Fast food chain El Pollo Loco (NASDAQ:LOCO) announced better-than-expected results in Q1 CY2024, with revenue up 1.4% year on year to $116.2 million. It made a non-GAAP profit of $0.22 per share, improving from its profit of $0.14 per share in the same quarter last year.

El Pollo Loco (LOCO) Q1 CY2024 Highlights:

- Revenue: $116.2 million vs analyst estimates of $111.1 million (4.6% beat)

- Adjusted EBITDA: $15.7 million vs analyst estimates of $12.4 million (large beat)

- EPS (non-GAAP): $0.22 vs analyst estimates of $0.14 ($0.08 beat)

- Gross Margin (GAAP): 21.9%, up from 19.4% in the same quarter last year

- Same-Store Sales were up 5.1% year on year (beat vs. expectations of up 3.2% year on year)

- Store Locations: 495 at quarter end, increasing by 5 over the last 12 months

- Market Capitalization: $263.2 million

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ:LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

The company was founded in 1980 in Los Angeles, California. While it started with that signature chicken dish, the chain has expanded its offering to include a variety of Mexican-inspired dishes like tacos, burritos, and quesadillas. In response to changing consumer tastes, El Pollo Loco now offers a ‘fit’ menu featuring items such as Keto burritos and salads.

The core El Pollo Loco customer is diverse but principally a middle-income individual or family seeking a tasty and unique menu that is also affordable. More specifically, the core customer is likely someone who appreciates the depths of Mexican food beyond just the simple taco.

El Pollo Loco locations are moderate in size, catering to the fast food and casual segments. There's often seating available, but it's typically limited compared to large sit-down restaurants. There are booths, tables, and sometimes outdoor patios. The vibe inside mirrors its Californian roots with a modern, relaxed atmosphere featuring hues of orange and earth tones. Artwork or motifs hinting at its Mexican culinary heritage complete the look. In all, it is a laid back, casual atmosphere where no one minds if things get lively or even celebratory.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Competitors offering Mexican-inspired fare or specialty chicken dishes include Chipotle (NYSE:CMG), Fiesta Restaurant Group (NASDAQ:FRGI), Chuy’s (NASDAQ:CHUY), and private company Qdoba.Sales Growth

El Pollo Loco is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

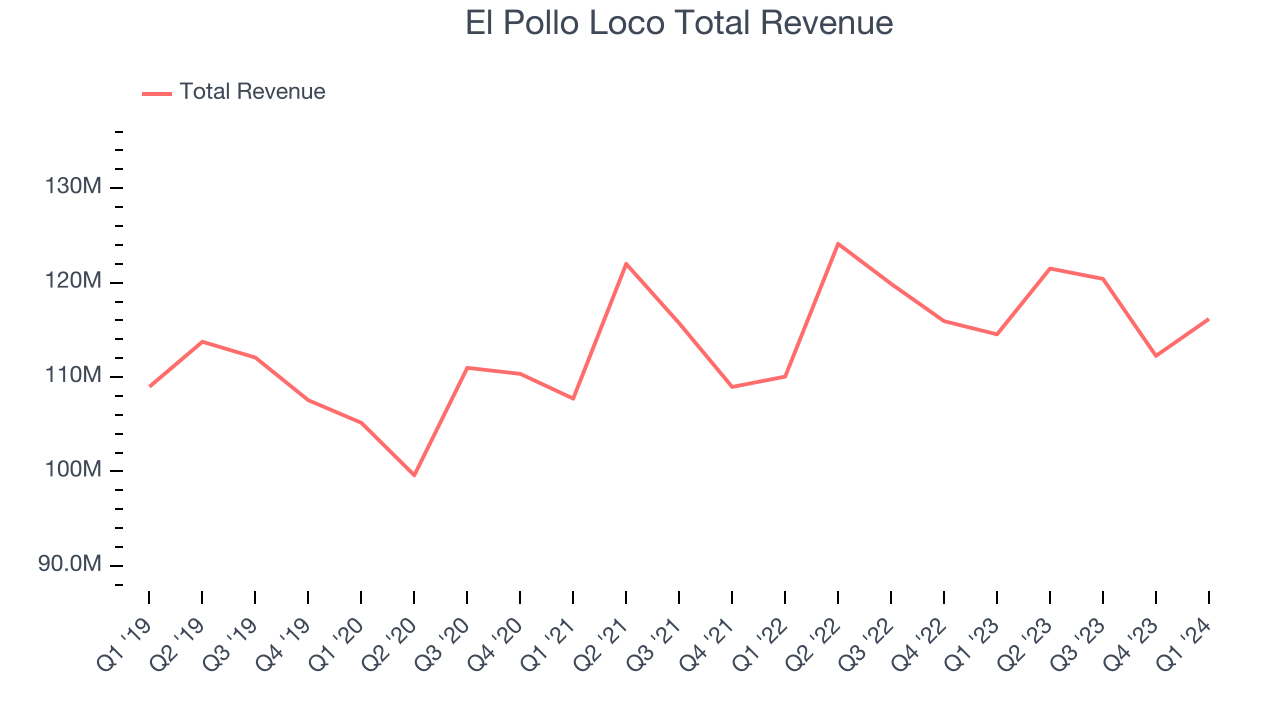

As you can see below, the company's annualized revenue growth rate of 1.4% over the last five years was weak , but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, El Pollo Loco reported decent year-on-year revenue growth of 1.4%, and its $116.2 million in revenue topped Wall Street's estimates by 4.6%.

Same-Store Sales

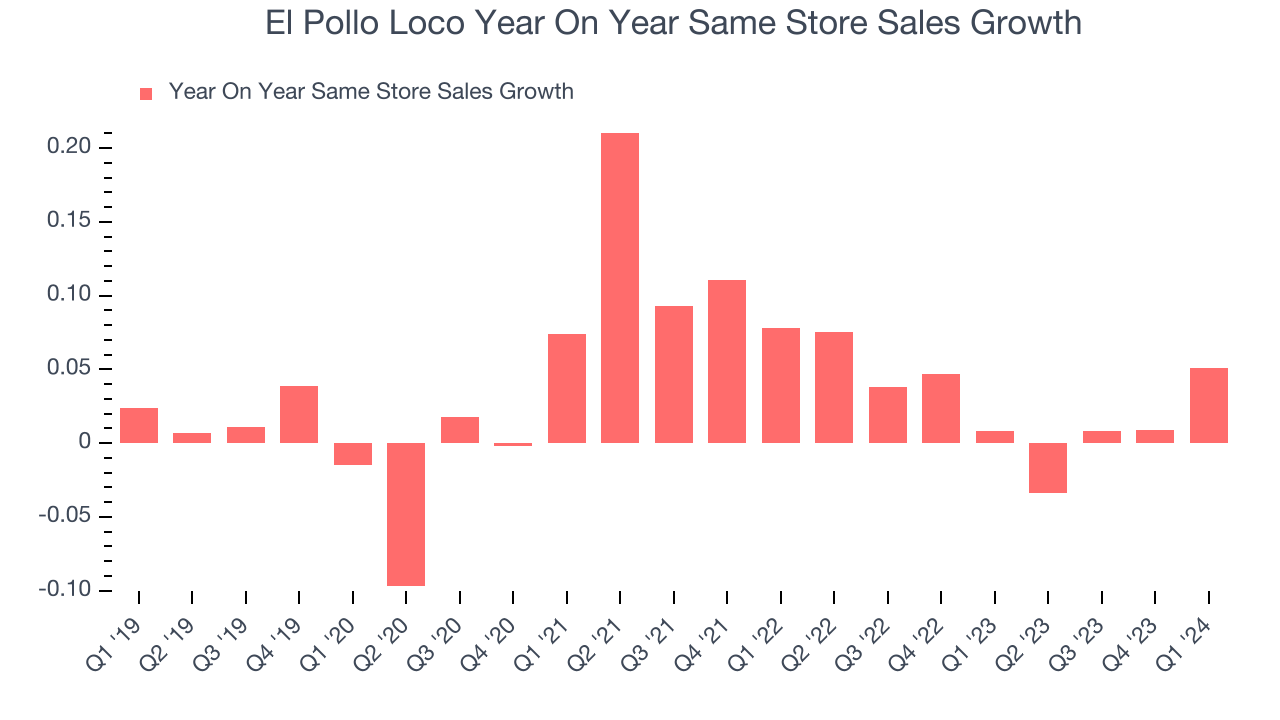

El Pollo Loco's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 2.5% year on year. With positive same-store sales growth amid an increasing number of restaurants, El Pollo Loco is reaching more diners and growing sales.

In the latest quarter, El Pollo Loco's same-store sales rose 5.1% year on year. This growth was an acceleration from the 0.8% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Number of Stores

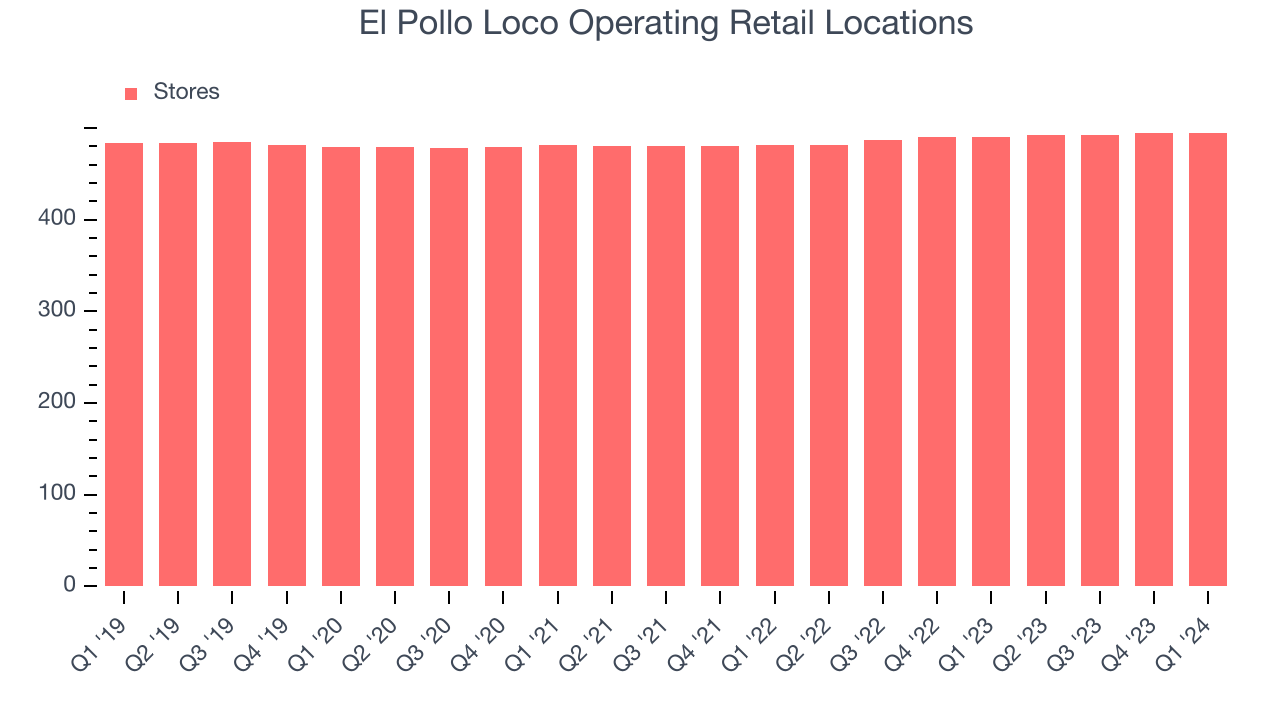

A restaurant chain's total number of dining locations is a crucial factor influencing how much it can sell and how quickly company-level sales can grow.

When a chain like El Pollo Loco is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Since last year, El Pollo Loco's restaurant count increased by 5, or 1%, to 495 locations in the most recently reported quarter.

Over the last two years, El Pollo Loco has generally opened new restaurants and averaged 1.4% annual growth in new locations, which is on par with the broader sector. Comparisons, however, should be taken with a grain of salt as the industry is quite mature. Analyzing a restaurant's location growth is important because expansion means El Pollo Loco has more opportunities to feed customers and generate sales.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

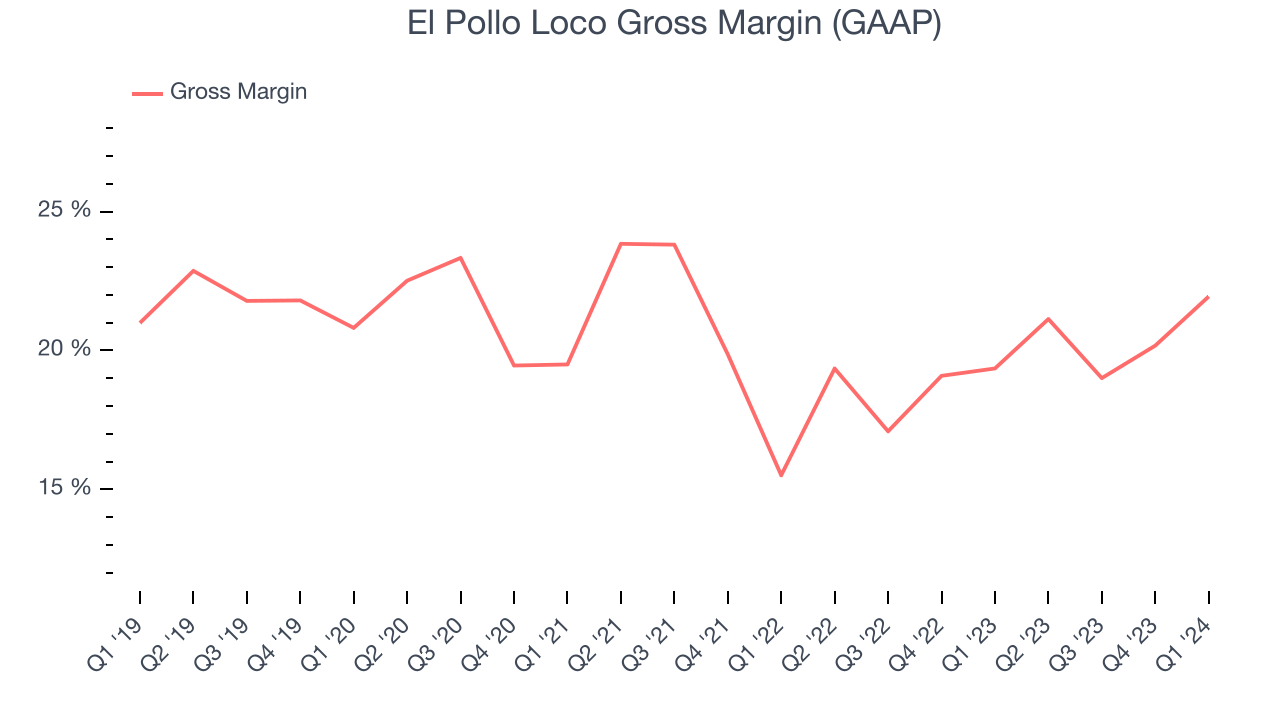

El Pollo Loco's gross profit margin came in at 21.9% this quarter. up 2.6 percentage points year on year. This means the company makes $0.20 for every $1 in revenue before accounting for its operating expenses.

El Pollo Loco has poor unit economics for a restaurant company, leaving it with little room for error if things go awry. As you can see above, it's averaged a 19.6% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 9.9% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

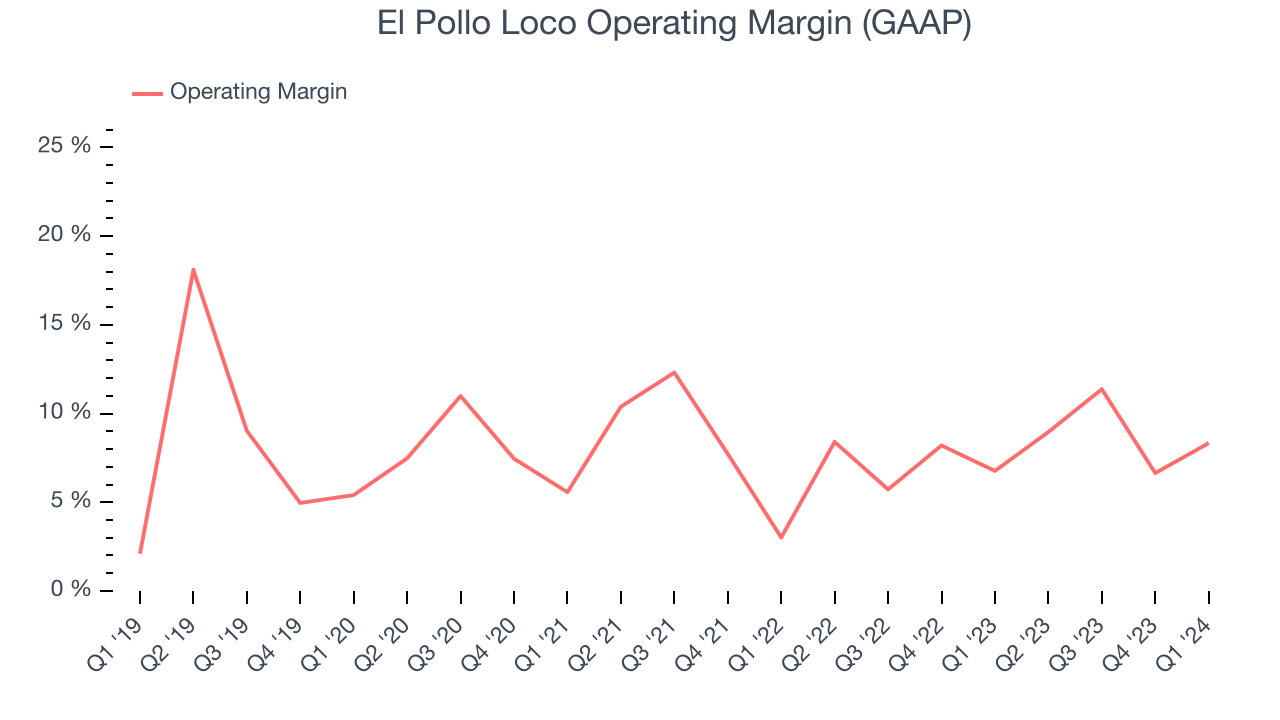

Operating Margin

Operating margin is an important measure of profitability for restaurants as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, El Pollo Loco generated an operating profit margin of 8.3%, up 1.6 percentage points year on year. This increase was encouraging and driven by stronger pricing power or lower ingredient/transportation costs, as indicated by the company's larger rise in gross margin.

Zooming out, El Pollo Loco has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 8.1%, higher than the broader restaurant sector. On top of that, its margin has improved, on average, by 1.6 percentage points each year, a great sign for shareholders. The company's operating profitability was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes tectonic shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for El Pollo Loco).

Zooming out, El Pollo Loco has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 8.1%, higher than the broader restaurant sector. On top of that, its margin has improved, on average, by 1.6 percentage points each year, a great sign for shareholders. The company's operating profitability was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes tectonic shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for El Pollo Loco).EPS

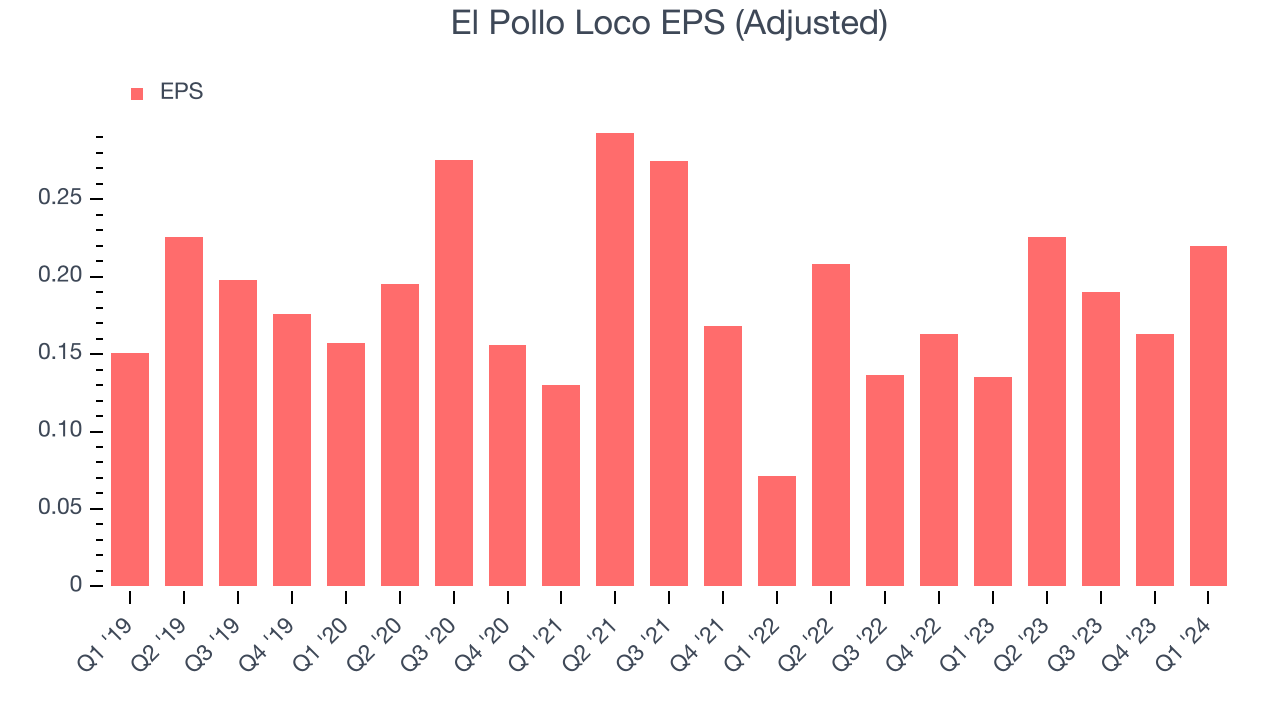

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, El Pollo Loco reported EPS at $0.22, up from $0.14 in the same quarter a year ago. This print beat Wall Street's estimates by 57.1%.

Over the next 12 months, however, Wall Street is projecting an average 13.6% year-on-year decline in EPS.

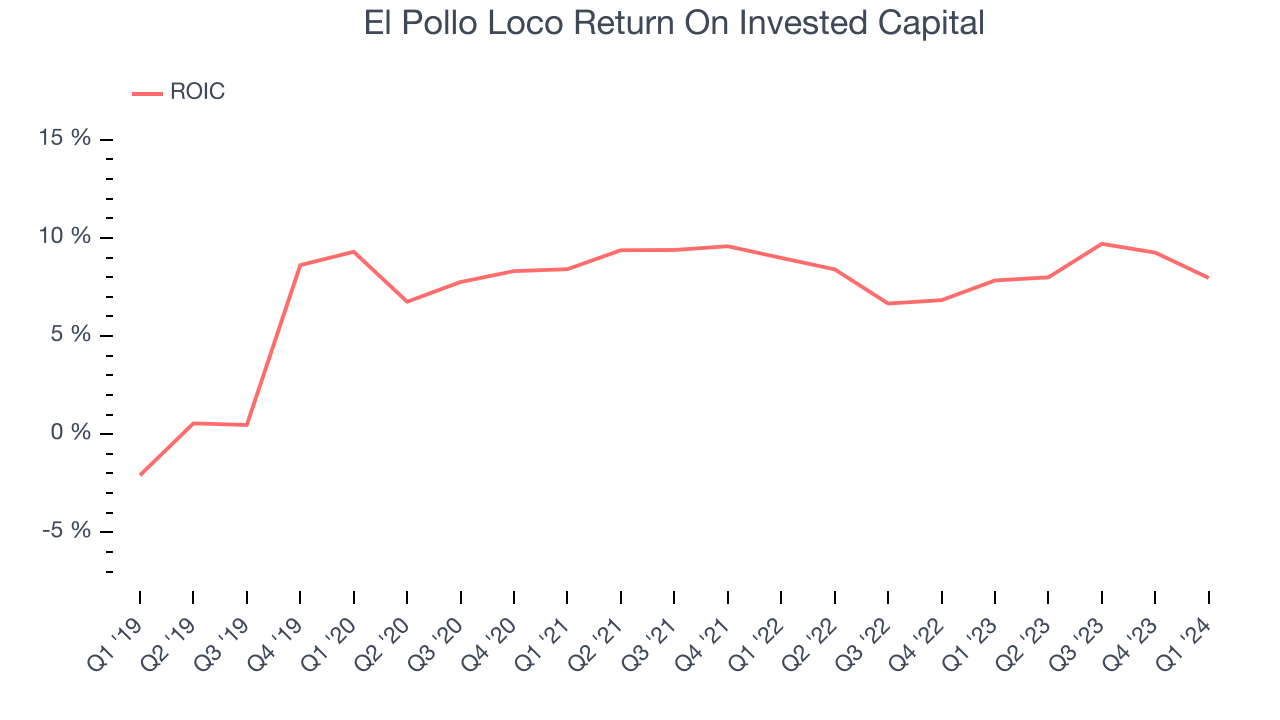

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

El Pollo Loco's five-year average ROIC was 8.5%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, El Pollo Loco's invested capital has produced decent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Uneventfully, El Pollo Loco's ROIC has stayed the same over the last few years. This is fine because its returns are solid, but if the company wants to become an investable business, it will need to increase its ROIC even more.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

El Pollo Loco reported $9.12 million of cash and $80 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $60.89 million of EBITDA over the last 12 months, we view El Pollo Loco's 1.2x net-debt-to-EBITDA ratio as safe. We also see its $2.24 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from El Pollo Loco's Q1 Results

We were impressed by how significantly El Pollo Loco beat analysts' same store sales, revenue, gross margin, and EPS expectations this quarter. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 12.3% after reporting and currently trades at $9.65 per share.

Is Now The Time?

El Pollo Loco may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of El Pollo Loco, we'll be cheering from the sidelines. First off, its revenue growth has been weak over the last five years. And while its stable growth in new restaurants shows it has steady demand, the downside is its brand caters to a niche market. On top of that, its projected EPS for the next year is lacking.

While there are some things to like about El Pollo Loco and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $10.50 per share right before these results (compared to the current share price of $9.65).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.