Manhattan Associates (NASDAQ:MANH) Surprises With Q1 Sales But Gross Margin Drops

Petr Huřťák 2024/04/23 4:04 pm EDT

Supply chain optimization software maker Manhattan Associates (NASDAQ:MANH) beat analysts' expectations in Q1 CY2024, with revenue up 15.2% year on year to $254.6 million. The company expects the full year's revenue to be around $1.03 billion, in line with analysts' estimates. It made a non-GAAP profit of $1.03 per share, improving from its profit of $0.80 per share in the same quarter last year.

Manhattan Associates (MANH) Q1 CY2024 Highlights:

- Revenue: $254.6 million vs analyst estimates of $243.3 million (4.6% beat)

- EPS (non-GAAP): $1.03 vs analyst estimates of $0.87 (18.4% beat)

- The company lifted its revenue guidance for the full year from $1.02 billion to $1.03 billion at the midpoint, a 1% increase

- Gross Margin (GAAP): 53.1%, in line with the same quarter last year

- Free Cash Flow of $52.42 million, down 39.3% from the previous quarter

- Market Capitalization: $14.06 billion

Boasting major consumer staples and pharmaceutical companies as clients, Manhattan Associates (NASDAQ:MANH) offers a software-as-service platform that helps customers manage their supply chains.

Due to the rise in dynamics such as globalization of production, just-in-time inventory management, and omnichannel commerce, supply chains for businesses large and small are increasingly complex. Manhattan Associates’ flagship product is Manhattan Active Supply Chain. It is designed to provide visibility into a customer’s inventory, transportation network, and warehouse operations, showing where everything was, is, and going. The result is that businesses using the product can see real-time data and employ advanced analytics that allow for more nimble decision making, such as where to build the next warehouse to get certain customers their products faster, for example. Better decisions can mean better time to market, cost savings, and/or higher customer satisfaction. Additionally, automation capabilities can allow supply chain employees to eliminate repetitive manual tasks.

Key Manhattan Associates customers include retailers, wholesalers, manufacturers, and logistics providers in a variety of sectors. In general, most companies that need to manage the physical flow of product components or finished goods can benefit from supply chain management. Manhattan Associates generates revenue primarily through software licensing. The company offers flexible deployment options such as on-premise, cloud-based, or hybrid. Additionally, revenue also is derived from professional services and customer support.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Competitors in supply chain, logistics, or inventory management software include private companies Blue Yonder and SAS Institute as well as SAP (NYSE:SAP).Sales Growth

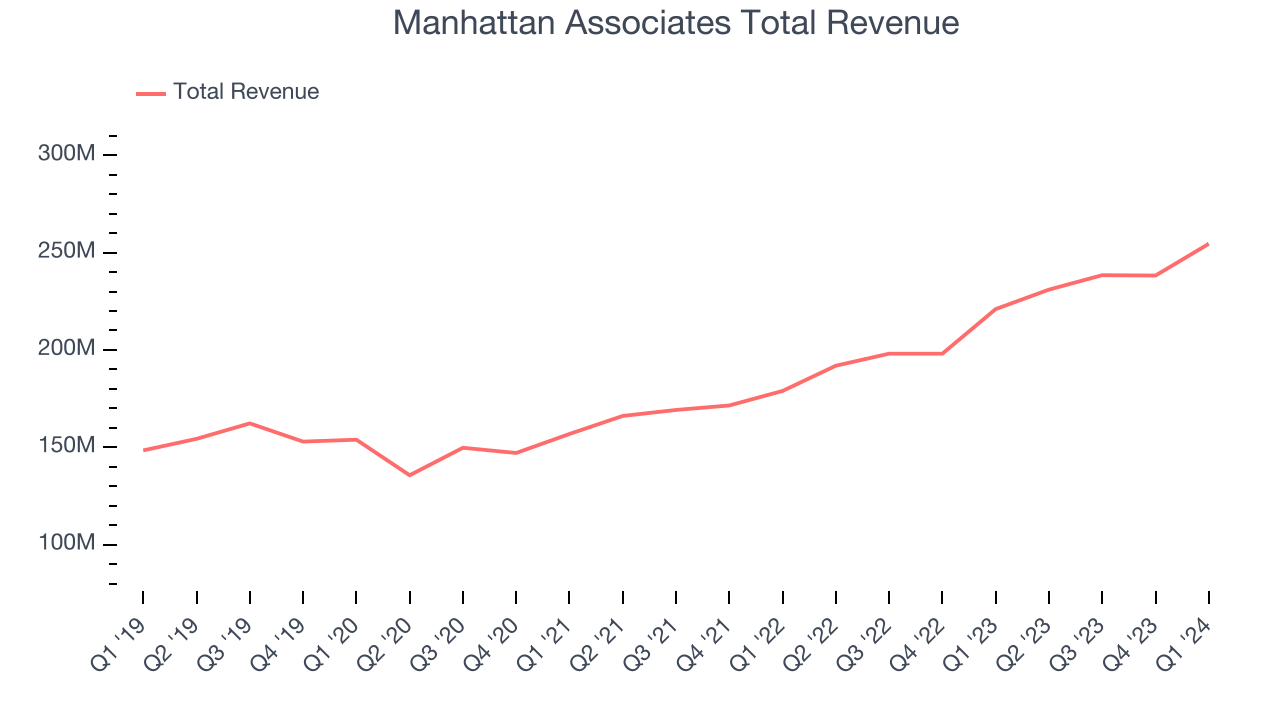

As you can see below, Manhattan Associates's revenue growth has been mediocre over the last three years, growing from $156.9 million in Q1 2021 to $254.6 million this quarter.

This quarter, Manhattan Associates's quarterly revenue was once again up 15.2% year on year. On top of that, its revenue increased $16.3 million quarter on quarter, a strong improvement from the $186,000 decrease in Q4 CY2023. This is a sign of acceleration of growth and very nice to see indeed.

Looking ahead, analysts covering the company were expecting sales to grow 9.4% over the next 12 months before the earnings results announcement.

Profitability

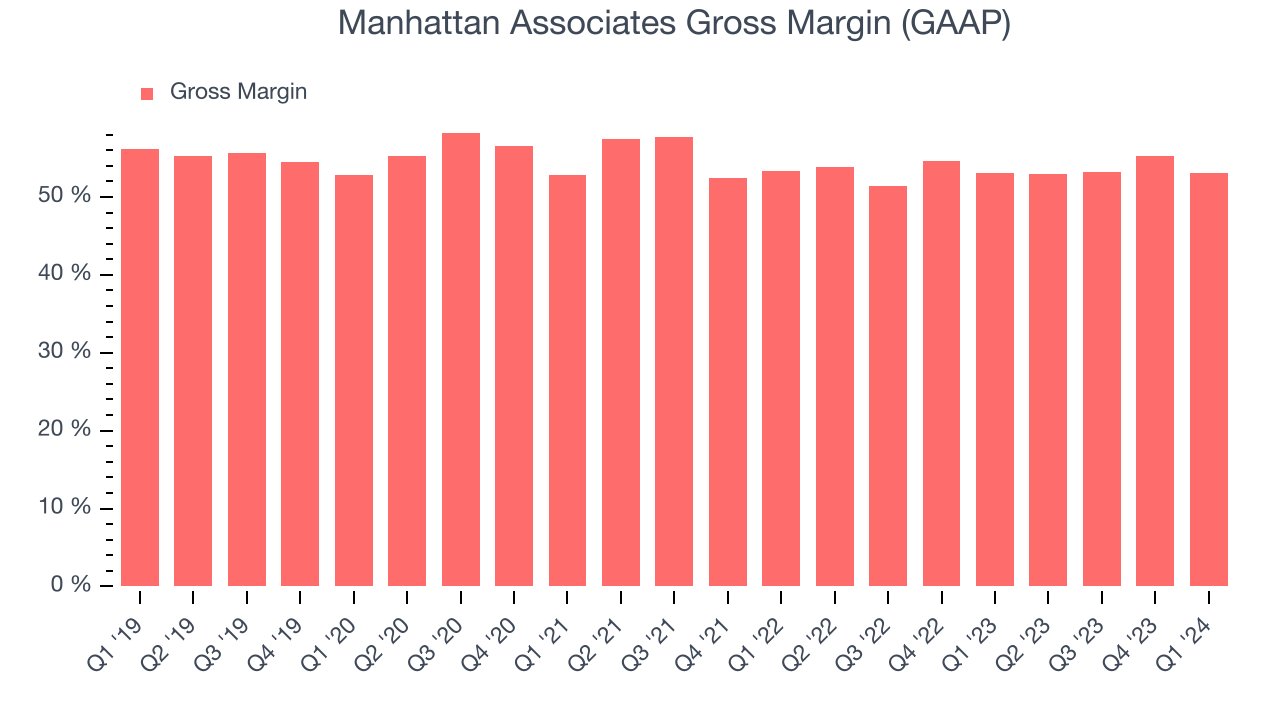

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Manhattan Associates's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 53.1% in Q1.

That means that for every $1 in revenue the company had $0.53 left to spend on developing new products, sales and marketing, and general administrative overhead. Manhattan Associates's gross margin is poor for a SaaS business and it's dropped significantly since the previous quarter. This is probably the exact opposite of what shareholders would like to see.

Cash Is King

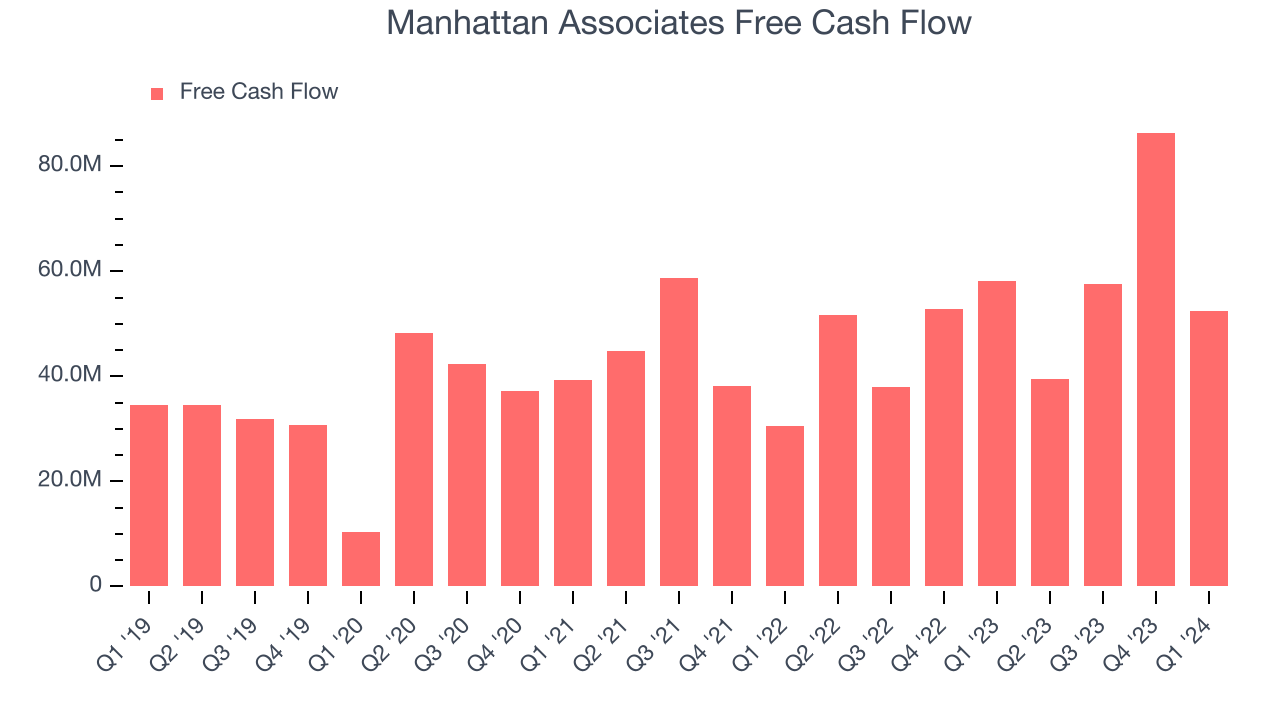

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Manhattan Associates's free cash flow came in at $52.42 million in Q1, down 9.7% year on year.

Manhattan Associates has generated $235.9 million in free cash flow over the last 12 months, an impressive 24.5% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Manhattan Associates is a well-capitalized company with $207.5 million of cash and $51.81 million of debt, meaning it could pay back all its debt tomorrow and still have $155.7 million of cash on its balance sheet. This net cash position gives Manhattan Associates the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Manhattan Associates's Q1 Results

It was good to see Manhattan Associates beat analysts' revenue and EPS expectations this quarter, driven by strong performance in its subscription and services segments. We were also glad it lifted its full-year revenue guidance, which came in higher than Wall Street's estimates. On the other hand, management cited macroeconomic volatility in its end markets. Overall, this quarter's results seemed fairly positive, but management's comments likely spooked investors, especially given last quarter's weakness across the broader software sector. The stock is down 5% after reporting, trading at $219.1 per share.

Is Now The Time?

When considering an investment in Manhattan Associates, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Manhattan Associates, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last three years, and analysts expect growth to deteriorate from here. And while its bountiful generation of free cash flow empowers it to invest in growth initiatives, the downside is its customer acquisition is less efficient than many comparable companies. On top of that, its gross margins show its business model is much less lucrative than the best software businesses.

Given its price-to-sales ratio of 13.7x based on the next 12 months, Manhattan Associates is priced with expectations for long-term growth. While there are some things to like about Manhattan Associates and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $240.65 right before these results (compared to the current share price of $219.10).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.