Aerospace and defense company Kratos (NASDAQ:KTOS) met Wall Street’s revenue expectations in Q3 CY2024, but sales were flat year on year at $275.9 million. On the other hand, next quarter’s revenue guidance of $282.5 million was less impressive, coming in 2.7% below analysts’ estimates. Its non-GAAP profit of $0.11 per share was 31.9% above analysts’ consensus estimates.

Is now the time to buy Kratos? Find out by accessing our full research report, it’s free.

Kratos (KTOS) Q3 CY2024 Highlights:

- Revenue: $275.9 million vs analyst estimates of $277.2 million (in line)

- Adjusted EPS: $0.11 vs analyst estimates of $0.08 (31.9% beat)

- EBITDA: $24.6 million vs analyst estimates of $22.18 million (10.9% beat)

- Revenue Guidance for Q4 CY2024 is $282.5 million at the midpoint, below analyst estimates of $290.4 million

- EBITDA guidance for the full year is $104.5 million at the midpoint, below analyst estimates of $107 million

- Gross Margin (GAAP): 25.1%, down from 26.7% in the same quarter last year

- Operating Margin: 2.4%, down from 4.4% in the same quarter last year

- EBITDA Margin: 8.9%, down from 10.1% in the same quarter last year

- Free Cash Flow was -$9.2 million compared to -$14.3 million in the same quarter last year

- Market Capitalization: $3.66 billion

Eric DeMarco, Kratos’ President and CEO, said, “Kratos’ strategy of making internally funded investments, to be first to market with relevant hardware, software and systems, in coordination with our partners and customers is working, as reflected in our financial results and our $12 billion opportunity pipeline. A recent representative example of this success is the successful flight of Kratos’ Zeus 1 and Zeus 2 system solid rocket motor stack with our customer’s payload, positioning Kratos for potential growth above our current future revenue year over year 10% target beginning in 2026.”

Company Overview

Established with a commitment to supporting national security, Kratos (NASDAQ:KTOS) is a provider of advanced engineering, technology, and security solutions tailored for critical national security applications.

Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

Sales Growth

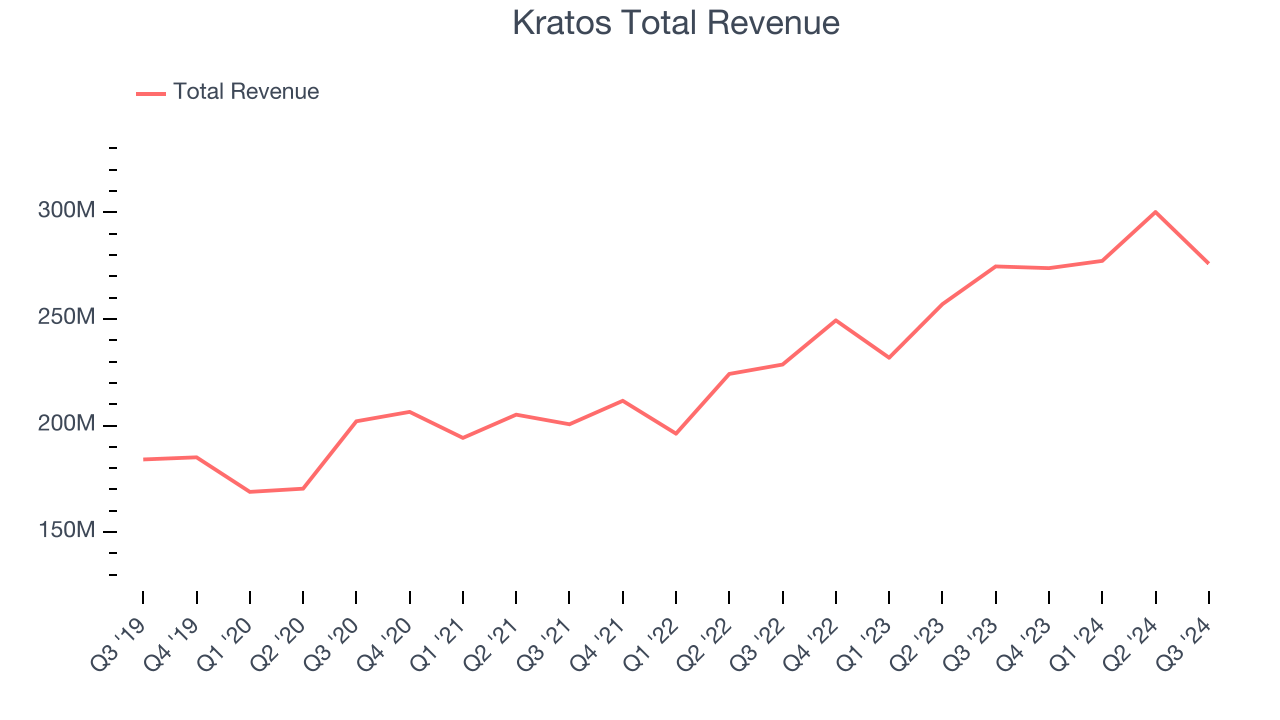

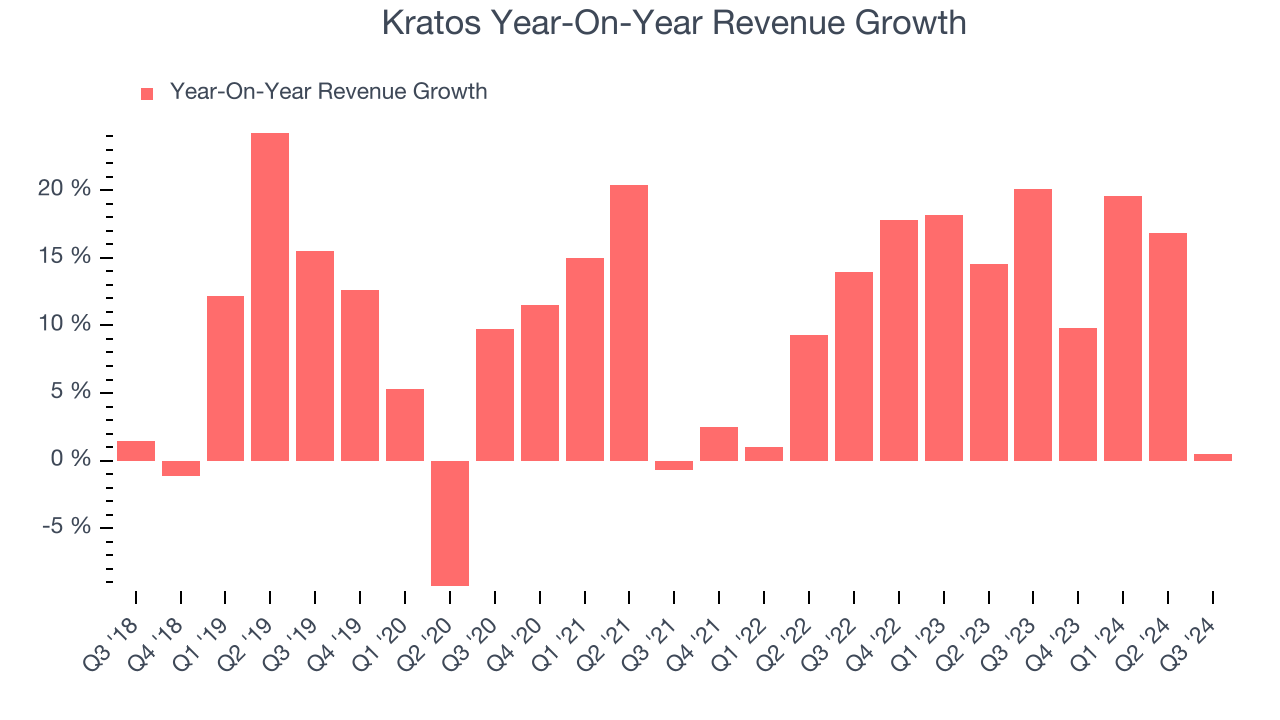

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Luckily, Kratos’s sales grew at a solid 10.1% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Kratos’s annualized revenue growth of 14.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Kratos’s $275.9 million of revenue was flat year on year and in line with Wall Street’s estimates. Management is currently guiding for a 3.2% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.1% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and indicates the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

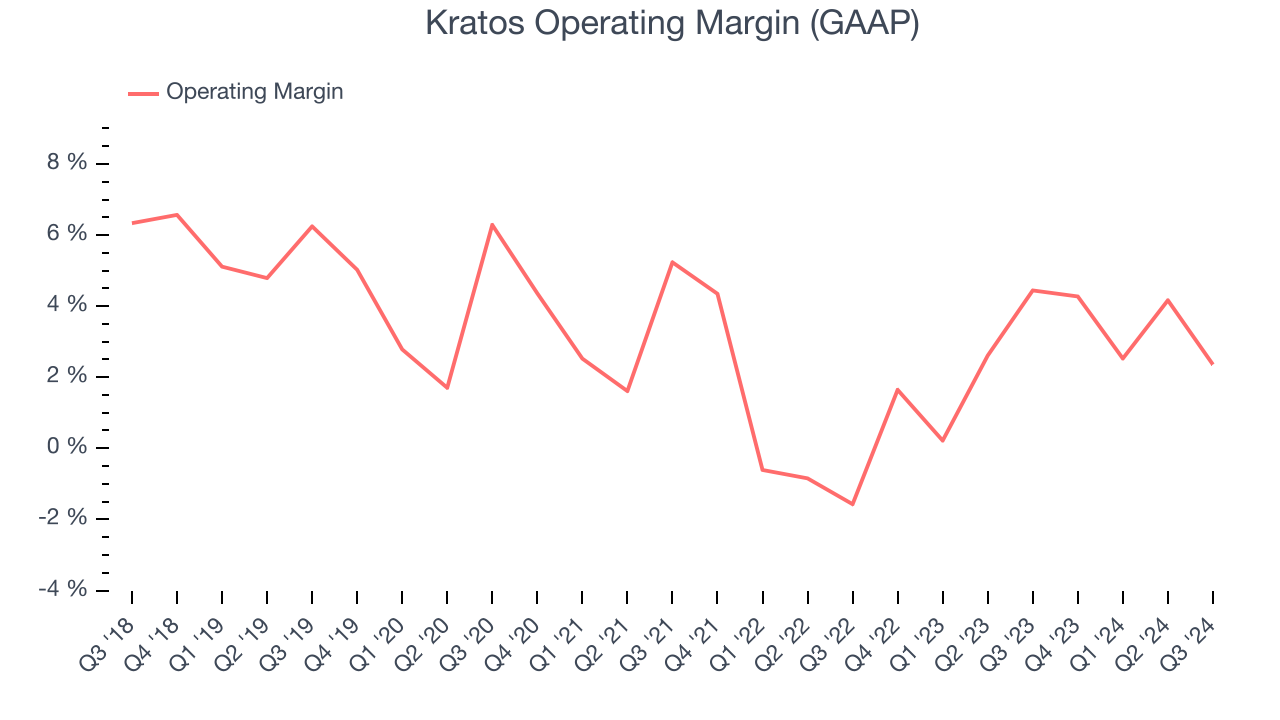

Kratos was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.7% was weak for an industrials business.

Looking at the trend in its profitability, Kratos’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business to change.

In Q3, Kratos generated an operating profit margin of 2.4%, down 2.1 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

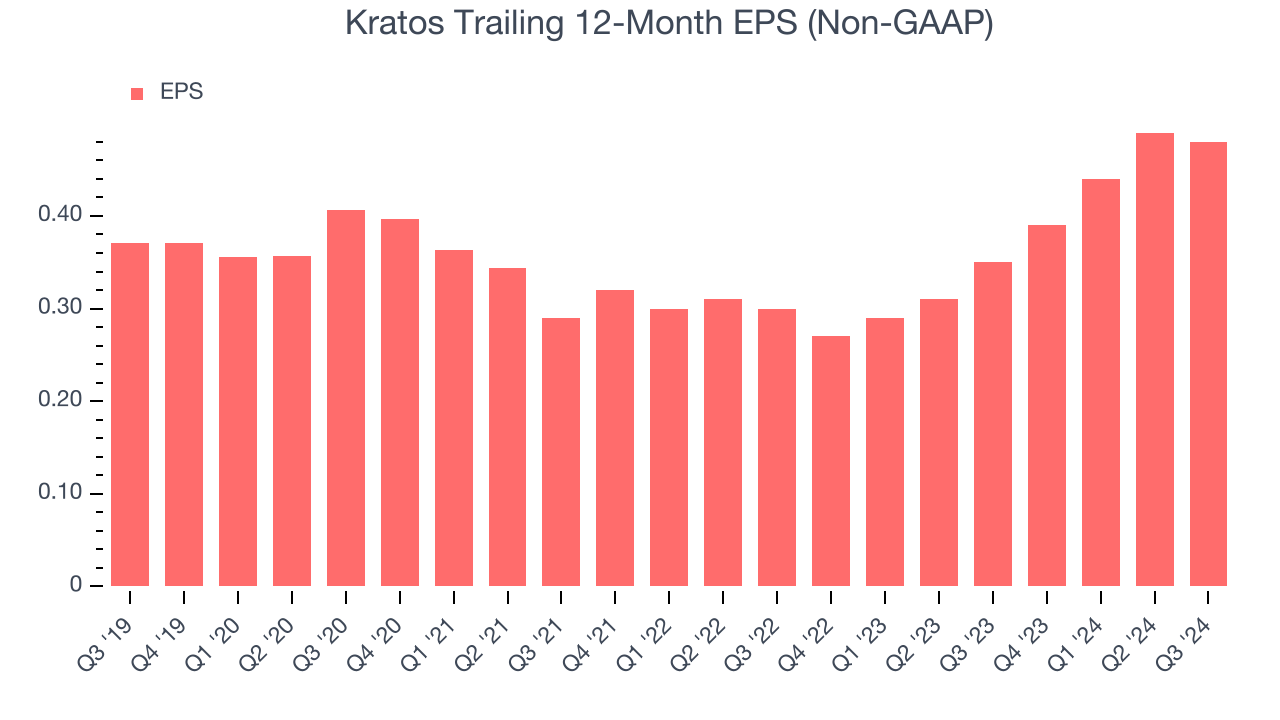

Kratos’s EPS grew at an unimpressive 5.3% compounded annual growth rate over the last five years, lower than its 10.1% annualized revenue growth. However, its operating margin didn’t change during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

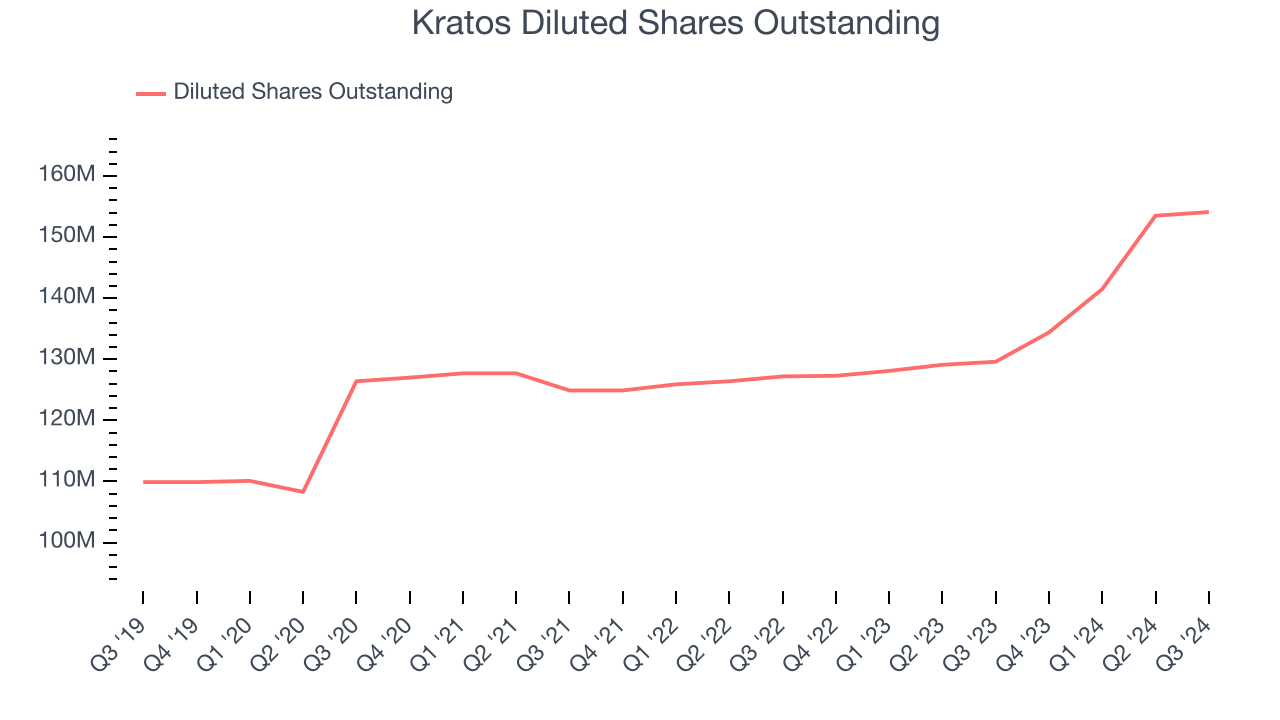

Diving into the nuances of Kratos’s earnings can give us a better understanding of its performance. A five-year view shows Kratos has diluted its shareholders, growing its share count by 40.2%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Kratos, its two-year annual EPS growth of 26.5% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Kratos reported EPS at $0.11, down from $0.12 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Kratos’s full-year EPS of $0.48 to grow by 9.3%.

Key Takeaways from Kratos’s Q3 Results

We were impressed by how significantly Kratos blew past analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue and EBITDA forecast for next quarter missed fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 1% to $24.18 immediately after reporting.

So should you invest in Kratos right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.