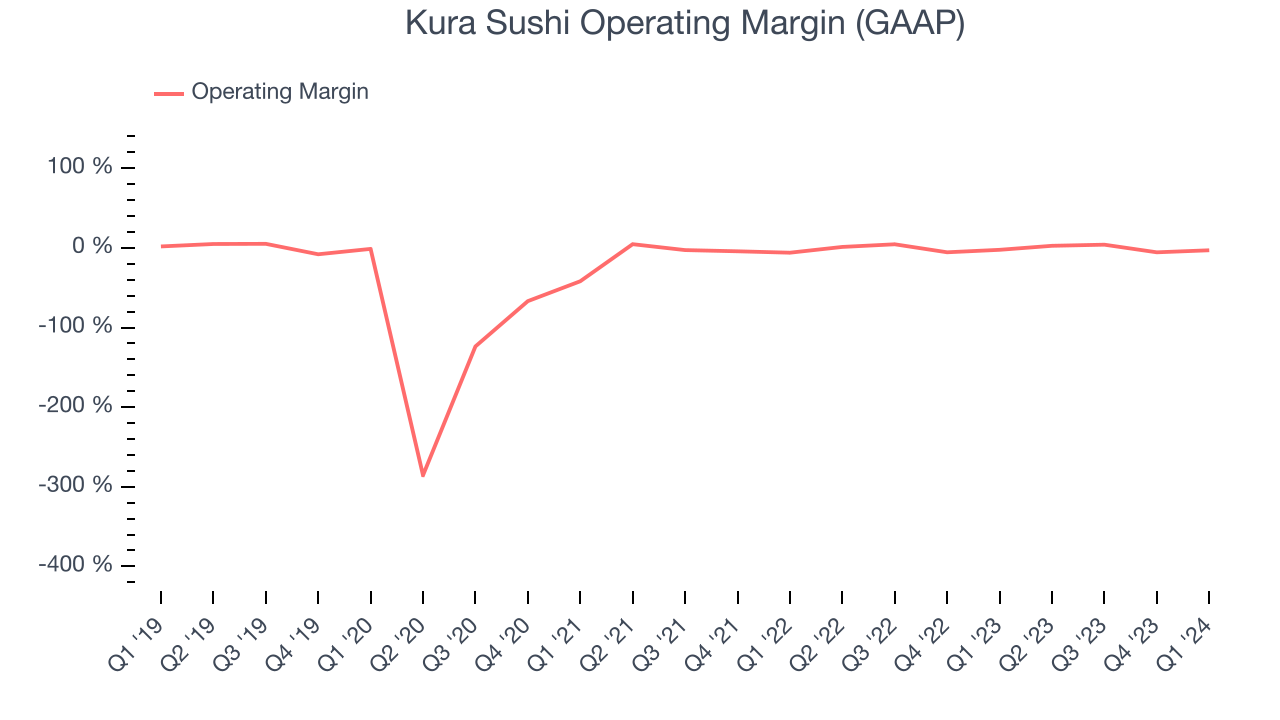

Operating Margin

Operating margin is an important measure of profitability for restaurants as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Kura Sushi generated an operating profit margin of negative 2.9%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

The restaurant business is tough to succeed in because of its unpredictability, whether it be employees not showing up for work, sudden changes in consumer preferences, or the cost of ingredients rising thanks to supply shortages. Unfortunately, Kura Sushi has been a victim of these challenges over the last two years, and its high expenses have contributed to an average operating margin of negative 0.5%. On top of that, Kura Sushi's margin has remained more or less the same, showing the company needs to change something about its operating practices.

The restaurant business is tough to succeed in because of its unpredictability, whether it be employees not showing up for work, sudden changes in consumer preferences, or the cost of ingredients rising thanks to supply shortages. Unfortunately, Kura Sushi has been a victim of these challenges over the last two years, and its high expenses have contributed to an average operating margin of negative 0.5%. On top of that, Kura Sushi's margin has remained more or less the same, showing the company needs to change something about its operating practices.EPS

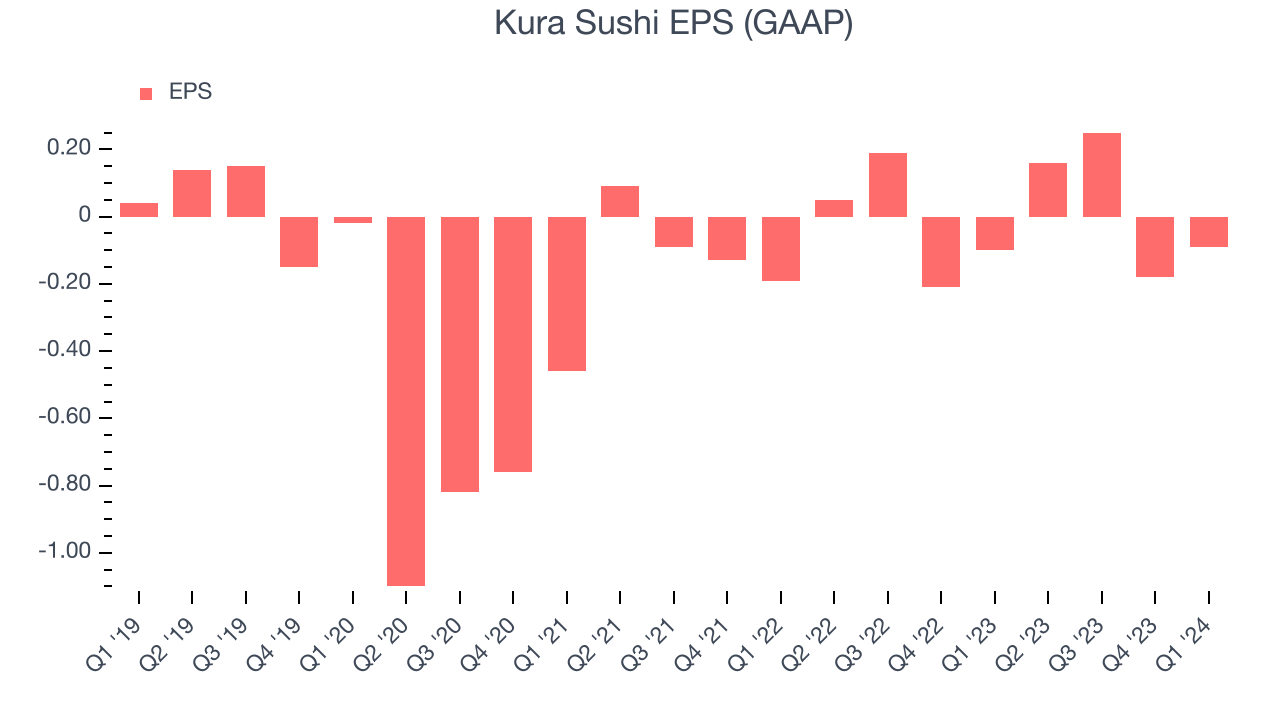

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Kura Sushi reported EPS at negative $0.09, up from negative $0.10 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 280% year-on-year increase in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Kura Sushi's five-year average ROIC was negative 16.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Kura Sushi's ROIC averaged 35 percentage point increases each year. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Key Takeaways from Kura Sushi's Q1 Results

It was good to see Kura Sushi beat analysts' revenue estimates as it opened five new restaurants during the quarter. On the other hand, its EPS missed Wall Street's expectations, but the market doesn't seem to care because the company lifted its full-year revenue guidance after providing it for the first time just last quarter.

Given management's confidence in the business, Kura Sushi will continue rapidly opening new restaurants (it's opened 10 new locations to date). Furthermore, the company announced a new project with DoorDash to deliver its meals. Both these facts show it is pursuing a high-growth strategy.

Zooming out, we think this was a decent quarter, showing that the company is staying on track. The stock is up 2.7% after reporting and currently trades at $106.99 per share.

Is Now The Time?

Kura Sushi may have had a mediocre quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Kura Sushi isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been exceptional over the last five years, its brand caters to a niche market. And while its new restaurant openings have increased its brand equity, the downside is its declining EPS over the last five years makes it hard to trust.

Kura Sushi's price-to-earnings ratio based on the next 12 months is 243.3x. We can find things to like about Kura Sushi and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $99.33 per share right before these results (compared to the current share price of $107), implying they didn't see much short-term potential in Kura Sushi.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.