Specialty food company Lancaster Colony (NASDAQ:LANC) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 1.4% year on year to $471.4 million. It made a GAAP profit of $1.03 per share, improving from its profit of $0.89 per share in the same quarter last year.

Is now the time to buy Lancaster Colony? Find out by accessing our full research report, it's free.

Lancaster Colony (LANC) Q1 CY2024 Highlights:

- Revenue: $471.4 million vs analyst estimates of $468.2 million (small beat)

- Operating profit: $47.3 million vs analyst estimates of $48.6 million (2.7% miss)

- EPS: $1.03 vs analyst expectations of $1.40 (26.3% miss)

- No guidance given but management anticipates "Retail sales will continue to benefit from our licensing program, including incremental growth from the recent additions of Subway and Texas Roadhouse sauces. In the Foodservice segment, we expect continued volume growth from select quick-service restaurant customers and our branded Foodservice products, while deflationary pricing is projected to remain a headwind to Foodservice segment net sales"

- Gross Margin (GAAP): 22.2%, up from 20.3% in the same quarter last year

- Sales Volumes were up 1.5% year on year

- Market Capitalization: $5.27 billion

CEO David A. Ciesinski commented, “We completed our fiscal third quarter with record net sales of $471.4 million. In the Retail segment, net sales increased 0.3% to $248.1 million driven by volume gains for our successful licensing program, led by Chick-fil-A® sauces and dressings; our newly introduced Subway® sandwich sauces and Texas Roadhouse® steak sauces; and Olive Garden® dressings. Sales volume for the Retail segment, measured in pounds shipped, increased 1.5%, outpacing the sales dollar growth as we invested in trade spending that supported household penetration growth and new items. Retail segment sales compare to a strong quarter last year when net sales increased 16.0% and volume was up 6.1%. In our Foodservice segment, net sales increased 2.6% to $223.4 million while Foodservice sales volume grew 3.9% as increased demand from several of our national chain restaurant customers and volume gains for our Marzetti® branded Foodservice products more than offset deflationary pricing in the segment.”

Known for its frozen garlic bread and Parkerhouse rolls, Lancaster Colony (NASDAQ:LANC) sells bread, dressing, and dips to the retail and food service channels.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

Lancaster Colony carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Lancaster Colony can still achieve high growth rates because its revenue base is not yet monstrous.

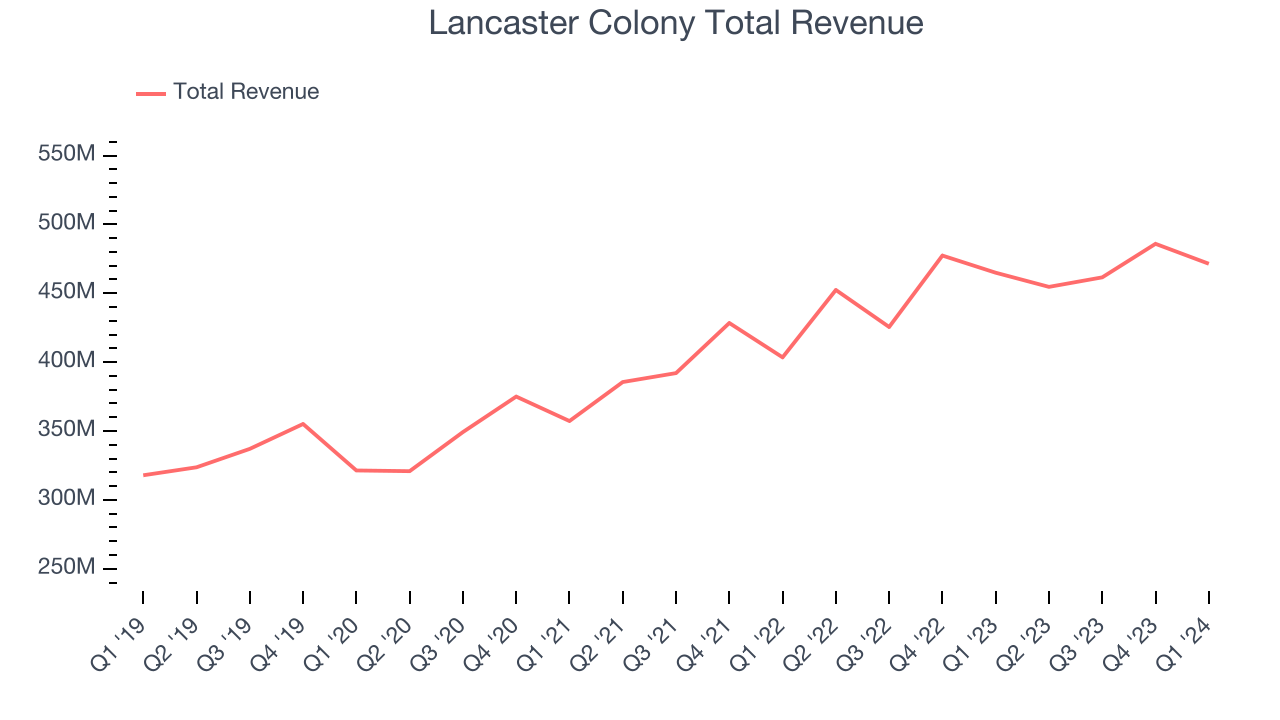

As you can see below, the company's annualized revenue growth rate of 10.1% over the last three years was decent for a consumer staples business.

This quarter, Lancaster Colony grew its revenue by 1.4% year on year, and its $471.4 million in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

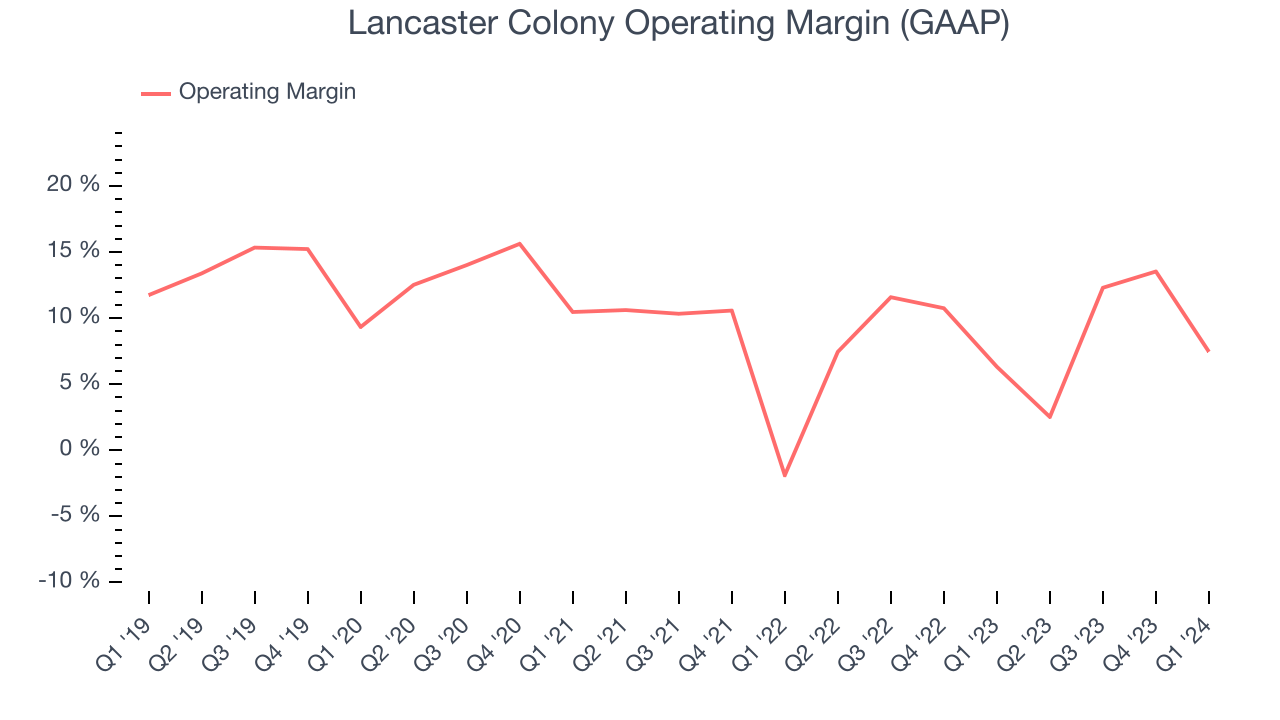

In Q1, Lancaster Colony generated an operating profit margin of 7.5%, up 1.1 percentage points year on year. This increase was encouraging, and we can infer Lancaster Colony had stronger pricing power and lower raw materials/transportation costs because its gross margin expanded more than its operating margin.

Zooming out, Lancaster Colony has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 9%, higher than the broader consumer staples sector. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. The company's operating profitability was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes tectonic shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Lancaster Colony).

Zooming out, Lancaster Colony has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 9%, higher than the broader consumer staples sector. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. The company's operating profitability was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes tectonic shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Lancaster Colony).Key Takeaways from Lancaster Colony's Q1 Results

It was encouraging to see Lancaster Colony narrowly top analysts' revenue expectations this quarter. On the other hand, its operating profit and operating margin missed analysts' expectations, leading to lower-than-expected EPS. Overall, the results could have been better. The stock is flat after reporting and currently trades at $191.43 per share.

So should you invest in Lancaster Colony right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.