As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q3. Today we are looking at the semiconductor manufacturing stocks, starting with Lam Research (NASDAQ:LRCX).

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers and data storage. The growth of data and technologies like artificial intelligence, 5G networks and smart cars are also creating a next wave of growth for the industry. To keep up with ever changing customer needs requires new tools that can design, fabricate and test at ever smaller sizes and more complex architectures, and that is driving the demand for semiconductor capital manufacturing equipment.

The 4 semiconductor manufacturing stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 2.97%, while on average next quarter revenue guidance was 2.03% above consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital, but semiconductor manufacturing stocks held their ground better than others, with the share prices up 18.6% since the previous earnings results, on average.

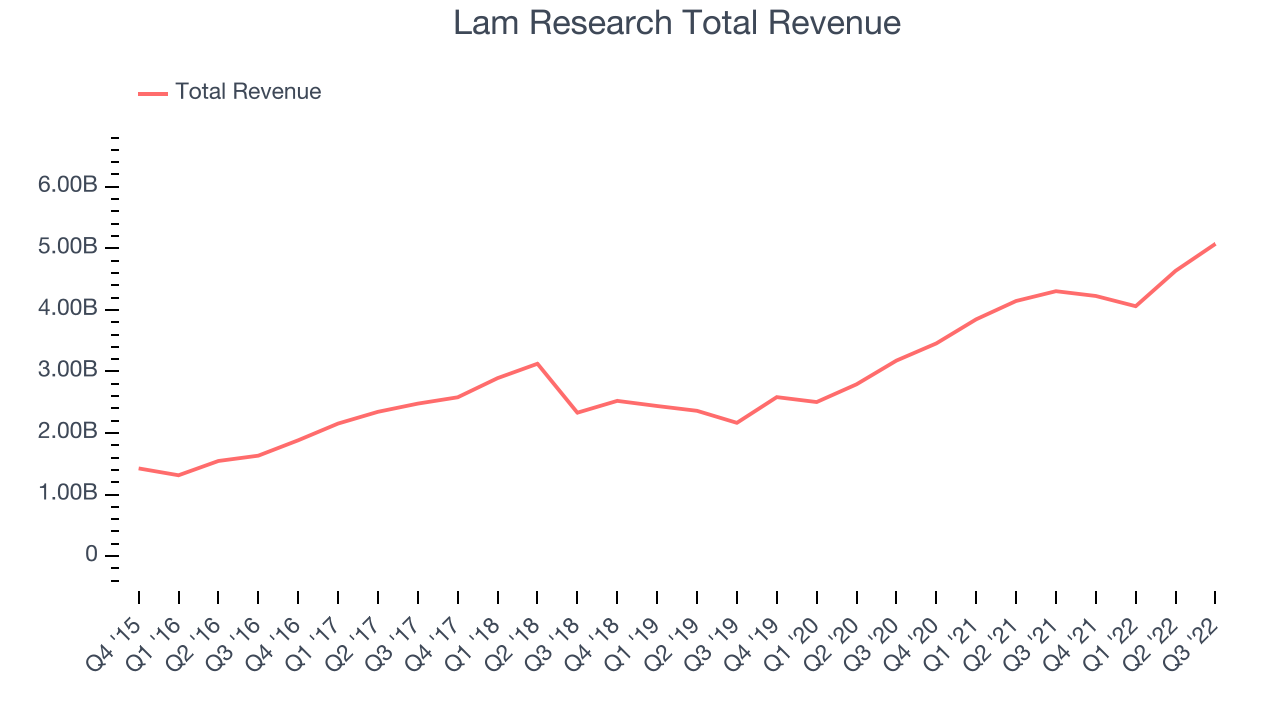

Lam Research (NASDAQ:LRCX)

Founded in 1980 by David Lam, who pioneered semiconductor etching technology, Lam Research (NASDAQ:LCRX) is one of the leading providers of the wafer fabrication equipment used to make semiconductors.

Lam Research reported revenues of $5.07 billion, up 17.8% year on year, beating analyst expectations by 3.36%. It was a strong quarter for the company, with a beat on the bottom line and very optimistic guidance for the next quarter.

“Lam exceeded $5 billion in revenue in the September quarter, an all-time record. Solid execution combined with easing supply chain conditions produced strong overall performance,” said Tim Archer, Lam Research’s President and Chief Executive Officer.

The stock is up 43.1% since the results and currently trades at $473.00.

Is now the time to buy Lam Research? Access our full analysis of the earnings results here, it's free.

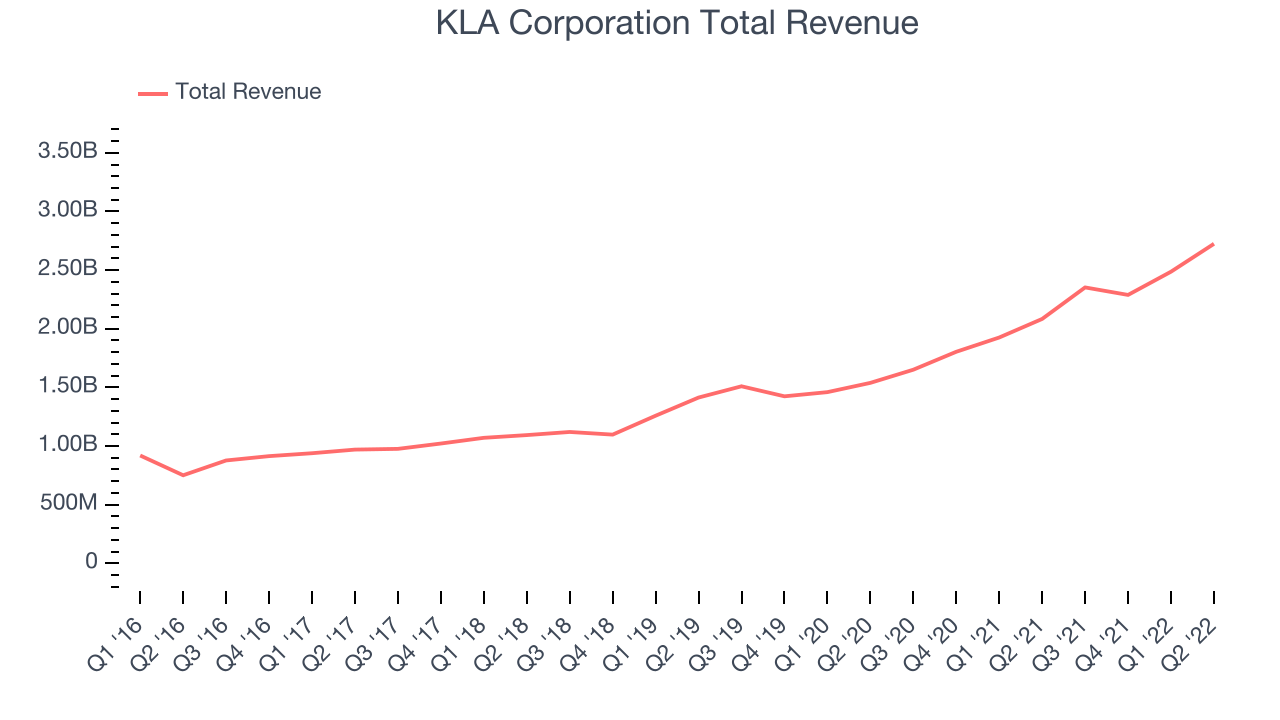

Best Q3: KLA Corporation (NASDAQ:KLAC)

Formed by the 1997 merger of the two leading semiconductor yield management companies, KLA Corporation (NASDAQ:KLAC) is the leading supplier of equipment used to measure and inspect semiconductor chips.

KLA Corporation reported revenues of $2.72 billion, up 30.7% year on year, beating analyst expectations by 4.95%. It was a strong quarter for the company, with a beat on the bottom line and very optimistic guidance for the next quarter.

KLA Corporation scored the strongest analyst estimates beat and fastest revenue growth among its peers. The stock is up 36.6% since the results and currently trades at $419.25.

Is now the time to buy KLA Corporation? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Marvell Technology (NASDAQ:MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $1.53 billion, up 26.9% year on year, missing analyst expectations by 1.28%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

Marvell Technology had the weakest performance against analyst estimates in the group. The stock is down 10.3% since the results and currently trades at $40.68.

Read our full analysis of Marvell Technology's results here.

Applied Materials (NASDAQ:AMAT)

Founded in 1967 as the first company that built the tools for other companies to use to make semiconductors, Applied Materials (NASDAQ:AMAT) is the largest provider of semiconductor wafer fabrication equipment.

Applied Materials reported revenues of $6.74 billion, up 10.2% year on year, beating analyst expectations by 4.85%. It was a decent quarter for the company, with a beat on the bottom line but slow revenue growth.

Applied Materials had the slowest revenue growth among the peers. The stock is up 5.17% since the results and currently trades at $109.9.

Read our full, actionable report on Applied Materials here, it's free.

The author has no position in any of the stocks mentioned