Gaming products and services provider Light & Wonder (NASDAQ:LNW) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 11.8% year on year to $817 million. Its GAAP profit of $0.71 per share was 30.9% below analysts’ consensus estimates.

Is now the time to buy Light & Wonder? Find out by accessing our full research report, it’s free.

Light & Wonder (LNW) Q3 CY2024 Highlights:

- Revenue: $817 million vs analyst estimates of $820.6 million (in line)

- EPS: $0.71 vs analyst expectations of $1.03 (30.9% miss)

- EBITDA: $319 million vs analyst estimates of $316.6 million (small beat)

- Gross Margin (GAAP): 69.9%, down from 84.5% in the same quarter last year

- Operating Margin: 19.5%, in line with the same quarter last year

- EBITDA Margin: 39%, in line with the same quarter last year

- Free Cash Flow Margin: 10.2%, down from 18.3% in the same quarter last year

- Market Capitalization: $9.18 billion

Company Overview

With names as crazy as Ultimate Fire Link Power 4 for its products, Light & Wonder (NASDAQ:LNW) is a gaming company supplying the casino industry with slot machines, table games, and digital games.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Sales Growth

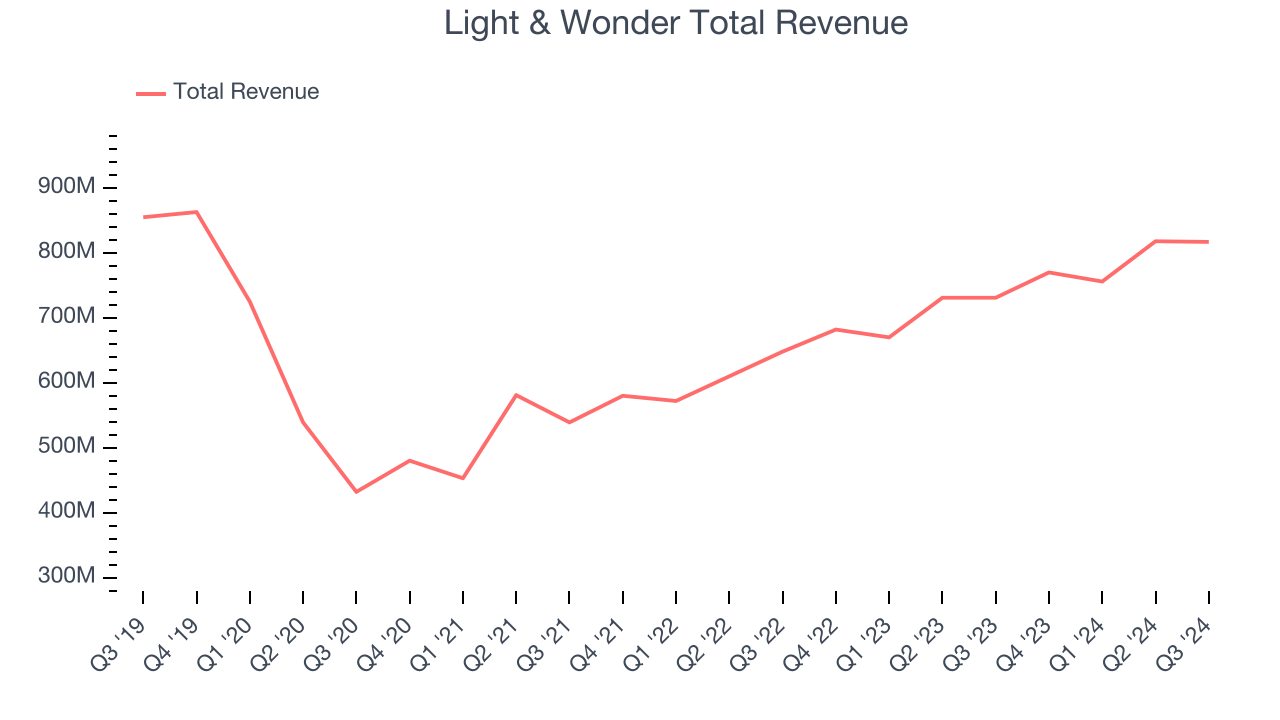

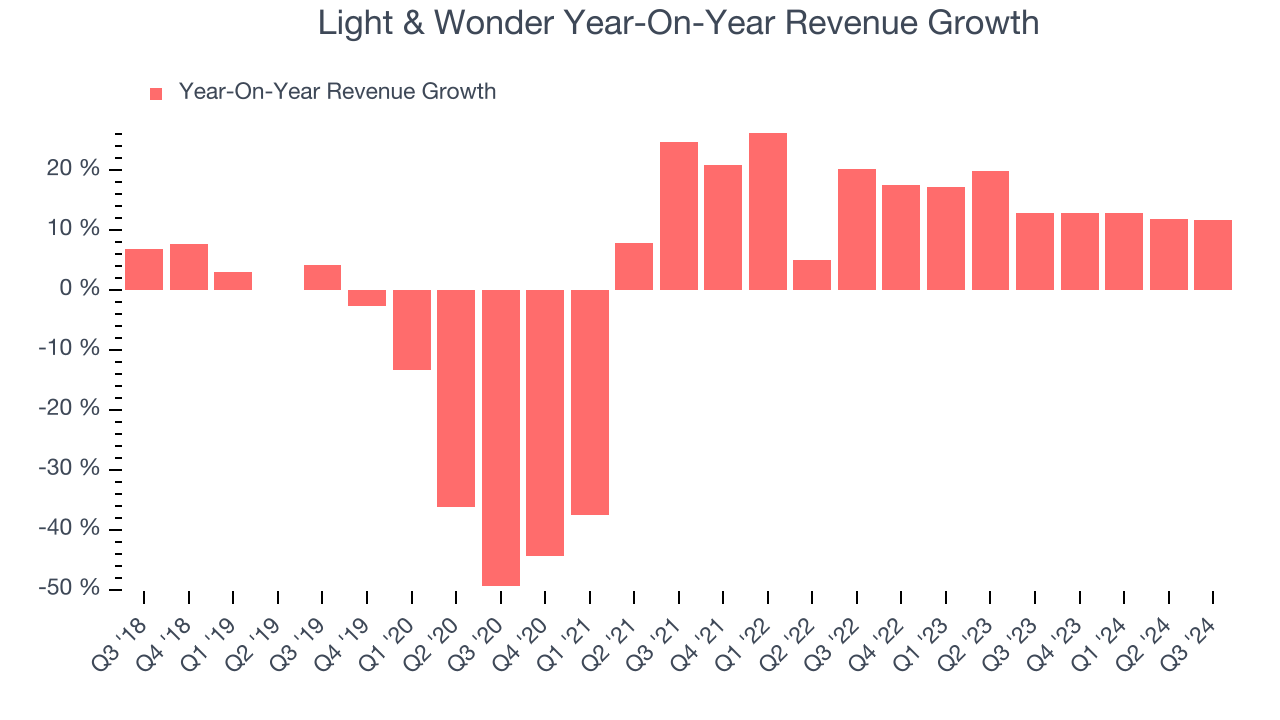

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, Light & Wonder’s revenue declined by 1.6% per year. This shows demand was weak, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Light & Wonder’s annualized revenue growth of 14.5% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Gaming, Social Gaming, and iGaming, which are 65.7%, 25.2%, and 9.1% of revenue. Over the last two years, Light & Wonder’s revenues in all three segments increased. Its Gaming revenue (slot machines, casino games) averaged year-on-year growth of 15.5% while its Social Gaming (free-to-play games) and iGaming (digital games) revenues averaged 13.1% and 12.3%.

This quarter, Light & Wonder’s year-on-year revenue growth was 11.8%, and its $817 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

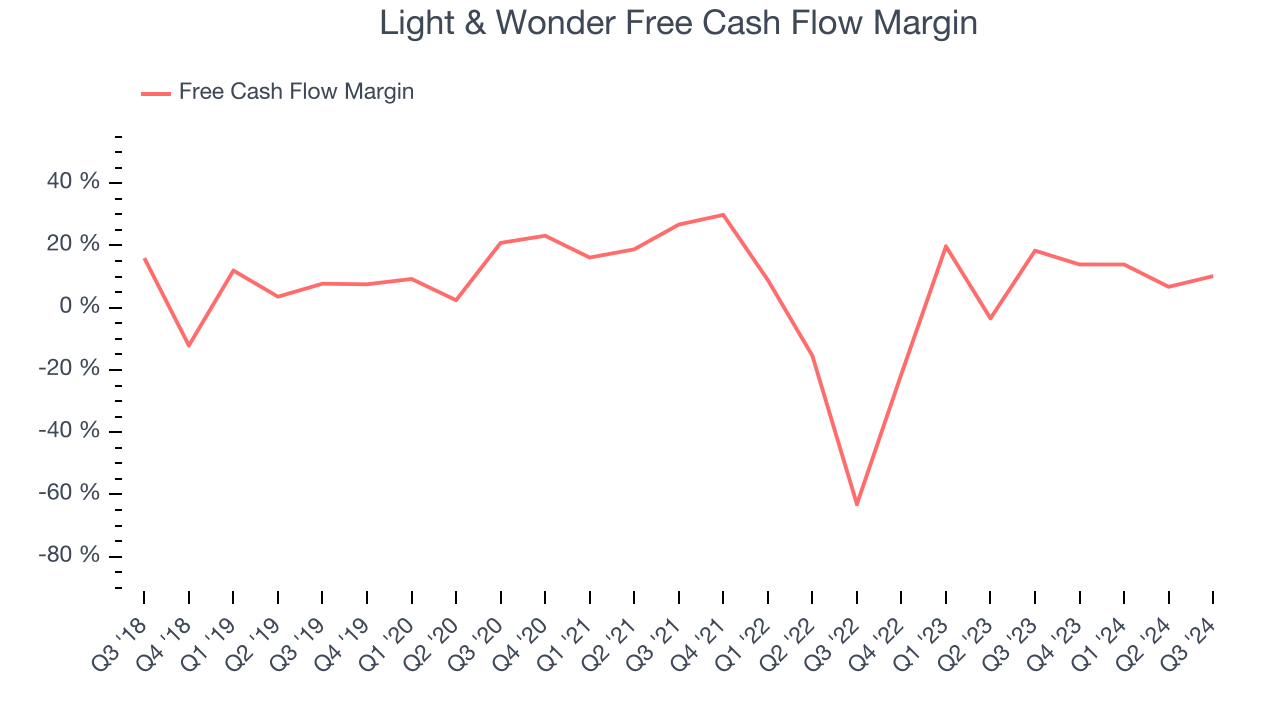

Light & Wonder has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.5%, subpar for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Light & Wonder to make large cash investments in working capital and capital expenditures.

Light & Wonder’s free cash flow clocked in at $83 million in Q3, equivalent to a 10.2% margin. The company’s cash profitability regressed as it was 8.2 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Light & Wonder’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 11.1% for the last 12 months will increase to 16.7%, giving it more flexibility for investments, share buybacks, and dividends.

Key Takeaways from Light & Wonder’s Q3 Results

Aside from the EBITDA beat, we struggled to find many resounding positives in these results as its EPS and Social Gaming revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $102.40 immediately following the results.

Light & Wonder’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.