Recreational boats manufacturer Malibu Boats (NASDAQ:MBUU) announced better-than-expected revenue in Q3 CY2024, but sales fell 32.9% year on year to $171.6 million. Its non-GAAP profit of $0.08 per share was also 198% above analysts’ consensus estimates.

Is now the time to buy Malibu Boats? Find out by accessing our full research report, it’s free.

Malibu Boats (MBUU) Q3 CY2024 Highlights:

- Revenue: $171.6 million vs analyst estimates of $167.3 million (2.6% beat)

- Adjusted EPS: $0.08 vs analyst estimates of -$0.08 ($0.16 beat)

- EBITDA: $9.90 million vs analyst estimates of $4.90 million (102% beat)

- Gross Margin (GAAP): 16.4%, down from 22.2% in the same quarter last year

- Operating Margin: -3.3%, down from 11.2% in the same quarter last year

- EBITDA Margin: 5.8%, down from 15.2% in the same quarter last year

- Market Capitalization: $844 million

"During the first fiscal quarter, we continued to navigate a challenging retail environment. While we see some encouraging signs from a macro perspective, our team remains focused on managing the factors within our control, particularly through disciplined inventory management and executing our strategic initiatives," commented Steve Menneto, Chief Executive Officer of Malibu Boats,

Company Overview

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

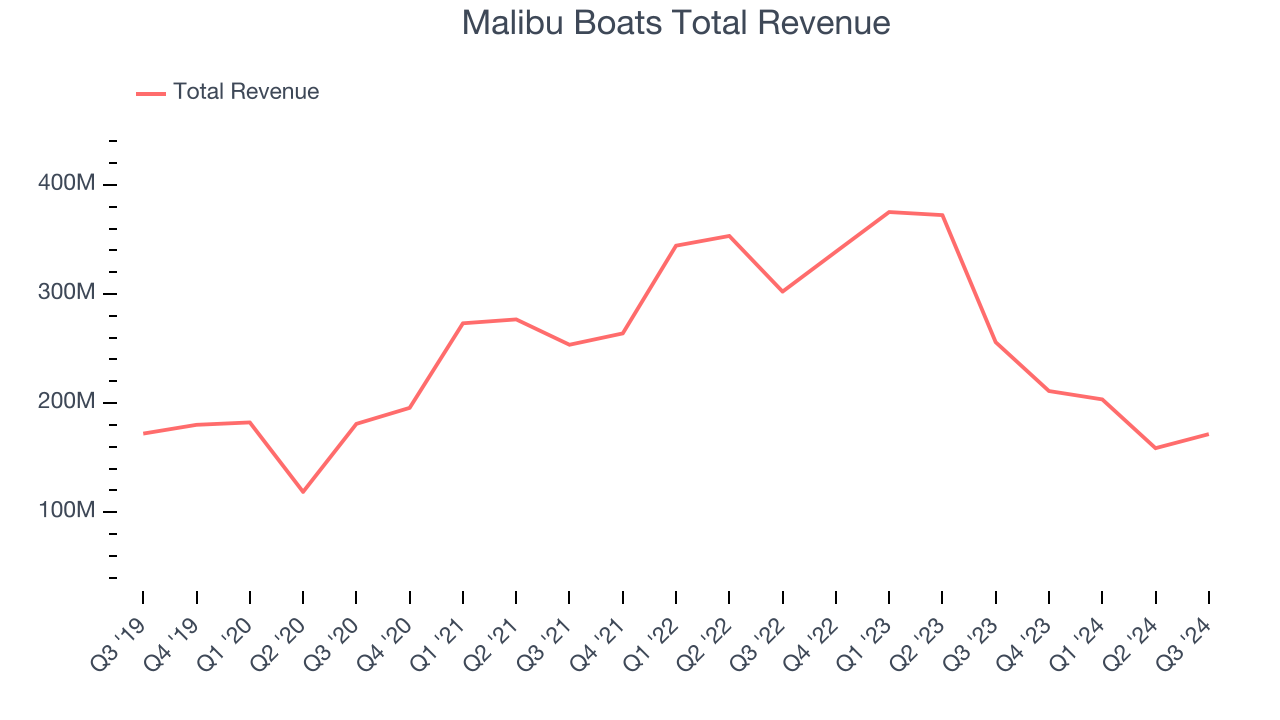

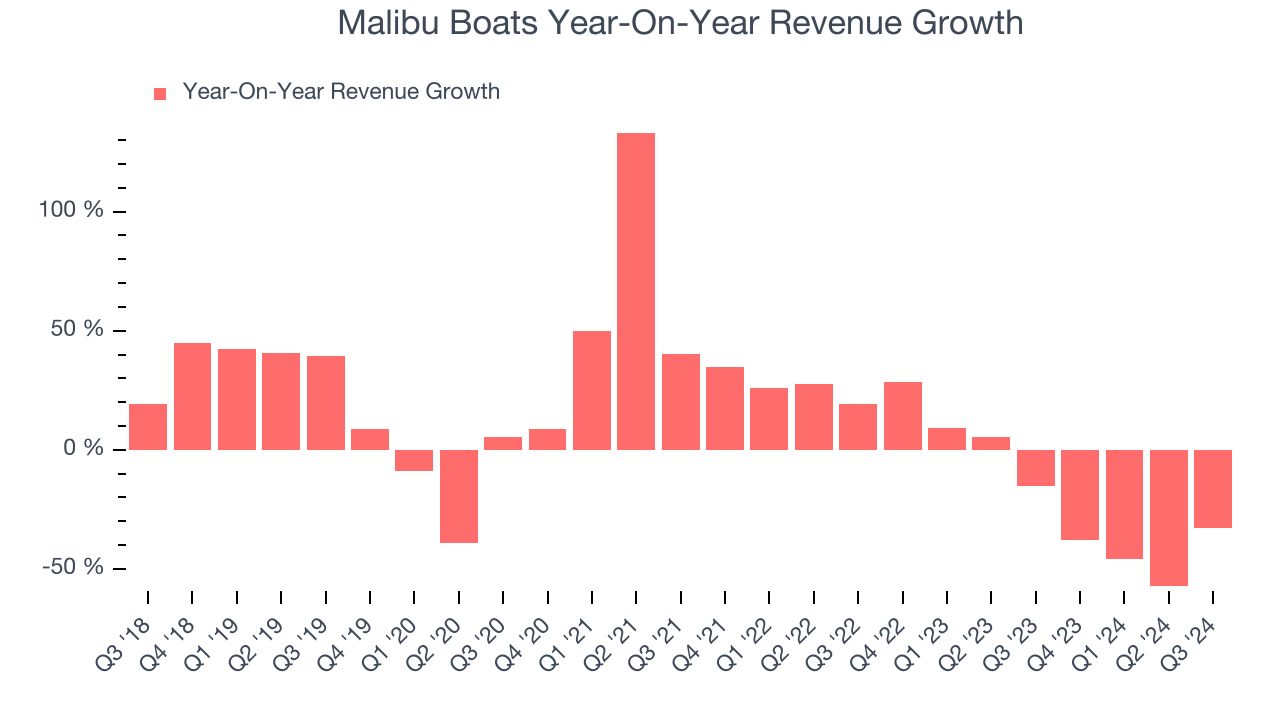

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Malibu Boats’s demand was weak over the last five years as its sales were flat, a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Malibu Boats’s recent history shows its demand has stayed suppressed as its revenue has declined by 23.2% annually over the last two years.

This quarter, Malibu Boats’s revenue fell 32.9% year on year to $171.6 million but beat Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 17.3% over the next 12 months, an improvement versus the last two years. This projection is commendable and shows the market believes its newer products and services will catalyze higher growth rates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

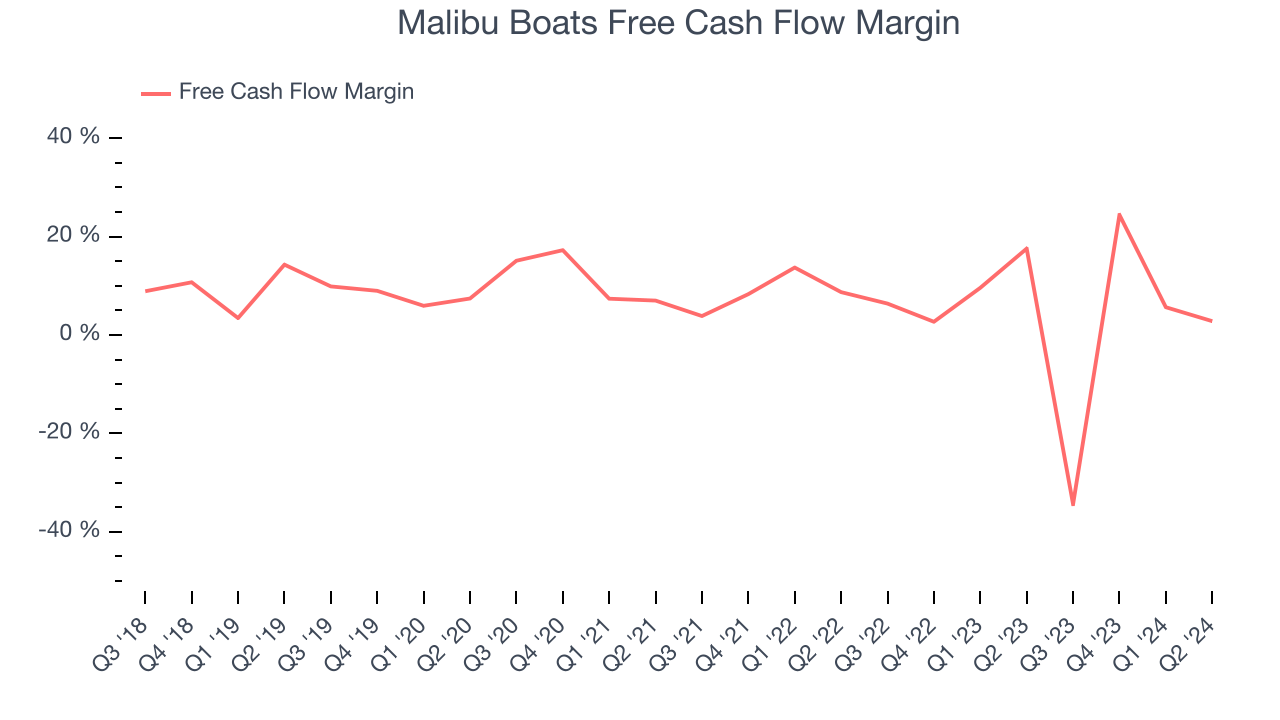

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Malibu Boats has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.7%, lousy for a consumer discretionary business.

The company’s cash burn increased from $87.94 million of lost cash in the same quarter last year . These numbers deviate from its longer-term margin, raising some eyebrows.

Key Takeaways from Malibu Boats’s Q3 Results

We were impressed by how significantly Malibu Boats blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 2.9% to $43.43 immediately after reporting.

Malibu Boats put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.