Wrapping up Q2 earnings, we look at the numbers and key takeaways for the electrical systems stocks, including LSI (NASDAQ:LYTS) and its peers.

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 15 electrical systems stocks we track reported a slower Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 2.1% below.

Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. This year has been a different story as mixed inflation signals have led to market volatility, and while some electrical systems stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.3% since the latest earnings results.

LSI (NASDAQ:LYTS)

Enhancing commercial environments, LSI (NASDAQ:LYTS) provides lighting and display solutions for businesses and retailers.

LSI reported revenues of $129 million, up 4.3% year on year. This print exceeded analysts’ expectations by 1.6%. Despite the top-line beat, it was still a mixed quarter for the company.

“The fiscal fourth quarter concludes a pivotal year for our business, as we continued to expand our vertical market capabilities, including the acquisition of EMI Industries,” stated James A. Clark, President, and CEO of LSI.

Interestingly, the stock is up 1.8% since reporting and currently trades at $15.

Is now the time to buy LSI? Access our full analysis of the earnings results here, it’s free.

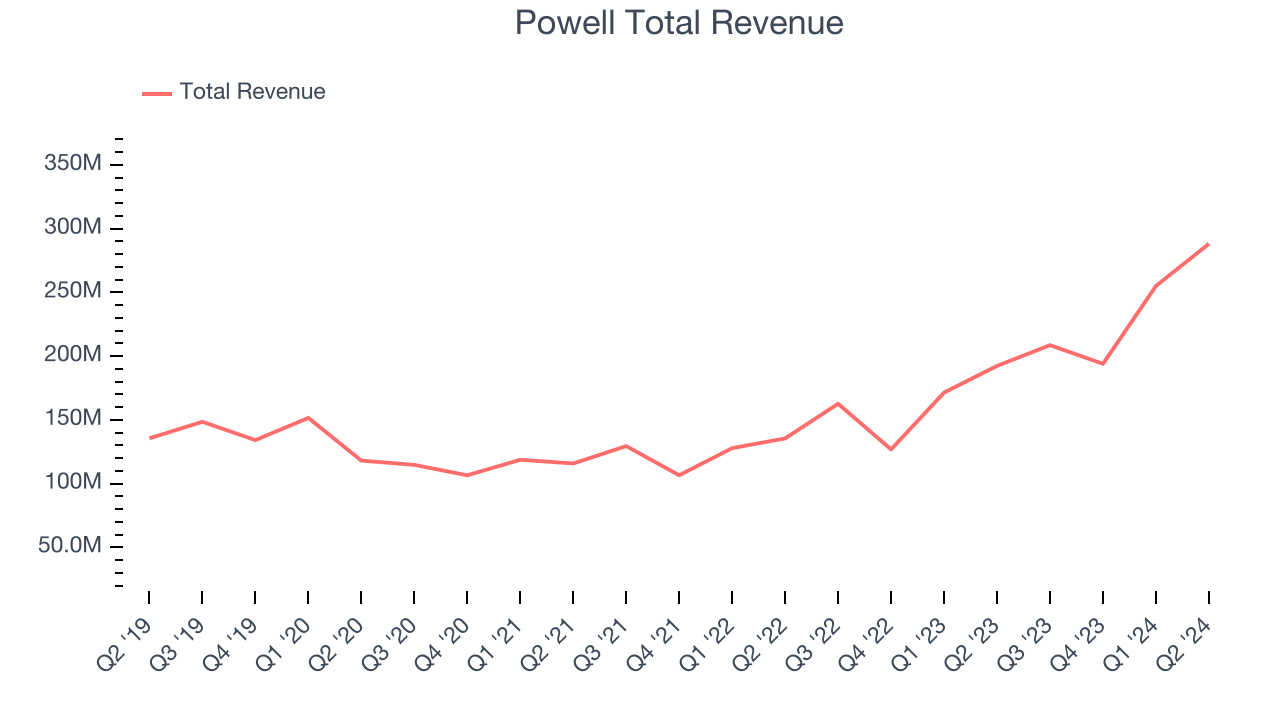

Best Q2: Powell (NASDAQ:POWL)

Originally a metal-working shop supporting local petrochemical facilities, Powell (NYSE:POWL) has grown from a small Houston manufacturer to a global provider of electrical systems.

Powell reported revenues of $288.2 million, up 49.8% year on year, outperforming analysts’ expectations by 29.7%. The business had an incredible quarter with an impressive beat of analysts’ earnings estimates.

Powell pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 25.4% since reporting. It currently trades at $167.26.

Is now the time to buy Powell? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Methode Electronics (NYSE:MEI)

Founded in 1946, Methode Electronics (NYSE:MEI) is a global supplier of custom-engineered solutions for Original Equipment Manufacturers (OEMs).

Methode Electronics reported revenues of $258.5 million, down 10.8% year on year, falling short of analysts’ expectations by 3%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

Interestingly, the stock is up 2.3% since the results and currently trades at $10.29.

Read our full analysis of Methode Electronics’s results here.

Verra Mobility (NASDAQ:VRRM)

Managing over 165 million tolling transactions per year, Verra Mobility (NYSE:VRRM) is a leading provider of smart mobility technology that enhances safety, efficiency, and convenience on roadways.

Verra Mobility reported revenues of $222.4 million, up 8.8% year on year. This number was in line with analysts’ expectations. However, it was a mixed quarter as it produced a miss of analysts’ operating margin and full-year revenue guidance.

The stock is down 2.7% since reporting and currently trades at $26.91.

Read our full, actionable report on Verra Mobility here, it’s free.

Kimball Electronics (NASDAQ:KE)

Founded in 1961, Kimball Electronics (NYSE:KE) is a global contract manufacturer specializing in electronics and manufacturing solutions for automotive, medical, and industrial markets.

Kimball Electronics reported revenues of $430.2 million, down 13.3% year on year. This number lagged analysts' expectations by 3.6%. Overall, it was a disappointing quarter as it also recorded a miss of analysts’ earnings estimates.

Kimball Electronics had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is down 13.6% since reporting and currently trades at $17.66.

Read our full, actionable report on Kimball Electronics here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.