Pool products retailer Leslie’s (NASDAQ:LESL) reported results ahead of analysts' expectations in Q1 FY2024, with revenue down 10.8% year on year to $174 million. The company expects the full year's revenue to be around $1.44 billion, in line with analysts' estimates. It made a non-GAAP loss of $0.20 per share, down from its loss of $0.14 per share in the same quarter last year.

Leslie's (LESL) Q1 FY2024 Highlights:

- Revenue: $174 million vs analyst estimates of $169.6 million (2.6% beat)

- EPS (non-GAAP): -$0.20 vs analyst estimates of -$0.21 (2.9% beat)

- The company reconfirmed its revenue guidance for the full year of $1.44 billion at the midpoint

- Free Cash Flow was -$82.61 million compared to -$190.1 million in the same quarter last year

- Gross Margin (GAAP): 29%, down from 33.5% in the same quarter last year

- Same-Store Sales were down 11.7% year on year

- Store Locations: 1,000 at quarter end, increasing by 8 over the last 12 months

- Market Capitalization: $1.24 billion

Named after founder Philip Leslie, who established the company in 1963, Leslie’s (NASDAQ:LESL) is a retailer that sells pool and spa supplies, equipment, and maintenance services.

The core customer is therefore a homeowner or commercial property manager who must maintain pools and hot tubs. This customer can count on Leslie’s for products such as pool chemicals, cleaning tools, and accessories such as lights, ladders, and covers. In addition to products, Leslie’s offers professional services such as equipment installation and water testing.

Overall, pools take consistent care to properly maintain, and overlooking or greatly delaying maintenance can lead to an unusable pool (green water, ew!) or much more expensive problems down the line. A number of products sold can therefore border on non-discretionary for a homeowner with a pool. Leslie’s is a one-stop shop for these maintenance and minor repair needs.

Leslie's stores typically range in size from 5,000 to 10,000 square feet. They are positioned in suburban areas with high household incomes and high residential density to increase the odds of nearby pools. In addition to the physical store footprint, Leslie’s has an e-commerce platform where customers can buy products for home delivery or store pickup as well as schedule service appointments.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Competitors that sell pool and spa supplies include Pool Corporation (NASDAQ:POOL) and Hayward Holdings (NYSE:HAYW), although these companies sell more to professionals than DIY homeowners.Sales Growth

Leslie's is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

As you can see below, the company's annualized revenue growth rate of 11.1% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was decent as it opened new stores and expanded its reach.

This quarter, Leslie's revenue fell 10.8% year on year to $174 million but beat Wall Street's estimates by 2.6%. Looking ahead, Wall Street expects sales to grow 1.2% over the next 12 months, an acceleration from this quarter.

Number of Stores

When a retailer like Leslie's is opening new stores, it usually means it's investing for growth because demand is greater than supply. At the end of this quarter, Leslie's operated 1,000 total retail locations, in line with its store count 12 months ago.

Taking a step back, the company has generally opened new stores over the last eight quarters, averaging 2.8% annual growth in its physical footprint. This is decent store growth and in line with other retailers. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

Leslie's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 2.6% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Leslie's same-store sales fell 11.7% year on year. This decrease was a further deceleration from the 4% year-on-year decline it posted 12 months ago.

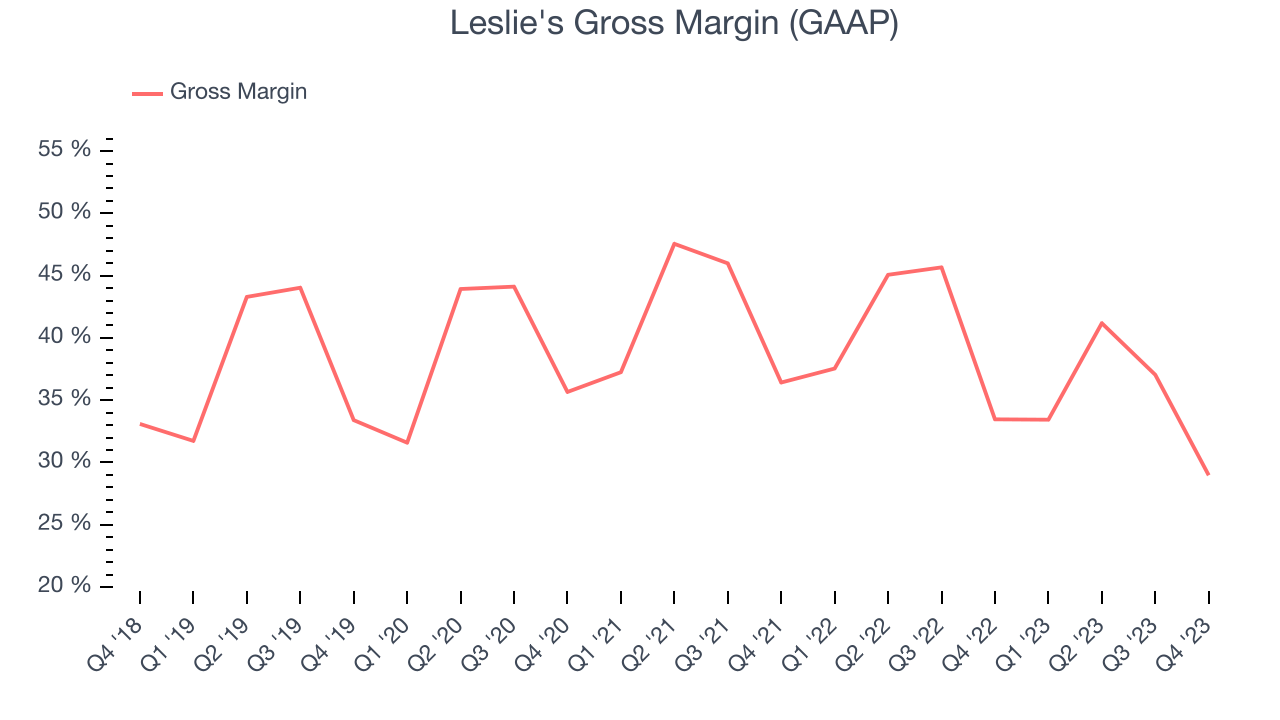

Gross Margin & Pricing Power

Gross profit margins tell us how much money a retailer gets to keep after paying for the goods it sells.

Leslie's unit economics are higher than the typical retailer, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it's averaged a decent 37.8% gross margin over the last eight quarters. This means the company makes $0.38 for every $1 in revenue before accounting for its operating expenses.

Leslie's gross profit margin came in at 29% this quarter, marking a 4.5 percentage point decrease from 33.5% in the same quarter last year. Although the company could've performed better, we care more about its long-term trends rather than just one quarter. Additionally, a retailer's gross margin can often change due to factors outside its control, such as product discounting and dynamic input costs (think distribution and freight expenses to move goods). We'll keep a close eye on this.

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Leslie's generated an operating profit margin of negative 21%, down 7.1 percentage points year on year. We can infer Leslie's was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Zooming out, Leslie's was profitable over the last two years but held back by its large expense base. Its average operating margin of 2.8% has been paltry for a consumer retail business. On top of that, Leslie's margin has declined, on average, by 7.8 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Zooming out, Leslie's was profitable over the last two years but held back by its large expense base. Its average operating margin of 2.8% has been paltry for a consumer retail business. On top of that, Leslie's margin has declined, on average, by 7.8 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.EPS

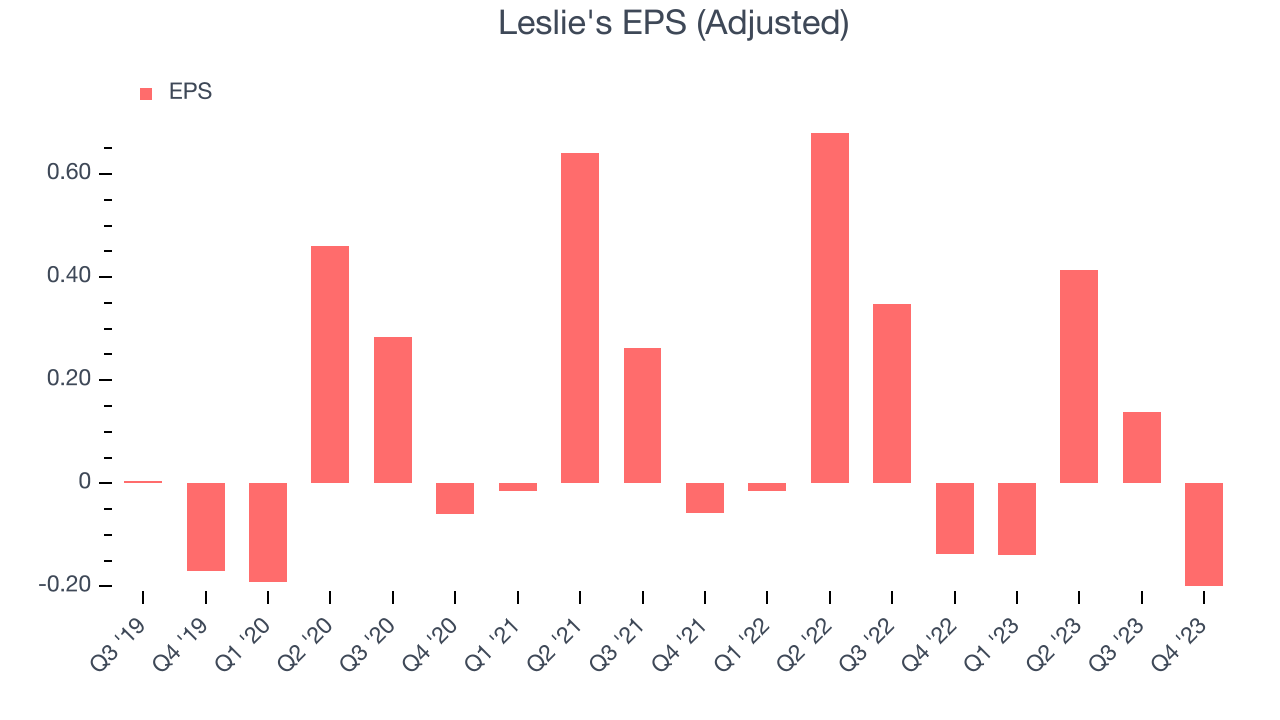

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Leslie's reported EPS at negative $0.20, down from negative $0.14 in the same quarter a year ago. This print beat Wall Street's estimates by 2.9%.

Between FY2020 and FY2024, Leslie's adjusted diluted EPS grew 273%, translating into a remarkable 39% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period, showing that Leslie's has excelled in managing its expenses.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 39.2% year-on-year increase in EPS.

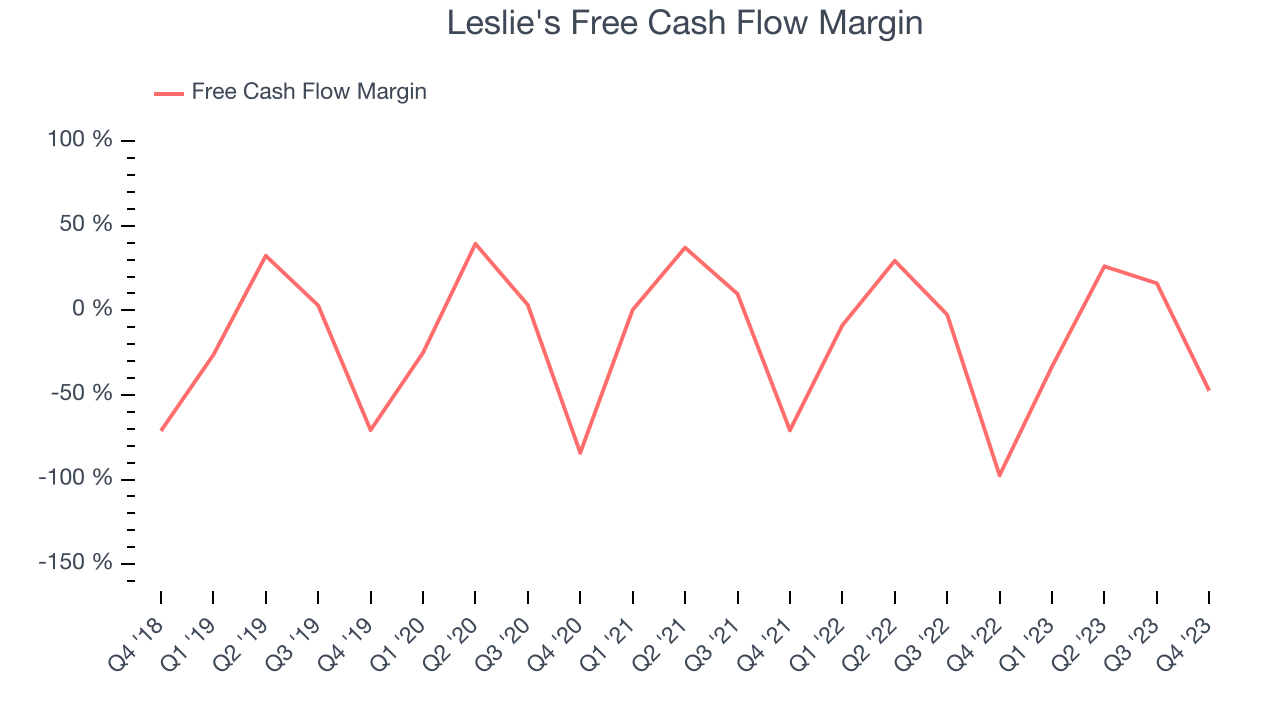

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

Leslie's burned through $82.61 million of cash in Q1, representing a negative 47.5% free cash flow margin. The company increased its cash burn by 56.5% year on year.

Over the last two years, Leslie's capital-intensive business model and demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer retail sector, averaging negative 14.7%. However, its margin has averaged year-on-year increases of 6.8 percentage points, showing the company is at least improving.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company's revenue growth was profitable. But was it capital-efficient? If two companies had equal growth, we’d prefer the one with lower reinvestment requirements.

Enter ROIC, a metric showing how much operating profit a company generates relative to its invested capital (debt and equity). ROIC not only gauges the ability to grow profits but also a management team's ability to allocate limited resources.

Although Leslie's hasn't been the highest-quality company lately, it historically did a wonderful job investing in profitable growth initiatives. Its five-year average ROIC was 29.6%, splendid for a retail business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, over the last two years, Leslie's ROIC has decreased. We like Leslie's average ROIC but are concerned it has declined recently, perhaps a symptom of waning opportunities to invest profitably.

Key Takeaways from Leslie's Q1 Results

We enjoyed seeing Leslie's exceed analysts' revenue expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. On the other hand, its gross margin missed analysts' expectations. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. Investors were likely expecting more, however, and the stock is down 3.1% after reporting, trading at $6.62 per share.

Is Now The Time?

Leslie's may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Leslie's isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been decent over the last four years, its cash burn raises the question of whether it can sustainably maintain growth. And while its projected EPS growth for the next year implies the company's fundamentals will improve, the downside is its shrinking same-store sales suggests it'll need to change its strategy to succeed.

Leslie's price-to-earnings ratio based on the next 12 months is 23.0x. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Leslie's, it seems to be trading at a reasonable price.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.