Education company Lincoln Educational (NASDAQ:LINC) announced better-than-expected results in Q1 CY2024, with revenue up 18.4% year on year to $103.4 million. The company's full-year revenue guidance of $423 million at the midpoint also came in 1.8% above analysts' estimates. It made a GAAP loss of $0.01 per share, down from its loss of $0 per share in the same quarter last year.

Lincoln Educational (LINC) Q1 CY2024 Highlights:

- Revenue: $103.4 million vs analyst estimates of $97 million (6.6% beat)

- EPS: -$0.01 vs analyst estimates of -$0.06 ($0.05 beat)

- The company lifted its revenue guidance for the full year from $415 million to $423 million at the midpoint, a 1.9% increase

- Gross Margin (GAAP): 58.4%, up from 56.4% in the same quarter last year

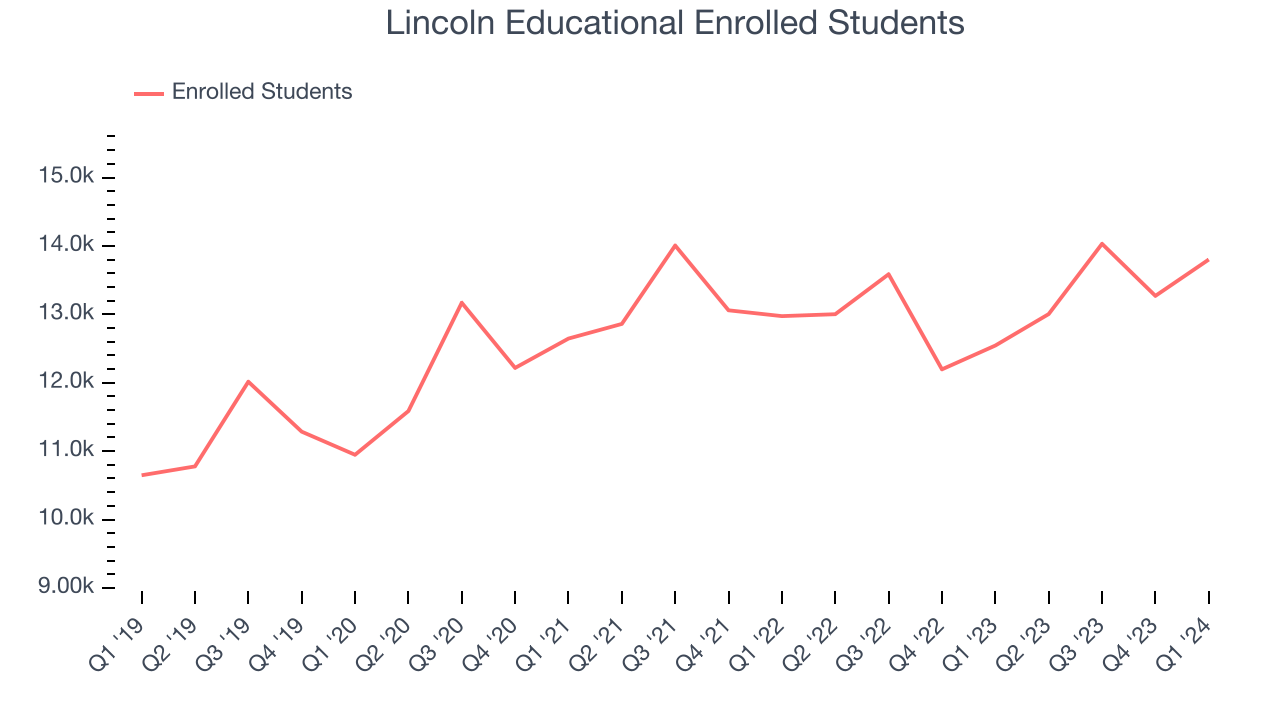

- Enrolled Students: 13,801

- Market Capitalization: $348.7 million

Established in 1946, Lincoln Educational (NASDAQ:LINC) is a provider of specialized technical training in the United States, offering career-oriented programs to provide practical skills required in the workforce.

The company primarily operates through Lincoln Technical Institute, Lincoln College of Technology, and Euphoria Institute of Beauty Arts and Sciences. These institutions are spread across 14 states and offer a variety of diploma, degree, and certificate programs.

Lincoln Educational focuses on five core areas: Automotive Technology, Health Sciences, Skilled Trades, Hospitality Services, and Business and IT. Each program is designed to equip students with hands-on experience and skills relevant to their chosen field.

Automotive and Skilled Trades programs partner with leading companies, ensuring students receive education aligned with industry standards and have access to advanced technologies. Partnerships with companies like Audi and BMW not only enhance the curriculum but also create pathways for student internships and employment.

In the Health Sciences sector, Lincoln Education offers programs in Nursing, Medical Assistant, Dental Assistant, and other allied health professions. The Euphoria Institute focuses on beauty and wellness programs, providing training in cosmetology, esthetics, and massage therapy.

Lincoln Educational places a strong emphasis on career services, assisting students with job searching, resume writing, and interview preparation.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Lincoln Educational's primary competitors include Universal Technical Institute (NYSE:UTI), Strayer Education (NASDAQ:STRA), Adtalem Global Education (NYSE:ATGE), and Grand Canyon Education (NASDAQ:LOPE).Sales Growth

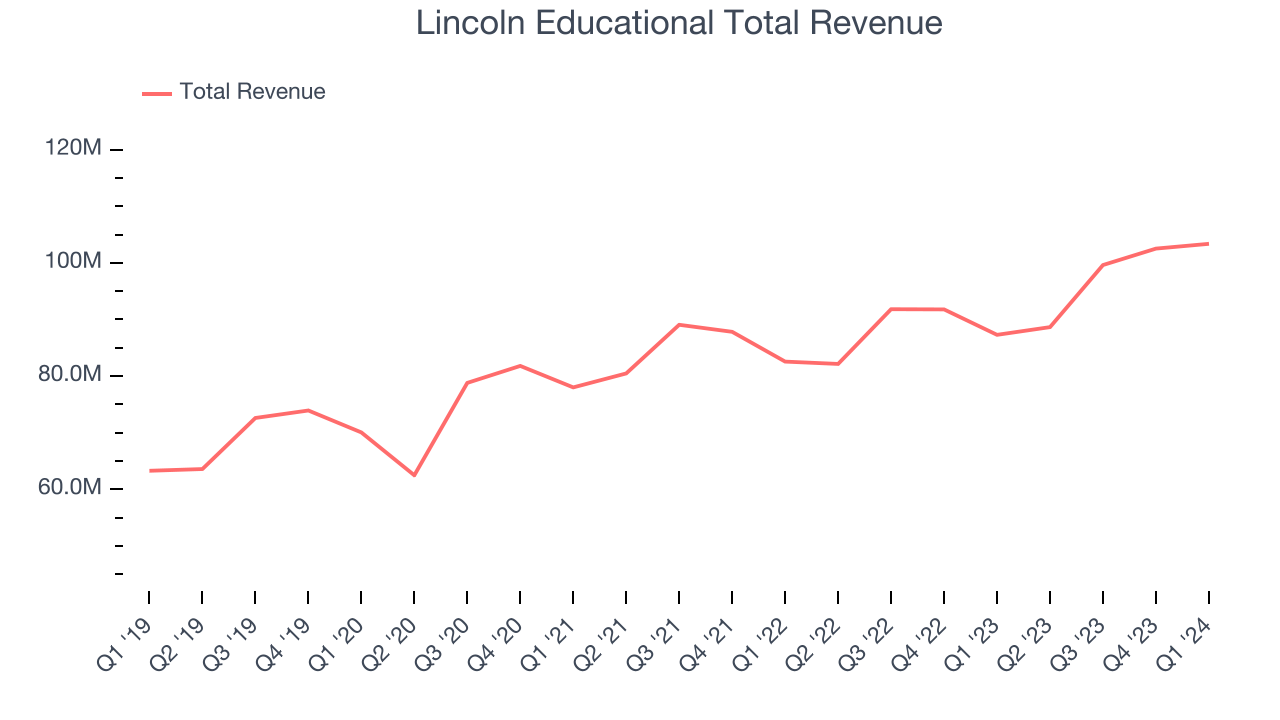

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Lincoln Educational's annualized revenue growth rate of 8.3% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Lincoln Educational's annualized revenue growth of 7.7% over the last two years aligns with its five-year revenue growth, suggesting the company's demand has been stable.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Lincoln Educational's annualized revenue growth of 7.7% over the last two years aligns with its five-year revenue growth, suggesting the company's demand has been stable.

We can better understand the company's revenue dynamics by analyzing its number of enrolled students, which reached 13,801 in the latest quarter. Over the last two years, Lincoln Educational's enrolled students averaged 1.3% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company's monetization of its consumers has risen.

This quarter, Lincoln Educational reported robust year-on-year revenue growth of 18.4%, and its $103.4 million of revenue exceeded Wall Street's estimates by 6.6%. Looking ahead, Wall Street expects sales to grow 6.3% over the next 12 months, a deceleration from this quarter.

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

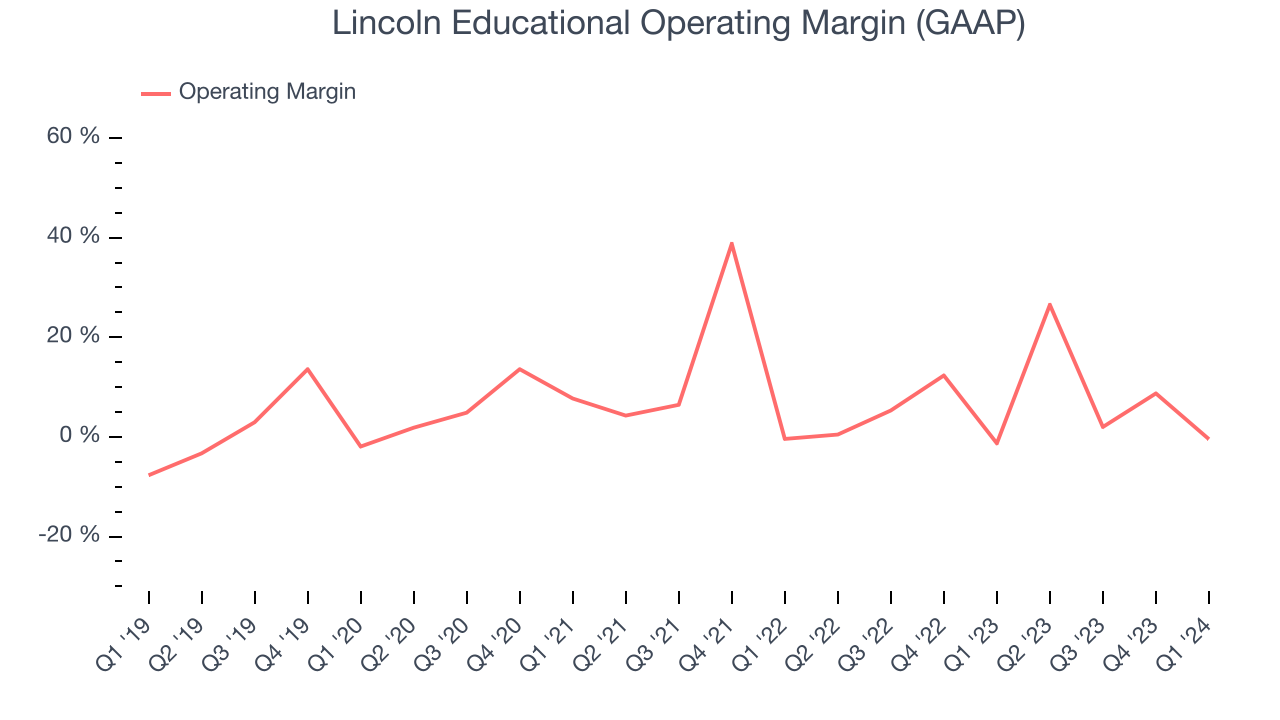

Lincoln Educational was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer discretionary business, producing an average operating margin of 6.6%.

This quarter, Lincoln Educational generated an operating profit margin of negative 0.4%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects Lincoln Educational to become less profitable. Analysts are expecting the company’s LTM operating margin of 8.6% to decline to 4.3%.EPS

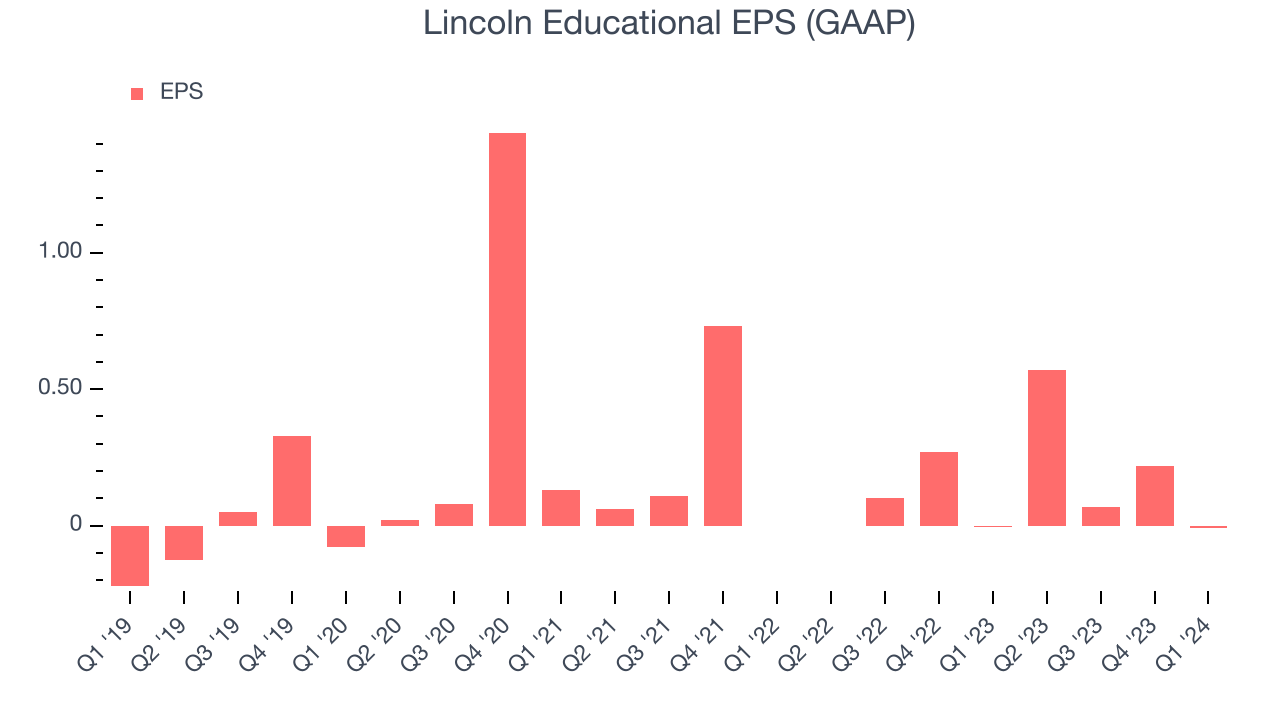

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Lincoln Educational cut its earnings losses and improved its EPS by 43.3% each year. This performance is materially higher than its 8.3% annualized revenue growth over the same period. Let's dig into why.

While we mentioned earlier that Lincoln Educational's operating margin was flat this quarter, a five-year view shows its margin has expanded 7.2 percentage points, leading to higher profitability and earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q1, Lincoln Educational reported EPS at negative $0.01, down from negative $0 in the same quarter last year. Despite falling year on year, this print beat analysts' estimates by 83.3%. Over the next 12 months, Wall Street expects Lincoln Educational to perform poorly. Analysts are projecting its LTM EPS of $0.85 to shrink to break even.

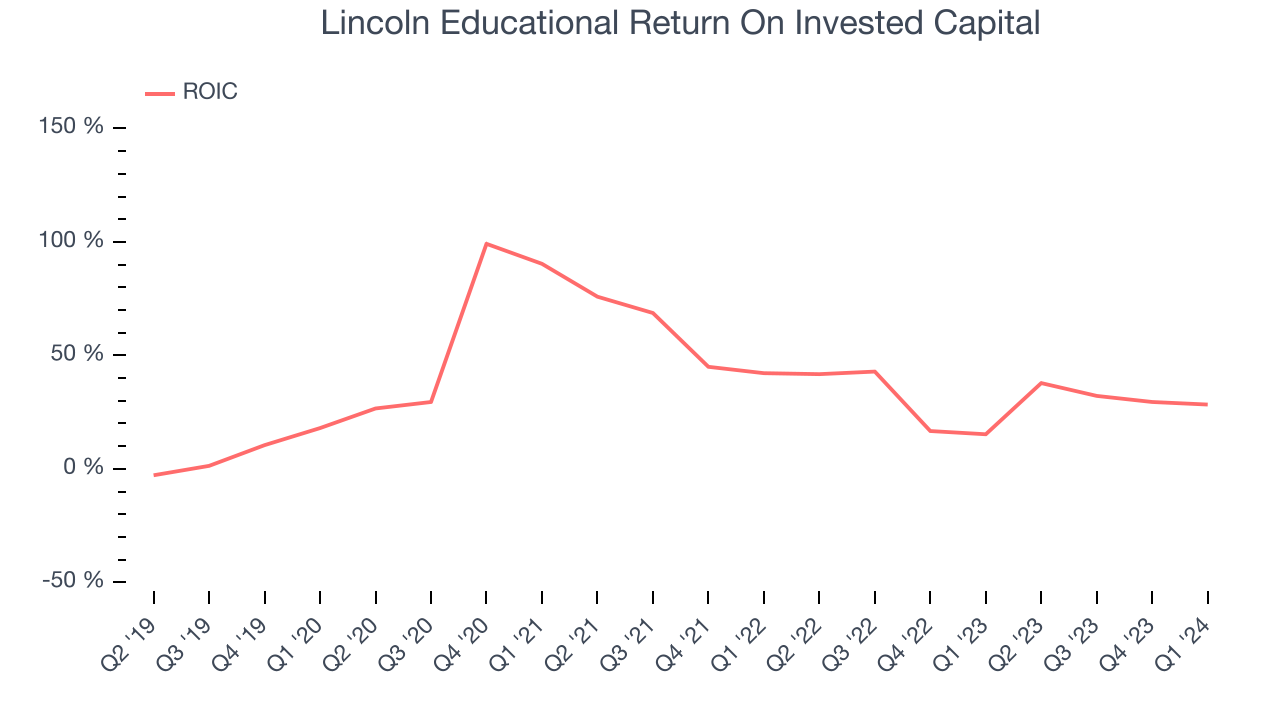

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Lincoln Educational hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average return on invested capital was 38.9%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Lincoln Educational's ROIC significantly decreased over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Lincoln Educational's Q1 Results

We were impressed by how significantly Lincoln Educational blew past analysts' revenue, operating margin, and EPS expectations this quarter. These beats were driven by more new students than anticipated, and management noted it's seeing stronger demand as the "American public is increasingly questioning the costs and value of a traditional four-year college degree". Given the favorable conditions, management raised its revenue, EBITDA, and adjusted EPS estimates, which beat Wall Street's estimates. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 6% after reporting and currently trades at $11.75 per share.

Is Now The Time?

Lincoln Educational may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Lincoln Educational, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last five years. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its projected EPS for the next year is lacking. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

While we've no doubt one can find things to like about Lincoln Educational, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $13.63 per share right before these results (compared to the current share price of $11.75).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.