Diversified solutions provider Matthews International (NASDAQ:MATW) reported results in line with analysts' expectations in Q4 CY2023, with revenue flat year on year at $450 million. It made a GAAP loss of $0.07 per share, down from its profit of $0.12 per share in the same quarter last year.

Matthews International (MATW) Q4 CY2023 Highlights:

- Revenue: $450 million vs analyst estimates of $451.9 million (small miss)

- EPS: -$0.07 vs analyst estimates of $0.21 (-$0.28 miss)

- Gross Margin (GAAP): 30.3%, down from 31.1% in the same quarter last year

- Free Cash Flow was -$41.34 million compared to -$10.87 million in the previous quarter

- Market Capitalization: $860.3 million

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews International offers memorialization products for families wanting to honor and remember their loved ones. The company also provides brand initiatives for companies looking to increase brand recognition. Lastly, the company provides products and services for companies seeking to optimize their manufacturing process.

Some products the company offers in the ceremonial industry include caskets, urns, and memorials. In the brand solutions industry, Matthews International develops, manages, and initiates effective branding initiatives for companies desiring increased brand recognition. The company tops these offerings off by providing marking, coding, and automation systems and services to all types of companies seeking to increase productivity.

Matthews International generates revenue from three main sources: the selling of the aforementioned ceremonial products to funeral homes, cemeteries, and individuals; service revenue from brand design, strategy, and implementation services to commercial companies; and service revenue from the optimization of companies’ production facilities.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Competitors offering ceremonial products include Service Corporation International (NYSE:SCI) and private company Aurora Casket. Competitors offering brand solution services include private company Interbrand while competitors in the industrial technologies sector include Hitachi Construction Machinery (TSE:6305).Sales Growth

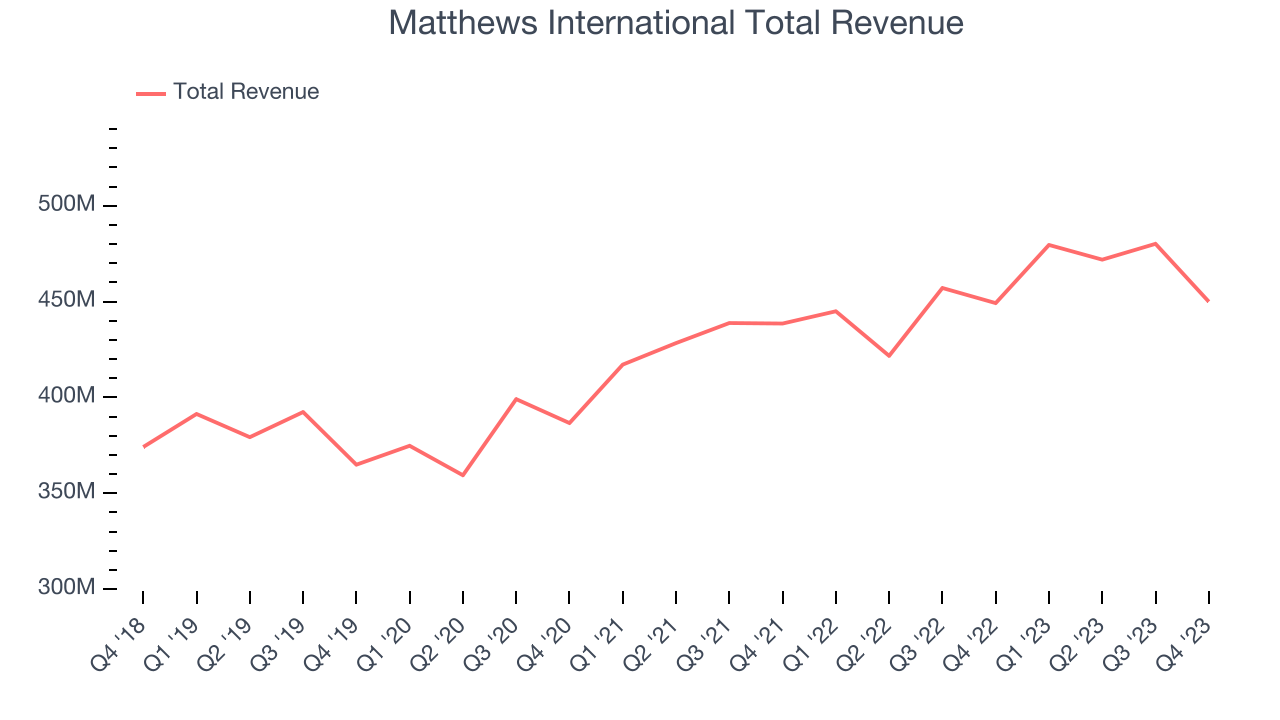

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Matthews International's annualized revenue growth rate of 5.3% over the last four years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Matthews International's annualized revenue growth of 4.5% over the last two years aligns with its four-year revenue growth, suggesting the company's demand has been stable.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Matthews International's annualized revenue growth of 4.5% over the last two years aligns with its four-year revenue growth, suggesting the company's demand has been stable.

This quarter, Matthews International's $450 million of revenue was flat year on year and in line with Wall Street's estimates.

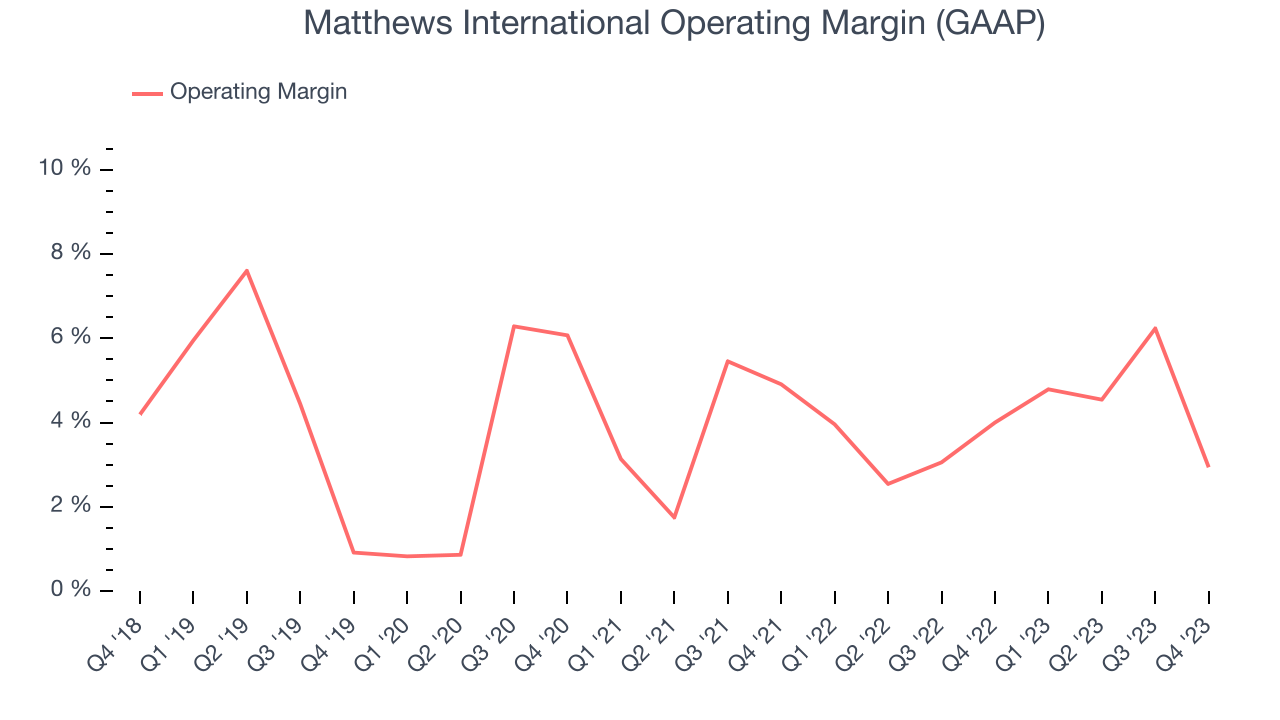

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Matthews International was profitable over the last two years but held back by its large expense base. Its average operating margin of 4% has been paltry for a consumer discretionary business.

This quarter, Matthews International generated an operating profit margin of 2.9%, down 1.1 percentage points year on year.

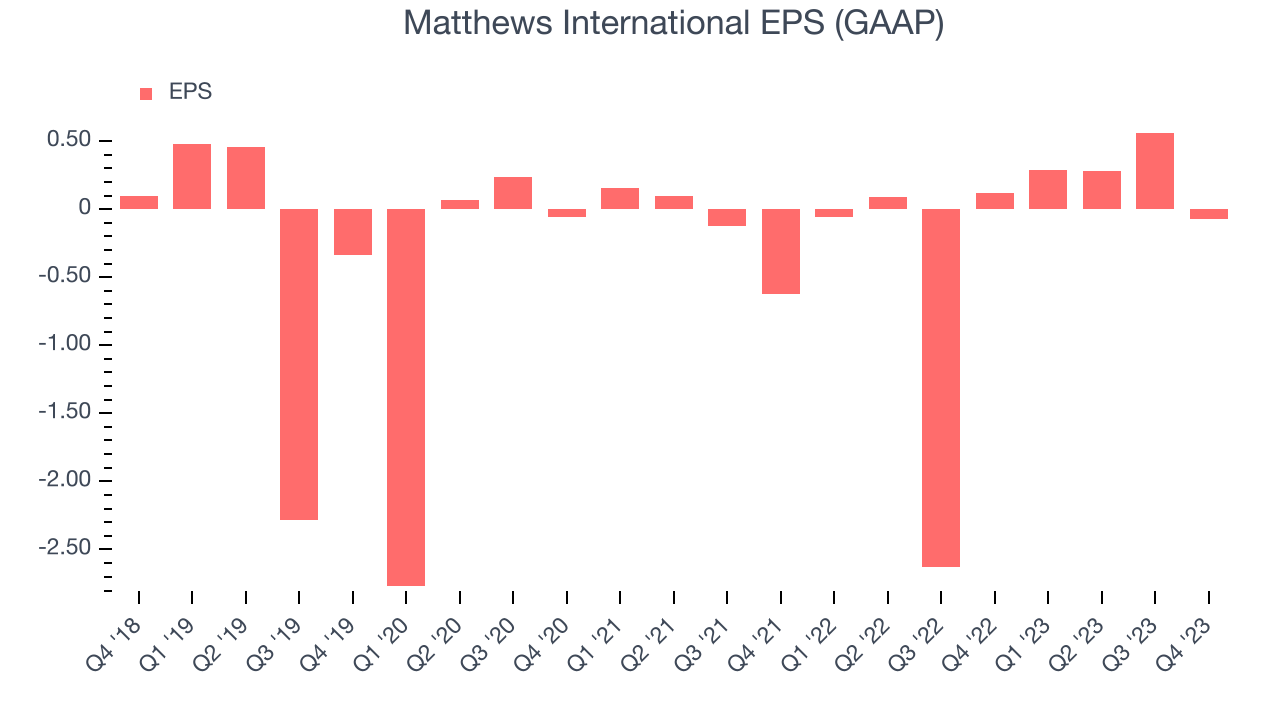

EPS

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last four years, Matthews International cut its earnings losses and improved its EPS by 27.3% each year. This performance is materially higher than its 5.3% annualized revenue growth over the same period. Let's dig into why.

While we mentioned earlier that Matthews International's operating margin declined this quarter, a four-year view shows its margin has expanded 2 percentage points, leading to higher profitability and earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q4, Matthews International reported EPS at negative $0.07, down from $0.12 in the same quarter a year ago. This print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. We also like to analyze expected EPS growth based on Wall Street analysts' consensus projections, but unfortunately, there is insufficient data.

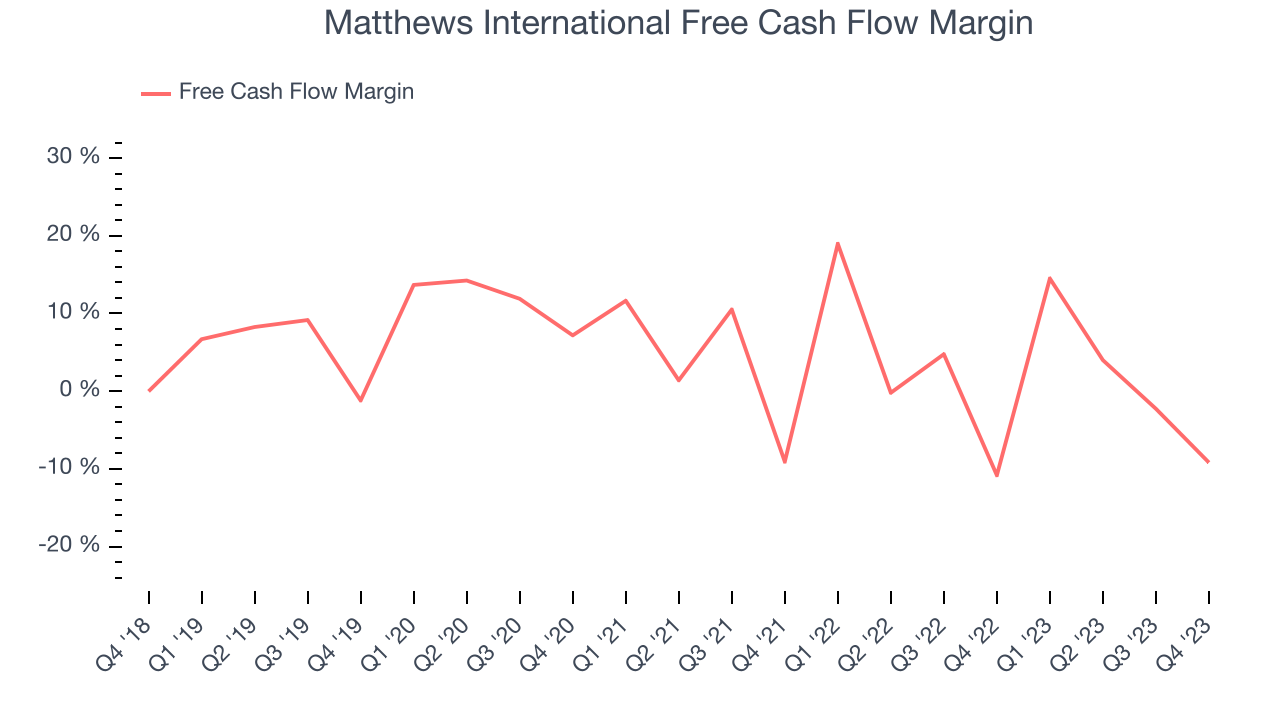

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Matthews International has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 2.5%, subpar for a consumer discretionary business.

Matthews International burned through $41.34 million of cash in Q4, equivalent to a negative 9.2% margin, increasing its cash burn by 15% year on year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Matthews International's five-year average return on invested capital was 5.1%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Matthews International's ROIC has stayed the same over the last few years. If the company wants to become an investable business, it will need to increase its returns.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Matthews International's $874.8 million of debt exceeds the $37.92 million of cash on its balance sheet. Although its EBITDA of $160.2 million over the last 12 months is sufficient to cover its annual interest expenses of $10.98 million, its 5x net-debt-to-EBITDA ratio shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Matthews International could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Matthews International can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Matthews International's Q4 Results

We struggled to find many strong positives in these results. Its operating margin missed and its EPS fell short of Wall Street's estimates. Overall, this was a mediocre quarter for Matthews International. The stock is up 2% after reporting and currently trades at $28.6 per share.

Is Now The Time?

Matthews International may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Matthews International, we'll be cheering from the sidelines. First off, its revenue growth has been uninspiring over the last four years. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its relatively low ROIC suggests it has historically struggled to find compelling business opportunities. On top of that, its low free cash flow margins give it little breathing room.

While the price is reasonable and there are some things to like about Matthews International, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $53 per share right before these results (compared to the current share price of $28.60).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.