Furniture company Lovesac (NASDAQ:LOVE) reported results ahead of analysts’ expectations in Q2 CY2024, with revenue up 1.3% year on year to $156.6 million. On the other hand, next quarter’s revenue guidance of $156 million was less impressive, coming in 4.9% below analysts’ estimates. It made a GAAP loss of $0.38 per share, down from its loss of $0.04 per share in the same quarter last year.

Is now the time to buy Lovesac? Find out by accessing our full research report, it’s free.

Lovesac (LOVE) Q2 CY2024 Highlights:

- Revenue: $156.6 million vs analyst estimates of $155.1 million (small beat)

- EPS: -$0.38 vs analyst estimates of -$0.44 (14.3% beat)

- The company dropped its revenue guidance for the full year to $717.5 million at the midpoint from $735 million, a 2.4% decrease

- EPS (GAAP) guidance for the full year is $1.14 at the midpoint, missing analyst estimates by 7.5%

- EBITDA guidance for the full year is $55.5 million at the midpoint, above analyst estimates of $50.66 million

- Gross Margin (GAAP): 59%, in line with the same quarter last year

- EBITDA Margin: 1%, down from 3.4% in the same quarter last year

- Free Cash Flow Margin: 0.1%, down from 8.3% in the same quarter last year

- Market Capitalization: $326.9 million

Shawn Nelson, Chief Executive Officer, stated, “Our second quarter results were inline with our expectations as we continued to drive market share gains amidst a challenging industry backdrop. We are pleased with the incredible reception we have seen with the product innovation we have delivered recently through our PillowSac Accent Chair as well as our newly launched AnyTable. We are excited to continue to build on the momentum we are driving through expanding our offering, and while we are prudently planning for the second half of the year given the category headwinds, we believe we are well positioned to deliver on our objectives for both the near- and long-term.”

Known for its oversized, premium beanbags, Lovesac (NASDAQ:LOVE) is a specialty furniture brand selling modular furniture.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Sales Growth

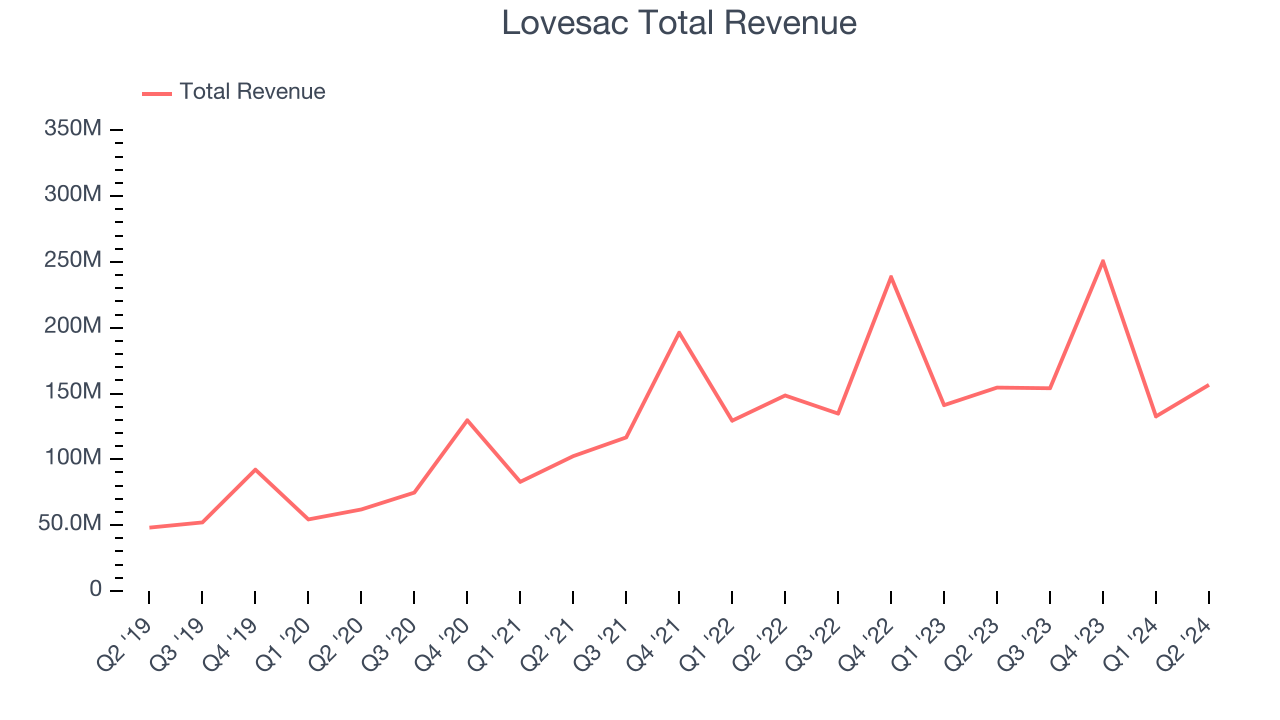

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one tends to grow for years. Thankfully, Lovesac’s 28.9% annualized revenue growth over the last five years was exceptional. This shows it expanded quickly, a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Lovesac’s recent history shows its demand slowed significantly as its annualized revenue growth of 8.4% over the last two years is well below its five-year trend.

This quarter, Lovesac reported reasonable year-on-year revenue growth of 1.3%, and its $156.6 million of revenue topped Wall Street’s estimates by 1%. The company is guiding for revenue to rise 1.3% year on year to $156 million next quarter, slowing from the 14.3% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 7.4% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

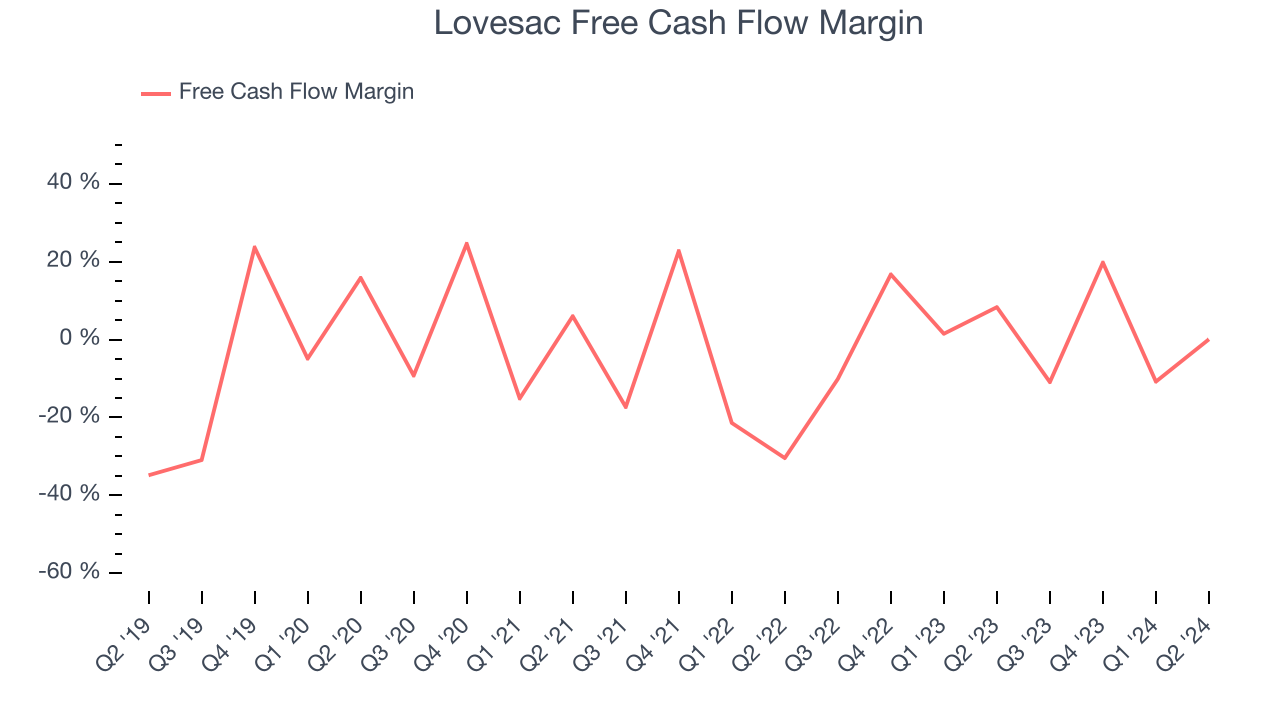

Lovesac has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.4%, lousy for a consumer discretionary business.

Lovesac broke even from a free cash flow perspective in Q2. The company’s cash profitability regressed as it was 8.3 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting Lovesac’s free cash flow margin of 2.7% for the last 12 months to remain the same.

Key Takeaways from Lovesac’s Q2 Results

It was good to see Lovesac beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its earnings forecast for next quarter missed and its full-year earnings guidance fell short of Wall Street’s estimates. Overall, this was a solid quarter coupled with underwhelming guidance. The stock traded up 2.2% to $21.50 immediately following the results.

So should you invest in Lovesac right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.