Higher education company Grand Canyon Education (NASDAQ:LOPE) beat analysts' expectations in Q1 CY2024, with revenue up 9.8% year on year to $274.7 million. The company expects next quarter's revenue to be around $223 million, in line with analysts' estimates. It made a GAAP profit of $2.29 per share, improving from its profit of $1.94 per share in the same quarter last year.

Grand Canyon Education (LOPE) Q1 CY2024 Highlights:

- Revenue: $274.7 million vs analyst estimates of $272.4 million (small beat)

- EPS: $2.29 vs analyst estimates of $2.15 (6.5% beat)

- Revenue Guidance for Q2 CY2024 is $223 million at the midpoint, roughly in line with what analysts were expecting

- The company slightly raised its revenue guidance for the full year of $1.03 billion at the midpoint (also raised full year EPS guidance)

- Gross Margin (GAAP): 55.6%, in line with the same quarter last year

- Free Cash Flow of $75.98 million, down 28.3% from the previous quarter

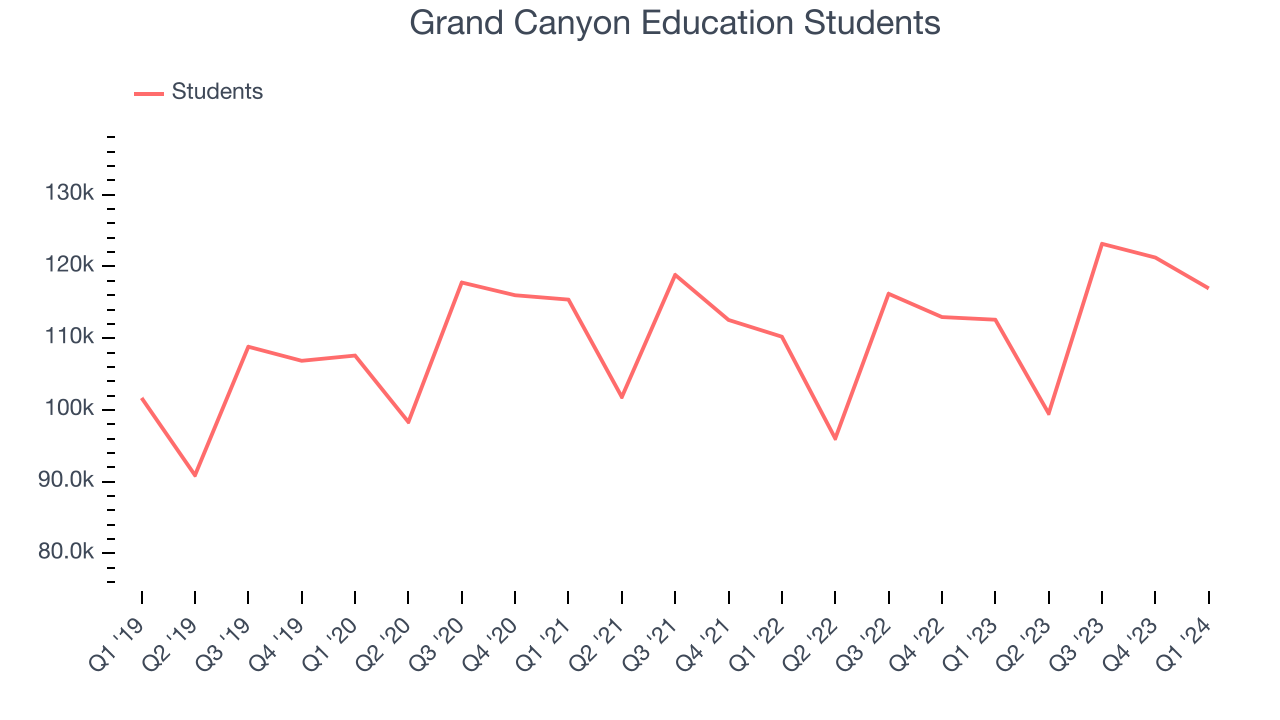

- Students: 116,952

- Market Capitalization: $4.12 billion

Founded in 1949, Grand Canyon Education (NASDAQ:LOPE) is an educational services provider known for its operation at Grand Canyon University.

The company provides a range of services including academic program development, technological support, faculty recruitment, admissions, financial aid, counseling, marketing, and administrative services. Its primary service is operating Grand Canyon University (GCU), a for-profit Christian university.

GCU offers a comprehensive range of degree programs both online and on its Phoenix, AZ campus. The university's programs cover various fields such as business, education, nursing, health sciences, liberal arts, and STEM. GCU is known for its flexible learning options, catering to traditional students, professionals, and online learners, making higher education accessible to a broader demographic.

The company invests in online learning experiences to make remote education engaging, interactive, and effective. This focus has been pivotal in growing GCU’s online student population, making it one of the largest online education providers in the United States.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Grand Canyon Education primary competitors include Apollo Global Management (NYSE:APO), Laureate Education (NASDAQ:LAUR), Strayer Education (NASDAQ:STRA), Capella Education (owned by Strategic Education NASDAQ:STRA), and American Public Education (NASDAQ:APEI).Sales Growth

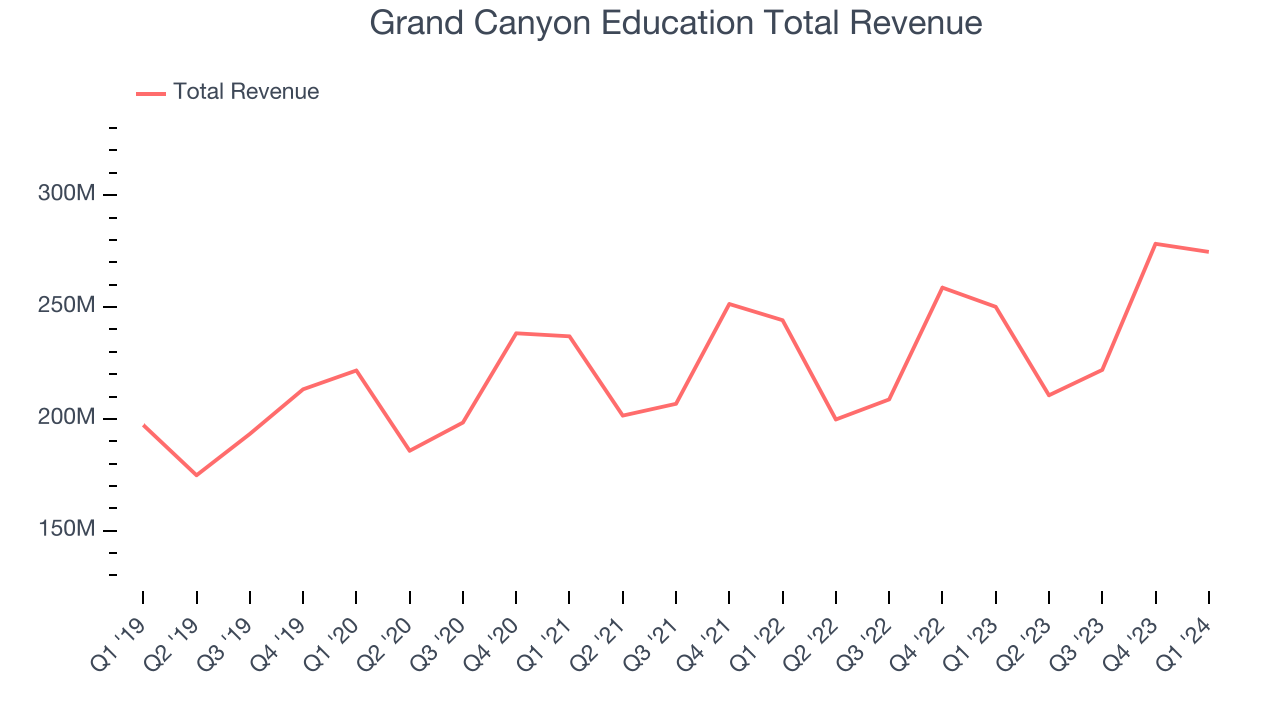

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Grand Canyon Education's annualized revenue growth rate of 5.1% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Grand Canyon Education's annualized revenue growth of 4.4% over the last two years aligns with its five-year revenue growth, suggesting the company's demand has been stable.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Grand Canyon Education's annualized revenue growth of 4.4% over the last two years aligns with its five-year revenue growth, suggesting the company's demand has been stable.

We can better understand the company's revenue dynamics by analyzing its number of students, which reached 116,952 in the latest quarter. Over the last two years, Grand Canyon Education's students averaged 1.9% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company's monetization of its consumers has risen.

This quarter, Grand Canyon Education reported solid year-on-year revenue growth of 9.8%, and its $274.7 million of revenue outperformed Wall Street's estimates by 0.8%. The company is guiding for revenue to rise 5.9% year on year to $223 million next quarter, in line with the 5.4% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 6.6% over the next 12 months, a deceleration from this quarter.

Operating Margin

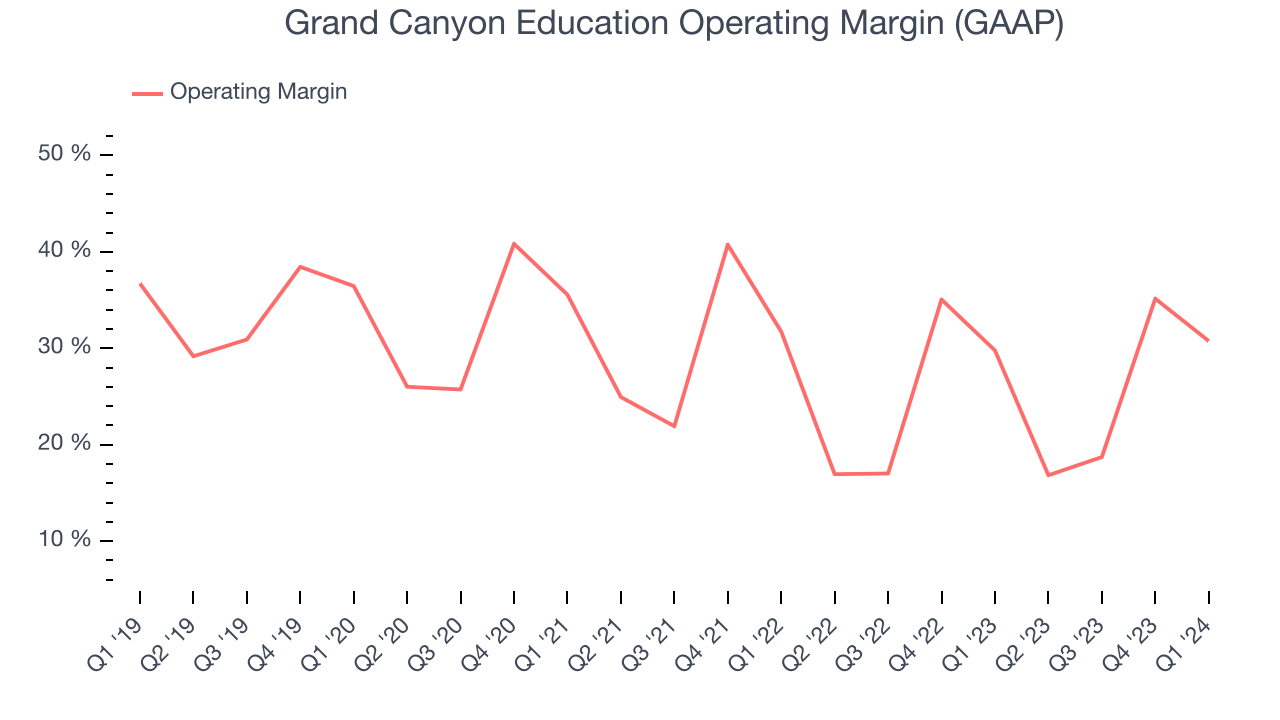

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Grand Canyon Education has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer discretionary business, boasting an average operating margin of 26%.

In Q1, Grand Canyon Education generated an operating profit margin of 30.8%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects Grand Canyon Education to maintain its LTM operating margin of 26.3%.EPS

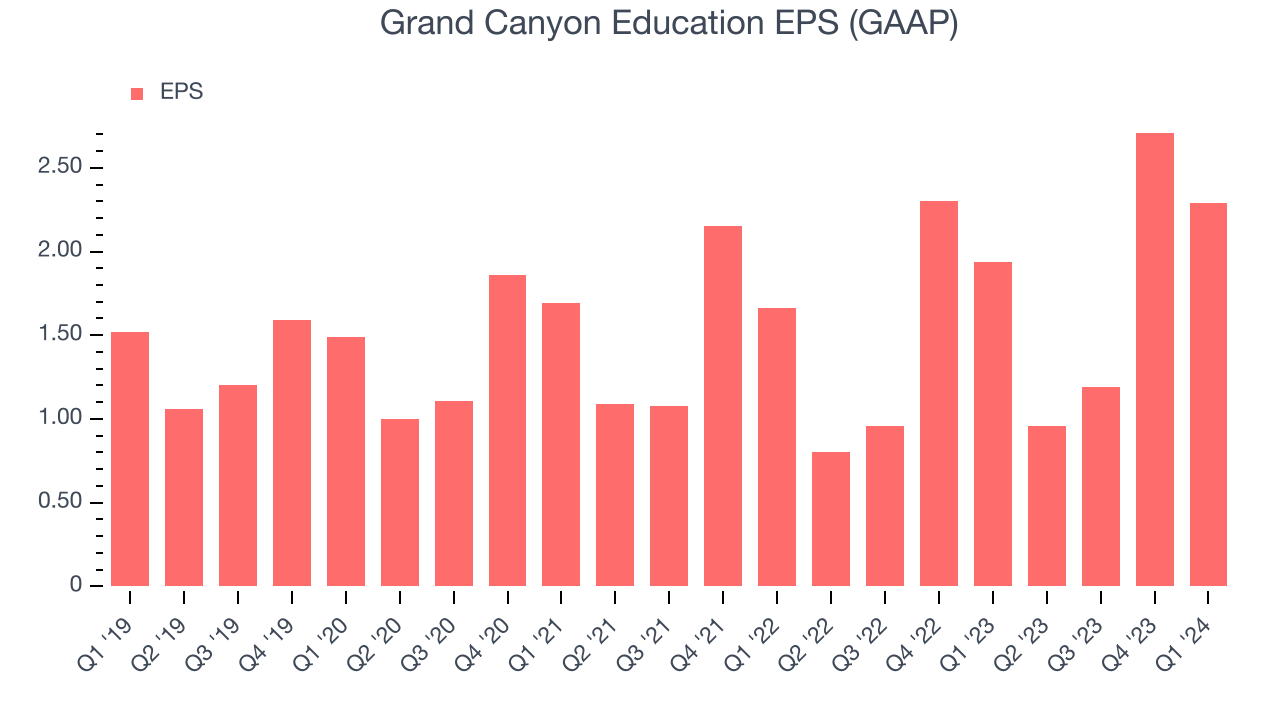

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Grand Canyon Education's EPS grew 51.2%, translating into an unimpressive 8.6% compounded annual growth rate. This performance, however, is materially higher than its 5.1% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals.

A five-year view shows that Grand Canyon Education has repurchased its stock, shrinking its share count by 38.6%. This has led to higher per share earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q1, Grand Canyon Education reported EPS at $2.29, up from $1.94 in the same quarter last year. This print beat analysts' estimates by 6.5%. We also like to analyze expected EPS growth based on Wall Street analysts' consensus projections, but unfortunately, there is insufficient data.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

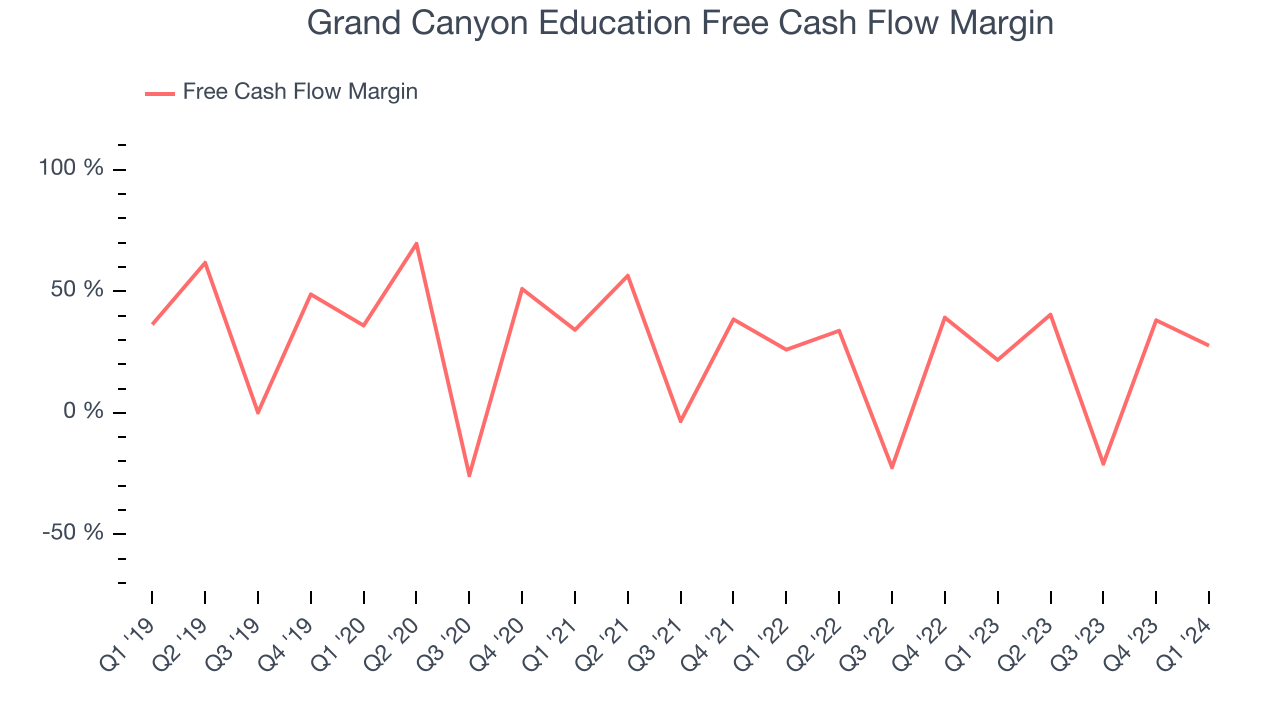

Over the last two years, Grand Canyon Education has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 20.9%, quite impressive for a consumer discretionary business.

Grand Canyon Education's free cash flow came in at $75.98 million in Q1, equivalent to a 27.7% margin and up 39.6% year on year. Over the next year, analysts' consensus estimates show they're expecting Grand Canyon Education's LTM free cash flow margin of 22.4% to remain the same.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

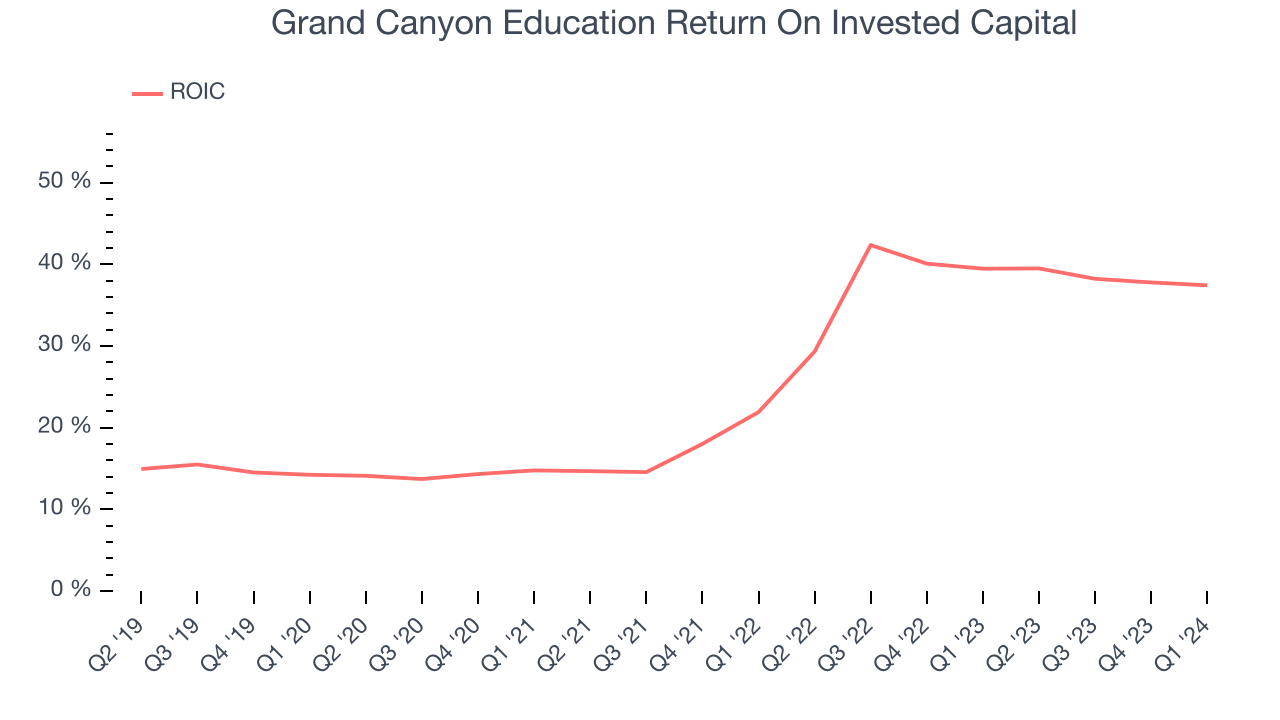

Grand Canyon Education's five-year average ROIC was 25.6%, placing it among the best consumer discretionary companies. Just as you’d like your investment dollars to generate returns, Grand Canyon Education's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Grand Canyon Education's ROIC has significantly increased. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Grand Canyon Education is a profitable, well-capitalized company with $290.7 million of cash and $97.3 million of debt, meaning it could pay back all its debt tomorrow and still have $193.4 million of cash on its balance sheet. This net cash position gives Grand Canyon Education the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Grand Canyon Education's Q1 Results

We were impressed by Grand Canyon Education's optimistic earnings forecast for next quarter, which beat analysts' expectations. On the other hand, number of students unfortunately missed this quarter and full-year earnings guidance missed Wall Street's estimates. Zooming out, we think this was a mixed, quarter. The stock is flat after reporting and currently trades at $139.78 per share.

Is Now The Time?

Grand Canyon Education may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Grand Canyon Education isn't a bad business. Although its revenue growth has been uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while its number of students has been disappointing, its impressive operating margins show it has a highly efficient business model.

Grand Canyon Education's price-to-earnings ratio based on the next 12 months is 17.6x. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Grand Canyon Education, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $158.33 per share right before these results (compared to the current share price of $139.78).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.