Luxury electric car manufacturer Lucid (NASDAQ:LCID) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 45.2% year on year to $200 million. Its non-GAAP loss of $0.28 per share was 9.7% above analysts’ consensus estimates.

Is now the time to buy Lucid? Find out by accessing our full research report, it’s free.

Lucid (LCID) Q3 CY2024 Highlights:

- Revenue: $200 million vs analyst estimates of $198.1 million (in line)

- Adjusted EPS: -$0.28 vs analyst estimates of -$0.31

- EBITDA: -$613.1 million vs analyst estimates of -$613.8 million (small beat)

- Gross Margin (GAAP): -106%, up from -241% in the same quarter last year

- Operating Margin: -385%, up from -546% in the same quarter last year

- EBITDA Margin: -306%, up from -453% in the same quarter last year

- Free Cash Flow was -$622.5 million compared to -$706.1 million in the same quarter last year

- Sales Volumes rose 90.9% year on year (4.2% in the same quarter last year)

- Market Capitalization: $6.41 billion

"Our momentum continues with our third consecutive quarter of record deliveries," said Peter Rawlinson, CEO and CTO at Lucid.

Company Overview

Lucid (NASDAQ:LCID) produces luxury electric vehicles that combine high-end design with electric technology.

Automobile Manufacturers

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

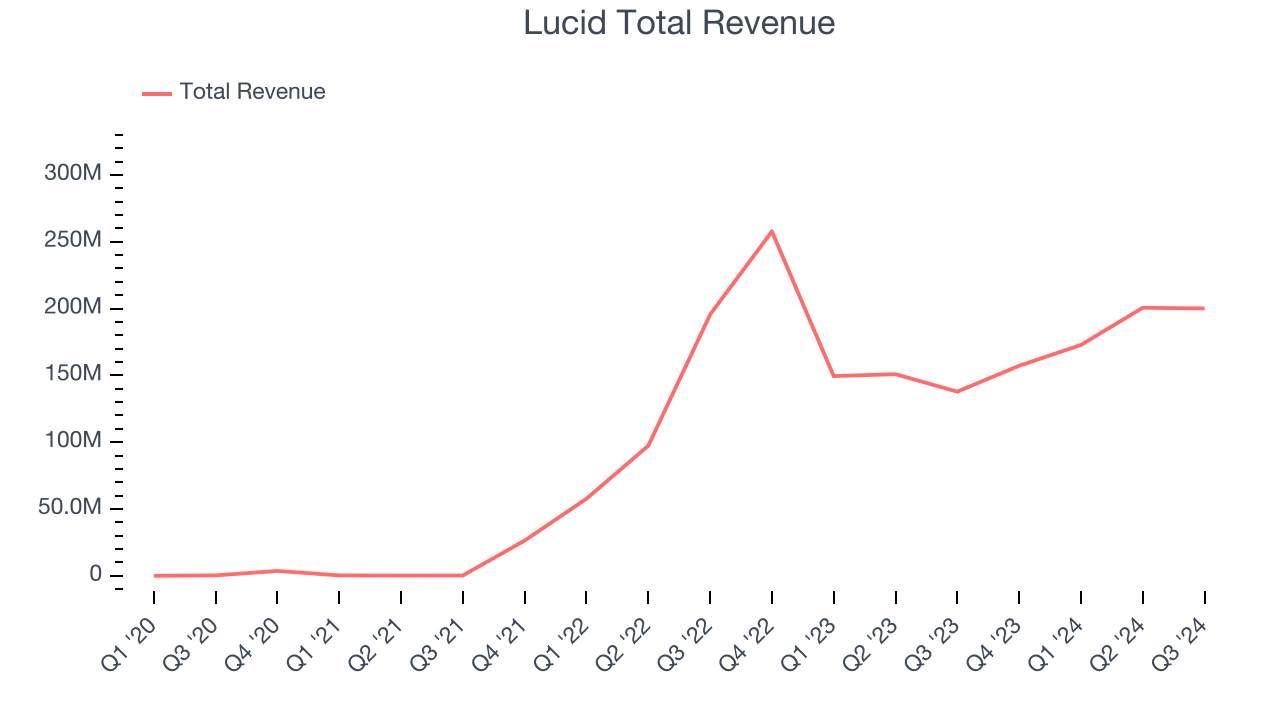

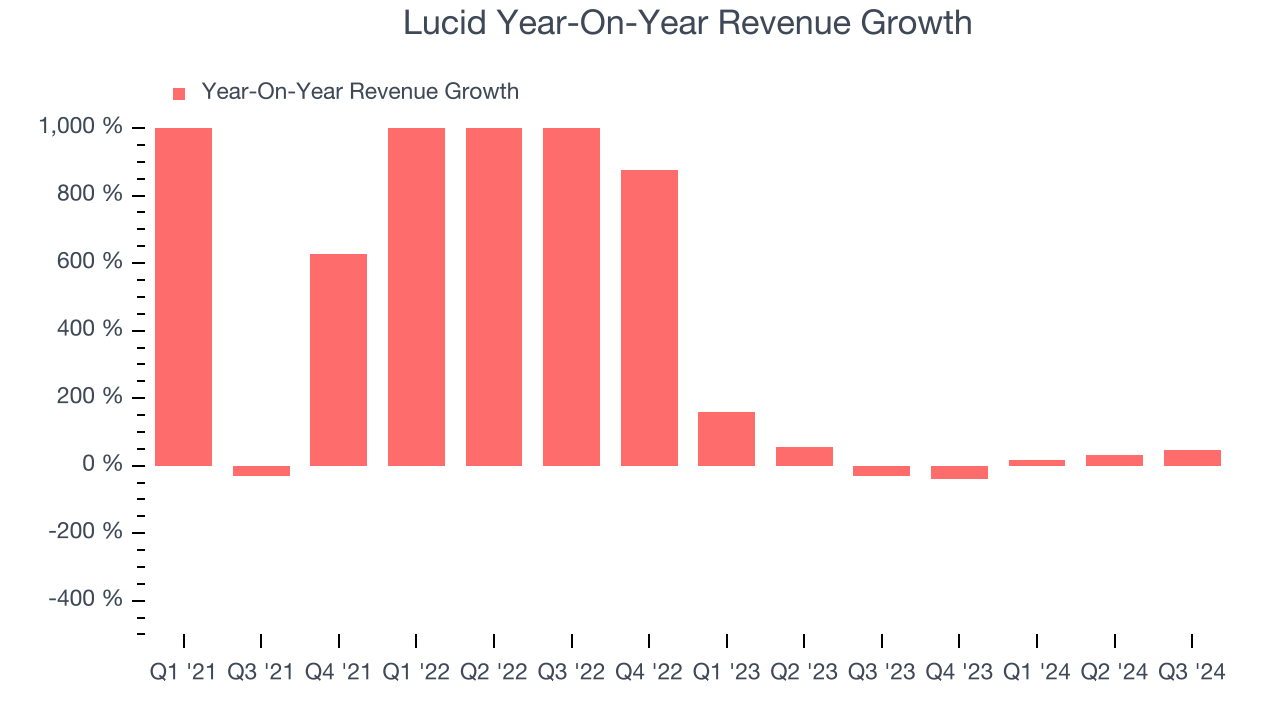

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Lucid grew its sales at an incredible 452% compounded annual growth rate. This is a great starting point for our analysis because it shows Lucid’s offerings resonate with customers.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Lucid’s annualized revenue growth of 39.2% over the last two years is below its three-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Lucid’s year-on-year revenue growth of 45.2% was magnificent, and its $200 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 87.3% over the next 12 months, an improvement versus the last two years. This projection is admirable and shows the market thinks its newer products and services will catalyze higher growth rates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

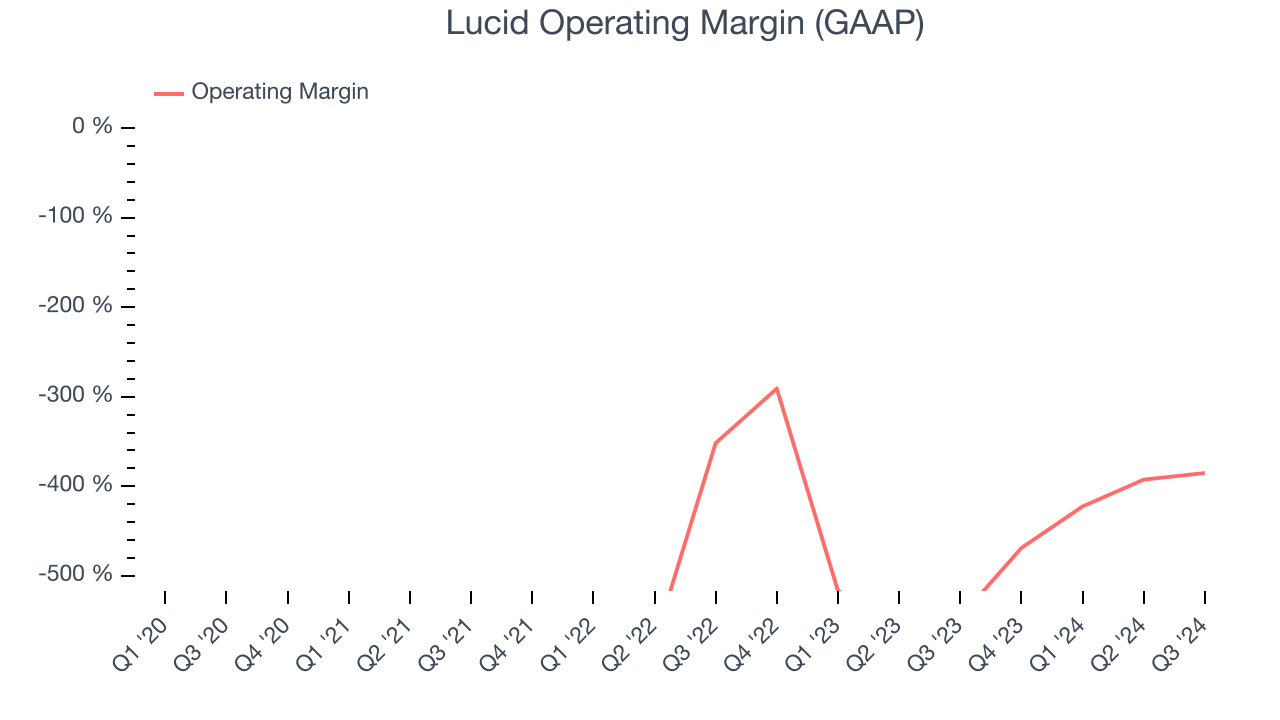

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Lucid’s high expenses have contributed to an average operating margin of negative 553% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Lucid’s annual operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

Lucid’s operating margin was negative 385% this quarter. The company's lack of profits raise a flag.

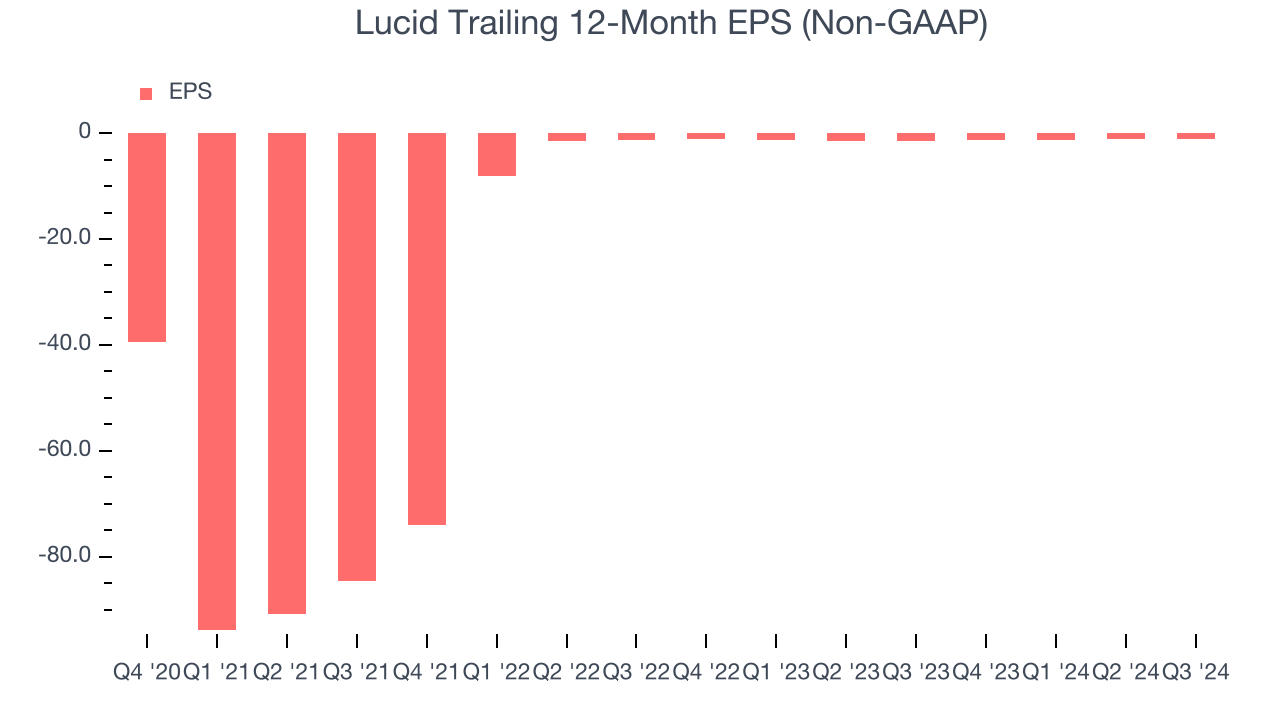

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Although Lucid’s full-year earnings are still negative, it reduced its losses and improved its EPS by 57.9% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Lucid, its two-year annual EPS growth of 8.3% was lower than its four-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.In Q3, Lucid reported EPS at negative $0.28, in line with the same quarter last year. This print beat analysts’ estimates by 9.7%. Over the next 12 months, Wall Street expects Lucid to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.18 will advance to negative $1.11.

Key Takeaways from Lucid’s Q3 Results

We were impressed by how significantly Lucid blew past analysts’ volume expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.8% to $2.37 immediately following the results.

Lucid had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.