Furniture company Lovesac (NASDAQ:LOVE) missed analysts' expectations in Q4 CY2023, with revenue up 4.9% year on year to $250.5 million. Next quarter's revenue guidance of $129 million also underwhelmed, coming in 13.8% below analysts' estimates. It made a GAAP profit of $1.87 per share, improving from its profit of $1.74 per share in the same quarter last year.

Lovesac (LOVE) Q4 CY2023 Highlights:

- Revenue: $250.5 million vs analyst estimates of $265.4 million (5.6% miss)

- EPS: $1.87 vs analyst expectations of $1.93 (2.9% miss)

- Revenue Guidance for Q1 CY2024 is $129 million at the midpoint, below analyst estimates of $149.6 million (EPS guidance for the period missed meaningfully)

- Management's revenue guidance for the upcoming financial year 2025 is $735 million at the midpoint, missing analyst estimates by 4.7% and implying 5% growth (vs 8.1% in FY2024) (EPS guidance for the period missed meaningfully)

- Gross Margin (GAAP): 59.7%, up from 56.6% in the same quarter last year

- Market Capitalization: $361.5 million

Known for its oversized, premium beanbags, Lovesac (NASDAQ:LOVE) is a specialty furniture brand selling modular furniture.

The company started with its signature product, the "Lovesac", which is a large and durable beanbag chair. It has since expanded to offer a unique line of modular sectional couches known as Sactionals.

Lovesac's Sactionals are a distinctive product in the furniture market, offering adaptability and customization. These modular couches have sections that can be combined in various configurations to fit any room size or shape, making them a practical choice for diverse living spaces. The Sactionals' design is user-friendly, allowing for easy assembly, reconfiguration, and expansion.

Lovasac products are quite expensive: its beanbags can cost $800 and some Sactionals are upwards of $10,000. As such, the company's products appeal to customers who like experimenting with their furniture and are willing to pay up for home decor.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Lovesac’s primary competitors include La-Z-Boy (NYSE:LZB), Wayfair (NYSE:W), West Elm (owned by Williams-Sonoma NYSE:WSM), and private companies IKEA and Ashley FurnitureSales Growth

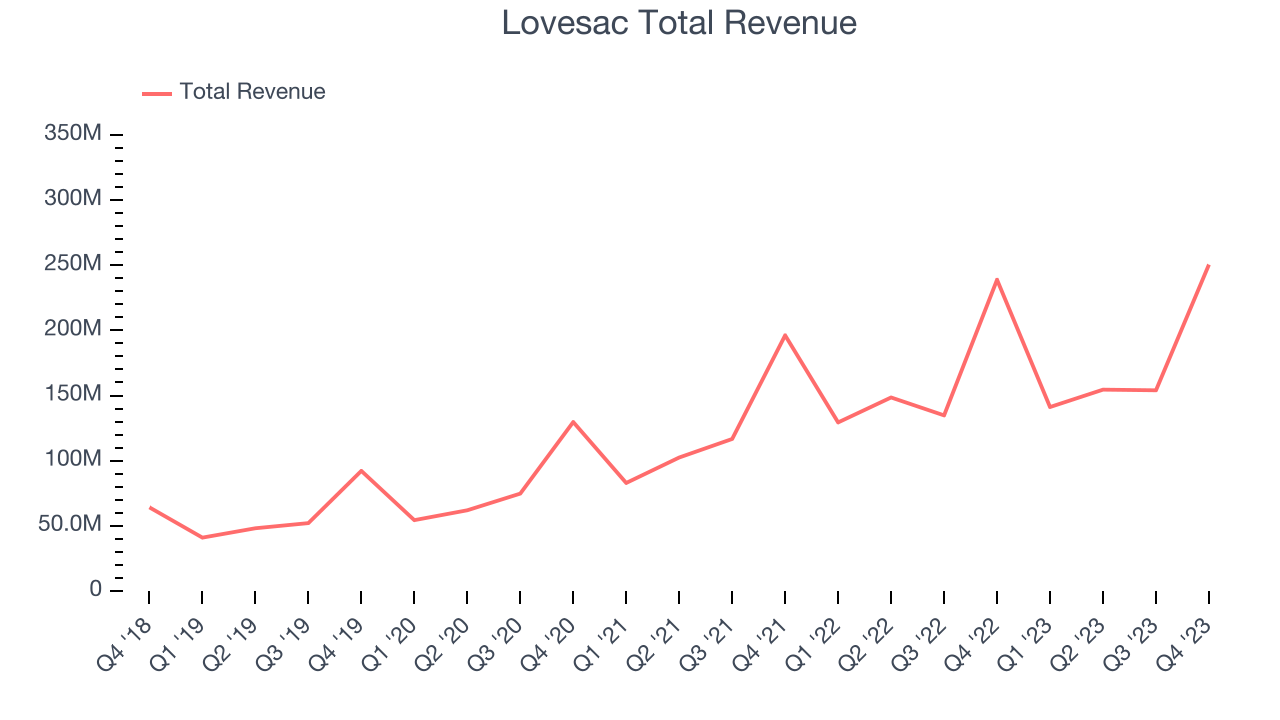

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Lovesac's annualized revenue growth rate of 33.4% over the last five years was incredible for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Lovesac's recent history shows its momentum has slowed as its annualized revenue growth of 18.6% over the last two years is below its five-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Lovesac's recent history shows its momentum has slowed as its annualized revenue growth of 18.6% over the last two years is below its five-year trend.

This quarter, Lovesac's revenue grew 4.9% year on year to $250.5 million, falling short of Wall Street's estimates. The company is guiding for a 8.6% year-on-year revenue decline next quarter to $129 million, a reversal from the 9.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 8.5% over the next 12 months, an acceleration from this quarter.

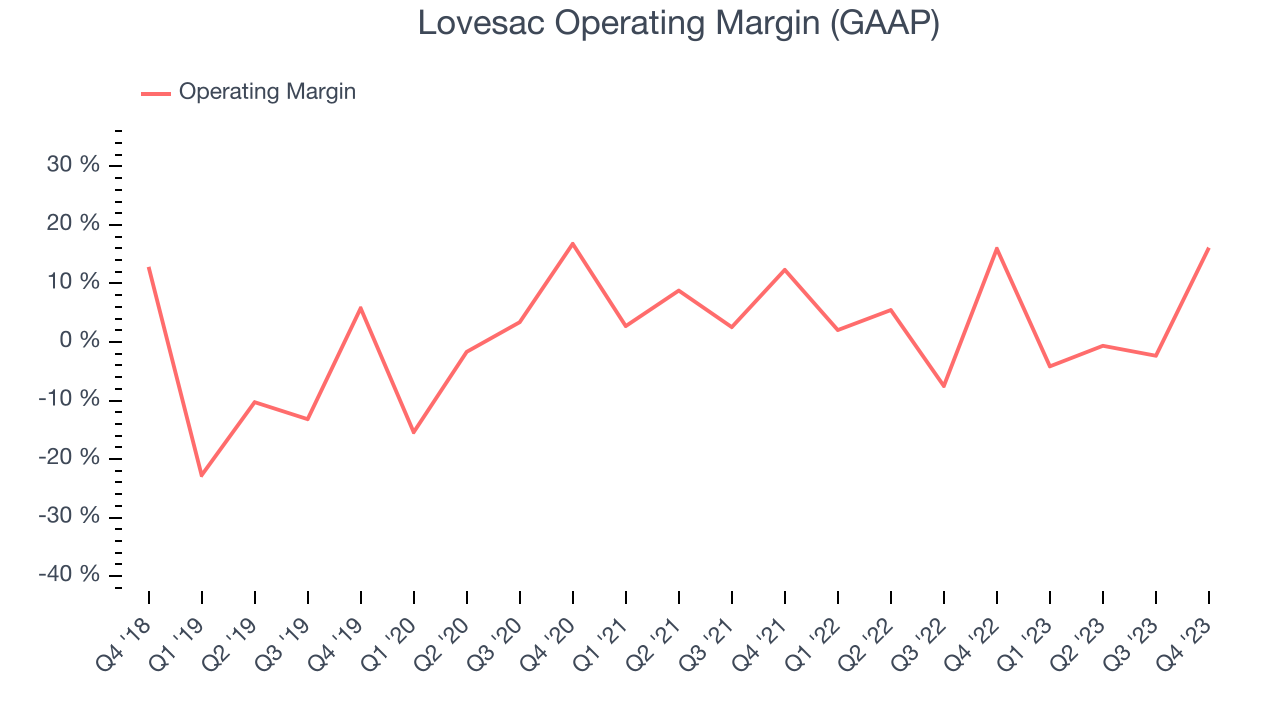

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Lovesac was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer discretionary business, producing an average operating margin of 5.1%.

In Q4, Lovesac generated an operating profit margin of 16.1%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects Lovesac to become more profitable. Analysts are expecting the company’s LTM operating margin of 4.3% to rise to 5.7%.EPS

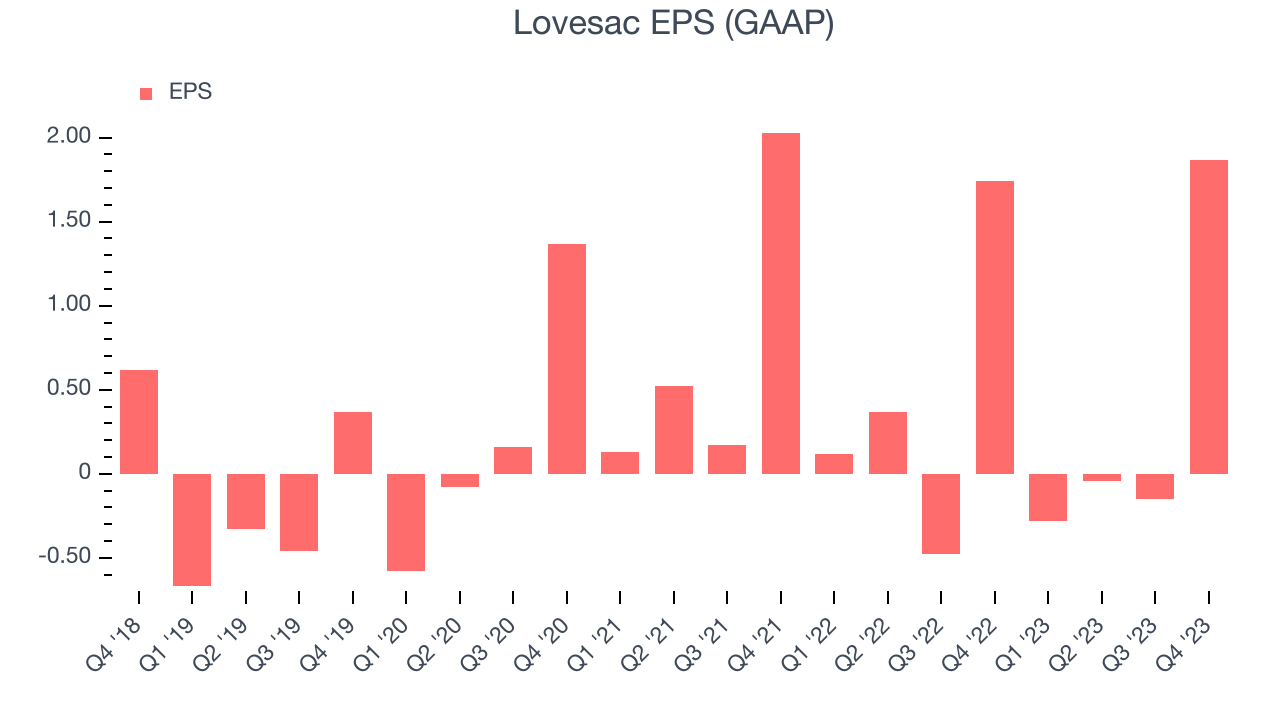

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Lovesac cut its earnings losses and improved its EPS by 18.2% each year. This performance, however, is worse than its 33.4% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals.

A five-year view shows Lovesac has diluted its shareholders, growing its share count by 22.3%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q4, Lovesac reported EPS at $1.87, up from $1.74 in the same quarter a year ago. This print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Lovesac to grow its earnings. Analysts are projecting its LTM EPS of $1.40 to climb by 36.4% to $1.91.

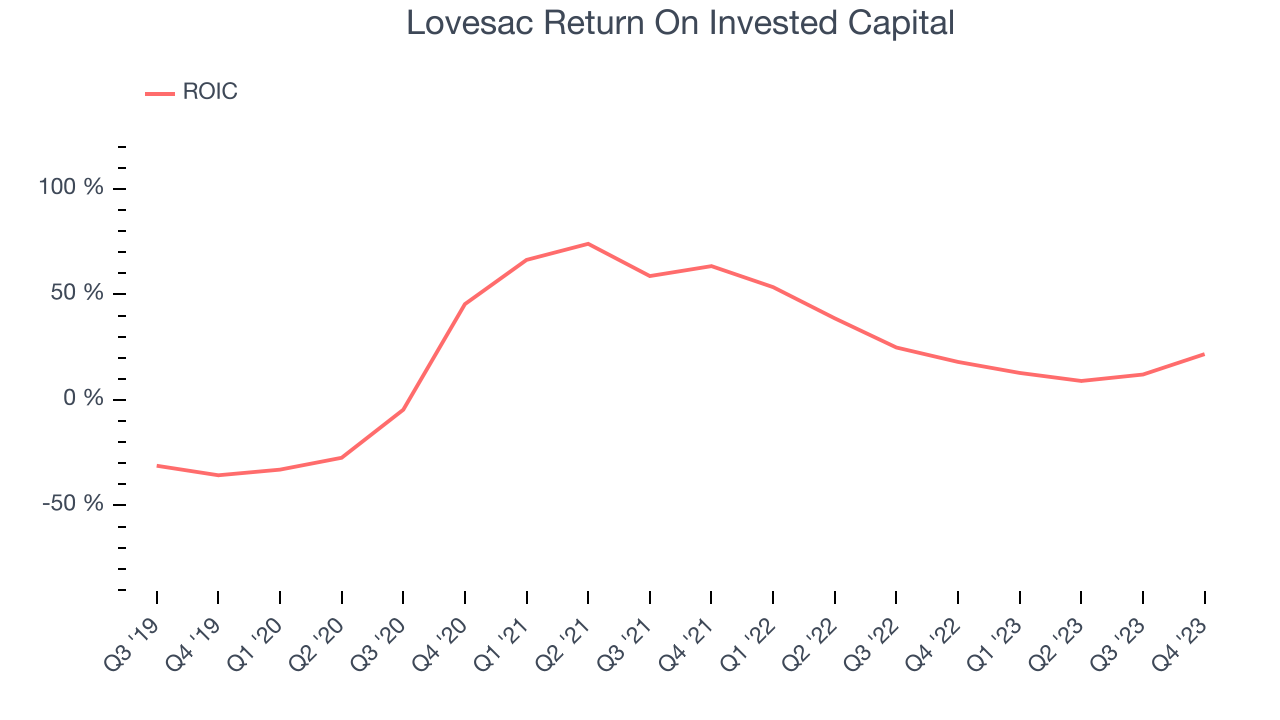

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Lovesac's five-year average ROIC was 22.6%, placing it among the best consumer discretionary companies. Just as you’d like your investment dollars to generate returns, Lovesac's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Lovesac's ROIC has significantly increased. The company has historically shown the ability to generate good returns, and its rising ROIC is a great sign. It could suggest its competitive advantage or profitable business opportunities are expanding.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is seperate from short-term stock price volatility, which we are much less bothered by.

Lovesac has $87.04 million of cash and $175.5 million of debt on its balance sheet. Its net-debt-to-EBITDA ratio is reasonable, as is its annual interest payments high relative to its EBITDA over the last 12 months.

We believe this level of interest expense is excessively high and has the potential to negatively impact the company's performance. We remain cautious of Lovesac until it increases its profitability or reduces its debt.

Key Takeaways from Lovesac's Q4 Results

Revenue and EPS both missed. Guidance wasn't much better. Next quarter's revenue and EPS guidance, as well as the full year outlook for revenue and EPS, missed expectations. In the release, management mentioned that they were anticipating an "eventual category rebound". Overall, this was a bad quarter for Lovesac. The company is down 16.5% on the results and currently trades at $19.47 per share.

Is Now The Time?

Lovesac may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Lovesac is a solid business. First off, its revenue growth has been exceptional over the last five years. And while its cash burn raises the question of whether it can sustainably maintain growth, its projected EPS for the next year implies the company's fundamentals will improve. On top of that, its stellar ROIC suggests it has been a well-run company historically.

Lovesac's price-to-earnings ratio based on the next 12 months is 12.2x. There are definitely things to like about Lovesac, and looking at the consumer discretionary landscape right now, it seems to be trading at a pretty interesting price.

Wall Street analysts covering the company had a one-year price target of $45.75 per share right before these results (compared to the current share price of $19.47), implying they saw upside in buying Lovesac in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.